Difference between revisions of "Timeline of Bitcoin"

| (566 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| − | This is a '''timeline of Bitcoin'''. | + | {{focused coverage period|end-date = February 2021}} |

| + | |||

| + | This is a '''timeline of {{w|Bitcoin}}''', attempting to describe the evolution of the cryptocurrency and its influence around the world. All {{w|Bitcoin Core}} version updates are included. | ||

| + | |||

| + | == Sample questions == | ||

| + | |||

| + | The following are some interesting questions that can be answered by reading this timeline: | ||

| + | |||

| + | * What are some significant events prior to the development of Bitcoin? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Prelude". | ||

| + | ** You will see significant events like early key publications and technologies. | ||

| + | * What are some significant early events related to the development of Bitcoin? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Early development". | ||

| + | ** You will see early events starting from the first codings by {{w|Satoshi Nakamoto}}. | ||

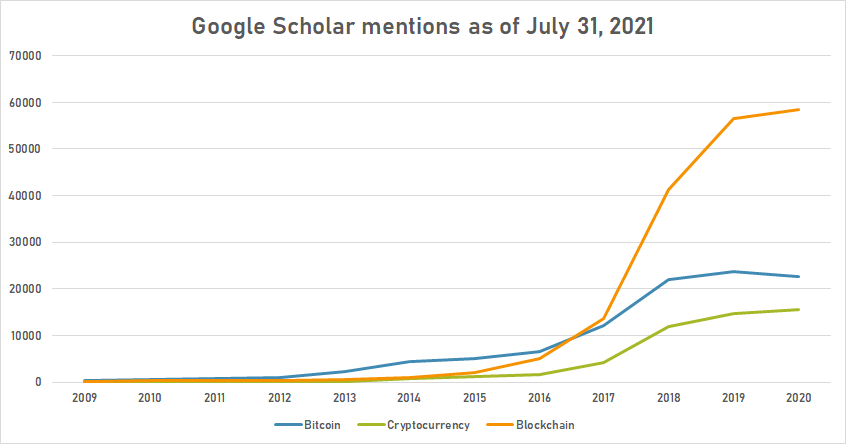

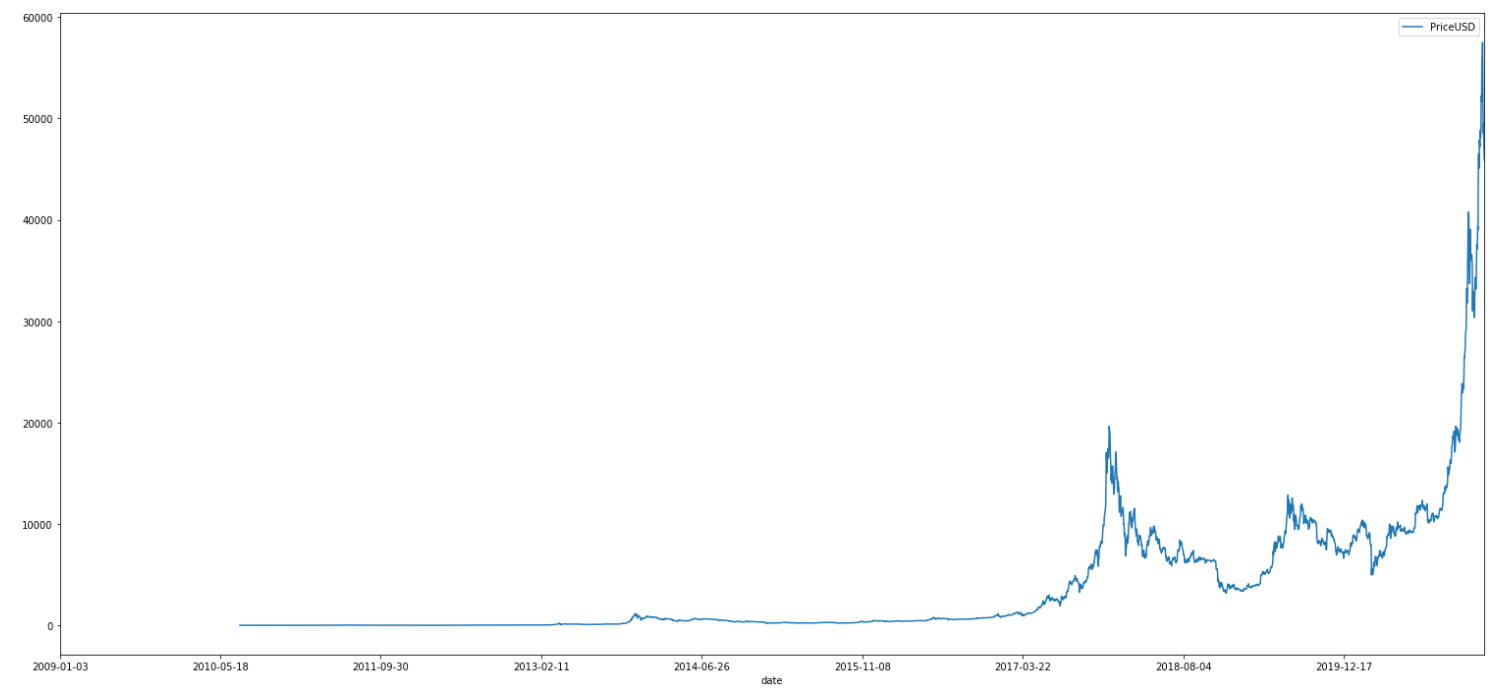

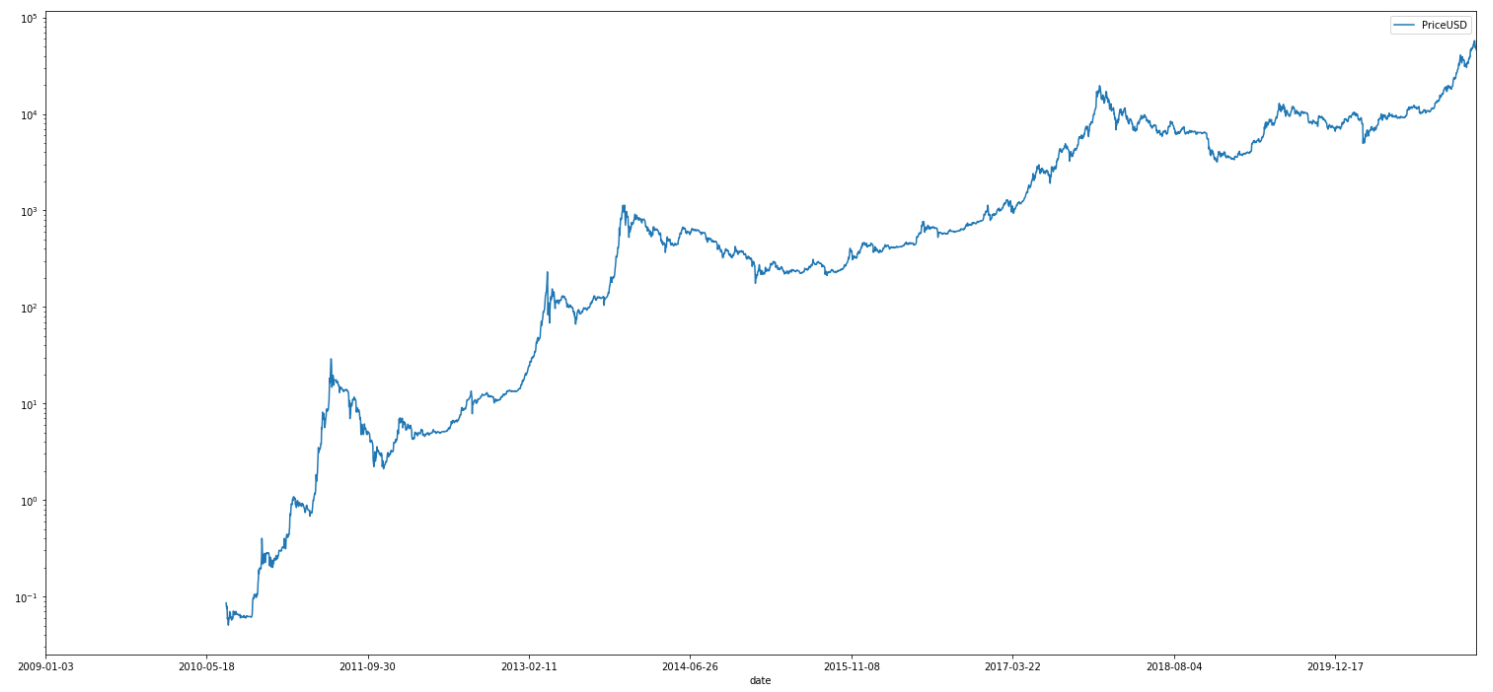

| + | * How did Bitcoin valuation evolve over time? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Valuation". | ||

| + | ** See the Visual data section which provides graphs illustrating the valuation of Bitcoin. | ||

| + | * What are some milestone transactions involving Bitcoin? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Milestone transaction". | ||

| + | ** You will discover some historic events, like two pizzas having been ordered in exchange for 10,000 Bitcoins in 2010. | ||

| + | * What are some Bitcoin acquisitions of historical importance? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Notable acquisition" | ||

| + | ** You will see sizable and/or early acquisitions by some notable people now commonly associated with the cryptocurrency. | ||

| + | * What are some events describing the adoption of Bitcoin? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Currency adoption" | ||

| + | ** You will see some notable examples of Bitcoin adoption as a payment method, as well as an investment and {{w|medium of exchange}}. | ||

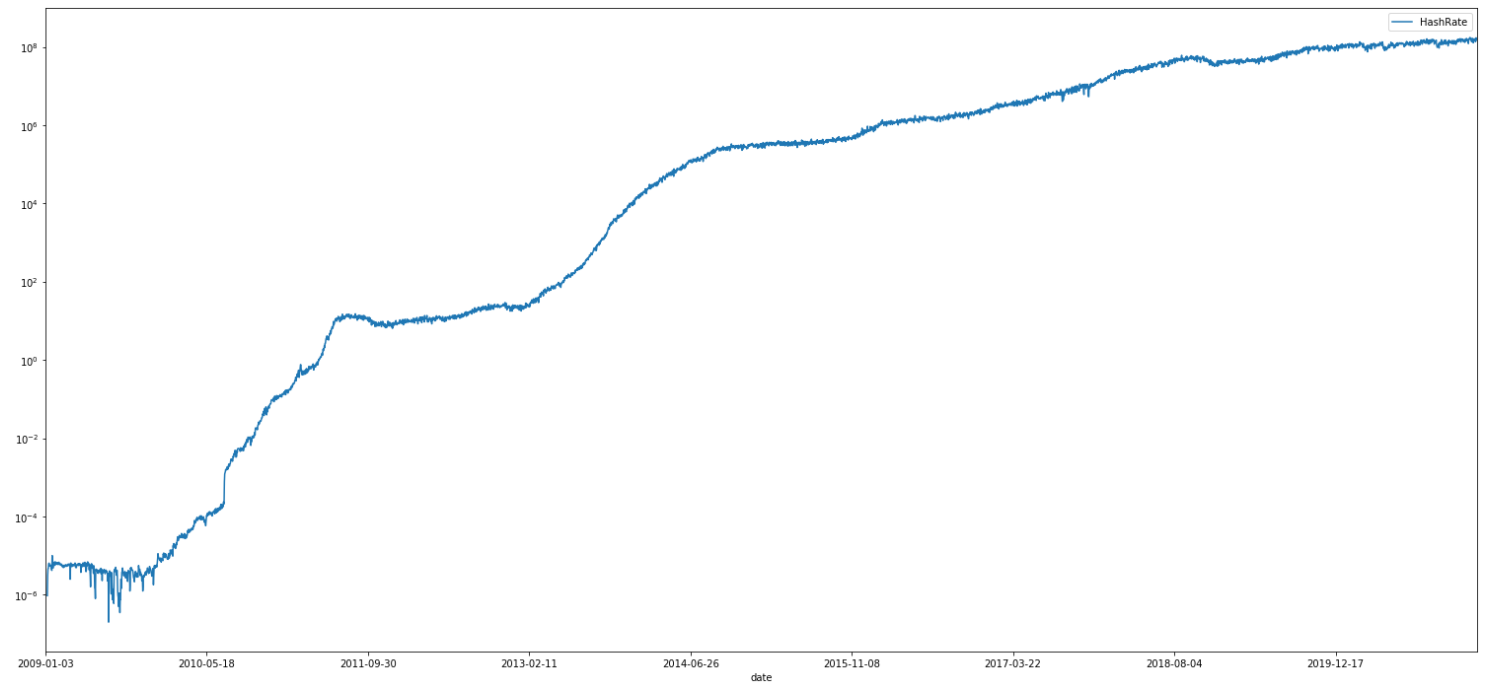

| + | * What are some notable events related to Bitcoin mining? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Mining". | ||

| + | ** You will see events related to Bitcoin halving, mining farms, companies specialized in bitcoin mining, and several milestone figures. | ||

| + | * What are some notable organizations related to Bitcoin? | ||

| + | ** For Bitcoin exchange, sort the full timeline by "Event type" and look for the group of rows with value "Organization ([[w:Bitcoin exchange|exchange company]])". | ||

| + | ** For other organizations, sort the full timeline by "Event type" and look for the group of rows with value "Organization". | ||

| + | * What are the several warnings on the use of Bitcoin issued by national authorities around the world? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Official response (warning)". | ||

| + | ** You will see events describing declarations by authorities against the use of Bitcoin and cryptocurrencies in general, due to several reasons. | ||

| + | * What are the several regulations of Bitcoin issued by national authorities around the world? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Official response (regulation)". | ||

| + | ** You will see a diverse list of events related to positive responses by authorities, like the adoption as payment for administrative costs in {{w|Switzerland}} to regulations in other countries aimed at legalizing transactions. | ||

| + | * What are the several negative reactions by national authorities around the world? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Official response (negative)". | ||

| + | ** You will see mostly events describing non recognitions by authorities to complete bans? | ||

| + | * What are some historic heists and hacks involving Bitcoins? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Security". | ||

| + | ** You will discover some important heists, like the {{w|Mt. Gox}} hack, Bitcoin's biggest heist to date. | ||

| + | * What are some notable Bitcoin forks? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Bitcoin fork". | ||

| + | ** You will see a list of major forks. | ||

| + | * What are some important papers, posts, and publications related to Bitcoin? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Literature". | ||

| + | ** You will see important contributions, including publications by {{w|Satoshi Nakamoto}}. | ||

| + | * What are some events describing web contribution of information on about Bitcoin? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "{{w|Content creation}}". | ||

| + | ** You will mostly see some notable forums on {{w|reddit}}. | ||

| + | * Other events are described under the following types: "Blockchain company", "{{w|Broadcasting}}", "Corporation policy", "Education", "Fraud case", "Legal", "{{w|Market capitalization}}", "Notable case", "Notable people", "Notable prediction", "Research", "Service shutdown", and "Website launch". | ||

==Big picture== | ==Big picture== | ||

| + | |||

| + | === Summary by year === | ||

{| class="wikitable" | {| class="wikitable" | ||

| Line 14: | Line 69: | ||

| 2011–2012 || Continued development || Satoshi Nakamoto disappears, but Bitcoin growth continues. Silk Road, BitPay, and Coinbase all launch during this period. | | 2011–2012 || Continued development || Satoshi Nakamoto disappears, but Bitcoin growth continues. Silk Road, BitPay, and Coinbase all launch during this period. | ||

|- | |- | ||

| − | | | + | | 2013 || First crash || The price of one Bitcoin reaches US$1,000 for the first time. Shortly after, the price quickly begins to decline, plummetting to around U$300. It would take more than two years before the price reached $1,000 again.<ref name="A Short History Of Bitcoin And Crypto Currency Everyone Should Read">{{cite web |title=A Short History Of Bitcoin And Crypto Currency Everyone Should Read |url=https://www.forbes.com/sites/bernardmarr/2017/12/06/a-short-history-of-bitcoin-and-crypto-currency-everyone-should-read/#593a48143f27 |website=forbes.com |accessdate=30 December 2019}}</ref> |

| + | |- | ||

| + | | 2014–2016 || Temporal stall || In January 2014, Mt.Gox, the world’s largest Bitcoin exchange, goes offline, and the owners lose 850,000 Bitcoins.<ref name="A Short History Of Bitcoin And Crypto Currency Everyone Should Read"/> This is considered the biggest Bitcoin heist in history. Quickly the Bitcoin price falls below $1,000 around the time, and would struggle below the key level for a few years.<ref name="Bitcoin History: Timeline"/> 2014 is characterized by mainstream investors discovering their appetite for bitcoin startups.<ref>{{cite web |title=Barry Silbert edges out Tim Draper with 48,000 bitcoin victory in fight for crypto-dominance |url=https://www.bizjournals.com/bizjournals/news/2014/12/09/barry-silbert-edges-out-tim-draper-with-48-000.html |website=www.bizjournals.com |access-date=8 February 2021}}</ref> | ||

| + | |- | ||

| + | | 2017 || Mainstream popularity || Bitcoin sees a roughly 20-fold rise since the beginning of the year, growing also exponentially in popularity. Throughout 2017, Bitcoin value would grow from US$900 to almost US$20,000. | ||

| + | |- | ||

| + | | 2018 || [[w:2018 cryptocurrency crash|Bitcoin crash]] || In January, the [[w:2018 cryptocurrency crash|Great crypto crash]] occurs. After an unprecedented boom in 2017, the price of Bitcoin falls by about 65 percent during the month from 6 January to 6 February. In late March, {{w|Facebook}}, {{w|Google}}, and {{w|Twitter}} ban advertisements for {{w|initial coin offering}}s (ICO) and token sales.<ref>{{Cite news|url=https://www.bloomberg.com/news/articles/2018-03-26/twitter-joins-facebook-google-in-banning-crypto-coin-sale-ads|title=Twitter Joins Facebook, Google in Banning Crypto Coin Sale Ads|last=Russo|first=Camila|date=March 26, 2018|work=Bloomberg|access-date=30 December 2019}}</ref> The price steadily drops all year.<ref name="Bitcoin History: Timeline">{{cite web |title=Bitcoin History: Timeline, Origins and Founder |url=https://www.thestreet.com/investing/bitcoin/bitcoin-history-14686578 |website=thestreet.com |accessdate=1 January 2020}}</ref> By November 15, Bitcoin's market capitalization falls below US$100 billion for the first time since October 2017 and the price of Bitcoin falls to $5,500.<ref>{{Cite news|url=https://www.cnbc.com/2018/11/15/bitcoin-market-cap-falls-below-100-billion-for-first-time-since-2017.html|title=Bitcoin market cap falls below $100 billion for first time since October 2017|last=Huang|first=Eustance|date=2018-11-14|publisher={{w|CNBC}}|access-date=2018-11-15}}</ref><ref>{{Cite news|url=http://fortune.com/2018/11/15/bitcoin-price-cryptocurrency-crash-why/|title=The Entire Cryptocurrency Scene—Including Bitcoin—Is Plummeting Again. These Might Be the Reasons Why|work=Fortune|access-date=30 December 2019|language=en}}</ref> | ||

| + | |- | ||

| + | | 2019 || Resurgence || Bitcoin sees a new resurgence in price and volume, rising to around US$10,000. As of the end of 2019, the price of one Bitcoin is of around US$7,250. | ||

| + | |- | ||

| + | | 2020–2021 || New heights || Bitcoin valuation surpasses the 2017 [[w:cryptocurrency bubble|bubble]] highest value. Increasing institutional adoption is experienced as the first real signs banks, money managers, insurance firms and companies start to embrace fast-growing markets for cryptocurrencies and digital assets.<ref>{{cite web |title=For many reasons 2020 will loom large in future textbooks on financial history. |url=https://www.coindesk.com/bitcoin-prices-in-2020-heres-what-happened |website=coindesk.com |access-date=15 February 2021}}</ref> | ||

| + | |- | ||

|} | |} | ||

| + | |||

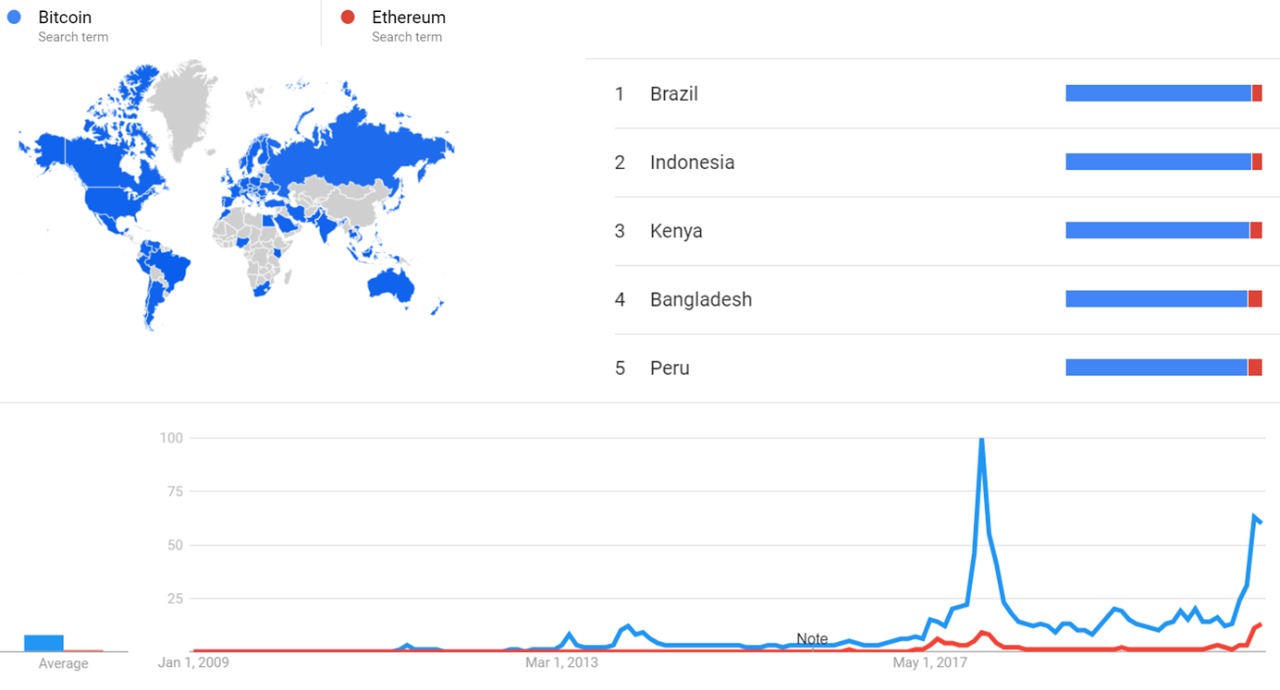

| + | === Summary by country === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | ! Key country !! Summary | ||

| + | |- | ||

| + | | {{w|United States}} || The United States is home to most of the world's largest Bitcoin companies, as well as most crypto endeavors and activities.<ref name="usethebitcoin.com"/><ref>{{cite web |title=Buy Bitcoin in the United States |url=https://www.buybitcoinworldwide.com/united-states/ |website=buybitcoinworldwide.com |accessdate=23 March 2020}}</ref> There is a large number of exchanges, trading platforms, funds, crypto mining facilities, and blockchain-oriented projects.<ref name="usethebitcoin.com"/> As of February 2019, This country leads with over 2,625 nodes, followed by Germany and France with 2016 and 698 respectively.<ref name="thenextweb.com">{{cite web |title=3 countries host over 50% of the world’s Bitcoin nodes |url=https://thenextweb.com/hardfork/2019/02/27/3-countries-50-perecent-bitcoin-network/ |website=thenextweb.com |accessdate=23 March 2020}}</ref> | ||

| + | |- | ||

| + | | {{w|China}} || As of June 2018, financial institutions are not allowed to facilitate Bitcoin transactions.<ref name="loc.govs"/> The country leads in digital trading, and its exchanges have one of the biggest volumes of Bitcoin being traded on a daily basis.<ref name="usethebitcoin.com">{{cite web |title=10 Countries with the Most Bitcoin Hodlers |url=https://usethebitcoin.com/10-countries-with-the-most-bitcoin-hodlers/ |website=usethebitcoin.com |accessdate=23 March 2020}}</ref> | ||

| + | |- | ||

| + | | {{w|Japan}} || As of 2020, Japan is one of the few countries that recognize cryptocurrencies as a legitimate means of payment. The country has one of the most effective regulatory environments in the world related to blockchain technology and virtual currencies. After the {{w|United States Dollar}}, Japan is also the country with the second-largest trading volume against Bitcoin around the world.<ref name="usethebitcoin.com"/> | ||

| + | |- | ||

| + | | {{w|South Korea}} || {{w|South Korea}} accounts for almost 10% of all the Bitcoin traded around the world, after the {{w|United States Dollar}} and the {{w|Japanese Yen}}. The country hosts a large amount of exchanges and crypto businesses and there is a big interest in trading and using cryptocurrencies among the population.<ref name="usethebitcoin.com"/> | ||

| + | |- | ||

| + | | {{w|Switzerland}} || {{w|Switzerland}} aims to become a cryptocurrency and blockchain hub. Local regulators have a very open mind towards digital assets.<ref name="usethebitcoin.com"/> It is possible to pay taxes with Bitcoin in some districts of the country. However, there is currently no form of "state-backed" cryptocurrency.<ref>{{cite web |title=Blockchain and cryptocurrency regulation 2020 |url=https://www.globallegalinsights.com/practice-areas/blockchain-laws-and-regulations/switzerland |website=globallegalinsights.com |accessdate=24 March 2020}}</ref> | ||

| + | |- | ||

| + | |} | ||

| + | |||

| + | |||

| + | |||

==Full timeline== | ==Full timeline== | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

{| class="sortable wikitable" | {| class="sortable wikitable" | ||

| − | ! Year !! Month and date !! Event type !! Details | + | ! Year !! Month and date !! Event type !! Details !! Country/location |

| + | |- | ||

| + | | 1976 || || Prelude || The [[wikipedia:Public-key cryptography#Public discovery|first public work on public-key cryptography]] is published.<ref name="gwern" /> Public-key cryptography is used in Bitcoin for specifying ownership of coins.<ref name="How_bitcoin_works" /> || {{w|United States}} | ||

| + | |- | ||

| + | | 1979 || || Prelude || The [[wikipedia:Merkle tree|Merkle tree]] is patented by [[wikipedia:Ralph Merkle|Ralph Merkle]].<ref name="gwern" /> || {{w|United States}} | ||

| + | |- | ||

| + | | 1991 || || Prelude || Haber and Stornetta's paper on linked timestamping is published.<ref name="princeton_bitcoin_book">{{cite book |title=Bitcoin and Cryptocurrency Technologies (draft version) |first1=Arvind |last1=Narayanan |first2=Joseph |last2=Bonneau |first3=Edward |last3=Felten |first4=Andrew |last4=Miller |first5=Steven |last5=Goldfeder |first6=Jeremy |last6=Clark |date=February 9, 2016 |publisher=Princeton University Press |url=https://d28rh4a8wq0iu5.cloudfront.net/bitcointech/readings/princeton_bitcoin_book.pdf?a=1}}</ref>{{rp|15}} || {{w|United States}} | ||

| + | |- | ||

| + | | 1992–1993 || || Prelude || A {{w|proof-of-work system}} for {{w|email spam}} is presented.<ref name="gwern" /> || | ||

| + | |- | ||

| + | | 1997 || {{dts|March 28}} || Prelude || {{w|Adam Back}} proposes [[wikipedia:Hashcash|Hashcash]] on the Cypherpunks mailing list.<ref name="gwern" /><ref>{{cite web |url=http://www.hashcash.org/papers/announce.txt |title=[ANNOUNCE] hash cash postage implementation |accessdate=June 16, 2017}}</ref> || | ||

| + | |- | ||

| + | | 1998 || || Prelude || Wei Dai's b-money paper is published.<ref name="gwern" /> || | ||

| + | |- | ||

| + | | 1998 || || Prelude || American computer scientist {{w|Nick Szabo}} claims to have had the idea of Bitgold as early as this year. He would only blog about the idea in 2005.<ref name="princeton_bitcoin_book" />{{rp|17}} || {{w|United States}} | ||

| + | |- | ||

| + | | 1999 || || Prelude || Sander and Ta-Shma's anonymous electronic cash system is published. "Satoshi could have integrated some anonymity insights of this approach into Bitcoin, but it is unclear whether he was not aware of this work when he released Bitcoin, whether he was familiar with it but decided not to use these features because of their high computational cost, or whether he consciously decided to leave Bitcoin pseudonymous."<ref>{{cite book |title=Understanding Bitcoin: Cryptography, engineering, and economics |author=Pedro Franco |year=2015 |publisher=Wiley}}</ref>{{rp|165–167}} || | ||

| + | |- | ||

| + | | 2001 || || Prelude || [[wikipedia:SHA-2|SHA-2]] is first published.<ref name="gwern" /> Of the SHA-2 family of hash functions, SHA-256 would be used in Bitcoin for "integrity, block-chaining, and the hashcash cost-function".<ref name="How_bitcoin_works">{{cite web |url=https://en.bitcoin.it/wiki/How_bitcoin_works |title=How bitcoin works |website=Bitcoin Wiki |accessdate=June 16, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2002 || {{dts|August 1}} || Prelude || Adam Back's Hashcash paper is published. This is the paper cited in Satoshi Nakamoto's white paper.<ref>{{cite web |url=http://www.hashcash.org/papers/hashcash.pdf |title=Hashcash - A Denial of Service Counter-Measure |author=Adam Back |date=August 1, 2002 |accessdate=June 16, 2017}}</ref> The paper also happens to be the most-recently-published reference in Satoshi Nakamoto's white paper.<ref>{{cite web |url=https://bitcoin.org/bitcoin.pdf |title=Bitcoin: A Peer-to-Peer Electronic Cash System |author=Satoshi Nakamoto |accessdate=June 16, 2017}}</ref> || {{w|United Kingdom}} | ||

| + | |- | ||

| + | | 2002 || {{dts|December 9}}–10 || Prelude || An entity x posts to the alt.internet.p2p and uk.finance newsgroups an "idea of a future with virtual peer to peer banking". This entity is speculated to be Satoshi Nakamoto.<ref>{{cite web |url=https://groups.google.com/forum/#!msg/uk.finance/-Ko72tv170I/HTKv-5VCbGQJ |title=Virtual peer to peer banking - Google Groups |accessdate=June 15, 2017}}</ref><ref>{{cite web |url=https://en.bitcoin.it/wiki/X |title=x |website=Bitcoin Wiki |accessdate=June 15, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2007 || {{dts|May}} || Early development || Satoshi Nakamoto claims he starts coding Bitcoin around this time.<ref name="princeton_bitcoin_book" />{{rp|18}} || | ||

| + | |- | ||

| + | | 2008 || {{dts|August}} || Early development || Satoshi Nakamoto emails Adam Back, the creator of hashcash, "asking him to look at a short paper describing something called Bitcoin".<ref name="popper_digitial_gold">{{cite book |title=Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money |author=Nathaniel Popper |year=2015 |publisher=Harper}}</ref> || | ||

| + | |- | ||

| + | | 2008 || {{dts|August 18}} || Early development || The <code>bitcoin.org</code> domain name is registered on this day.<ref name="gwern">{{cite web |url=https://www.gwern.net/Bitcoin%20is%20Worse%20is%20Better |author=gwern |date=May 27, 2011 |title=Bitcoin is Worse is Better |website=Gwern.net |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2008 || {{dts|August 22}} || Notable people || Satoshi Nakamoto emails Wei Dai. In the email, Nakamoto links to a "pre-release draft" of the white paper and asks when Dai's b-money paper was published, claiming that he wants to know this so he can cite the paper correctly in his own.<ref name="gwern_2008_nakamoto" /> || | ||

| + | |- | ||

| + | | 2008 || {{dts|October 3}} || Notable people || A version of Satoshi Nakamoto's white paper exists from this day.<ref name="gwern_2008_nakamoto">{{cite web |url=https://www.gwern.net/docs/2008-nakamoto |author=Satoshi Nakamoto, Wei Dai |date=March 17, 2014 |title=Dai/Nakamoto emails |website=Gwern.net |accessdate=June 13, 2017}}</ref><ref>{{cite web |url=https://www.gwern.net/docs/20081003-nakamoto-bitcoindraft.pdf |title=20081003-nakamoto-bitcoindraft.pdf |accessdate=June 13, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2008 || {{dts|November 1}} || Literature || The first public version of Satoshi Nakamoto's white paper, titled "Bitcoin: A Peer-to-Peer Electronic Cash System", is published.<ref name="gwern" /><ref>{{cite web |url=https://www.mail-archive.com/cryptography@metzdowd.com/msg09959.html |title=Bitcoin P2P e-cash paper |accessdate=June 12, 2017 |date=November 1, 2008}}</ref> Depending on the time zone, this is October 31.<ref name="cat_hist" /> || | ||

| + | |- | ||

| + | | 2008 || {{dts|November 9}} || Early development || The Bitcoin project is registered on [[wikipedia:SourceForge|SourceForge]].<ref name="cat_hist" /><ref>{{cite web |url=https://sourceforge.net/projects/bitcoin/ |title=Bitcoin |publisher=SourceForge |accessdate=June 12, 2017 |quote=Registered 2008-11-09}}</ref> || | ||

| + | |- | ||

| + | | 2008 || {{dts|November}}–December || Notable people || Satoshi Nakamoto sends Hal Finney "an early, beta version [of Bitcoin] for testing". "In test runs in November and December they worked out some of the early kinks."<ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2009 || {{dts|January 3}} || Early development || The Bitcoin genesis block is established.<ref>{{cite web |url=https://blockexplorer.com/block/000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f |title=Bitcoin Block 0 |website=Bitcoin Block Explorer |accessdate=June 12, 2017}}</ref><ref name="cat_hist">{{cite web |url=https://en.bitcoin.it/wiki/Category:History |title=Category:History |website=Bitcoin Wiki |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|January 12}} || Milestone transaction || The first Bitcoin transaction takes place, from Satoshi Nakamoto to [[wikipedia:Hal Finney (computer scientist)|Hal Finney]].<ref name="firsts">{{cite web |url=https://en.bitcoin.it/wiki/Bitcoin_Firsts |title=Bitcoin Firsts |website=Bitcoin Wiki |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|March 8}} || {{w|Content creation}} || The article {{w|Bitcoin}} is created on {{w|English Wikipedia}}.<ref>{{cite web |title=Bitcoin: Revision history |url=https://en.wikipedia.org/w/index.php?title=Bitcoin&dir=prev&action=history |website=en.wikipedia.org |access-date=11 December 2020}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|May}} || Early development || Martti Malmi emails Satoshi Nakamoto for the first time, expressing willingness to help with Bitcoin development.<ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2009 || {{dts|August 29}} || {{w|Content creation}} || The first revision in the Bitcoin Git repository is made on this day. However this commit is converted from the Subversion revision control system.<ref name="gwern" /><ref>{{cite web |url=https://github.com/bitcoin/bitcoin/commit/4405b78d6059e536c36974088a8ed4d9f0f29898 |publisher=GitHub |title=First commit · bitcoin/bitcoin@4405b78 |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|October 5}} || Early development || BTC–USD exchange rates are first posted by NewLibertyStandard, where $1 is worth 1,309.03 BTC.<ref name="cat_hist" /> "During 2009 my exchange rate was calculated by dividing $1.00 by the average amount of electricity required to run a computer with high CPU for a year, 1331.5 kWh, multiplied by […] the average residential cost of electricity in the United States for the previous year, $0.1136, divided by 12 months divided by the number of bitcoins generated by my computer over the past 30 days."<ref>{{cite web |url=http://newlibertystandard.wikifoundry.com/page/2009+Exchange+Rate |title=2009 Exchange Rate - New Liberty Standard |accessdate=June 14, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|October 9}}–12 || {{w|Content creation}} || The channel #bitcoin-dev is apparently registered on the [[wikipedia:Freenode|Freenode]] IRC network around this time. The two sources documenting this have conflicting dates, neither provides a source, and it's unclear how to tell when a channel was registered.<ref name="cat_hist" /><ref>{{cite web |url=https://books.google.com/books?id=Jjw4DAAAQBAJ&lpg=PT4&ots=UAySAnv_Jt&dq=freenode%20%22bitcoin-dev%22&pg=PT4#v=onepage&q=freenode%20%22bitcoin-dev%22&f=false |title=Be a BITCOIN Millionaire |publisher=Google Books |accessdate=June 14, 2017}}</ref> Discussion about chat logs would only come almost a year later.<ref>{{cite web |url=https://bitcointalk.org/index.php?topic=986.0 |title=Freenode / #Bitcoin-Dev Chat Logs |accessdate=June 14, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|October 12}} || Milestone transaction || The first trade of Bitcoin for [[wikipedia:Fiat money|fiat money]] takes place. Martti Malmi (Sirius) sells 5,050 BTC to NewLibertyStandard for $5.02.<ref name="firsts" /><ref>{{cite web |url=https://twitter.com/marttimalmi/status/423455561703624704 |title=Martti Malmi on Twitter |publisher=Twitter |accessdate=June 12, 2017 |quote=Found the first known bitcoin to USD transaction from my email backups. I sold 5,050 BTC for $5,02 on 2009-10-12.}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|November 22}} || {{w|Content creation}} || Bitcoin Talk, a discussion forum about Bitcoin, is created.<ref>{{cite web |url=https://en.bitcoin.it/wiki/BitcoinTalk |title=BitcoinTalk - Bitcoin Wiki |accessdate=June 24, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2009 || {{dts|December 30}} || || The first difficulty increase occurs, from 1 to 1.18.<ref>{{cite web |url=https://blockchain.info/block/000000004f2886a170adb7204cb0c7a824217dd24d11a74423d564c4e0904967 |title=Bitcoin Block #32256 |accessdate=June 14, 2017}}</ref><ref>{{cite web |url=http://www.ggtrust.com/currency/files/2015/06/3.-Basics-of-Cryptocurrency.pdf |title=PowerPoint Presentation - 3.-Basics-of-Cryptocurrency.pdf |accessdate=June 14, 2017}}</ref><ref name="cat_hist" /> || | ||

| + | |- | ||

| + | | 2010 || {{dts|February 6}} || Organization ([[w:Bitcoin exchange|exchange company]]) || An early version of Bitcoin Market begins operating.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Bitcoin_Market |title=Bitcoin Market |website=Bitcoin Wiki |accessdate=June 14, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2010 || {{dts|March 17}} || Organization ([[w:Bitcoin exchange|exchange company]]) || BitcoinMarket.com starts operating as the first bitcoin exchange. The price per Bitcoin is of around US$0.003 at the time.<ref>{{cite web |title=Bitcoin History part 3 |url=https://www.pivot.one/share/post/5c21d34e595ce716ecc10970?uid=5baf14acf3098d7b5b37ac16&invite_code=CVWPZS |website=pivot.one |accessdate=30 December 2019}}</ref> || | ||

| + | |- | ||

| + | | 2010 || {{dts|April}}–May || Mining || Laszlo Hanecz (also "Hanyecz") begins mining bitcoin with a GPU around this time. On May 17 he wins twenty-eight blocks; these wins give him fourteen hundred new coins that day.<ref name="popper_digitial_gold" /> || {{w|United States}} | ||

| + | |- | ||

| + | | 2010 || {{dts|May 22}} || Milestone transaction || Laszlo Hanyecz (laszlo) reports that he has traded 10,000 of his bitcoins for two pizzas ordered by Jeremy Sturdivant (jercos). This transaction is the first documented purchase of a good using bitcoin.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Laszlo_Hanyecz |title=Laszlo Hanyecz |publisher=Bitcoin Wiki |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://en.bitcoin.it/wiki/Jercos |title=Jercos |publisher=Bitcoin Wiki |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=137.0 |title=Pizza for bitcoins? |accessdate=June 12, 2017}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2010 || {{dts|July}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Ross Ulbricht begins the development of Silk Road.<ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2010 || {{dts|July 11}} || Currency adoption || Release of Bitcoin version 0.3 is posted to Slashdot. This is the result of a "campaign to get Bitcoin real press coverage". With the increase in traffic from Slashdot, the Bitcoin website temporarily goes down. Despite "the derogatory comments that showed up under the Slashdot item", this brings in a bunch of new Bitcoin users: "The number of downloads would jump from around three thousand in June to over twenty thousand in July. The day after the Slashdot piece appeared, Gavin Andresen's Bitcoin faucet gave away 5,000 Bitcoins and was running empty."<ref name="popper_digitial_gold" /><ref>{{cite web |url=http://historyofbitcoin.org/ |title=Bitcoin History: The Complete History of Bitcoin [Timeline] |accessdate=June 16, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2010 || {{dts|July 18}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|Mt. Gox}}, a bitcoin exchange founded by Jed McCaleb, is announced.<ref>{{cite web |url=https://www.gwern.net/docs/2014-mccaleb |author=Jed McCaleb |date=February 16, 2014 |title=Jed McCaleb interview |website=Gwern.net |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=444.0 |title=New Bitcoin Exchange (mtgox.com) |accessdate=June 12, 2017 |author=mtgox}}</ref> McCaleb had heard about Bitcoin from the Slashdot post several days earlier.<ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2010 || {{dts|July 18}} || Mining || ArtForz generates "his first block after establishing his personal OpenCL GPU hash farm". Apparently ArtForz announces this date on Bitcoin Talk, but neither source links to it, and a quick search didn't turn it up.<ref name="cat_hist" /><ref>{{cite web |url=http://www.ofnumbers.com/2014/04/20/how-artforz-changed-the-history-of-bitcoin-mining/ |title=How ArtForz changed the history of Bitcoin mining |date=April 20, 2014 |author=Tim Swanson |publisher=Great Wall of Numbers |accessdate=June 14, 2017 |quote=Assuming he began mining on July 18th (based on his forum post stating that)}}</ref> || | ||

| + | |- | ||

| + | | 2010 || {{dts|July}} (late) || {{w|Content creation}} || Martti Malmi launches the non-English Bitcoin forum, in Russian.<ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2010 || {{dts|September 9}} || {{w|Content creation}} || The main Bitcoin subreddit, r/Bitcoin, is created. As of March 28, 2020 it has over 1,3 million members.<ref>{{cite web |title=Bitcoin - The Currency of the Internet |url=https://www.reddit.com/r/Bitcoin/new/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2010 || {{dts|October 17}} || {{w|Content creation}} || The Freenode IRC channel #bitcoin-otc is established. (Citation gives this date but does not provide a source.)<ref name="cat_hist" /> || | ||

| + | |- | ||

| + | | 2010 || {{dts|November 6}} || {{w|Market capitalization}} || Bitcoin market capitalization passes $1 million.<ref name="cat_hist" /><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=1672 |title=Bitcoin economy passes US $1 Million! |accessdate=June 14, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2010 || {{dts|December 12}} || Literature || The last post from the "satoshi" account on Bitcoin Talk is from this day.<ref>{{cite web |url=https://bitcointalk.org/index.php?action=profile;u=3;sa=showPosts |title=Latest posts of: satoshi |accessdate=June 16, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2010 || {{dts|December 19}} || Notable people || American software developer {{w|Gavin Andresen}} announces that he is stepping in to do "more active project management for bitcoin".<ref>{{cite web |url=https://bitcointalk.org/index.php?topic=2367.0;all |title=Development process straw-man |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://www.technologyreview.com/s/527051/the-man-who-really-built-bitcoin/ |author=Tom Simonite |title=Meet Gavin Andresen, the most powerful person in the world of Bitcoin |publisher=MIT Technology Review |date=August 15, 2014 |accessdate=June 12, 2017}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2011 || || Physical bitcoin || Casascius coins are first created.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Casascius_physical_bitcoins |title=Casascius physical bitcoins |website=Bitcoin Wiki |accessdate=June 27, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|January 6}} || Milestone transaction || First documented payment for work using Bitcoin takes place around this time.<ref name="firsts" /><ref>{{cite web |url=http://www.bitcoinblogger.com/2011/01/power-of-bitcoins.html |archiveurl=https://web.archive.org/web/20130618021437/http://www.bitcoinblogger.com/2011/01/power-of-bitcoins.html |archivedate=June 18, 2013 |title=The Power of Bitcoins |website=Bitcoin Blogger |date=January 6, 2011 |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|February}} || {{w|Exchange company}} || [[wikipedia:Silk Road (marketplace)|Silk Road]], the first modern darknet market, launches.<ref>{{cite web |url=https://bitcointalk.org/index.php?topic=3984.msg57086#msg57086 |title=Silk Road: anonymous marketplace. Feedback requested :) |accessdate=June 22, 2017}}</ref> Silk Road is the [[wikipedia:Darknet market#Silk Road and early markets|first darknet market to use both Tor and Bitcoin escrow]]. || | ||

| + | |- | ||

| + | | 2011 || {{dts|April 16}} || Literature || Jerry Brito's "Online Cash Bitcoin Could Challenge Governments, Banks" is published on ''Time''.<ref>{{cite web |url=http://techland.time.com/2011/04/16/online-cash-bitcoin-could-challenge-governments/ |publisher=TIME.com |title=Online Cash Bitcoin Could Challenge Governments, Banks |author=Jerry Brito |date=April 16, 2011 |accessdate=June 24, 2017}}</ref> Nathaniel Popper calls this "the first mainstream news coverage for Bitcoin".<ref name="popper_digitial_gold" /> || {{w|United States}} | ||

| + | |- | ||

| + | | 2011 || {{dts|April}} (late){{snd}}May (early) || Notable people || The final emails from Satoshi Nakamoto are from this period.<ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2011 || {{dts|May}} || {{w|Payment service provider}} || {{w|BitPay}}, a Bitcoin payment service provider, is founded.<ref>{{cite web |url=https://www.crunchbase.com/organization/bitpay |title=BitPay |publisher=Crunchbase |accessdate=June 12, 2017 |quote=Founded: May 1, 2011}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2011 || {{dts|May 9}} || Physical bitcoin || The launch of Bitbills is announced. Bitbills are the first physical incarnation of bitcoins, coming in plastic cards that contain the cryptographic information.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Bitbills |title=Bitbills |publisher=Bitcoin Wiki |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=http://www.bitcoin.org/smf/index.php?topic=7724.0 |archiveurl=https://web.archive.org/web/20110514051850/http://www.bitcoin.org/smf/index.php?topic=7724.0 |archivedate=May 14, 2011 |date=May 9, 2011 |author=llama |title=Introducing Bitbills! |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|May 20}} || {{w|Content creation}} || The subreddit r/btc is created. As of March 28, 2020 it has 289,000 members.<ref>{{cite web |title=Bitcoin - The Internet of Money |url=https://www.reddit.com/r/btc/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|June 1}} || Literature || The Gawker piece on Silk Road is published.<ref>{{cite web |url=http://gawker.com/the-underground-website-where-you-can-buy-any-drug-imag-30818160 |title=The Underground Website Where You Can Buy Any Drug Imaginable |author=Adrian Chen |publisher=Gawker |accessdate=June 22, 2017}}</ref><ref name="liu">{{cite web |url=https://motherboard.vice.com/en_us/article/turning-five-a-timeline-of-bitcoins-greatest-milestones |publisher=Motherboard |title=Turning Five: A Timeline of Bitcoin's Greatest Milestones |author=Alec Liu |date=January 5, 2014 |accessdate=June 22, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|June 1}} || [[W:cryptocurrency exchange|Exchange company]] || [[w:BTCC (company)|BTCC]] launches as a bitcoin trading platform that enables its users to buy and sell bitcoins in the native Chinese CNY currency.<ref>{{cite web |title=BTCC |url=https://www.crunchbase.com/organization/btcc#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|June 14}} || Notable people || American software developer {{w|Gavin Andresen}} gives a talk on Bitcoin at the CIA.<ref name="popper_digitial_gold" /><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=6652.msg251755#msg251755 |title=Re: Gavin will visit the CIA |accessdate=June 24, 2017 |author=Gavin Andresen |date=June 20, 2011 |quote=I just uploaded pdf and KeyNote versions of the talk I gave at the CIA last Tuesday}}</ref><ref>{{cite web |url=https://twitter.com/gavinandresen/status/80785477342478336?lang=en |title=Gavin Andresen on Twitter |publisher=Twitter |accessdate=June 24, 2017 |quote=My talk at the CIA went well today. The hallways there are REALLY wide, and full of interesting stuff.}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2011 || {{dts|June 15}} || {{w|Content creation}} || The Bitcoin mining subreddit, r/BitcoinMining, is created. As of March 28, 2020 it has 37,300 members.<ref>{{cite web |title=Bitcoin Mining Forums: Turning Computers Into Cash Since 2011 |url=https://www.reddit.com/r/BitcoinMining/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|June 19}} || [[w:Cryptocurrency and security|Security]] || Mt. Gox is hacked, causing the price of bitcoin to drop "from $17 to 1 penny in less than an hour".<ref name="popper_digitial_gold" /><ref name="The rise and fall of Mt. Gox"/> || | ||

| + | |- | ||

| + | | 2011 || {{dts|July 26}} || [[w:Cryptocurrency and security|Security]] || The Polish exchange site Bitomat temporarily goes offline.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Bitomat |title=Bitomat |website=Bitcoin Wiki |accessdate=June 25, 2017}}</ref> It would later be announced that the private keys belonging to customers' Bitcoin addresses were accidentally deleted.<ref name="popper_digitial_gold" /> || {{w|Poland}} | ||

| + | |- | ||

| + | | 2011 || {{dts|July 28}} || [[W:cryptocurrency exchange|Exchange company]] || [[w:Kraken (company)|Kraken]] launches in the United States.<ref>{{cite web |title=Kraken |url=https://captainaltcoin.com/kraken-review/ |website=captainaltcoin.com |accessdate=29 December 2019}}</ref><ref>{{cite web |title=Kraken |url=https://www.bestbitcoinexchange.net/en/kraken-com/comment-page-3/ |website=bestbitcoinexchange.net |accessdate=29 December 2019}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2011 || {{dts|July 29}} || Service shutdown || The bitcoin wallet service MyBitcoin shuts down. "The founder of the site, a man who called himself Tom Williams, was unresponsive and soon enough all the wallets were frozen."<ref name="popper_digitial_gold" /><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=32900.0 |title=mybitcoin down or just me? |accessdate=June 25, 2017}}</ref><ref>{{cite web |url=https://en.bitcoin.it/wiki/MyBitcoin |title=MyBitcoin |website=Bitcoin Wiki |accessdate=June 25, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|July}} || [[w:Cryptocurrency and security|Security]] || The operator of Bitomat, the third-largest bitcoin exchange, announces having lost access to his wallet.dat file with about 17,000 bitcoins (roughly equivalent to US$220,000 at that time). He announces that he would sell the service for the missing amount, aiming to use funds from the sale to refund his customers.<ref>Dotson, Kyt (1 August 2011) {{cite web |url=http://siliconangle.com/blog/2011/08/01/third-largest-bitcoin-exchange-bitomat-lost-their-wallet-over-17000-bitcoins-missing/ |title=Third Largest Bitcoin Exchange Bitomat Lost Their Wallet, Over 17,000 Bitcoins Missing}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|August 19}} || Early development || The first Bitcoin Improvement Proposal (BIP) is submitted, explaining what a BIP is.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Bitcoin_Improvement_Proposals |title=Bitcoin Improvement Proposals - Bitcoin Wiki |accessdate=June 22, 2017}}</ref><ref>{{cite web |url=https://github.com/bitcoin/bips/blob/master/bip-0001.mediawiki |publisher=GitHub |title=bitcoin/bips |accessdate=June 22, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|August}} (late) || Conference || The Bitcoin Conference & World Expo NYC 2011, organized by Bruce Wagner of ''The Bitcoin Show'', takes place.<ref name="popper_digitial_gold" /> || {{w|United States}} | ||

| + | |- | ||

| + | | 2011 || {{dts|August 30}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|Blockchain.com}} launches.<ref>{{cite web |title=Blockchain.com - The Most Trusted Crypto Company |url=https://www.blockchain.com/research |website=www.blockchain.com |access-date=11 February 2021 |language=en}}</ref><ref>{{cite web |title=Blockchain.com - 48 Reviews - Bitcoin Exchange - BitTrust.org |url=http://bittrust.org/blockchaincom/0 |website=bittrust.org |access-date=11 February 2021}}</ref> || | ||

| + | |- | ||

| + | | 2011 || {{dts|August}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Bitcoin exchange {{w|Bitstamp}} is founded.<ref>{{cite web |title=bitstamp |url=https://www.bitstamp.net/article/bitstamps-fifth-anniversary/ |website=www.bitstamp.net |access-date=11 February 2021}}</ref><ref>{{cite web |title=Bitstamp deja de operar en Londres luego de 8 años de funcionamiento |url=https://es.cointelegraph.com/news/bitstamp-reportedly-leaves-london-after-8-years-of-operation |website=Cointelegraph |access-date=11 February 2021 |language=es}}</ref> || | ||

| + | |- | ||

| + | | 2011 || ? || Notable acquisition || {{w|Roger Ver}} starts investing in Bitcoin shares in this year.<ref name="henryharvin">{{cite web |title=WHO ARE THE RICHEST BITCOIN OWNERS? Bitcoin - Henry Harvin |url=https://www.henryharvin.com/blog/who-are-the-top-richest-bitcoin-owners/ |website=www.henryharvin.com |access-date=8 February 2021}}</ref> || | ||

| + | |- | ||

| + | | 2012 || {{dts|April 24}} || Website launch || Satoshi Dice (now called [[wikipedia:MegaDice|MegaDice]]), a betting site, is announced on Bitcoin Talk by [[wikipedia:Erik Voorhees|Erik Voorhees]].<ref>{{cite web |url=https://bitcointalk.org/index.php?topic=77870.0 |title=SatoshiDICE.com - The World's Most Popular Bitcoin Game |accessdate=June 27, 2017}}</ref><ref>{{cite web |url=https://en.bitcoin.it/wiki/Satoshi_Dice |title=Satoshi Dice |website=Bitcoin Wiki |accessdate=June 27, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2012 || {{dts|May 30}} || {{w|Content creation}} || The Bitcoin Magazine subreddit, r/BitcoinMagazine, is created. As of March 28, 2020 it has 998 subscribers.<ref>{{cite web |title=Bitcoin Magazine: Reading into Bitcoin |url=https://www.reddit.com/r/BitcoinMagazine/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2012 || {{dts|June}} || Organization ([[w:Bitcoin exchange|exchange company]]) || [[wikipedia:Coinbase|Coinbase]], a digital asset exchange company that operates exchanges of Bitcoin (among other digital currencies), is founded.<ref>{{cite web |url=https://www.coinbase.com/about?locale=en-US |title=Coinbase - Buy and Sell Bitcoin, Ethereum, and Litecoin |accessdate=June 12, 2017 |quote=Founded in June of 2012, Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like bitcoin, ethereum, and litecoin.}}</ref><ref>{{cite web |url=https://www.crunchbase.com/organization/coinbase |title=Coinbase |publisher=Crunchbase |accessdate=June 12, 2017 |quote=Founded: June 1, 2012}} Crunchbase gives June 1 as the founding date, but Wikipedia gives June 20 with no citation.</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2012 || {{dts|June 15}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|LocalBitcoins}} is founded.<ref>{{cite web |title=LocalBitcoins |url=https://www.crunchbase.com/organization/localbitcoins |website=crunchbase.com |accessdate=22 December 2019}}</ref> || | ||

| + | |- | ||

| + | | 2012 || {{dts|September 27}} || Organization || The [[wikipedia:Bitcoin Foundation|Bitcoin Foundation]] is founded.<ref>{{cite web |url=http://www.forbes.com/sites/jonmatonis/2012/09/27/bitcoin-foundation-launches-to-drive-bitcoins-advancement/ |first=Jon |last=Matonis |archivedate=January 23, 2013 |archiveurl=http://archive.is/0NaKf |title=Bitcoin Foundation Launches To Drive Bitcoin's Advancement |publisher=Forbes |date=September 27, 2012 |accessdate=June 12, 2017 |quote=Several months in the making, the Bitcoin Foundation launches this week}}</ref><ref name="liu" /> || {{w|United States}} | ||

| + | |- | ||

| + | | 2012 || {{dts|November 15}} || Milestone transaction || [[wikipedia:WordPress.com|WordPress.com]] begins accepting bitcoins for the purchase of upgrades.<ref name="firsts" /><ref>{{cite web |url=https://en.blog.wordpress.com/2012/11/15/pay-another-way-bitcoin/ |title=Pay Another Way: Bitcoin |date=November 15, 2012 |publisher=The WordPress.com Blog |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2012 || {{dts|November 23}} || Official response (negative) || The Central Bank of Norway releases per ethical guidelines indicating that it does not recognize cryptocurrencies, but it also does not prohibit its staff from owning or investing in them.<ref name="loc.govs"/> || {{w|Norway}} | ||

| + | |- | ||

| + | | 2012 || {{dts|November 29}} || Mining || The first Bitcoin halving event occurs at block height 210,000.<ref name="bitcoinblockhalf.coms">{{cite web |title=Bitcoin Block Reward Halving Countdown |url=https://www.bitcoinblockhalf.com/?fbclid=IwAR0PTtSY7ijsIWcHG6lop31QepEDsZo47ZTwrnKvk9hTYHkU4J8_BsNG-Tw |website=bitcoinblockhalf.com |accessdate=29 March 2020}}</ref> From then on, the amount of new Bitcoins issued every 10 minutes drops from 50 bitcoins to 25.<ref name="BITCOIN CLOCK">{{cite web |title=BITCOIN CLOCK |url=https://www.buybitcoinworldwide.com/bitcoin-clock/ |website=buybitcoinworldwide.com |accessdate=29 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2012 || {{dts|December}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Cryptocurrency exchange {{w|Bitfinex}} launches.<ref>{{cite web |title=The (r)evolution has begun |url=https://blog.bitfinex.com/announcements/the-revolution-has-begun/ |website=Bitfinex blog |access-date=12 February 2021 |date=17 October 2019}}</ref> || | ||

| + | |- | ||

| + | | 2013 || || Mining || The Bitcoin startup 21 is founded as 21e6. The company produces specialized bitcoin mining chips and also works toward the mass adoption of bitcoin by "building bitcoin products for the general public".<ref>{{cite web |url=https://blogs.wsj.com/digits/2015/03/10/secretive-bitcoin-startup-21-reveals-record-funds-hints-at-mass-consumer-play/ |author=Michael J. Casey |publisher=[[wikipedia:The Wall Street Journal|The Wall Street Journal]] |title=Secretive Bitcoin Startup 21 Reveals Record Funds, Hints at Mass Consumer Play |accessdate=June 28, 2017 |date=March 10, 2015}}</ref><ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|January 31}} || Mining || The first [[wikipedia:Application-specific integrated circuit|application-specific integrated circuits]] (ASICs) designed for Bitcoin mining are shipped.<ref name="liu" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|February 14}} || Milestone transaction || The social news aggregation website [[wikipedia:Reddit|Reddit]] begins accepting bitcoins for the purchase of reddit gold (reddit's premium membership).<ref name="firsts" /><ref>{{cite web |url=https://redditblog.com/2013/02/14/new-gold-payment-options-bitcoin-and-credit-card/ |publisher=Upvoted |title=New Gold Payment Options: Bitcoin and Credit Card |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://techcrunch.com/2013/02/14/reddit-starts-accepting-bitcoin-for-reddit-gold-purchases-thanks-to-partnership-with-coinbase/ |date=February 14, 2013 |publisher=TechCrunch |title=Reddit Starts Accepting Bitcoin for Reddit Gold Purchases Thanks To Partnership With Coinbase |author=Drew Olanoff |accessdate=June 12, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|February 15}} || {{w|Content creation}} || The subreddit r/Jobs4Bitcoins is created. As of March 28, 2020 it has 27,100 members.<ref>{{cite web |title=Jobs4Bitcoins: Find Work, Find Workers! |url=https://www.reddit.com/r/Jobs4Bitcoins/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|March 2}} || Organization || {{w|CloudHashing}} is founded. It is a bitcoin mining-as-a-service company offering cloud mining contracts.<ref>{{cite web |title=CloudHashing |url=https://www.crunchbase.com/organization/cloudhashing#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|March 3}} || Conference || A secretive technology conference for "tech-industry power players" takes place. At the conference, [[wikipedia:Wences Casares|Wences Casares]] introduces or explains Bitcoin to business leaders including [[wikipedia:Reid Hoffman|Reid Hoffman]], [[wikipedia:Michael Ovitz|Michael Ovitz]], and [[wikipedia:Henry Blodget|Henry Blodget]].<ref name="popper_digitial_gold" /><ref>{{cite web |url=http://www.businessinsider.com/what-is-bitcoin-2013-3 |date=March 6, 2013 |title=Suddenly, Everyone's Talking About Bitcoin... |publisher=Business Insider |accessdate=June 28, 2017 |author=Henry Blodget}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|March 6}} || {{w|Content creation}} || The subreddit r/BitcoinBeginners is created. As of March 28, 2020 it has 83,300 members.<ref>{{cite web |title=Bitcoin for Beginners |url=https://www.reddit.com/r/BitcoinBeginners/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|March 12}} || {{w|Bitcoin fork}} || An unexpected fork of the Bitcoin blockchain occurs due to a newer version of the Bitcoin client accepting a particular block that older versions of the client reject.<ref>{{cite web |url=https://raw.githubusercontent.com/bitcoin/bips/master/bip-0050.mediawiki |title=March 2013 Chain Fork Post-Mortem |accessdate=June 22, 2017}}</ref><ref>{{cite web |url=https://bitcoin.org/chainfork.html |title=11/12 March 2013 Chain Fork Information |accessdate=June 22, 2017}}</ref><ref>{{cite web |url=https://motherboard.vice.com/en_us/article/3ddw3v/weathering-the-storm-bitcoin-finds-new-resiliency |publisher=Motherboard |title=Weathering the Storm? Bitcoin Finds New Resiliency |author=Alec Liu |date=March 16, 2013 |accessdate=June 22, 2017 |quote=A block was produced that the latest version of the Bitcoin software, version 0.8, recognized as valid but that nodes still running version 0.7 or earlier rejected.}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|March 18}} || Official response || The [[wikipedia:Financial Crimes Enforcement Network|Financial Crimes Enforcement Network]] (FinCEN) releases guidance on using virtual currencies.<ref>{{cite web |url=https://www.fincen.gov/statutes_regs/guidance/html/FIN-2013-G001.html |archiveurl=https://web.archive.org/web/20130319213642/https://www.fincen.gov/statutes_regs/guidance/html/FIN-2013-G001.html |title=FIN-2013-G001 |date=March 18, 2013 |archivedate=March 19, 2013}}</ref><ref name="liu" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|March 28}} || {{w|Market capitalization}} || Bitcoin market capitalization passes $1 billion.<ref>{{cite web |url=http://spectrum.ieee.org/computing/networks/bitcoin-hits-1billion |publisher=IEEE Spectrum: Technology, Engineering, and Science News |author=Morgen Peck |date=April 2, 2013 |title=Bitcoin Hits $1 Billion |accessdate=June 13, 2017}}</ref><ref name="cat_hist" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|April 11}} || {{w|Content creation}} || The subreddit r/BitcoinMarkets is created. As of March 28, 2020 it has 148,000 members.<ref>{{cite web |title=Sharing of ideas, tips, and strategies for increasing your Bitcoin trading profits |url=https://www.reddit.com/r/BitcoinMarkets/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|April}} || Notable acquisition || American entrepreneurs [[w:Tyler Winklevoss|Tyler]] and {{w|Cameron Winklevoss}} announce having acquired US$11 million worth of Bitcoins.<ref>{{cite web |title=The $11 million in bitcoins the Winklevoss brothers bought is now worth $32 million |url=https://www.washingtonpost.com/news/the-switch/wp/2013/11/09/the-11-million-in-bitcoins-the-winklevoss-brothers-bought-is-now-worth-32-million/ |website=washingtonpost.com |access-date=8 February 2021}}</ref><ref name="Medium"/> || {{w|United States}} | ||

| + | |- | ||

| + | | 2013 || {{dts|May 7}} || Currency adoption || Coinbase announces "the largest funding round to date for a Bitcoin startup, a $5 million investment led by [[wikipedia:Union Square Ventures|Union Square Ventures]]".<ref>{{cite web |url=https://blogs.wsj.com/venturecapital/2013/05/07/coinbase-nabs-5m-in-biggest-funding-for-bitcoin-startup/ |author=Sarah E. Needleman |date=May 7, 2013 |publisher=[[wikipedia:The Wall Street Journal|The Wall Street Journal]] |title=Coinbase Nabs $5M in Biggest Funding for Bitcoin Startup |accessdate=June 22, 2017}}</ref><ref name="liu" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|May 14}} || Legal || The [[wikipedia:Dwolla|Dwolla]] account belonging to Mt. Gox is frozen due to a seizure warrant issued by the Department of Homeland Security.<ref>{{cite web |url=https://www.theverge.com/2013/5/15/4332698/dwolla-payments-mtgox-halted-by-homeland-security-seizure-warrant |date=May 15, 2013 |publisher=The Verge |author=Amar Toor |title=US seizes and freezes funds at biggest Bitcoin exchange |accessdate=June 22, 2017}}</ref><ref>{{cite web |url=https://arstechnica.com/tech-policy/2013/05/feds-seize-money-from-top-bitcoin-exchange-mt-gox/ |publisher=[[wikipedia:Ars Technica|Ars Technica]] |title=Feds seize money from Dwolla account belonging to top Bitcoin exchange Mt. Gox |author=Joe Mullin |date=May 14, 2013 |accessdate=June 22, 2017}}</ref><ref name="liu" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|May 17}} || Conference || The first official Bitcoin conference takes place in San Jose.<ref name="liu" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|May}} || Organization || {{w|CoinDesk}} launches. It is a news site specializing in {{w|Bitcoin}} and {{w|digital currencies}}. || | ||

| + | |- | ||

| + | | 2013 || ? || Organization || Independent media platform <code>cointelegraph.com</code> launches.<ref>{{cite web |title=Latest News on Cointelegraph |url=https://cointelegraph.com/tags/cointelegraph |website=Cointelegraph |access-date=15 February 2021 |language=en}}</ref><ref>{{cite web |title=Cointelegraph: Contact Information, Journalists, and Overview {{!}} Muck Rack |url=https://muckrack.com/media-outlet/cointelegraph |website=muckrack.com |access-date=15 February 2021 |language=en}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|July 23}} || Legal || Trendon T. Shavers is "sued by the Securities and Exchange Commission on Tuesday and accused of running a fund that collected bitcoins from investors, promising them 7 percent weekly returns".<ref>{{cite web |url=https://dealbook.nytimes.com/2013/07/23/s-e-c-says-texas-man-operated-bitcoin-ponzi-scheme/ |author=Nathaniel Popper |date=July 23, 2013 |title=S.E.C. Says Texas Man Operated Bitcoin Ponzi Scheme |publisher=[[wikipedia:The New York Times|The New York Times]] |accessdate=June 17, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|July 30}} || Organization || {{w|BitGive Foundation}} is founded.<ref>{{cite web |title=BitGive Foundation |url=https://www.crunchbase.com/organization/bitgive-foundation#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|July}} || Organization || Bitcoin {{w|mining pool}} {{w|Ghash.io}} starts operating. Within a year, this mining pool would contribute about one-third of the overall hashing power out of the total.<ref>{{cite web |title=GHash.IO, The Leading Bitcoin Mining Pool - Sponsored Post |url=https://www.finsmes.com/2014/09/ghash-io-the-leading-bitcoin-mining-pool-sp.html |website=FinSMEs |access-date=24 February 2021 |date=5 September 2014}}</ref> || | ||

| + | |- | ||

| + | | 2013 || {{dts|August}} || Official response (regulation) || The German Finance Ministry characterizes Bitcoin as a {{w|unit of account}},<ref name="Marketwatch20130819">{{cite web |url=http://blogs.marketwatch.com/thetell/2013/08/19/bitcoins-are-private-money-in-germany/ |title=Bitcoins are private money in Germany |last=Vaishampayan |first=Saumya |date=19 August 2013 |website={{w|Marketwatch}}|accessdate= 30 December 2019}}</ref> usable in [[w:Clearing house (finance)|multilateral clearing circles]] and subject to capital gains tax if held less than one year.<ref name="FAZ20130816">{{cite news|url=http://www.faz.net/aktuell/finanzen/devisen-rohstoffe/digitale-waehrung-deutschland-erkennt-bitcoins-als-privates-geld-an-12535059.html|title=Deutschland erkennt Bitcoins als privates Geld an (Germany recognizes Bitcoin as private money) |last=Nestler |first=Franz|date=16 August 2013 |website={{w|Frankfurter Allgemeine Zeitung}}|accessdate= 30 December 2019}}</ref> || {{w|Germany}} | ||

| + | |- | ||

| + | | 2013 || {{dts|September 26}} || Currency adoption || [[wikipedia:NASDAQ Private Market|SecondMarket]] begins raising money for the Bitcoin Investment Trust, an investment fund holding only bitcoins.<ref>{{cite web |url=https://dealbook.nytimes.com/2013/09/25/fund-to-let-investors-bet-on-price-of-bitcoins/ |first1=Peter |last1=Lattman |first2=Nathaniel |last2=Popper |date=September 25, 2013 |title=Fund to Let Investors Bet on Price of Bitcoins |publisher=[[wikipedia:The New York Times|The New York Times]] |accessdate=June 17, 2017 |quote=On Thursday, SecondMarket is expected to begin raising money for an investment fund — the first of its kind in the United States — that will hold only bitcoins, giving wealthy investors exposure to the trendy but controversial virtual currency.}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2013 || {{dts|September}} || Notable case || The {{w|FBI}} takes the notorious “dark web drug bazaar” [[w:Silk Road (marketplace)|Silk Road]] and confiscates 144,000 Bitcoins owned by the website operator.<ref name="Medium"/> || {{w|United States}} | ||

| + | |- | ||

| + | | 2013 || {{dts|September 25}} || Organization || {{w|Barry Silbert}} founds Grayscale Bitcoin Trust (BGTC), now considered a traditional investment trust.<ref name="henryharvin"/> || {{w|United States}} | ||

| + | |- | ||

| + | | 2013 || {{dts|October 29}} || Technology || The first Bitcoin ATM in the world opens in {{w|Vancouver}}, {{w|Canada}}.<ref>{{cite web |title=World's First Bitcoin ATM Opens In Vancouver, Canada |url=https://mashable.com/2013/10/30/bitcoin-atm-2/ |website=mashable.com |accessdate=24 December 2019}}</ref> || {{w|Canada}} | ||

| + | |- | ||

| + | | 2013 || {{dts|November 1}} || Literature || The initial version of "Majority is not Enough: Bitcoin Mining is Vulnerable" by Eyal and Sirer is uploaded to the preprint repository [[wikipedia:arXiv|arXiv]].<ref>{{cite web |url=https://arxiv.org/abs/1311.0243v1 |title=[1311.0243v1] Majority is not Enough: Bitcoin Mining is Vulnerable |accessdate=June 23, 2017}}</ref> The paper is announced on the authors' blog on November 4.<ref>{{cite web |url=http://hackingdistributed.com/2013/11/04/bitcoin-is-broken/ |title=Bitcoin Is Broken |publisher=Hacking Distributed |date=November 4, 2013 |first1=Ittay |last1=Eyal |first2=Emin Gün |last2=Sirer |accessdate=June 23, 2017}}</ref> The paper receives coverage on ''[[wikipedia:Vice (magazine)|Vice]]'',<ref>{{cite web |url=https://motherboard.vice.com/en_us/article/8qx47k/bitcoin-isnt-broken-despite-a-potential-flaw |publisher=Motherboard |title=Bitcoin Isn't Broken, Despite a Potential Flaw |author=Alec Liu |date=November 7, 2013 |accessdate=June 23, 2017}}</ref> Bitcoin Magazine,<ref>{{cite web |url=https://bitcoinmagazine.com/articles/selfish-mining-a-25-attack-against-the-bitcoin-network-1383578440/ |publisher=Bitcoin Magazine |title=Selfish Mining: A 25% Attack Against the Bitcoin Network |author=Vitalik Buterin |date=November 4, 2013 |accessdate=June 23, 2017}}</ref> and Bitcoin Talk.<ref>{{cite web |url=https://bitcointalk.org/index.php?topic=324413.0 |title=Majority is not Enough: Bitcoin Mining is Vulnerable |accessdate=June 23, 2017}}</ref><ref name="liu" /> || | ||

| + | |- | ||

| + | | 2013 || {{dts|November 18}} || Official response (regulation) || United States federal officials indicate at a Senate that digital currency networks offer real benefits for the financial system even as they acknowledge that new forms of digital money have provided avenues for money laundering and illegal activity.<ref>{{cite web |url=http://www.nytimes.com/interactive/technology/bitcoin-timeline.html?_r=0 |date=November 19, 2013 |publisher=[[wikipedia:The New York Times|The New York Times]] |title=An Abridged History of Bitcoin |accessdate=June 17, 2017}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2013 || {{dts|November 20}} || Milestone transaction || The [[wikipedia:University of Nicosia|University of Nicosia]] in Cyprus becomes the first university to accept payment for tuition in bitcoin.<ref name="liu" /><ref>{{cite web |url=https://motherboard.vice.com/en_us/article/xyw8yq/cyprus-university-students-can-pay-tuition-in-bitcoin-and-major-in-digital-currency |publisher=Motherboard |title=Cyprus' University Is the World's First to Accept Tuition in Bitcoin |author=Meghan Neal |date=November 20, 2013 |accessdate=June 23, 2017}}</ref><ref>{{cite web |url=https://www.geekwire.com/2013/cyprusbased-school-university-accept-bitcoin-tuition/ |title=This university is the first in the world to accept Bitcoin for tuition |publisher=GeekWire |author=Taylor Soper |date=November 20, 2013 |accessdate=June 23, 2017}}</ref> || {{w|Cyprus}} | ||

| + | |- | ||

| + | | 2013 || {{dts|November}} || Official response (warning) || The {{w|National Bank of Slovakia}} issues a warning to inform the general public that virtual currencies are not national currencies and that unauthorized currency production constitutes a criminal offense.<ref name="loc.govs"/> || {{w|Slovakia}} | ||

| + | |- | ||

| + | | 2013 || {{dts|December 3}} || Official response (warning) || Chinese regulators jointly issue a notice warning the public about the risks of bitcoin. The circular defines Bitcoin as “by nature a special virtual commodity,” which “does not have equal legal status as currencies” and “cannot and should not be circulated in the market as a currency.”<ref name="loc.govs"/> || {{w|China}} | ||

| + | |- | ||

| + | | 2013 || {{dts|December 19}} || Official response (warning) || The [[w:Banque du Liban|Lebanese Central Bank]] issues a notice to the country’s banks and financial institutions warning them of the dangers of using cybercurrencies, especially bitcoin.<ref name="loc.govs"/> || {{w|Lebanon}} | ||

| + | |- | ||

| + | | 2013 || {{dts|December}} || Official response (warning) || The {{w|People’s Bank of China}} and four other financial regulators issue a joint notice outlining the risks associated with bitcoin. The Chinese Government states that it is not a currency, and prohibits banks and other financial institutes from trading in it. However, it acknowledges the cryptocurrency as a “commodity traded online” and allows the public to buy and sell it as they please, with its only proviso being that they do so at their own risk.<ref name="scmp.comvv">{{cite web |title=Beijing bans bitcoin, but when did it all go wrong for cryptocurrencies in China? |url=https://www.scmp.com/news/china/economy/article/2132119/beijing-bans-bitcoin-when-did-it-all-go-wrong-cryptocurrencies |website=scmp.com |accessdate=22 December 2019}}</ref> || {{w|China}} | ||

| + | |- | ||

| + | | 2013 || {{dts|December}} || Official response (negative) || The Danish Financial Supervisory Authority issues a statement rejecting the bitcoin as a currency and stating that it will not regulate bitcoin use.<ref name="loc.govs"/> || {{w|Denmark}} | ||

| + | |- | ||

| + | | 2013 || {{dts|December}} || Official response (negative) || The French Central Bank publishes a report stating that bitcoin cannot be considered a real currency or means of payment under current French law.<ref name="loc.govs"/> || {{w|France}} | ||

| + | |- | ||

| + | | 2013 || {{dts|December}} || Official response (warning) || The Norwegian Financial Supervisory Authority issues a warning against cryptocurrencies, comming as a result of warnings on the risk of use of cryptocurrencies by the European Supervisory Authority, ESMA.<ref name="loc.govs"/> || {{w|Norway}} | ||

| + | |- | ||

| + | | 2014 || {{dts|January 2}} || Official response (negative) || The {{w|Central Bank of Malaysia}} issues a statement saying that “The Bitcoin is not recognized as legal tender in Malaysia. The Central Bank does not regulate the operations of Bitcoin. The public is therefore advised to be cautious of the risks associated with the usage of such digital currency.”<ref name="loc.govs"/> || {{w|Malaysia}} | ||

| + | |- | ||

| + | | 2014 || {{dts|January 9}} || Milestone transaction || [[wikipedia:Overstock.com|Overstock.com]] becomes the first major online retailer to accept payments in bitcoin.<ref>{{cite web |url=https://www.wired.com/2014/01/overstock-bitcoin-live/ |title=The Grand Experiment Goes Live: Overstock.com Is Now Accepting Bitcoins |author=Cade Metz |date=January 9, 2014 |accessdate=June 23, 2017 |publisher=[[wikipedia:WIRED|WIRED]]}}</ref><ref name="liu" /> In December 2013 the company had announced that it was preparing to accept bitcoin.<ref>{{cite web |url=https://motherboard.vice.com/en_us/article/9ak5my/bitcoin-just-scored-its-first-major-us-retailer |publisher=Motherboard |title=Bitcoin Just Scored Its First Major US Retailer |author=Alec Liu |date=December 20, 2013 |accessdate=June 23, 2017}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2014 || {{dts|January 9}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|BitFlyer}} is founded in {{w|Japan}}.<ref>{{cite web |title=bitFlyer |url=https://www.crunchbase.com/organization/bitflyer#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || {{w|Japan}} | ||

| + | |- | ||

| + | | 2014 || {{dts|January 26}} || Legal || [[wikipedia:Charlie Shrem|Charlie Shrem]] is arrested. He is accused of using his company, BitInstant, to "knowingly convert money into virtual currency for people interested in buying narcotics on the Silk Road site" and of buying drugs on Silk Road.<ref>{{cite web |url=https://dealbook.nytimes.com/2014/01/27/two-executives-of-bitcoin-businesses-are-arrested/ |author=Nathaniel Popper |date=January 27, 2014 |title=Bitcoin Figure Is Accused of Conspiring to Launder Money |publisher=[[wikipedia:The New York Times|The New York Times]] |accessdate=June 29, 2017}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2014 || {{dts|January}} || Official response (warning) || The Belgian National Bank and the Financial Services and Markets Authority issue a joint press release warning consumers about the risks of cryptocurrencies.<ref name="loc.govs"/> || {{w|Belgium}} | ||

| + | |- | ||

| + | | 2014 || {{dts|February 7}} || [[w:Cryptocurrency and security|Security]] || The Bitcoin exchange [[wikipedia:Mt. Gox|Mt. Gox]] halts all bitcoin withdrawals due to insolvency after an apparently undetected theft that had been occurring since 2011.<ref>{{cite web |url=http://www.bloomberg.com/news/2014-02-07/bitcoin-price-falls-as-mt-gox-exchange-halts-activity.html |archiveurl=https://archive.is/ueuoH |archivedate=February 7, 2014 |publisher=Bloomberg |title=Bitcoin Price Plunges as Mt. Gox Exchange Halts Activity |date=February 7, 2014 |accessdate=June 12, 2017}}</ref> By the end of the month, Mt. Gox would file for bankruptcy protection.<ref name="The rise and fall of Mt. Gox">{{cite web |title=The rise and fall of Mt. Gox |url=https://www.fool.com/investing/2018/04/02/the-history-of-bitcoin.aspx |website=fool.com |accessdate=30 December 2019}}</ref> || | ||

| + | |- | ||

| + | | 2014 || {{dts|February 10}} || Valuation || A {{w|flash crash}} occurs on the [[wikipedia:BTC-e|BTC-e]] exchange.<ref>{{cite web |url=https://en.bitcoin.it/wiki/February_10,_2014_flash_crash |title=February 10, 2014 flash crash |website=Bitcoin Wiki |accessdate=June 13, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2014 || {{dts|February 19}} || Official response (warning) || The {{w|Bank of Israel}} and several Israeli regulatory agencies issue a statement warning the public against dealing in virtual currencies. The warning lays out the dangers associated with trading in virtual currencies, including fraud, money laundering, and financing of terrorism, among others.<ref name="loc.govs"/> || {{w|Israel}} | ||

| + | |- | ||

| + | | 2014 || {{dts|February}} || Official response (warning) || The Central Bank of Jordan (CBJ) warns the public against the use of Bitcoin.<ref name="loc.govs"/> || {{w|Jordan}} | ||

| + | |- | ||

| + | | 2014 || {{dts|March 25}} || Official response (regulation) || In its first substantive ruling on cryptocurrencies, the United States {{w|Internal Revenue Service}} states that Bitcoin will be treated as property for tax purposes.<ref>{{cite web |url=https://www.bloomberg.com/news/articles/2014-03-25/bitcoin-is-property-not-currency-in-tax-system-irs-says |title=Bitcoin Is Property Not Currency in Tax System, IRS Says |date=March 25, 2014 |first1=Richard |last1=Rubin |first2=Carter |last2=Dougherty |publisher=Bloomberg Business |archiveurl=https://web.archive.org/web/20150202014708/https://www.bloomberg.com/news/articles/2014-03-25/bitcoin-is-property-not-currency-in-tax-system-irs-says |archivedate=February 2, 2015}}</ref><ref>{{cite web |url=https://bitcoinmagazine.com/articles/the-united-states-is-falling-behind-in-bitcoin-regulation-1461604211/ |publisher=Bitcoin Magazine |title=The United States Is Falling Behind in Bitcoin Regulation |author=Kyle Torpey |date=April 25, 2016 |accessdate=June 29, 2017}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2014 || {{dts|March}} || Organization || {{w|Xapo}} is founded by Argentinian entrepreneur {{w|Wences Casares}}. Based in {{w|Hong Kong}}, the company provides a {{w|Bitcoin}} wallet combined with a [[w:Cryptocurrency wallet|cold storage]] vault and a Bitcoin-based {{w|debit card}}.<ref>{{cite web |title=Xapo - Branding & Web Design Case Study |url=https://aerolab.co/xapo |website=Aerolab |access-date=15 February 2021 |language=en}}</ref><ref name="NYT March 2014">{{cite news|last1=Sreeharsha|first1=Vinod|title=Start-Up Seeks to Capitalize on Security Concerns for Bitcoins|url=https://dealbook.nytimes.com/2014/03/14/start-up-seeks-to-capitalize-on-security-concerns-for-bitcoins/?_php=true&_type=blogs&_r=0|access-date=20 June 2014|work=The New York Times|publisher=The New York Times|date=14 March 2014|ref=The New York Times}}</ref><ref name="Wall Street Journal">{{cite news|last1=Rusli|first1=Evelyn M.|title=First Bitcoin Vaults, Now Xapo Debuts Debit Cards|url=https://blogs.wsj.com/digits/2014/04/24/first-bitcoin-vaults-now-xapo-debuts-debit-cards/|access-date=20 June 2014|work=Wall Street Journal|publisher=Wall Street Journal|date=24 April 2014|ref=Wall Street Journal}}</ref> | ||

| + | |- | ||

| + | | 2014 || {{dts|May 15}} || Security || The [[wikipedia:Stoned (computer virus)#Bitcoin blockchain incident|DOS Stoned incident]] occurs, when the signature of the [[w:Stoned (computer virus)|Stoned]] virus is inserted into the Bitcoin {{w|blockchain}}, causing {{w|Microsoft Security Essentials}} to recognize copies of the blockchain as the virus, prompting it to remove the file in question, and subsequently forcing the node to reload the block chain from that point, continuing the cycle.<ref>{{cite web|url=https://answers.microsoft.com/en-us/protect/forum/mse-protect_updating/microsoft-security-essentials-reporting-false/0240ed8e-5a27-4843-a939-0279c8110e1c?tm=1400189799602&auth=1|title=Microsoft Security Essentials reporting false positives in the Bitcoin blockchain, constantly notifying users.|website=answers.microsoft.com}}</ref><ref>{{cite web|url=https://www.theregister.co.uk/2014/05/18/bitcoin_user_stoned_on_virus_warnings/|title=Bitcoin blockchain allegedly infected by ancient 'Stoned' virus|first=Richard Chirgwin 18 May 2014 at 21:58|last=tweet_btn()|publisher=}}</ref>.<ref>{{cite web |url=https://en.bitcoin.it/wiki/DOS/STONED_incident |title=DOS/STONED incident |website=Bitcoin Wiki |accessdate=June 13, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2014 || {{dts|June 30}} || Notable acquisition || American venture capitalist {{w|Timothy Draper}} buys 30,000 bitcoins at a value of US$19.4 million (price per coin: $647).<ref name="People are">{{cite web |last1=Ciolli |first1=Joe |title=People are making a fortune buying government-seized bitcoins |url=https://www.businessinsider.com/bitcoin-price-government-auction-winners-2017-5 |website=Business Insider |access-date=8 February 2021}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2014 || {{dts|August 11}} || Official response (negative) || The United States [[wikipedia:Consumer Financial Protection Bureau|Consumer Financial Protection Bureau]] begins taking complaints about Bitcoin.<ref>{{cite web |url=https://www.washingtonpost.com/news/the-switch/wp/2014/08/11/consumer-bureau-now-taking-and-expecting-bitcoin-complaints/ |publisher=[[wikipedia:The Washington Post|The Washington Post]] |title=Consumer bureau now taking — and expecting — Bitcoin complaints |author=Nancy Scola |date=August 11, 2014 |accessdate=June 29, 2017}}</ref><ref>{{cite web |url=https://www.consumerfinance.gov/about-us/blog/consumer-advisory-virtual-currencies-and-what-you-should-know-about-them/ |title=Consumer advisory: Virtual currencies and what you should know about them |author=Will Wade-Gery |date=August 11, 2014 |publisher=Consumer Financial Protection Bureau |accessdate=June 29, 2017}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2014 || {{dts|August}} || Technology || The Bitcoin blockchain file size, containing records of all transactions that have occurred on the network, reaches 20GB ({{w|gigabyte}}s).<ref name="hadi">{{cite book |title=Handbook of Digital Currency: Bitcoin, Innovation, Financial Instruments, and Big Data |editor-last=Chuen |editor-first=David LEE Kuo |year=2015 |publisher=Academic Press |isbn=978-0-12-802351-8 |chapter=A Light Touch of Regulation for Virtual Currencies |last1=Nian |first1=Lam Pak |last2=Chuen |first2=David LEE Kuo |page=319 }}</ref> || | ||

| + | |- | ||

| + | | 2014 || {{dts|August}} || Official response (negative) || The Central Bank of Iceland announces that bitcoin is not a recognized currency and even if it was, purchases of bitcoins would still be illegal as such purchases would violate the foreign transactions restrictions in place.<ref name="loc.govs"/> || {{w|Iceland}} | ||

| + | |- | ||

| + | | 2014 || {{dts|August}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Bitcoin wallet and exchange service {{w|Coincheck}} launches.<ref>{{cite web |title=Coincheck – NGL Latam Spain |url=https://nemespanol.io/tag/coincheck/ |website=nemespanol.io |access-date=12 February 2021}}</ref> || {{w|Japan}} | ||

| + | |- | ||

| + | | 2014 || {{dts|June}} || Official response (regulation) || Canadian law is enacted as the world’s first national law on digital currencies, and the world’s first treatment in law of digital currency financial transactions under national anti-money laundering law. The new law treats virtual currencies, including Bitcoin, as “money service businesses” for the purposes of the anti-money laundering law.<ref name="loc.govs"/> || {{w|Canada}} | ||

| + | |- | ||

| + | | 2014 || {{dts|September 18}} || Research || Coin Center, a non-profit group focused on cryptocurrency research and advocacy, is established.<ref>{{cite web |url=https://www.washingtonpost.com/news/the-switch/wp/2014/09/18/bitcoin-gets-an-industry-backed-advocacy-group/ |publisher=[[wikipedia:The Washington Post|The Washington Post]] |title=Bitcoin gets an industry-backed advocacy group |author=Nancy Scola |date=September 18, 2014 |accessdate=June 29, 2017}}</ref> || | ||

| + | |- | ||

| + | | 2014 || {{dts|September 23}} || Notable prediction || {{w|Tim Draper}} predicts that 1 Bitcoin share would reach 10,000 dollars by 2017. His prediction would come true and on 29 November 2017 the price of a Bitcoin share would cross 10,000 U.S dollars.<ref name="henryharvin"/> || | ||

| + | |- | ||

| + | | 2014 || {{dts|October 2}} || Official response (warning) || The National Bank of Serbia makes announcement clarifying that “anyone investing in Bitcoins or engaging in any other activity involving virtual currencies shall do so at their own liability, bearing all financial risks and risks in terms of noncompliance with regulations governing foreign exchange operations, taxation, trade, etc.”<ref name="loc.govs"/> || {{w|Serbia}} | ||

| + | |- | ||