Timeline of money transfer

This is a timeline of money transfer, attempting to describe important events in the development of the service.

Sample questions

The following are some interesting questions that can be answered by reading this timeline:

- ¿Which was the first company to offer the service of money transfer?

- ¿What is the position of money transfer in chronological context compared to specific services and technologies like credit cards and ATMs?

Big picture

| Time period | Development summary |

|---|---|

| Ancient times | In Ptolomean Egypt giro-transfer is already developed. Purchases are carried out by using transfer giro orders or cheques.[1][2] The hawala system already exists since the 8th century between Arabic and Muslim traders alongside the Silk Road and beyond as a protection against theft. |

| 1871 < | Era of electronic money transfer, starting with the first transaction by Western Union. |

| 1920s | Companies such as Western Union and later oil companies start to issue credit cards.[3] |

| 1960s–1970s | ATMs emerge, following a progressive trend of “self-service” and “automation”.[4] Early in the 1970s, Americans have already over 100 million credit cards. Overall the world would accept credit cards without many inhibitions.[3] |

| 2000 < | Remittance flows to developing countries more than quadruple since 2000.[5] |

Full timeline

| Year | Event type | Details | Country/Geographical location |

|---|---|---|---|

| c. 750–945 CE | Development | The hawala (bill of exchange in Arabic) remittance system develops during the Abbasid Caliphate, centuries before the invention of free–market capitalism. Designed to lower the risks of commerce along the old Silk Road, hawala enables trade by freeing merchants from having to carry large quantities of cash along the way.[6] | Middle East |

| 1659 | Development | The first check is written in England for £400 (around $59,000 today).[7] | United Kingdom |

| 1717 | Development | The Bank of England delivers the first check written on a printed form.[7] | United Kingdom |

| 1851 | Organization | Western Union starts operating as The New York and Mississippi Valley Printing Telegraph Company.[8][9][10][11][12] | United States |

| 1866 | Development | Western Union introduces the stock ticker.[11] | United States |

| 1871 | Development | Western Union introduces the concept of wire transfer, a business that would eventually replace message sending as the company’s primary business.[8][11][13][12] | United States |

| 1884 | Western Union is one of eleven stocks included in the first Dow Jones Average.[14], becoming one of the first companies to be ever listed on the New York Stock Exchange.[12] | United States | |

| 1918 | Federal Reserve Banks begin to move currency via telegraph. Some historians consider this as the birthplace of electric money. | ||

| 1940 | Organization | American money transfer company MoneyGram is founded.[15][12] | United States |

| 1958 | Service | Visa credit cards are first issued.[3] | |

| 1962 | Organization | Online money transfer provider Moneycorp is established as Travelers Express Co. Inc.[16][17][18][19] | United Kingdom |

| 1966 | Service | MasterCards are first issued.[3] | |

| 1967 | The first Automated teller machine (ATM) is invented by John Shepherd-Barron and is installed at Barclays Bank in London.[7] | United Kingdom | |

| 1969 | The first Automated teller machine in the United States is installed at Chemical Bank in Rockville Center, New York.[7] | United States | |

| 1973 | Organization | The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is founded as a cooperative society under Belgian law. Today SWIFT is a nonprofit cooperative society that links member banks worldwide through a data processing and transmission network. Its messaging platform, products and services connect more than 11,000 banking and securities organizations, market infrastructures and corporate customers in more than 200 countries and territories.[20][21][22][23][12] | Belgium |

| 1976 | Organization | Travelex is established.[12] | |

| 1979 | Moneycorp begins dealing in foreign exchange.[18][24][25][12] | ||

| 1980 | Organization | Xpress Money is established as a money transfer company.[26] | |

| 1985 | Organization | The British Securities and Investments Board Ltd ("SIB") is incorporated. SIB would change its name to Financial Services Authority in 1997. The FSA regulates the financial services industry in the United Kingdom.[27][28][29][12] | United Kingdom |

| 1986 | Organization | Al-Barakat starts as a group in Saudi Arabia by Somali businessmen based there, with the main objective to act as a money transfer service for Somalis in the diaspora sending money back home. Al-Barakat is involved in the modern form of hawala.[30] | Saudi Arabia |

| 1987 | Organization | Ria Money Transfer is founded in New York. Today, it is one of the world's leading money transfer providers, with a local global agent network of approximately 314,000 locations in 144 countries.[12][31][32] | United States (serves in 144 countries) |

| 1988 | Organization | Money transfer service Transfast is established. It provides Automated Clearing House transfer and wire transfer.[33] | United States |

| 1990 | Statistics | The inflow of remittances worldwide is US$64 billion.[34] | |

| 1990 | Organization | Venstar Exchange is established. Headquartered in California, it operates ACH transfer, and wire transfer.[35] | |

| 1994 | Organization | RemitMoney is established. Powered by Axis Bank, Remitmoney is an online money transfer facility which enables NRIs from United States, United Kingdom, Canada, Australia, Singapore and Euro Zone to send money to India.[36] | |

| 1996 | Organization | Placid Express is established as a money transfer provider that specializes in direct money transfers with competitive exchange rates and zero to low transfer fees.[37] | United States (it sends money to 8 different countries) |

| 1996 | Organization | Currencies Direct is established as a money transfer company. It has offices in the United Kingdom, France, Spain, Portugal, India, China, South Africa, and the United States.[38][39] | United Kingdom |

| 1998 | Organization | Peter Thiel and Max Levchin found PayPal under the name Confinity, with the idealistic vision of borderless currency, free from governmental controls. PayPal would grow rapidly so as to alter the way international money transfers are completed, normalizing the online platform.[40][41][42][12] | United States |

| 1998 | Acquisition | Viad acquires Moneygram Payment Systems.[12] | |

| 1998 | Organization | MoneyGram International is formed.[43] | United States |

| 1998 | Organization | Australian online foreign exchange and payments company OFX is founded as OzForex.[44][45] | Australia |

| 1999 | Organization | Moneydart is founded. It operates ACH transfer. Moneydart is powered by UAE Exchange.[46] | |

| 2000 | Organization | Confinity merges with X.com (founded by Elon Musk) to become PayPal.[47][48][49][50] | |

| 2001 | Statistics | Western Union is the largest regulated money transfer business, with 124,000 agencies worldwide having completed 109 million transfers in the year, amounting to over US$40 billion.[51] | |

| 2001 | Organization | Remit2India is founded. Headquartered in Mumbai, it operates sending money to over 90 banks in India.[52] | India |

| 2001 | Organization | Global Reach Partners Corporate FX & Money Transfer is originally established as 4 separate brand names: Corporate FX, Private FX, Smart FX and Travel FX, which would merge into Global Reach Partners in 2012.[53] | |

| 2001 | Organization | Xoom Corporation is established as a digital money transfer provider. It pay bills and reload mobile phones from the United States to 52 countries, including China, India, Guyana, Pakistan, Mexico and the Philippines. Xoom operates Credit Card/Debit Card and ACH transfer.[54] | United States (operates in over 50 countries) |

| 2002 | Acquisition | eBay buys PayPal. This would open the gateway for online money transfers to be prevalent in many people's everyday lives.[55][56][57][58][12] | |

| 2003 | Organization | Currency Solutions Money Transfer is established. It has offices in the United Kingdom and Cyprus. Currency Solutions is regulated by the Financial Conduct Authority (UK).[59] | United Kingdom |

| 2003 | Acquisition | Travelers Express gains full ownership of MoneyGram.[12] | |

| 2004 | Organization | WorldFirst Money Transfer is established. It has offices in the United Kingdom, United States, The Netherlands, Australia, Hong Kong and Singapore.[60] | United Kingdom |

| 2004 | Organization | Tor Currency Exchange Ltd ("TorFX") is established to provide foreign exchange and international payments to companies and individuals. TorFX would expand across the globe, including Australia, South Africa, the United Kingdom, India, the United States, Spain, Portugal and France.[61][62][63][64][65] | |

| 2005 | Organization | OFX Money Transfer is established. It has global offices in Auckland, Sydney, Toronto, San Francisco, Hong Kong and London.[66] | |

| 2005 | Organization | Halo Financial is established as a currency transfer company.[67] | |

| 2005 | Organization | Xendpay is established as a money transfer platform. It operates Credit Card/Debit Card, ACH transfer, and wire transfer.[68] | Operates in 173 countries |

| 2006 | Service | Western Union discontinues its telegram service.[12] | |

| 2007 | Service | M-Pesa (M for mobile, pesa is Swahili for money), a mobile phone-based money transfer, financing and microfinancing service, launches in Kenia.[69] | |

| 2008 | Organization | OrbitRemit is established as an online money transfer company. Based in Wellington, New Zealand, it operates Credit Card/Debit Card and ACH transfer.[70] | New Zealand |

| 2008 | Statistics | Worldwide remittance flows in the year reaches US$328 billion. India, China and Mexico are the top recipients, each receiving US$52, 41 and 26 billion respectively.[71] | |

| 2010 | Organization | WorldRemit is founded in London with the goal of modernizing the money transfer process. WorldRemit users can send money from 50 countries to more than 120 countries around the world.[72] | United Kingdom |

| 2010 | Organization | Remitly is established as a money transfer company.[73] | United States |

| 2011 | Organization | Estonian developed and UK-based peer-to-peer money transfer service TransferWise is established in London.[74][75][76][77][78] | United Kingdom |

| 2011 | Acquisition | Western Union acquires foreign exchange company Travelex.[12] | |

| 2012 | Organization | Azimo is established. Headquartered in London, it operates ACH transfer and wire transfer. Azimo has over 270,000 cash pick-up locations and a presence in 20,000 banks globally.[79] | United Kingdom (operates in over 190 countries) |

| 2012 | Statistics | The inflow of remittances worldwide reaches an estimated US$533 billion in the year.[34] Officially recorded remittance flows to developing countries are an estimated US$401 billion in the same year.[5] | |

| 2014 | Organization | Pangea Money Transfer is established as a money transfer company.[80] | Operates in 15 countries across Asia & Latin America including India, China, Mexico and the Philippines |

| 2014 | Organization | bridge21 is established. It enables businesses and individuals to send money between the United States and Mexico.[81] | |

| 2014 | Organization | Wave is founded by Drew Durbin and Lincoln Quirk, two engineers from Brown University and Harvard University; with the purpose to make sending money to Africa as easy and affordable as sending a text.[82] | Tanzania, Uganda, Ghana |

| 2017 | Acquisition | Alibaba affiliate company Ant Financial acquires MoneyGram.[83][84][85][86][87][12] | |

| 2017 | MoneyCorp acquires Commonwealth Foreign Exchange, q US-based corporate international payments business.[88][89][90][91] | ||

| 2017 | Organization | The OFX Group consolidates services under the global brand OFX from prior and existing brands OzForex, UKForex, USForex, CanadianForex, NZForex, Tranzfers and ClearFX.[12][92] |

Numerical and visual data

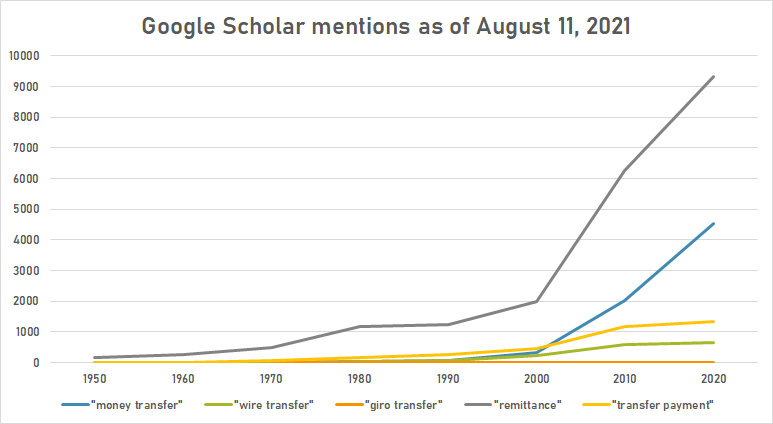

Google Scholar

The following table summarizes per-year mentions on Google Scholar as of August 11, 2021.

| Year | "money transfer" | "wire transfer" | "giro transfer" | "remittance" | "transfer payment" |

|---|---|---|---|---|---|

| 1950 | 2 | 1 | 180 | 5 | |

| 1960 | 3 | 2 | 275 | 16 | |

| 1970 | 14 | 6 | 3 | 497 | 58 |

| 1980 | 49 | 32 | 2 | 1,190 | 164 |

| 1990 | 68 | 81 | 2 | 1,230 | 253 |

| 2000 | 317 | 222 | 9 | 1,980 | 455 |

| 2010 | 2,010 | 599 | 8 | 6,260 | 1,170 |

| 2020 | 4,520 | 661 | 17 | 9,310 | 1,340 |

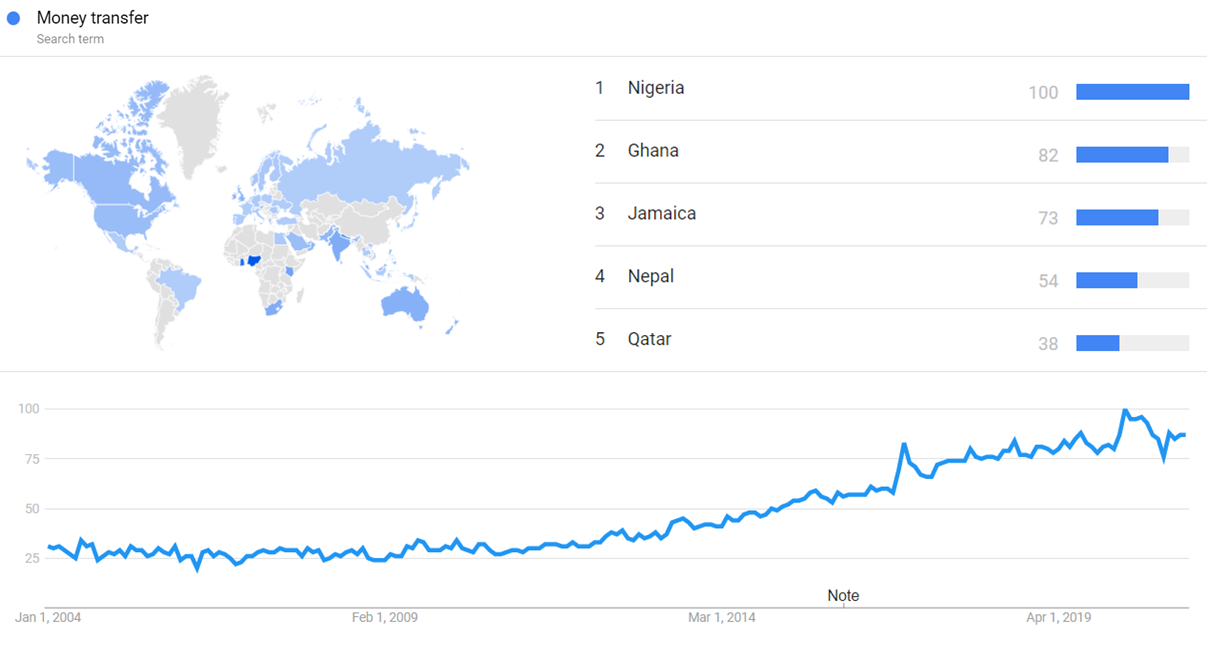

Google Trends

The image below shows Google Trends data for Money transfer (Search term), from January 2004 to March 2021, when the screenshot was taken. Interest is also ranked by country and displayed on world map.[93]

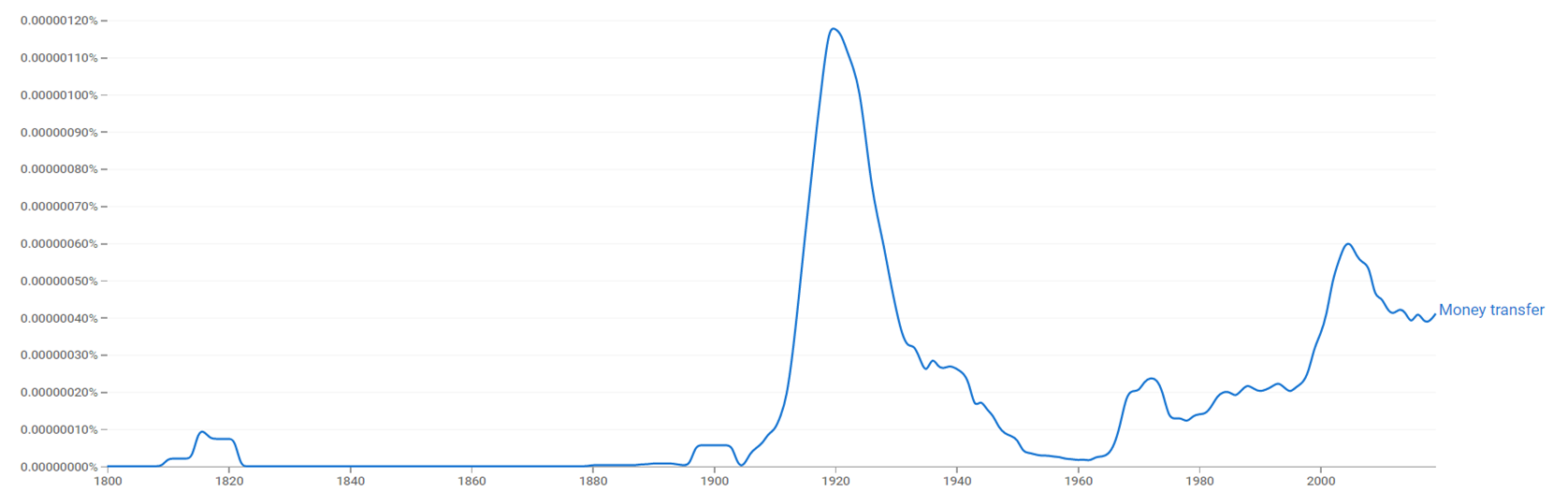

Google Ngram Viewer

The chart below shows Google Ngram Viewer data for Money transfer, from 1800 to 2019.[94]

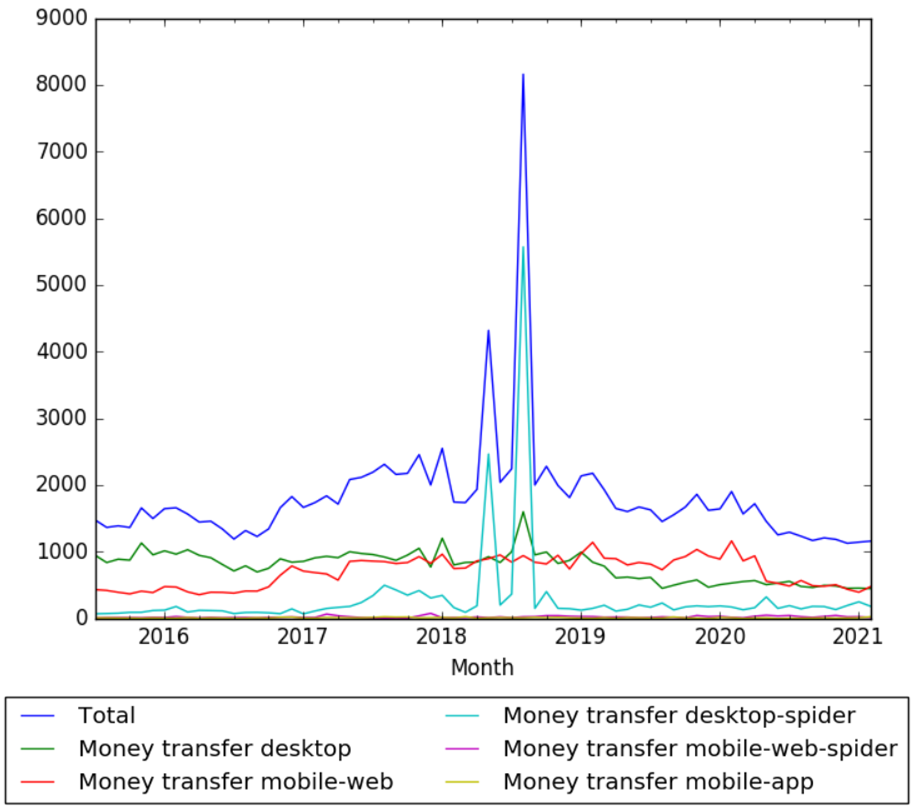

Wikipedia Views

The chart below shows pageviews of the English Wikipedia article Money transfer, on desktop, mobile-web, desktop-spider, mobile-web-spider and mobile app, from July 2015 to February 2021.[95]

Meta information on the timeline

How the timeline was built

The initial version of the timeline was written by User:Sebastian.

Funding information for this timeline is available.

What the timeline is still missing

Some sources that can be used for initial event lists:

More sources:

Timeline update strategy

See also

- Timeline of PayPal

- Timeline of Square

- Timeline of Stripe

- Timeline of mobile telephony

- Timeline of Bitcoin

External links

References

- ↑ Suhr, Dieter. The Capitalistic Cost-Benefit Structure of Money: An Analysis of Money’s Structural Nonneutrality and its Effects on the Economy. Retrieved 20 December 2017.

- ↑ Majumdar, Gautam. Financial Terms Simplified. Retrieved 20 December 2017.

- ↑ 3.0 3.1 3.2 3.3 "The History of Money Transfers". blog.coinpip.com. Retrieved 24 December 2017.

- ↑ "The ATM is Dead. Long Live the ATM!". smithsonianmag.com. Retrieved 24 December 2017.

- ↑ 5.0 5.1 Migrant Remittances in South Asia: Social, Economic and Political Implications (M. Rahman, T. Yong, A. Ullah ed.). Retrieved 23 December 2017.

- ↑ Beare, Margaret E. Encyclopedia of Transnational Crime and Justice. Retrieved 24 December 2017.

- ↑ 7.0 7.1 7.2 7.3 "From bartering and trades to Apple Pay, this is the history of how we save — and how we spend". finder.com. Retrieved 10 March 2018.

- ↑ 8.0 8.1 "Western Union Financial Services, Inc". encyclopedia.com. Retrieved 5 December 2017.

- ↑ Wolff, Joshua D. Western Union and the Creation of the American Corporate Order, 1845–1893. Retrieved 15 December 2017.

- ↑ Byers, Terri. Contemporary Issues in Sport Management: A Critical Introduction. Retrieved 15 December 2017.

- ↑ 11.0 11.1 11.2 Rowe, Glenn; Guerrero, Laura. Cases in Leadership. Retrieved 15 December 2017.

- ↑ 12.00 12.01 12.02 12.03 12.04 12.05 12.06 12.07 12.08 12.09 12.10 12.11 12.12 12.13 12.14 12.15 12.16 "50 Milestones in International Money Transfer History". moneytransfercomparison.com. Retrieved 22 December 2017.

- ↑ Foust Allen, Charlsie. Ardmore. Retrieved 22 December 2017.

- ↑ "Western Union: A Spin-Off With Value". seekingalpha.com. Retrieved 5 December 2017.

- ↑ "How safe is MoneyGram for international money transfers?". finder.com. Retrieved 5 December 2017.

- ↑ "About moneycorp". global.moneycorp.com. Retrieved 15 December 2017.

- ↑ "Moneycorp: A review of the money transfer specialists". finder.com. Retrieved 15 December 2017.

- ↑ 18.0 18.1 "MoneyCorp Review". internationalmoneytransfer.co. Retrieved 15 December 2017.

- ↑ "Moneycorp – Basic Company Information". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "Introduction to SWIFT". swift.com. Retrieved 15 December 2017.

- ↑ Scott, Susan V.; Zachariadis, Markos. The Society for Worldwide Interbank Financial Telecommunication (SWIFT): Cooperative Governance for Network Innovation, Standards, and Community. Retrieved 15 December 2017.

- ↑ Kyrtsis, A. Financial Markets and Organizational Technologies: System Architectures, Practices and Risks in the Era of Deregulation. p. 118. Retrieved 15 December 2017.

- ↑ Seeman, Bharath. Bank Exam Pedia: Dec 2014. p. 73. Retrieved 15 December 2017.

- ↑ "Thrifty Brits abroad choose to keep their holiday cash". moneycorp.com. Retrieved 15 December 2017.

- ↑ "MoneyCorp Review". internationalmoneytransfer.co. Retrieved 15 December 2017.

- ↑ "Xpress Money". compareremit.com. Retrieved 23 December 2017.

- ↑ Powell, Ray; Powell, James. AQA A-level Economics, Book 2. Retrieved 15 December 2017.

- ↑ Bordo, Michael D. Central Banks at a Crossroads: What Can We Learn from History?. p. 468. Retrieved 15 December 2017.

- ↑ King, Jane; Carey, Mary. Personal Finance. Retrieved 15 December 2017.

- ↑ "How Al Barakat Closure is Affecting Somalis". panapress.com. Retrieved 20 December 2017.

- ↑ "Money Transfer Services". euronetworldwide.com. Retrieved 22 December 2017.

- ↑ "RIA Money Transfer". compareremit.com. Retrieved 23 December 2017.

- ↑ "Transfast". compareremit.com. Retrieved 23 December 2017.

- ↑ 34.0 34.1 Hanlon, Bernadette; Vicino, Thomas J. Global Migration: The Basics. Retrieved 22 December 2017.

- ↑ "Venstar-Exchange". compareremit.com. Retrieved 24 December 2017.

- ↑ "RemitMoney". compareremit.com. Retrieved 23 December 2017.

- ↑ "Placid Express". compareremit.com. Retrieved 23 December 2017.

- ↑ "Smile, you are on Foreign Exchange". underconsideration.com. Retrieved 15 December 2017.

- ↑ "Currencies Direct Review". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "History of PayPal: the history of the biggest online payment system in the world". techworld.com. Retrieved 20 December 2017.

- ↑ Gardner, James A. Innovation and the Future Proof Bank: A Practical Guide to Doing Different Business-as-Usual. Retrieved 20 December 2017.

- ↑ Gayles, Kiesha. Amazon Paypal eBay. Retrieved 20 December 2017.

- ↑ "History". moneygram.com. Retrieved 20 December 2017.

- ↑ Business Review Weekly: BRW, Volume 27, Issues 39-42. Retrieved 20 December 2017.

- ↑ "What does the OFX say?". underconsideration.com. Retrieved 20 December 2017.

- ↑ "MoneyDart - Money2Anywhere". compareremit.com. Retrieved 23 December 2017.

- ↑ Napier, H. Albert; Rivers, Ollie N.; Wagner, Stuart. Creating a Winning E-Business.

- ↑ Sherif, Mostafa Hashem. Protocols for Secure Electronic Commerce, Third Edition.

- ↑ Samit, Jay. Disrupt You!: Master Personal Transformation, Seize Opportunity, and Thrive in the Era of Endless Innovation. Retrieved 20 December 2017.

- ↑ Packer, George. The Unwinding: An Inner History of the New America.

- ↑ Current Developments in Monetary and Financial Law (International Monetary Fund ed.). Retrieved 23 December 2017.

- ↑ "Remit2India". compareremit.com. Retrieved 23 December 2017.

- ↑ "Global Reach Partners Corporate FX & Money Transfer Review". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "Xoom". compareremit.com. Retrieved 23 December 2017.

- ↑ Ivantsov, Evgueni. Heads or Tails: Financial Disaster, Risk Management and Survival Strategy in the World of Extreme Risk. Retrieved 20 December 2017.

- ↑ Blythe, Jim. Principles and Practice of Marketing. Retrieved 20 December 2017.

- ↑ Scott, Celicia. YouTube®: How Steve Chen Changed the Way We Watch Videos. Retrieved 20 December 2017.

- ↑ E-Retailing Challenges and Opportunities in the Global Marketplace (Dixit, Shailja ed.). Retrieved 20 December 2017.

- ↑ "Currency Solutions – Basic Company Information". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "World First Review". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "About Us: Security". torfx.com. Retrieved 20 December 2017.

- ↑ "Learn more about TorFX and whether they are good option for sending money overseas". thecurrencyshop.com.au. Retrieved 20 December 2017.

- ↑ "TorFX Review". fxcompared.com. Retrieved 20 December 2017.

- ↑ "Find the Best Way to Transfer Money Overseas". thecurrencyshop.com. Retrieved 20 December 2017.

- ↑ "torfx Review". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "OFX – Basic Company Information". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "Halo Financial Review". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "Xendpay". compareremit.com. Retrieved 23 December 2017.

- ↑ "Kenya sets world first with money transfers by mobile". theguardian.com. Retrieved 10 March 2018.

- ↑ "OrbitRemit". compareremit.com. Retrieved 23 December 2017.

- ↑ "International Labour Migration: A Rights-Based Approach". digitalcommons.ilr.cornell.edu. Retrieved 29 December 2017.

- ↑ "WorldRemit Money Transfer". compareremit.com. Retrieved 23 December 2017.

- ↑ "Remitly". compareremit.com. Retrieved 23 December 2017.

- ↑ Botsman, Rachel. Who Can You Trust?: How Technology Brought Us Together and Why It Might Drive Us Apart. Retrieved 20 December 2017.

- ↑ Entrepreneurship in Transition Economies: Diversity, Trends, and Perspectives (Arnis Sauka, Alexander Chepurenko ed.). Retrieved 20 December 2017.

- ↑ Klein, Joshua. Reputation Economics: Why Who You Know Is Worth More Than What You Have. Retrieved 20 December 2017.

- ↑ pigel, Ivo. The European Startup Revolution: Interviews With European Entrepreneurs. Retrieved 20 December 2017.

- ↑ "Transferwise – Basic Company Information". moneytransfercomparison.com. Retrieved 23 December 2017.

- ↑ "Azimo". compareremit.com. Retrieved 23 December 2017.

- ↑ "Pangea Money Transfer". compareremit.com. Retrieved 23 December 2017.

- ↑ "bridge21". compareremit.com. Retrieved 23 December 2017.

- ↑ "Our story". wave.com. Retrieved 10 March 2018.

- ↑ "Alibaba's Ant Financial may have won the bidding war for MoneyGram after upping its offer to $1.2B". techcrunch.com. Retrieved 20 December 2017.

- ↑ "Ant Financial to try again for U.S. approval of MoneyGram deal: source". reuters.com. Retrieved 20 December 2017.

- ↑ "China's Ant Financial Pushes U.S. to Approve MoneyGram Deal". bloomberg.com. Retrieved 20 December 2017.

- ↑ "Ant Financial Resubmits To CFIUS For MoneyGram Buy Approval". pymnts.com. Retrieved 20 December 2017.

- ↑ "Big data, Chinese surveillance, and Donald Trump could keep China's biggest payments company from entering the US". qz.com. Retrieved 20 December 2017.

- ↑ "Moneycorp to acquire US-based Commonwealth Foreign Exchange". finextra.com. Retrieved 20 December 2017.

- ↑ "Moneycorp Goes After SMEs With Corporate FX Acquisition". pymnts.com. Retrieved 20 December 2017.

- ↑ Vaish, Esha. "Britain's Moneycorp targets U.S. market with Commonwealth FX purchase". reuters.com. Retrieved 20 December 2017.

- ↑ "Moneycorp buys Commonwealth Foreign Exchange for US boost". bankingtech.com. Retrieved 20 December 2017.

- ↑ "OFX Hires Mike Kennedy as President, North America". businesswire.com. Retrieved 23 December 2017.

- ↑ "Money transfer". Google Trends. Retrieved 19 March 2021.

- ↑ "Money transfer". books.google.com. Retrieved 19 March 2021.

- ↑ "Money transfer". wikipediaviews.org. Retrieved 20 March 2021.