Difference between revisions of "Timeline of Bitcoin"

| (88 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | {{focused coverage period|end-date = | + | {{focused coverage period|end-date = February 2021}} |

This is a '''timeline of {{w|Bitcoin}}''', attempting to describe the evolution of the cryptocurrency and its influence around the world. All {{w|Bitcoin Core}} version updates are included. | This is a '''timeline of {{w|Bitcoin}}''', attempting to describe the evolution of the cryptocurrency and its influence around the world. All {{w|Bitcoin Core}} version updates are included. | ||

| Line 19: | Line 19: | ||

** Sort the full timeline by "Event type" and look for the group of rows with value "Milestone transaction". | ** Sort the full timeline by "Event type" and look for the group of rows with value "Milestone transaction". | ||

** You will discover some historic events, like two pizzas having been ordered in exchange for 10,000 Bitcoins in 2010. | ** You will discover some historic events, like two pizzas having been ordered in exchange for 10,000 Bitcoins in 2010. | ||

| + | * What are some Bitcoin acquisitions of historical importance? | ||

| + | ** Sort the full timeline by "Event type" and look for the group of rows with value "Notable acquisition" | ||

| + | ** You will see sizable and/or early acquisitions by some notable people now commonly associated with the cryptocurrency. | ||

* What are some events describing the adoption of Bitcoin? | * What are some events describing the adoption of Bitcoin? | ||

** Sort the full timeline by "Event type" and look for the group of rows with value "Currency adoption" | ** Sort the full timeline by "Event type" and look for the group of rows with value "Currency adoption" | ||

| Line 49: | Line 52: | ||

** Sort the full timeline by "Event type" and look for the group of rows with value "{{w|Content creation}}". | ** Sort the full timeline by "Event type" and look for the group of rows with value "{{w|Content creation}}". | ||

** You will mostly see some notable forums on {{w|reddit}}. | ** You will mostly see some notable forums on {{w|reddit}}. | ||

| − | * Other events are described under the following types: "Blockchain company", "{{w|Broadcasting}}", "Corporation policy", "Education", "Fraud case", "Legal", "{{w|Market capitalization}}", "Notable people", "Research", "Service shutdown", and "Website launch". | + | * Other events are described under the following types: "Blockchain company", "{{w|Broadcasting}}", "Corporation policy", "Education", "Fraud case", "Legal", "{{w|Market capitalization}}", "Notable case", "Notable people", "Notable prediction", "Research", "Service shutdown", and "Website launch". |

==Big picture== | ==Big picture== | ||

| Line 76: | Line 79: | ||

| 2019 || Resurgence || Bitcoin sees a new resurgence in price and volume, rising to around US$10,000. As of the end of 2019, the price of one Bitcoin is of around US$7,250. | | 2019 || Resurgence || Bitcoin sees a new resurgence in price and volume, rising to around US$10,000. As of the end of 2019, the price of one Bitcoin is of around US$7,250. | ||

|- | |- | ||

| − | | | + | | 2020–2021 || New heights || Bitcoin valuation surpasses the 2017 [[w:cryptocurrency bubble|bubble]] highest value. Increasing institutional adoption is experienced as the first real signs banks, money managers, insurance firms and companies start to embrace fast-growing markets for cryptocurrencies and digital assets.<ref>{{cite web |title=For many reasons 2020 will loom large in future textbooks on financial history. |url=https://www.coindesk.com/bitcoin-prices-in-2020-heres-what-happened |website=coindesk.com |access-date=15 February 2021}}</ref> |

|- | |- | ||

|} | |} | ||

| Line 98: | Line 101: | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==Full timeline== | ==Full timeline== | ||

| Line 199: | Line 170: | ||

| 2010 || {{dts|March 17}} || Organization ([[w:Bitcoin exchange|exchange company]]) || BitcoinMarket.com starts operating as the first bitcoin exchange. The price per Bitcoin is of around US$0.003 at the time.<ref>{{cite web |title=Bitcoin History part 3 |url=https://www.pivot.one/share/post/5c21d34e595ce716ecc10970?uid=5baf14acf3098d7b5b37ac16&invite_code=CVWPZS |website=pivot.one |accessdate=30 December 2019}}</ref> || | | 2010 || {{dts|March 17}} || Organization ([[w:Bitcoin exchange|exchange company]]) || BitcoinMarket.com starts operating as the first bitcoin exchange. The price per Bitcoin is of around US$0.003 at the time.<ref>{{cite web |title=Bitcoin History part 3 |url=https://www.pivot.one/share/post/5c21d34e595ce716ecc10970?uid=5baf14acf3098d7b5b37ac16&invite_code=CVWPZS |website=pivot.one |accessdate=30 December 2019}}</ref> || | ||

|- | |- | ||

| − | | 2010 || {{dts|April}}–May || Mining || Laszlo Hanecz (also "Hanyecz") begins mining bitcoin with a GPU around this time. | + | | 2010 || {{dts|April}}–May || Mining || Laszlo Hanecz (also "Hanyecz") begins mining bitcoin with a GPU around this time. On May 17 he wins twenty-eight blocks; these wins give him fourteen hundred new coins that day.<ref name="popper_digitial_gold" /> || {{w|United States}} |

|- | |- | ||

| 2010 || {{dts|May 22}} || Milestone transaction || Laszlo Hanyecz (laszlo) reports that he has traded 10,000 of his bitcoins for two pizzas ordered by Jeremy Sturdivant (jercos). This transaction is the first documented purchase of a good using bitcoin.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Laszlo_Hanyecz |title=Laszlo Hanyecz |publisher=Bitcoin Wiki |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://en.bitcoin.it/wiki/Jercos |title=Jercos |publisher=Bitcoin Wiki |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=137.0 |title=Pizza for bitcoins? |accessdate=June 12, 2017}}</ref> || {{w|United States}} | | 2010 || {{dts|May 22}} || Milestone transaction || Laszlo Hanyecz (laszlo) reports that he has traded 10,000 of his bitcoins for two pizzas ordered by Jeremy Sturdivant (jercos). This transaction is the first documented purchase of a good using bitcoin.<ref>{{cite web |url=https://en.bitcoin.it/wiki/Laszlo_Hanyecz |title=Laszlo Hanyecz |publisher=Bitcoin Wiki |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://en.bitcoin.it/wiki/Jercos |title=Jercos |publisher=Bitcoin Wiki |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=137.0 |title=Pizza for bitcoins? |accessdate=June 12, 2017}}</ref> || {{w|United States}} | ||

|- | |- | ||

| 2010 || {{dts|July}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Ross Ulbricht begins the development of Silk Road.<ref name="popper_digitial_gold" /> || | | 2010 || {{dts|July}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Ross Ulbricht begins the development of Silk Road.<ref name="popper_digitial_gold" /> || | ||

| + | |- | ||

| + | | 2010 || {{dts|July 11}} || Currency adoption || Release of Bitcoin version 0.3 is posted to Slashdot. This is the result of a "campaign to get Bitcoin real press coverage". With the increase in traffic from Slashdot, the Bitcoin website temporarily goes down. Despite "the derogatory comments that showed up under the Slashdot item", this brings in a bunch of new Bitcoin users: "The number of downloads would jump from around three thousand in June to over twenty thousand in July. The day after the Slashdot piece appeared, Gavin Andresen's Bitcoin faucet gave away 5,000 Bitcoins and was running empty."<ref name="popper_digitial_gold" /><ref>{{cite web |url=http://historyofbitcoin.org/ |title=Bitcoin History: The Complete History of Bitcoin [Timeline] |accessdate=June 16, 2017}}</ref> || | ||

|- | |- | ||

| 2010 || {{dts|July 18}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|Mt. Gox}}, a bitcoin exchange founded by Jed McCaleb, is announced.<ref>{{cite web |url=https://www.gwern.net/docs/2014-mccaleb |author=Jed McCaleb |date=February 16, 2014 |title=Jed McCaleb interview |website=Gwern.net |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=444.0 |title=New Bitcoin Exchange (mtgox.com) |accessdate=June 12, 2017 |author=mtgox}}</ref> McCaleb had heard about Bitcoin from the Slashdot post several days earlier.<ref name="popper_digitial_gold" /> || | | 2010 || {{dts|July 18}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|Mt. Gox}}, a bitcoin exchange founded by Jed McCaleb, is announced.<ref>{{cite web |url=https://www.gwern.net/docs/2014-mccaleb |author=Jed McCaleb |date=February 16, 2014 |title=Jed McCaleb interview |website=Gwern.net |accessdate=June 12, 2017}}</ref><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=444.0 |title=New Bitcoin Exchange (mtgox.com) |accessdate=June 12, 2017 |author=mtgox}}</ref> McCaleb had heard about Bitcoin from the Slashdot post several days earlier.<ref name="popper_digitial_gold" /> || | ||

| Line 241: | Line 214: | ||

| 2011 || {{dts|June 1}} || [[W:cryptocurrency exchange|Exchange company]] || [[w:BTCC (company)|BTCC]] launches as a bitcoin trading platform that enables its users to buy and sell bitcoins in the native Chinese CNY currency.<ref>{{cite web |title=BTCC |url=https://www.crunchbase.com/organization/btcc#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || | | 2011 || {{dts|June 1}} || [[W:cryptocurrency exchange|Exchange company]] || [[w:BTCC (company)|BTCC]] launches as a bitcoin trading platform that enables its users to buy and sell bitcoins in the native Chinese CNY currency.<ref>{{cite web |title=BTCC |url=https://www.crunchbase.com/organization/btcc#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || | ||

|- | |- | ||

| − | | 2011 || {{dts|June 14}} || Notable people || {{w|Gavin Andresen}} gives a talk on Bitcoin at the CIA.<ref name="popper_digitial_gold" /><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=6652.msg251755#msg251755 |title=Re: Gavin will visit the CIA |accessdate=June 24, 2017 |author=Gavin Andresen |date=June 20, 2011 |quote=I just uploaded pdf and KeyNote versions of the talk I gave at the CIA last Tuesday}}</ref><ref>{{cite web |url=https://twitter.com/gavinandresen/status/80785477342478336?lang=en |title=Gavin Andresen on Twitter |publisher=Twitter |accessdate=June 24, 2017 |quote=My talk at the CIA went well today. The hallways there are REALLY wide, and full of interesting stuff.}}</ref> || | + | | 2011 || {{dts|June 14}} || Notable people || American software developer {{w|Gavin Andresen}} gives a talk on Bitcoin at the CIA.<ref name="popper_digitial_gold" /><ref>{{cite web |url=https://bitcointalk.org/index.php?topic=6652.msg251755#msg251755 |title=Re: Gavin will visit the CIA |accessdate=June 24, 2017 |author=Gavin Andresen |date=June 20, 2011 |quote=I just uploaded pdf and KeyNote versions of the talk I gave at the CIA last Tuesday}}</ref><ref>{{cite web |url=https://twitter.com/gavinandresen/status/80785477342478336?lang=en |title=Gavin Andresen on Twitter |publisher=Twitter |accessdate=June 24, 2017 |quote=My talk at the CIA went well today. The hallways there are REALLY wide, and full of interesting stuff.}}</ref> || {{w|United States}} |

|- | |- | ||

| 2011 || {{dts|June 15}} || {{w|Content creation}} || The Bitcoin mining subreddit, r/BitcoinMining, is created. As of March 28, 2020 it has 37,300 members.<ref>{{cite web |title=Bitcoin Mining Forums: Turning Computers Into Cash Since 2011 |url=https://www.reddit.com/r/BitcoinMining/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | | 2011 || {{dts|June 15}} || {{w|Content creation}} || The Bitcoin mining subreddit, r/BitcoinMining, is created. As of March 28, 2020 it has 37,300 members.<ref>{{cite web |title=Bitcoin Mining Forums: Turning Computers Into Cash Since 2011 |url=https://www.reddit.com/r/BitcoinMining/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

| Line 259: | Line 232: | ||

| 2011 || {{dts|August}} (late) || Conference || The Bitcoin Conference & World Expo NYC 2011, organized by Bruce Wagner of ''The Bitcoin Show'', takes place.<ref name="popper_digitial_gold" /> || {{w|United States}} | | 2011 || {{dts|August}} (late) || Conference || The Bitcoin Conference & World Expo NYC 2011, organized by Bruce Wagner of ''The Bitcoin Show'', takes place.<ref name="popper_digitial_gold" /> || {{w|United States}} | ||

|- | |- | ||

| − | | 2011 || {{dts|August 30}} || || {{w|Blockchain.com}} launches.<ref>{{cite web |title=Blockchain.com - The Most Trusted Crypto Company |url=https://www.blockchain.com/research |website=www.blockchain.com |access-date=11 February 2021 |language=en}}</ref><ref>{{cite web |title=Blockchain.com - 48 Reviews - Bitcoin Exchange - BitTrust.org |url=http://bittrust.org/blockchaincom/0 |website=bittrust.org |access-date=11 February 2021}}</ref> | + | | 2011 || {{dts|August 30}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|Blockchain.com}} launches.<ref>{{cite web |title=Blockchain.com - The Most Trusted Crypto Company |url=https://www.blockchain.com/research |website=www.blockchain.com |access-date=11 February 2021 |language=en}}</ref><ref>{{cite web |title=Blockchain.com - 48 Reviews - Bitcoin Exchange - BitTrust.org |url=http://bittrust.org/blockchaincom/0 |website=bittrust.org |access-date=11 February 2021}}</ref> || |

|- | |- | ||

| − | | 2011 {{dts|August}} || || | | + | | 2011 || {{dts|August}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Bitcoin exchange {{w|Bitstamp}} is founded.<ref>{{cite web |title=bitstamp |url=https://www.bitstamp.net/article/bitstamps-fifth-anniversary/ |website=www.bitstamp.net |access-date=11 February 2021}}</ref><ref>{{cite web |title=Bitstamp deja de operar en Londres luego de 8 años de funcionamiento |url=https://es.cointelegraph.com/news/bitstamp-reportedly-leaves-london-after-8-years-of-operation |website=Cointelegraph |access-date=11 February 2021 |language=es}}</ref> || |

|- | |- | ||

| 2011 || ? || Notable acquisition || {{w|Roger Ver}} starts investing in Bitcoin shares in this year.<ref name="henryharvin">{{cite web |title=WHO ARE THE RICHEST BITCOIN OWNERS? Bitcoin - Henry Harvin |url=https://www.henryharvin.com/blog/who-are-the-top-richest-bitcoin-owners/ |website=www.henryharvin.com |access-date=8 February 2021}}</ref> || | | 2011 || ? || Notable acquisition || {{w|Roger Ver}} starts investing in Bitcoin shares in this year.<ref name="henryharvin">{{cite web |title=WHO ARE THE RICHEST BITCOIN OWNERS? Bitcoin - Henry Harvin |url=https://www.henryharvin.com/blog/who-are-the-top-richest-bitcoin-owners/ |website=www.henryharvin.com |access-date=8 February 2021}}</ref> || | ||

| Line 305: | Line 278: | ||

| 2013 || {{dts|April 11}} || {{w|Content creation}} || The subreddit r/BitcoinMarkets is created. As of March 28, 2020 it has 148,000 members.<ref>{{cite web |title=Sharing of ideas, tips, and strategies for increasing your Bitcoin trading profits |url=https://www.reddit.com/r/BitcoinMarkets/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | | 2013 || {{dts|April 11}} || {{w|Content creation}} || The subreddit r/BitcoinMarkets is created. As of March 28, 2020 it has 148,000 members.<ref>{{cite web |title=Sharing of ideas, tips, and strategies for increasing your Bitcoin trading profits |url=https://www.reddit.com/r/BitcoinMarkets/ |website=reddit.com |accessdate=28 March 2020}}</ref> || | ||

|- | |- | ||

| − | | 2013 || {{dts|April}} || || | + | | 2013 || {{dts|April}} || Notable acquisition || American entrepreneurs [[w:Tyler Winklevoss|Tyler]] and {{w|Cameron Winklevoss}} announce having acquired US$11 million worth of Bitcoins.<ref>{{cite web |title=The $11 million in bitcoins the Winklevoss brothers bought is now worth $32 million |url=https://www.washingtonpost.com/news/the-switch/wp/2013/11/09/the-11-million-in-bitcoins-the-winklevoss-brothers-bought-is-now-worth-32-million/ |website=washingtonpost.com |access-date=8 February 2021}}</ref><ref name="Medium"/> || {{w|United States}} |

|- | |- | ||

| 2013 || {{dts|May 7}} || Currency adoption || Coinbase announces "the largest funding round to date for a Bitcoin startup, a $5 million investment led by [[wikipedia:Union Square Ventures|Union Square Ventures]]".<ref>{{cite web |url=https://blogs.wsj.com/venturecapital/2013/05/07/coinbase-nabs-5m-in-biggest-funding-for-bitcoin-startup/ |author=Sarah E. Needleman |date=May 7, 2013 |publisher=[[wikipedia:The Wall Street Journal|The Wall Street Journal]] |title=Coinbase Nabs $5M in Biggest Funding for Bitcoin Startup |accessdate=June 22, 2017}}</ref><ref name="liu" /> || | | 2013 || {{dts|May 7}} || Currency adoption || Coinbase announces "the largest funding round to date for a Bitcoin startup, a $5 million investment led by [[wikipedia:Union Square Ventures|Union Square Ventures]]".<ref>{{cite web |url=https://blogs.wsj.com/venturecapital/2013/05/07/coinbase-nabs-5m-in-biggest-funding-for-bitcoin-startup/ |author=Sarah E. Needleman |date=May 7, 2013 |publisher=[[wikipedia:The Wall Street Journal|The Wall Street Journal]] |title=Coinbase Nabs $5M in Biggest Funding for Bitcoin Startup |accessdate=June 22, 2017}}</ref><ref name="liu" /> || | ||

| Line 313: | Line 286: | ||

| 2013 || {{dts|May 17}} || Conference || The first official Bitcoin conference takes place in San Jose.<ref name="liu" /> || | | 2013 || {{dts|May 17}} || Conference || The first official Bitcoin conference takes place in San Jose.<ref name="liu" /> || | ||

|- | |- | ||

| − | | 2013 || {{dts|May}} || || {{w|CoinDesk}} launches | + | | 2013 || {{dts|May}} || Organization || {{w|CoinDesk}} launches. It is a news site specializing in {{w|Bitcoin}} and {{w|digital currencies}}. || |

|- | |- | ||

| − | | 2013 || ? || || Independent media platform <code>cointelegraph.com</code> launches.<ref>{{cite web |title=Latest News on Cointelegraph |url=https://cointelegraph.com/tags/cointelegraph |website=Cointelegraph |access-date=15 February 2021 |language=en}}</ref><ref>{{cite web |title=Cointelegraph: Contact Information, Journalists, and Overview {{!}} Muck Rack |url=https://muckrack.com/media-outlet/cointelegraph |website=muckrack.com |access-date=15 February 2021 |language=en}}</ref> || | + | | 2013 || ? || Organization || Independent media platform <code>cointelegraph.com</code> launches.<ref>{{cite web |title=Latest News on Cointelegraph |url=https://cointelegraph.com/tags/cointelegraph |website=Cointelegraph |access-date=15 February 2021 |language=en}}</ref><ref>{{cite web |title=Cointelegraph: Contact Information, Journalists, and Overview {{!}} Muck Rack |url=https://muckrack.com/media-outlet/cointelegraph |website=muckrack.com |access-date=15 February 2021 |language=en}}</ref> || |

|- | |- | ||

| 2013 || {{dts|July 23}} || Legal || Trendon T. Shavers is "sued by the Securities and Exchange Commission on Tuesday and accused of running a fund that collected bitcoins from investors, promising them 7 percent weekly returns".<ref>{{cite web |url=https://dealbook.nytimes.com/2013/07/23/s-e-c-says-texas-man-operated-bitcoin-ponzi-scheme/ |author=Nathaniel Popper |date=July 23, 2013 |title=S.E.C. Says Texas Man Operated Bitcoin Ponzi Scheme |publisher=[[wikipedia:The New York Times|The New York Times]] |accessdate=June 17, 2017}}</ref> || | | 2013 || {{dts|July 23}} || Legal || Trendon T. Shavers is "sued by the Securities and Exchange Commission on Tuesday and accused of running a fund that collected bitcoins from investors, promising them 7 percent weekly returns".<ref>{{cite web |url=https://dealbook.nytimes.com/2013/07/23/s-e-c-says-texas-man-operated-bitcoin-ponzi-scheme/ |author=Nathaniel Popper |date=July 23, 2013 |title=S.E.C. Says Texas Man Operated Bitcoin Ponzi Scheme |publisher=[[wikipedia:The New York Times|The New York Times]] |accessdate=June 17, 2017}}</ref> || | ||

| Line 321: | Line 294: | ||

| 2013 || {{dts|July 30}} || Organization || {{w|BitGive Foundation}} is founded.<ref>{{cite web |title=BitGive Foundation |url=https://www.crunchbase.com/organization/bitgive-foundation#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || | | 2013 || {{dts|July 30}} || Organization || {{w|BitGive Foundation}} is founded.<ref>{{cite web |title=BitGive Foundation |url=https://www.crunchbase.com/organization/bitgive-foundation#section-overview |website=crunchbase.com |accessdate=24 December 2019}}</ref> || | ||

|- | |- | ||

| − | | 2013 || {{dts|July}} || || {{w|Ghash.io}} | + | | 2013 || {{dts|July}} || Organization || Bitcoin {{w|mining pool}} {{w|Ghash.io}} starts operating. Within a year, this mining pool would contribute about one-third of the overall hashing power out of the total.<ref>{{cite web |title=GHash.IO, The Leading Bitcoin Mining Pool - Sponsored Post |url=https://www.finsmes.com/2014/09/ghash-io-the-leading-bitcoin-mining-pool-sp.html |website=FinSMEs |access-date=24 February 2021 |date=5 September 2014}}</ref> || |

|- | |- | ||

| 2013 || {{dts|August}} || Official response (regulation) || The German Finance Ministry characterizes Bitcoin as a {{w|unit of account}},<ref name="Marketwatch20130819">{{cite web |url=http://blogs.marketwatch.com/thetell/2013/08/19/bitcoins-are-private-money-in-germany/ |title=Bitcoins are private money in Germany |last=Vaishampayan |first=Saumya |date=19 August 2013 |website={{w|Marketwatch}}|accessdate= 30 December 2019}}</ref> usable in [[w:Clearing house (finance)|multilateral clearing circles]] and subject to capital gains tax if held less than one year.<ref name="FAZ20130816">{{cite news|url=http://www.faz.net/aktuell/finanzen/devisen-rohstoffe/digitale-waehrung-deutschland-erkennt-bitcoins-als-privates-geld-an-12535059.html|title=Deutschland erkennt Bitcoins als privates Geld an (Germany recognizes Bitcoin as private money) |last=Nestler |first=Franz|date=16 August 2013 |website={{w|Frankfurter Allgemeine Zeitung}}|accessdate= 30 December 2019}}</ref> || {{w|Germany}} | | 2013 || {{dts|August}} || Official response (regulation) || The German Finance Ministry characterizes Bitcoin as a {{w|unit of account}},<ref name="Marketwatch20130819">{{cite web |url=http://blogs.marketwatch.com/thetell/2013/08/19/bitcoins-are-private-money-in-germany/ |title=Bitcoins are private money in Germany |last=Vaishampayan |first=Saumya |date=19 August 2013 |website={{w|Marketwatch}}|accessdate= 30 December 2019}}</ref> usable in [[w:Clearing house (finance)|multilateral clearing circles]] and subject to capital gains tax if held less than one year.<ref name="FAZ20130816">{{cite news|url=http://www.faz.net/aktuell/finanzen/devisen-rohstoffe/digitale-waehrung-deutschland-erkennt-bitcoins-als-privates-geld-an-12535059.html|title=Deutschland erkennt Bitcoins als privates Geld an (Germany recognizes Bitcoin as private money) |last=Nestler |first=Franz|date=16 August 2013 |website={{w|Frankfurter Allgemeine Zeitung}}|accessdate= 30 December 2019}}</ref> || {{w|Germany}} | ||

| Line 327: | Line 300: | ||

| 2013 || {{dts|September 26}} || Currency adoption || [[wikipedia:NASDAQ Private Market|SecondMarket]] begins raising money for the Bitcoin Investment Trust, an investment fund holding only bitcoins.<ref>{{cite web |url=https://dealbook.nytimes.com/2013/09/25/fund-to-let-investors-bet-on-price-of-bitcoins/ |first1=Peter |last1=Lattman |first2=Nathaniel |last2=Popper |date=September 25, 2013 |title=Fund to Let Investors Bet on Price of Bitcoins |publisher=[[wikipedia:The New York Times|The New York Times]] |accessdate=June 17, 2017 |quote=On Thursday, SecondMarket is expected to begin raising money for an investment fund — the first of its kind in the United States — that will hold only bitcoins, giving wealthy investors exposure to the trendy but controversial virtual currency.}}</ref> || {{w|United States}} | | 2013 || {{dts|September 26}} || Currency adoption || [[wikipedia:NASDAQ Private Market|SecondMarket]] begins raising money for the Bitcoin Investment Trust, an investment fund holding only bitcoins.<ref>{{cite web |url=https://dealbook.nytimes.com/2013/09/25/fund-to-let-investors-bet-on-price-of-bitcoins/ |first1=Peter |last1=Lattman |first2=Nathaniel |last2=Popper |date=September 25, 2013 |title=Fund to Let Investors Bet on Price of Bitcoins |publisher=[[wikipedia:The New York Times|The New York Times]] |accessdate=June 17, 2017 |quote=On Thursday, SecondMarket is expected to begin raising money for an investment fund — the first of its kind in the United States — that will hold only bitcoins, giving wealthy investors exposure to the trendy but controversial virtual currency.}}</ref> || {{w|United States}} | ||

|- | |- | ||

| − | | 2013 || {{dts|September}} || || | + | | 2013 || {{dts|September}} || Notable case || The {{w|FBI}} takes the notorious “dark web drug bazaar” [[w:Silk Road (marketplace)|Silk Road]] and confiscates 144,000 Bitcoins owned by the website operator.<ref name="Medium"/> || {{w|United States}} |

|- | |- | ||

| − | | 2013 || {{dts|September 25}} || || | + | | 2013 || {{dts|September 25}} || Organization || {{w|Barry Silbert}} founds Grayscale Bitcoin Trust (BGTC), now considered a traditional investment trust.<ref name="henryharvin"/> || {{w|United States}} |

|- | |- | ||

| 2013 || {{dts|October 29}} || Technology || The first Bitcoin ATM in the world opens in {{w|Vancouver}}, {{w|Canada}}.<ref>{{cite web |title=World's First Bitcoin ATM Opens In Vancouver, Canada |url=https://mashable.com/2013/10/30/bitcoin-atm-2/ |website=mashable.com |accessdate=24 December 2019}}</ref> || {{w|Canada}} | | 2013 || {{dts|October 29}} || Technology || The first Bitcoin ATM in the world opens in {{w|Vancouver}}, {{w|Canada}}.<ref>{{cite web |title=World's First Bitcoin ATM Opens In Vancouver, Canada |url=https://mashable.com/2013/10/30/bitcoin-atm-2/ |website=mashable.com |accessdate=24 December 2019}}</ref> || {{w|Canada}} | ||

| Line 373: | Line 346: | ||

| 2014 || {{dts|March 25}} || Official response (regulation) || In its first substantive ruling on cryptocurrencies, the United States {{w|Internal Revenue Service}} states that Bitcoin will be treated as property for tax purposes.<ref>{{cite web |url=https://www.bloomberg.com/news/articles/2014-03-25/bitcoin-is-property-not-currency-in-tax-system-irs-says |title=Bitcoin Is Property Not Currency in Tax System, IRS Says |date=March 25, 2014 |first1=Richard |last1=Rubin |first2=Carter |last2=Dougherty |publisher=Bloomberg Business |archiveurl=https://web.archive.org/web/20150202014708/https://www.bloomberg.com/news/articles/2014-03-25/bitcoin-is-property-not-currency-in-tax-system-irs-says |archivedate=February 2, 2015}}</ref><ref>{{cite web |url=https://bitcoinmagazine.com/articles/the-united-states-is-falling-behind-in-bitcoin-regulation-1461604211/ |publisher=Bitcoin Magazine |title=The United States Is Falling Behind in Bitcoin Regulation |author=Kyle Torpey |date=April 25, 2016 |accessdate=June 29, 2017}}</ref> || {{w|United States}} | | 2014 || {{dts|March 25}} || Official response (regulation) || In its first substantive ruling on cryptocurrencies, the United States {{w|Internal Revenue Service}} states that Bitcoin will be treated as property for tax purposes.<ref>{{cite web |url=https://www.bloomberg.com/news/articles/2014-03-25/bitcoin-is-property-not-currency-in-tax-system-irs-says |title=Bitcoin Is Property Not Currency in Tax System, IRS Says |date=March 25, 2014 |first1=Richard |last1=Rubin |first2=Carter |last2=Dougherty |publisher=Bloomberg Business |archiveurl=https://web.archive.org/web/20150202014708/https://www.bloomberg.com/news/articles/2014-03-25/bitcoin-is-property-not-currency-in-tax-system-irs-says |archivedate=February 2, 2015}}</ref><ref>{{cite web |url=https://bitcoinmagazine.com/articles/the-united-states-is-falling-behind-in-bitcoin-regulation-1461604211/ |publisher=Bitcoin Magazine |title=The United States Is Falling Behind in Bitcoin Regulation |author=Kyle Torpey |date=April 25, 2016 |accessdate=June 29, 2017}}</ref> || {{w|United States}} | ||

|- | |- | ||

| − | | 2014 || {{dts|March}} || || {{w|Xapo}} | + | | 2014 || {{dts|March}} || Organization || {{w|Xapo}} is founded by Argentinian entrepreneur {{w|Wences Casares}}. Based in {{w|Hong Kong}}, the company provides a {{w|Bitcoin}} wallet combined with a [[w:Cryptocurrency wallet|cold storage]] vault and a Bitcoin-based {{w|debit card}}.<ref>{{cite web |title=Xapo - Branding & Web Design Case Study |url=https://aerolab.co/xapo |website=Aerolab |access-date=15 February 2021 |language=en}}</ref><ref name="NYT March 2014">{{cite news|last1=Sreeharsha|first1=Vinod|title=Start-Up Seeks to Capitalize on Security Concerns for Bitcoins|url=https://dealbook.nytimes.com/2014/03/14/start-up-seeks-to-capitalize-on-security-concerns-for-bitcoins/?_php=true&_type=blogs&_r=0|access-date=20 June 2014|work=The New York Times|publisher=The New York Times|date=14 March 2014|ref=The New York Times}}</ref><ref name="Wall Street Journal">{{cite news|last1=Rusli|first1=Evelyn M.|title=First Bitcoin Vaults, Now Xapo Debuts Debit Cards|url=https://blogs.wsj.com/digits/2014/04/24/first-bitcoin-vaults-now-xapo-debuts-debit-cards/|access-date=20 June 2014|work=Wall Street Journal|publisher=Wall Street Journal|date=24 April 2014|ref=Wall Street Journal}}</ref> |

|- | |- | ||

| 2014 || {{dts|May 15}} || Security || The [[wikipedia:Stoned (computer virus)#Bitcoin blockchain incident|DOS Stoned incident]] occurs, when the signature of the [[w:Stoned (computer virus)|Stoned]] virus is inserted into the Bitcoin {{w|blockchain}}, causing {{w|Microsoft Security Essentials}} to recognize copies of the blockchain as the virus, prompting it to remove the file in question, and subsequently forcing the node to reload the block chain from that point, continuing the cycle.<ref>{{cite web|url=https://answers.microsoft.com/en-us/protect/forum/mse-protect_updating/microsoft-security-essentials-reporting-false/0240ed8e-5a27-4843-a939-0279c8110e1c?tm=1400189799602&auth=1|title=Microsoft Security Essentials reporting false positives in the Bitcoin blockchain, constantly notifying users.|website=answers.microsoft.com}}</ref><ref>{{cite web|url=https://www.theregister.co.uk/2014/05/18/bitcoin_user_stoned_on_virus_warnings/|title=Bitcoin blockchain allegedly infected by ancient 'Stoned' virus|first=Richard Chirgwin 18 May 2014 at 21:58|last=tweet_btn()|publisher=}}</ref>.<ref>{{cite web |url=https://en.bitcoin.it/wiki/DOS/STONED_incident |title=DOS/STONED incident |website=Bitcoin Wiki |accessdate=June 13, 2017}}</ref> || | | 2014 || {{dts|May 15}} || Security || The [[wikipedia:Stoned (computer virus)#Bitcoin blockchain incident|DOS Stoned incident]] occurs, when the signature of the [[w:Stoned (computer virus)|Stoned]] virus is inserted into the Bitcoin {{w|blockchain}}, causing {{w|Microsoft Security Essentials}} to recognize copies of the blockchain as the virus, prompting it to remove the file in question, and subsequently forcing the node to reload the block chain from that point, continuing the cycle.<ref>{{cite web|url=https://answers.microsoft.com/en-us/protect/forum/mse-protect_updating/microsoft-security-essentials-reporting-false/0240ed8e-5a27-4843-a939-0279c8110e1c?tm=1400189799602&auth=1|title=Microsoft Security Essentials reporting false positives in the Bitcoin blockchain, constantly notifying users.|website=answers.microsoft.com}}</ref><ref>{{cite web|url=https://www.theregister.co.uk/2014/05/18/bitcoin_user_stoned_on_virus_warnings/|title=Bitcoin blockchain allegedly infected by ancient 'Stoned' virus|first=Richard Chirgwin 18 May 2014 at 21:58|last=tweet_btn()|publisher=}}</ref>.<ref>{{cite web |url=https://en.bitcoin.it/wiki/DOS/STONED_incident |title=DOS/STONED incident |website=Bitcoin Wiki |accessdate=June 13, 2017}}</ref> || | ||

| Line 391: | Line 364: | ||

| 2014 || {{dts|September 18}} || Research || Coin Center, a non-profit group focused on cryptocurrency research and advocacy, is established.<ref>{{cite web |url=https://www.washingtonpost.com/news/the-switch/wp/2014/09/18/bitcoin-gets-an-industry-backed-advocacy-group/ |publisher=[[wikipedia:The Washington Post|The Washington Post]] |title=Bitcoin gets an industry-backed advocacy group |author=Nancy Scola |date=September 18, 2014 |accessdate=June 29, 2017}}</ref> || | | 2014 || {{dts|September 18}} || Research || Coin Center, a non-profit group focused on cryptocurrency research and advocacy, is established.<ref>{{cite web |url=https://www.washingtonpost.com/news/the-switch/wp/2014/09/18/bitcoin-gets-an-industry-backed-advocacy-group/ |publisher=[[wikipedia:The Washington Post|The Washington Post]] |title=Bitcoin gets an industry-backed advocacy group |author=Nancy Scola |date=September 18, 2014 |accessdate=June 29, 2017}}</ref> || | ||

|- | |- | ||

| − | | 2014 || {{dts|September 23}} || Notable prediction || | + | | 2014 || {{dts|September 23}} || Notable prediction || {{w|Tim Draper}} predicts that 1 Bitcoin share would reach 10,000 dollars by 2017. His prediction would come true and on 29 November 2017 the price of a Bitcoin share would cross 10,000 U.S dollars.<ref name="henryharvin"/> || |

|- | |- | ||

| 2014 || {{dts|October 2}} || Official response (warning) || The National Bank of Serbia makes announcement clarifying that “anyone investing in Bitcoins or engaging in any other activity involving virtual currencies shall do so at their own liability, bearing all financial risks and risks in terms of noncompliance with regulations governing foreign exchange operations, taxation, trade, etc.”<ref name="loc.govs"/> || {{w|Serbia}} | | 2014 || {{dts|October 2}} || Official response (warning) || The National Bank of Serbia makes announcement clarifying that “anyone investing in Bitcoins or engaging in any other activity involving virtual currencies shall do so at their own liability, bearing all financial risks and risks in terms of noncompliance with regulations governing foreign exchange operations, taxation, trade, etc.”<ref name="loc.govs"/> || {{w|Serbia}} | ||

| Line 431: | Line 404: | ||

| 2016 || {{dts|June 11}} || Market capitalization || Bitcoin market capitalization reaches US$ 10 billion.<ref>{{cite web |title=Bitcoin Price Rally Rages on, Market Cap Passes $10Bn USD |url=https://news.bitcoin.com/bitcoin-price-market-cap-10-billion/ |website=news.bitcoin.com |accessdate=2 January 2020}}</ref> || | | 2016 || {{dts|June 11}} || Market capitalization || Bitcoin market capitalization reaches US$ 10 billion.<ref>{{cite web |title=Bitcoin Price Rally Rages on, Market Cap Passes $10Bn USD |url=https://news.bitcoin.com/bitcoin-price-market-cap-10-billion/ |website=news.bitcoin.com |accessdate=2 January 2020}}</ref> || | ||

|- | |- | ||

| − | | 2016 || {{dts|July 10}} || Mining || The second Bitcoin halving event occurs at block height 420,000.<ref name="bitcoinblockhalf.coms"/> The amount of new Bitcoins issued every 10 minutes drops from 25 bitcoins to 12.5.<ref name="BITCOIN CLOCK"/> | + | | 2016 || {{dts|July 10}} || Mining || The second Bitcoin halving event occurs at block height 420,000.<ref name="bitcoinblockhalf.coms"/> The amount of new Bitcoins issued every 10 minutes drops from 25 bitcoins to 12.5.<ref name="BITCOIN CLOCK"/> || |

|- | |- | ||

| 2016 || {{dts|August 2}} || [[w:Cryptocurrency and security|Security]] || The [[wikipedia:Bitfinex hack|Bitfinex hack]] is first announced.<ref>{{cite web |url=http://www.reuters.com/article/us-bitfinex-hacked-hongkong-idUSKCN10E0KP |author=Clare Baldwin |date=August 3, 2016 |publisher=Reuters |title=Bitcoin worth $72 million stolen from Bitfinex exchange in Hong Kong |accessdate=June 12, 2017 |quote=Bitcoin plunged just over 23 percent on Tuesday after the news broke.}}</ref> || | | 2016 || {{dts|August 2}} || [[w:Cryptocurrency and security|Security]] || The [[wikipedia:Bitfinex hack|Bitfinex hack]] is first announced.<ref>{{cite web |url=http://www.reuters.com/article/us-bitfinex-hacked-hongkong-idUSKCN10E0KP |author=Clare Baldwin |date=August 3, 2016 |publisher=Reuters |title=Bitcoin worth $72 million stolen from Bitfinex exchange in Hong Kong |accessdate=June 12, 2017 |quote=Bitcoin plunged just over 23 percent on Tuesday after the news broke.}}</ref> || | ||

| Line 463: | Line 436: | ||

| 2017 || {{dts|May 17}} || Official response (negative) || The State Bank of Pakistan states that it does not recognize digital currencies.<ref name="loc.govs"/> || {{w|Pakistan}} | | 2017 || {{dts|May 17}} || Official response (negative) || The State Bank of Pakistan states that it does not recognize digital currencies.<ref name="loc.govs"/> || {{w|Pakistan}} | ||

|- | |- | ||

| − | | 2017 || {{dts|May}} || || | + | | 2017 || {{dts|May}} || Notable case || The Bulgarian Government manages to confiscate 213,519 bitcoins (enough to pay off a quarter of the country’s national debt), during a standard police action cracking on some local cyber criminals who were to blame for making a ransom virus.<ref name="Medium">{{cite web |last1=Hussain |first1=Sajjad |title=Top ten Bitcoin holders in the world |url=https://medium.com/cryptocurrencies-ups-and-down/top-ten-bitcoin-holders-in-the-world-c0c23a3db7b3 |website=Medium |access-date=8 February 2021 |language=en |date=8 February 2021}}</ref><ref>{{cite web |last1=R. |first1=Ivan |title=Bulgaria seized 213.000 Bitcoins worth $3 Billion, They Realized This Could Pay Off 1/5 of National Debt |url=https://www.slavorum.org/bulgaria-seized-213-000-bitcoins-worth-3-billion-they-realized-this-could-pay-off-1-5-of-national-debt/ |website=Slavorum |access-date=15 February 2021 |date=14 December 2017}}</ref><ref>{{cite web |last1=Roh |first1=Chelsea |title=Bulgarian Law Enforcement Holding $3 Billion of Bitcoin of Bitcoin |url=https://cryptocurrencynews.com/daily-news/bitcoin-news/bulgarian-law-enforcement-holding-3-billion-of-bitcoin-of-bitcoin/ |website=Crypto Currency News |access-date=15 February 2021 |date=8 December 2017}}</ref> || {{w|Bulgaria}} |

|- | |- | ||

| 2017 || {{dts|June 13}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Gemini, the digital currency exchange started by the [[wikipedia:Winklevoss twins|Winklevoss twins]], begins operating in Washington State after it is granted a license to do so.<ref>{{cite web |url=https://www.cryptoninjas.net/2017/06/13/gemini-now-licensed-provide-digital-asset-exchange-services-washington-state/ |title=Gemini now licensed to provide digital asset exchange services in Washington State |publisher=CryptoNinjas |date=June 13, 2017 |accessdate=June 30, 2017}}</ref> || {{w|United States}} | | 2017 || {{dts|June 13}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Gemini, the digital currency exchange started by the [[wikipedia:Winklevoss twins|Winklevoss twins]], begins operating in Washington State after it is granted a license to do so.<ref>{{cite web |url=https://www.cryptoninjas.net/2017/06/13/gemini-now-licensed-provide-digital-asset-exchange-services-washington-state/ |title=Gemini now licensed to provide digital asset exchange services in Washington State |publisher=CryptoNinjas |date=June 13, 2017 |accessdate=June 30, 2017}}</ref> || {{w|United States}} | ||

| Line 471: | Line 444: | ||

| 2017 || {{dts|June}} || Official response (warning) || The Financial Superintendency of Colombia warns that bitcoin is not currency in Colombia and therefore may not be considered legal tender susceptible of cancelling debts.<ref name="loc.govs"/> || {{w|Colombia}} | | 2017 || {{dts|June}} || Official response (warning) || The Financial Superintendency of Colombia warns that bitcoin is not currency in Colombia and therefore may not be considered legal tender susceptible of cancelling debts.<ref name="loc.govs"/> || {{w|Colombia}} | ||

|- | |- | ||

| − | | 2017 || {{dts|July 1}} || Organization ([[w:Bitcoin exchange|exchange company]]) || {{w|Binance}} is founded.<ref>{{cite web |title=Binance |url=https://www.crunchbase.com/organization/binance#section-overview |website=crunchbase.com |accessdate=22 December 2019}}</ref> || | + | | 2017 || {{dts|July 1}} || Organization ([[w:Bitcoin exchange|exchange company]]) || Cryptocurrency exchange {{w|Binance}} is founded.<ref>{{cite web |title=Binance |url=https://www.crunchbase.com/organization/binance#section-overview |website=crunchbase.com |accessdate=22 December 2019}}</ref> || {{w|China}} |

|- | |- | ||

| 2017 || {{dts|July 4}} || Official response (warning) || The Saudi Arabian Monetary Agency issues a warning against bitcoin because it is not being monitored or supported by any legitimate financial authority.<ref name="loc.govs"/> || {{w|Saudi Arabia}} | | 2017 || {{dts|July 4}} || Official response (warning) || The Saudi Arabian Monetary Agency issues a warning against bitcoin because it is not being monitored or supported by any legitimate financial authority.<ref name="loc.govs"/> || {{w|Saudi Arabia}} | ||

| Line 509: | Line 482: | ||

| 2017 || {{dts|September 27}} || Official response (warning) || The Monetary Authority of Macau (AMCM) issues a statement warning the financial industry and the public about the risks of virtual commodities and tokens. AMCM states: “Any trading of these commodities involves considerable risks, including but not limited to those relating to money laundering and terrorism financing, against which all participants should remain vigilant.”<ref name="loc.govs"/> || {{w|Macau}} | | 2017 || {{dts|September 27}} || Official response (warning) || The Monetary Authority of Macau (AMCM) issues a statement warning the financial industry and the public about the risks of virtual commodities and tokens. AMCM states: “Any trading of these commodities involves considerable risks, including but not limited to those relating to money laundering and terrorism financing, against which all participants should remain vigilant.”<ref name="loc.govs"/> || {{w|Macau}} | ||

|- | |- | ||

| − | | 2017 || {{dts|September 27}} || Notable acquisition || | + | | 2017 || {{dts|September 27}} || Notable acquisition || {{w|Tim Draper}} buys 2000 Bitcoin shares at a price of US$ 400,000.<ref name="henryharvin"/> || {{w|United States}} |

|- | |- | ||

| 2017 || {{dts|September 29}} || Official response (regulation) || Japan's {{w|Financial Services Agency}} (FSA) issues operating licenses to 11 Bitcoin exchanges.<ref>{{cite web|title=Japan Endorses 11 Different Crypto Exchanges, Turns Into Friendliest Asian Bitcoin Market|url=https://news.bitcoin.com/japan-endorses-11-exchanges-transitions-to-largest-bitcoin-market/#:~:text=29-,Japan%20Endorses%2011%20Different%20Crypto%20Exchanges%2C%20Turns%20Into%20Friendliest%20Asian,endorsing%2011%20different%20cryptocurrency%20exchanges.&text=This%20means%20Japan%20now%20represents,cryptocurrency%2Dfriendly%20countries%20in%20Asia.|website=bitcoin.com|accessdate=11 December 2017}}</ref><ref>{{cite web|title=Japan Issues Licenses for 11 Bitcoin Exchanges|url=https://www.coindesk.com/japans-finance-regulator-issues-licenses-for-11-bitcoin-exchanges/|website=coindesk.com|accessdate=11 December 2017}}</ref> || {{w|Japan}} | | 2017 || {{dts|September 29}} || Official response (regulation) || Japan's {{w|Financial Services Agency}} (FSA) issues operating licenses to 11 Bitcoin exchanges.<ref>{{cite web|title=Japan Endorses 11 Different Crypto Exchanges, Turns Into Friendliest Asian Bitcoin Market|url=https://news.bitcoin.com/japan-endorses-11-exchanges-transitions-to-largest-bitcoin-market/#:~:text=29-,Japan%20Endorses%2011%20Different%20Crypto%20Exchanges%2C%20Turns%20Into%20Friendliest%20Asian,endorsing%2011%20different%20cryptocurrency%20exchanges.&text=This%20means%20Japan%20now%20represents,cryptocurrency%2Dfriendly%20countries%20in%20Asia.|website=bitcoin.com|accessdate=11 December 2017}}</ref><ref>{{cite web|title=Japan Issues Licenses for 11 Bitcoin Exchanges|url=https://www.coindesk.com/japans-finance-regulator-issues-licenses-for-11-bitcoin-exchanges/|website=coindesk.com|accessdate=11 December 2017}}</ref> || {{w|Japan}} | ||

| Line 655: | Line 628: | ||

| 2018 || {{dts|February 15}} || Official response (warning) || The National Bank of Moldova issues a statement recommending that citizens be as cautious as possible in deciding whether to invest in crypto-assets, given the technical characteristics of cryptocurrency, its high volatility, and the absence of any regulation that would protect investors.<ref name="loc.govs"/> || {{w|Moldova}} | | 2018 || {{dts|February 15}} || Official response (warning) || The National Bank of Moldova issues a statement recommending that citizens be as cautious as possible in deciding whether to invest in crypto-assets, given the technical characteristics of cryptocurrency, its high volatility, and the absence of any regulation that would protect investors.<ref name="loc.govs"/> || {{w|Moldova}} | ||

|- | |- | ||

| − | | 2018 || {{dts|February}} || | + | | 2018 || {{dts|February}} || Mining || Several scientists working at a top-secret Russian nuclear warhead facility are arrested for allegedly using one of the country's most powerful supercomputers to mine Bitcoins.<ref>{{cite web |title=Russian nuclear scientists arrested for 'Bitcoin mining plot' |url=https://www.bbc.com/news/world-europe-43003740 |website=bbc.com |accessdate=22 December 2019}}</ref><ref>{{cite web |title=Russian nuclear scientists were arrested for using a supercomputer to mine bitcoin |url=https://qz.com/1203665/russian-nuclear-scientists-were-arrested-for-using-a-supercomputer-to-mine-bitcoin/ |website=qz.com |accessdate=22 December 2019}}</ref><ref>{{cite web |title=Russians arrested for 'mining bitcoin' at nuclear facility |url=https://www.theguardian.com/world/2018/feb/10/russians-arrested-for-mining-bitcoin-at-nuclear-facility |website=theguardian.com |accessdate=22 December 2019}}</ref> || |

|- | |- | ||

| 2018 || {{dts|February}} || Official response (regulation) || The {{w|Israeli government}} confirms that it would treat bitcoin and other cryptocurrencies as a kind of property instead of currency, making it therefore taxable as such.<ref>{{cite web |title=Israel Confirms It Will Tax Bitcoin as Property |url=https://www.coindesk.com/israel-confirms-will-tax-bitcoin-property |website=coindesk.com |accessdate=22 December 2019}}</ref> || {{w|Israel}} | | 2018 || {{dts|February}} || Official response (regulation) || The {{w|Israeli government}} confirms that it would treat bitcoin and other cryptocurrencies as a kind of property instead of currency, making it therefore taxable as such.<ref>{{cite web |title=Israel Confirms It Will Tax Bitcoin as Property |url=https://www.coindesk.com/israel-confirms-will-tax-bitcoin-property |website=coindesk.com |accessdate=22 December 2019}}</ref> || {{w|Israel}} | ||

| Line 728: | Line 701: | ||

|- | |- | ||

| 2020 || {{dts|April 8}} || {{w|Bitcoin fork}} || {{w|Bitcoin Cash}} undergoes halving event, reducing its block rewards by half, and causing many miners to see gross margins drop to near zero.<ref>{{cite web |title=Bitcoin Cash Undergoes ‘Halving’ Event, Casting Shadow on Miner Profitability |url=https://www.coindesk.com/bitcoin-cash-undergoes-halving-event-casting-shadow-on-miner-profitability |website=coindesk.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=Bitcoin Cash "halving event" could cause many miners to give up |url=https://www.techradar.com/news/bitcoin-cash-halving-event-could-cause-many-miners-to-give-up |website=techradar.com |access-date=7 December 2020}}</ref> || | | 2020 || {{dts|April 8}} || {{w|Bitcoin fork}} || {{w|Bitcoin Cash}} undergoes halving event, reducing its block rewards by half, and causing many miners to see gross margins drop to near zero.<ref>{{cite web |title=Bitcoin Cash Undergoes ‘Halving’ Event, Casting Shadow on Miner Profitability |url=https://www.coindesk.com/bitcoin-cash-undergoes-halving-event-casting-shadow-on-miner-profitability |website=coindesk.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=Bitcoin Cash "halving event" could cause many miners to give up |url=https://www.techradar.com/news/bitcoin-cash-halving-event-could-cause-many-miners-to-give-up |website=techradar.com |access-date=7 December 2020}}</ref> || | ||

| + | |- | ||

| + | | 2020 || {{dts|May 7}} || Notable acquisition || American hedge fund manager {{w|Paul Tudor Jones}} reportedly buys Bitcoin as an inflation hedge in order to seek protection against central banks around the globe printing money to relieve coronavirus-battered economies.<ref>{{cite web |last1=Franck |first1=Thomas |title=Paul Tudor Jones reportedly buys bitcoin as an inflation hedge, compares crypto to 70s gold trade |url=https://www.cnbc.com/2020/05/07/paul-tudor-jones-reportedly-buys-bitcoin-as-an-inflation-hedge-compares-crypto-to-70s-gold-trade.html |website=CNBC |access-date=23 February 2021 |language=en |date=7 May 2020}}</ref> || {{w|United States}} | ||

|- | |- | ||

| 2020 || {{dts|May 16}} || Mining || The third Bitcoin halving should take place around this date on block 630,000.<ref name="BITCOIN CLOCK"/><ref>{{cite web |title=Bitcoin Halving Countdown |url=https://bravenewcoin.com/data-and-charts/bitcoin-halving |website=bravenewcoin.com |accessdate=29 March 2020}}</ref><ref name="Bitcoin Halving, Explained">{{cite web |title=Bitcoin Halving, Explained |url=https://www.coindesk.com/bitcoin-halving-explainer |website=coindesk.com |accessdate=29 March 2020}}</ref> The amount of new Bitcoins issued every 10 minutes will drop from 12.5 Bitcoins to 6.25.<ref name="BITCOIN CLOCK"/> || | | 2020 || {{dts|May 16}} || Mining || The third Bitcoin halving should take place around this date on block 630,000.<ref name="BITCOIN CLOCK"/><ref>{{cite web |title=Bitcoin Halving Countdown |url=https://bravenewcoin.com/data-and-charts/bitcoin-halving |website=bravenewcoin.com |accessdate=29 March 2020}}</ref><ref name="Bitcoin Halving, Explained">{{cite web |title=Bitcoin Halving, Explained |url=https://www.coindesk.com/bitcoin-halving-explainer |website=coindesk.com |accessdate=29 March 2020}}</ref> The amount of new Bitcoins issued every 10 minutes will drop from 12.5 Bitcoins to 6.25.<ref name="BITCOIN CLOCK"/> || | ||

| Line 742: | Line 717: | ||

|- | |- | ||

| 2020 || {{dts|October 21}} || Currency adoption || American {{w|financial services}} company {{w|PayPal}} announces a new service allowing all users in the United States buy, hold, or sell bitcoin using PayPal.<ref>{{cite web |title=PayPal to allow cryptocurrency buying, selling and shopping on its network |url=https://www.reuters.com/article/paypal-cryptocurrency/paypal-to-allow-cryptocurrency-buying-selling-and-shopping-on-its-network-idUSL1N2HB14U |website=reuters.com |access-date=9 December 2020}}</ref><ref>{{cite web |title=PayPal and Venmo will offer and accept cryptocurrency for all online payments |url=https://www.theverge.com/2020/10/21/21527288/paypal-cryptocurrency-support-buy-sell-venmo-bitcoin |website=theverge.com |access-date=9 December 2020}}</ref><ref>{{cite web |title=PayPal Launches New Service Enabling Users to Buy, Hold and Sell Cryptocurrency |url=https://newsroom.paypal-corp.com/2020-10-21-PayPal-Launches-New-Service-Enabling-Users-to-Buy-Hold-and-Sell-Cryptocurrency |website=newsroom.paypal-corp.com |access-date=9 December 2020}}</ref> || {{w|United States}} | | 2020 || {{dts|October 21}} || Currency adoption || American {{w|financial services}} company {{w|PayPal}} announces a new service allowing all users in the United States buy, hold, or sell bitcoin using PayPal.<ref>{{cite web |title=PayPal to allow cryptocurrency buying, selling and shopping on its network |url=https://www.reuters.com/article/paypal-cryptocurrency/paypal-to-allow-cryptocurrency-buying-selling-and-shopping-on-its-network-idUSL1N2HB14U |website=reuters.com |access-date=9 December 2020}}</ref><ref>{{cite web |title=PayPal and Venmo will offer and accept cryptocurrency for all online payments |url=https://www.theverge.com/2020/10/21/21527288/paypal-cryptocurrency-support-buy-sell-venmo-bitcoin |website=theverge.com |access-date=9 December 2020}}</ref><ref>{{cite web |title=PayPal Launches New Service Enabling Users to Buy, Hold and Sell Cryptocurrency |url=https://newsroom.paypal-corp.com/2020-10-21-PayPal-Launches-New-Service-Enabling-Users-to-Buy-Hold-and-Sell-Cryptocurrency |website=newsroom.paypal-corp.com |access-date=9 December 2020}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2020 || {{dts|November 16}} || Notable prediction || A senior Citibank analyst predicts that Bitcoin could potentially reach US$318,000 in value by December 2021.<ref>{{cite web |last1=Malwa |first1=Decrypt / Shaurya |title=Citibank Analyst Puts Bitcoin Price Prediction: 'As High as $318,000' |url=https://decrypt.co/48359/citibank-analyst-puts-bitcoin-price-prediction-as-high-as-318000 |website=Decrypt |access-date=1 March 2021 |date=16 November 2020}}</ref><ref>{{cite web |title=Citibank Analyst Says Bitcoin Could Pass $300K by December 2021 |url=https://www.coindesk.com/citibank-bitcoin-gold-318k-2021 |website=CoinDesk |access-date=1 March 2021 |language=en |date=16 November 2020}}</ref><ref>{{cite web |last1=Bambrough |first1=Billy |title=Leaked Citibank Report Reveals Bitcoin Could Rocket To $300,000 Price By End Of 2021 |url=https://www.forbes.com/sites/billybambrough/2020/11/19/leaked-citibank-report-reveals-bitcoin-could-rocket-to-300000-price-by-end-of-2021/?sh=782f23176eab |website=Forbes |access-date=1 March 2021 |language=en}}</ref> || {{w|United States}} | ||

|- | |- | ||

| 2020 || {{dts|November 19}} || Fraud case || The Chinese police seizes crypto assets worth more than US$4.2 billion (including 194,775 BTC) from PlusToken, a cryptocurrency {{w|Ponzi scheme}} disguised as a high-yield investment program.<ref>{{cite web |title=Chinese police have seized $4.2 billion cryptos from PlusToken Ponzi crackdown |url=https://www.theblockcrypto.com/post/85873/china-seize-billion-cryptos-from-plustoken-crackdown |website=theblockcrypto.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=Plus Token (PLUS) Scam – Anatomy of a Ponzi |url=https://boxmining.com/plus-token-ponzi/ |website=boxmining.com |access-date=10 December 2020}}</ref> || {{w|China}} | | 2020 || {{dts|November 19}} || Fraud case || The Chinese police seizes crypto assets worth more than US$4.2 billion (including 194,775 BTC) from PlusToken, a cryptocurrency {{w|Ponzi scheme}} disguised as a high-yield investment program.<ref>{{cite web |title=Chinese police have seized $4.2 billion cryptos from PlusToken Ponzi crackdown |url=https://www.theblockcrypto.com/post/85873/china-seize-billion-cryptos-from-plustoken-crackdown |website=theblockcrypto.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=Plus Token (PLUS) Scam – Anatomy of a Ponzi |url=https://boxmining.com/plus-token-ponzi/ |website=boxmining.com |access-date=10 December 2020}}</ref> || {{w|China}} | ||

| Line 753: | Line 730: | ||

| 2020 || December 3 || Currency adoption || Private German bank {{w|Hauck & Aufhäuser}} announces launch of a cryptocurrency fund which includes {{w|Bitcoin}}, {{w|Ethereum}}, and [[w:Stellar (payment network)|Stellar]], in an attempt to pursue a passive investment strategy.<ref>{{cite web |title=Hauck & Aufhäuser und Kapilendo starten ersten Kryptofonds |url=https://www.hauck-aufhaeuser.com/presseinformation-hauck-aufhaeuser-und-kapilendo-starten-ersten-kryptofonds |website=hauck-aufhaeuser.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=Private German Bank to Launch Cryptocurrency Fund |url=https://www.coindesk.com/private-german-bank-hauck-aufhauser-cryptocurrency-fund |website=coindesk.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=German Bank Hauck & Aufhauser to Launch Cryptocurrency Fund in January 2021 |url=https://www.coinspeaker.com/hauck-aufhauser-crypto-fund-2021/ |website=coinspeaker.com |access-date=9 December 2020}}</ref> || | | 2020 || December 3 || Currency adoption || Private German bank {{w|Hauck & Aufhäuser}} announces launch of a cryptocurrency fund which includes {{w|Bitcoin}}, {{w|Ethereum}}, and [[w:Stellar (payment network)|Stellar]], in an attempt to pursue a passive investment strategy.<ref>{{cite web |title=Hauck & Aufhäuser und Kapilendo starten ersten Kryptofonds |url=https://www.hauck-aufhaeuser.com/presseinformation-hauck-aufhaeuser-und-kapilendo-starten-ersten-kryptofonds |website=hauck-aufhaeuser.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=Private German Bank to Launch Cryptocurrency Fund |url=https://www.coindesk.com/private-german-bank-hauck-aufhauser-cryptocurrency-fund |website=coindesk.com |access-date=7 December 2020}}</ref><ref>{{cite web |title=German Bank Hauck & Aufhauser to Launch Cryptocurrency Fund in January 2021 |url=https://www.coinspeaker.com/hauck-aufhauser-crypto-fund-2021/ |website=coinspeaker.com |access-date=9 December 2020}}</ref> || | ||

|- | |- | ||

| − | | 2021 || February 8 || Notable acquisition || | + | | 2020 || December 10 || Currency adoption || {{w|Massachusetts}}-based life insurance company {{w|MassMutual}} invests US$100 million in Bitcoin for its general investment fund.<ref>{{cite web |title=169-Year-Old MassMutual Invests $100 Million in Bitcoin |url=https://www.bloomberg.com/news/articles/2020-12-10/169-year-old-insurer-massmutual-invests-100-million-in-bitcoin |website=Bloomberg.com |access-date=16 February 2021 |language=en |date=10 December 2020}}</ref><ref>{{cite web |last1=Vigna |first1=Paul |title=MassMutual Joins the Bitcoin Club With $100 Million Purchase |url=https://www.wsj.com/articles/massmutual-joins-the-bitcoin-club-with-100-million-purchase-11607626800 |website=Wall Street Journal |access-date=16 February 2021 |date=10 December 2020}}</ref><ref>{{cite web |last1=Sharma |first1=Rakesh |title=Insurance Giant MassMutual Buys $100 Million of Bitcoin |url=https://www.investopedia.com/decoding-insurance-giant-massmutuals-bitcoin-investment-5092586#:~:text=Insurance%20giant%20Massachusetts%20Mutual%20recently,in%20the%20fund%20management%20outfit. |website=Investopedia |access-date=16 February 2021 |language=en}}</ref> || {{w|United States}} |

| + | |- | ||

| + | | 2020 || December || Currency adoption || American financier {{w|Anthony Scaramucci}} launches the SkyBridge Bitcoin Fund, an institutional grade fund to invest in Bitcoin.<ref name="CoinMarketCapw"/> || {{w|United States}} | ||

| + | |- | ||

| + | | 2021 || January 5 || Notable prediction || American multinational investment bank {{w|JPMorgan Chase}} predicts that Bitcoin price could rise over US$146,000 in the long term, as it competes with gold as an asset class.<ref>{{cite web |title=JPMorgan Predicts Bitcoin Price Could Rise Over $146K in Long Term |url=https://www.coindesk.com/jpmorgan-predicts-bitcoin-price-could-rise-over-146000-in-long-term |website=CoinDesk |access-date=17 February 2021 |language=en |date=5 January 2021}}</ref> Previously, JPMorgan CEO {{w|Jamie Dimon}} has called Bitcoin a “fraud”.<ref>{{cite web |last1=Browne |first1=Ryan |title=JPMorgan says bitcoin could rise to $146,000 long term as it competes with gold |url=https://www.cnbc.com/2021/01/05/jpmorgan-bitcoin-price-could-rise-to-146k-as-it-competes-with-gold.html |website=CNBC |access-date=23 February 2021 |language=en |date=5 January 2021}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2021 || January 29 || Notable case || Bitcoin valuation spikes 20% after {{w|Elon Musk}} adds the hashtag #bitcoin to his {{w|Twitter}} bio.<ref>{{cite web |last1=Browne |first1=Ryan |title=Bitcoin spikes 20% after Elon Musk adds #bitcoin to his Twitter bio |url=https://www.cnbc.com/2021/01/29/bitcoin-spikes-20percent-after-elon-musk-adds-bitcoin-to-his-twitter-bio.html |website=CNBC |access-date=16 February 2021 |language=en |date=29 January 2021}}</ref><ref>{{cite web |last1=Fish |first1=Tom |title=Bitcoin price news: BTC spikes 20% after Elon Musk adds #bitcoin to Twitter bio |url=https://www.express.co.uk/finance/city/1390940/bitcoin-price-news-btc-spike-elon-musk-twitter-bio-gamestop-evg |website=Express.co.uk |access-date=20 February 2021 |language=en |date=29 January 2021}}</ref><ref>{{cite web |title=Bitcoin surges 20% after Elon Musk pumps ‘#bitcoin’ on Twitter |url=https://fortune.com/2021/01/29/bitcoin-price-elon-musk-twitter-bio/ |website=Fortune |access-date=20 February 2021 |language=en}}</ref> || | ||

| + | |- | ||

| + | | 2021 || February 1 || Notable comment || {{w|European Central Bank}} governing council member {{w|Gabriel Makhlouf}} warns that Bitcoin investors may "lose all their money" by investing in a “highly speculative asset”.<ref>{{cite web |last1=Shalvey |first1=Kevin |title=Bitcoin investors may 'lose all their money,' warns European Central Bank governing council member |url=https://www.businessinsider.com/ecb-council-member-bitcoin-investors-may-lose-all-their-money-2021-1 |website=Business Insider |access-date=16 February 2021}}</ref> || | ||

| + | |- | ||

| + | | 2021 || February 3 || Currency adoption || Credit card company {{w|Visa Inc.}} announces plans to help banks roll out Bitcoin and cryptocurrency buying and trading services with a Visa crypto software program, set to launch later in the year.<ref>{{cite web |title=Visa Expands Digital Currency Roadmap with First Boulevard |url=https://usa.visa.com/about-visa/newsroom/press-releases.releaseId.17721.html |website=usa.visa.com |access-date=16 February 2021 |language=en}}</ref><ref>{{cite web |title=Visa Reveals Bitcoin And Crypto Banking Roadmap Amid Race To Reach Network Of 70 Million |url=https://www.forbes.com/sites/billybambrough/2021/02/03/visa-reveals-bitcoin-and-crypto-banking-roadmap-amid-race-to-reach-network-of-70-million/?sh=960237b401cd |website=forbes.com |access-date=16 February 2021}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2021 || February 8 || Notable acquisition || {{w|Tesla, Inc.}} announces having bought US$1.5 billion worth of Bitcoin.<ref>{{cite web |title=Tesla says it has bought $1.5 billion worth of bitcoin |url=https://www.theblockcrypto.com/linked/94155/tesla-has-bought-1-5-billion-bitcoin-btc |website=The Block |access-date=8 February 2021 |language=en}}</ref> || | ||

| + | |- | ||

| + | | 2021 || February 10 || Currency adoption || American financial services corporation {{w|Mastercard}} announces that that it will begin supporting cryptocurrencies on its network later in the year.<ref>{{cite web |title=Mastercard says it will support 'select cryptocurrencies directly on our network' this year |url=https://www.theblockcrypto.com/linked/94560/mastercard-cryptocurrency-support-2021-payments |website=The Block |access-date=23 February 2021}}</ref><ref>{{cite web |last1=Crypto |first1=The Street |title=Mastercard to Add Cryptocurrency to Global Payment Network |url=https://www.thestreet.com/crypto/bitcoin/mastercard-crypto |website=The Street Crypto: Bitcoin and cryptocurrency news, advice, analysis and more |access-date=23 February 2021 |language=en}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2021 || February 10 || Mining || Analysis by {{w|Cambridge University}} suggests that Bitcoin mining consumes around 121.36 terawatt-hours (TWh) a year,more than the whole of {{w|Argentina}}.<ref>{{cite web |title=Bitcoin consumes 'more electricity than Argentina' |url=https://www.bbc.com/news/technology-56012952 |website=bbc.com |access-date=15 February 2021}}</ref><ref>{{cite web |title=Bitcoin Consumes 'More Electricity Than Argentina' - Slashdot |url=https://hardware.slashdot.org/story/21/02/11/2252200/bitcoin-consumes-more-electricity-than-argentina |website=hardware.slashdot.org |access-date=15 February 2021 |language=en}}</ref><ref>{{cite web |title=Bitcoin Mining Now Uses More Electricity Than Argentina |url=https://www.iflscience.com/technology/bitcoin-mining-now-uses-more-electricity-than-argentina/ |website=IFLScience |access-date=15 February 2021 |language=en}}</ref> || {{w|United Kingdom}} | ||

| + | |- | ||

| + | | 2021 || February 11 || Currency adoption || The {{w|Bank of New York Mellon}} announces that it will begin financing Bitcoin and other digital currencies. This is regarded as a validation of crypto from a key bank in the financial system.<ref>{{cite web |last1=Franck |first1=Thomas |title=BNY Mellon to offer bitcoin services, a validation of crypto from a key bank in the financial system |url=https://www.cnbc.com/2021/02/11/bny-mellon-to-offer-bitcoin-services-a-validation-of-crypto-from-a-key-bank-in-the-financial-system.html |website=CNBC |access-date=16 February 2021 |language=en |date=11 February 2021}}</ref><ref>{{cite web |title=BNY Mellon’s crypto entrance seeks to bridge generational adoption gap |url=https://cointelegraph.com/news/bny-mellon-s-crypto-entrance-seeks-to-bridge-generational-adoption-gap |website=Cointelegraph |access-date=16 February 2021 |language=en}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2021 || February 11 || Notable comment || United States secretary of the treasury {{w|Janet Yellen}} says that "misuse" of cryptocurrencies like Bitcoin is a growing problem, as regulators increase scrutiny after surge in interest. Yellen also emphasizes that "cryptocurrencies have been used to launder the profits of online drug traffickers; they’ve been a tool to finance terrorism."<ref>{{cite web |last1=GmbH |first1=finanzen net |title=Janet Yellen says 'misuse' of cryptocurrencies like bitcoin is a growing problem, as regulators increase scrutiny after surge in interest |url=https://markets.businessinsider.com/currencies/news/janet-yellen-bitcoin-misuse-cryptocurrencies-growing-problem-tesla-2021-2-1030071724 |website=markets.businessinsider.com |access-date=16 February 2021 |language=en-us}}</ref><ref>{{cite web |title=Janet Yellen says innovation can help fight misuse of cryptocurrencies and narrow digital gaps |url=https://www.cnbc.com/2021/02/11/janet-yellen-says-innovation-can-help-fight-misuse-of-cryptocurrencies.html |website=CNBC |access-date=23 February 2021 |language=en |date=11 February 2021}}</ref> || {{w|United States}} | ||

| + | |- | ||

| + | | 2021 || February 11 || Official response (negative) || The {{w|Government of India}} announces being in the process levying a complete ban on crypto investment in the country. Existing investors would reportedly get a 3-6 month transition period for liquidating their investments.<ref>{{cite web |title=India to ban cryptocurrency investment completely: Report |url=https://www.theblockcrypto.com/post/94740/india-to-ban-crypto-investment-completely-report |website=The Block |access-date=16 February 2021}}</ref><ref>{{cite web |title=India to Implement Complete Cryptocurrency Ban, Reports Says {{!}} Finance Magnates |url=https://www.financemagnates.com/cryptocurrency/news/india-to-implement-complete-cryptocurrency-ban-reports-says/ |website=Finance Magnates {{!}} Financial and business news |access-date=20 February 2021 |language=en |date=12 February 2021}}</ref><ref>{{cite web |title=India to ban cryptocurrency investment completely: Report {{!}} Headlines {{!}} News |url=https://coinmarketcap.com/headlines/news/india-to-ban-crypto-investment-completely-report/ |website=CoinMarketCap |access-date=20 February 2021 |language=en}}</ref> || {{w|India}} | ||

| + | |- | ||

| + | | 2021 || February 15 || Mining || A study published in journal {{w|Nature Climate Change}} warns on the growing environmental impact of Bitcoin mining and reports that if Bitcoin is implemented at similar rates at which other technologies have been incorporated, it alone could produce enough emissions to raise global temperatures by 2°C as soon as 2033.<ref>{{cite web |last1=Goldstein |first1=Alexis |title=Bitcoin Could Push Global Emissions Above 2 Degrees Celsius, Scientists Say |url=https://truthout.org/articles/bitcoin-could-push-global-emissions-above-2-degrees-celsius-scientists-say/?fbclid=IwAR2bsXCCru2lF-Gkh-pGA1CbW7jV3Zrw9vWZwOfaKJ633BPjQWzrts3lxo8 |website=Truthout |access-date=16 February 2021}}</ref><ref>{{cite web |title=Bitcoin can push global warming above 2 degrees C in a couple decades: It alone could produce enough emissions to raise global temperatures as soon as 2033 |url=https://www.sciencedaily.com/releases/2018/10/181029130951.htm |website=ScienceDaily |access-date=19 February 2021 |language=en}}</ref> || | ||

| + | |- | ||

| + | | 2021 || February 17 || Notable comment || {{w|Anthony Scaramucci}} estimates that Bitcoin would surpass US$100,000 before year's end.<ref name="CoinMarketCapw">{{cite web |title=Anthony Scaramucci Expects Bitcoin to Hit $100,000 Before Year's End {{!}} Headlines {{!}} News |url=https://coinmarketcap.com/headlines/news/anthony-scaramucci-expects-bitcoin-to-hit-100000-before-years-end/ |website=CoinMarketCap |access-date=23 February 2021 |language=en}}</ref><ref>{{cite web |last1=Belvedere |first1=Matthew J. |title=SkyBridge's Anthony Scaramucci sees bitcoin nearly doubling to $100,000 before year-end |url=https://www.cnbc.com/2021/02/17/skybridge-anthony-scaramucci-sees-bitcoin-nearly-doubling-to-100000-dollars-before-year-end.html#:~:text=Anthony%20Scaramucci%2C%20founder%20of%20hedge,dollars%20in%20bitcoin%20right%20now. |website=CNBC |access-date=23 February 2021 |language=en |date=17 February 2021}}</ref> || {{w|United States}} | ||

|- | |- | ||

| 2024 || March–June || Mining || The fourth Bitcoin halving will happen at block 840,000.<ref name="BITCOIN CLOCK"/> || | | 2024 || March–June || Mining || The fourth Bitcoin halving will happen at block 840,000.<ref name="BITCOIN CLOCK"/> || | ||

| Line 762: | Line 765: | ||

|} | |} | ||

| − | + | == {{w|Bitcoin Core}} version updates == | |

| − | |||

| − | |||

{| class="wikitable" | {| class="wikitable" | ||

| Line 894: | Line 895: | ||

|- | |- | ||

| 2020 || {{dts|August 1}} || 0.20.1<ref>{{cite web |title= 0.20.1 released |url=https://bitcoin.org/en/release/v0.20.1 |website=bitcoin.org |access-date=9 December 2020}}</ref> | | 2020 || {{dts|August 1}} || 0.20.1<ref>{{cite web |title= 0.20.1 released |url=https://bitcoin.org/en/release/v0.20.1 |website=bitcoin.org |access-date=9 December 2020}}</ref> | ||

| + | |- | ||

| + | | 2021 || {{dts|January 14}} || 0.21.0.<ref>{{cite web |title=Bitcoin Core version 0.21.0 released |url=https://bitcoin.org/en/release/v0.21.0 |website=bitcoin.org |access-date=15 February 2021 |language=en}}</ref> | ||

|- | |- | ||

|} | |} | ||

| Line 964: | Line 967: | ||

|- | |- | ||

|} | |} | ||

| + | |||

| + | == Numerical and visual data == | ||

| + | |||

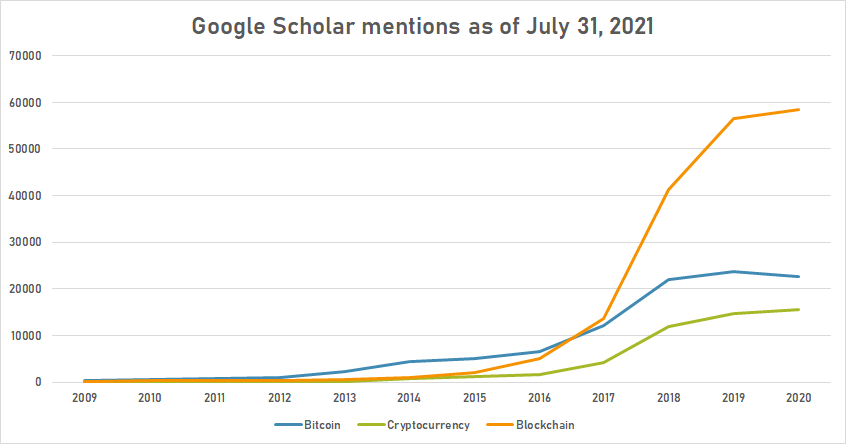

| + | === Mentions on Google Scholar === | ||

| + | |||

| + | The following table summarizes per-year mentions on Google Scholar as of July 31, 2021. | ||

| + | |||

| + | {| class="sortable wikitable" | ||

| + | ! Year | ||

| + | ! Bitcoin | ||

| + | ! Cryptocurrency | ||

| + | ! Blockchain | ||

| + | |- | ||

| + | | 2009 || 434 || 110 || 200 | ||

| + | |- | ||

| + | | 2010 || 482 || 155 || 280 | ||

| + | |- | ||

| + | | 2011 || 721 || 167 || 278 | ||

| + | |- | ||

| + | | 2012 || 927 || 127 || 322 | ||

| + | |- | ||

| + | | 2013 || 2,200 || 228 || 522 | ||

| + | |- | ||

| + | | 2014 || 4,440 || 783 || 1,040 | ||

| + | |- | ||

| + | | 2015 || 5,170 || 1,150 || 1,960 | ||

| + | |- | ||

| + | | 2016 || 6,530 || 1,700 || 5,000 | ||

| + | |- | ||

| + | | 2017 || 12,100 || 4,270 || 13,700 | ||

| + | |- | ||

| + | | 2018 || 22,100 || 12,000 || 41,400 | ||

| + | |- | ||

| + | | 2019 || 23,800 || 14,800 || 56,600 | ||

| + | |- | ||

| + | | 2020 || 22,600 || 15,600 || 58,500 | ||

| + | |- | ||

| + | |} | ||

| + | |||

| + | [[File:Bitcoin google sch.png|thumb|center|700px]] | ||

| + | |||

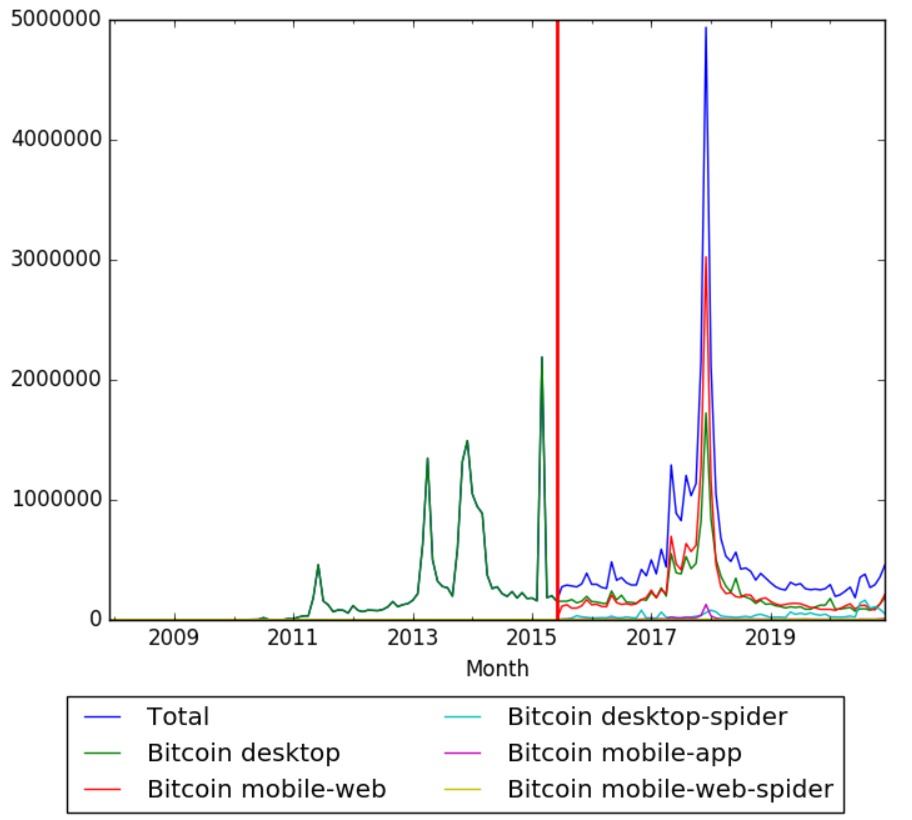

| + | === Wikipedia pageviews === | ||

| + | |||

| + | The image shows pageviews of the English Wikipedia page {{w|Bitcoin}} on desktop from December 2007, and on mobile-web, desktop-spider, mobile-web-spider and mobile app, from June 2015; to January 2021. | ||

| + | |||

| + | [[File:Bitcoin wv.jpeg|thumb|center|500px]] | ||

| + | |||

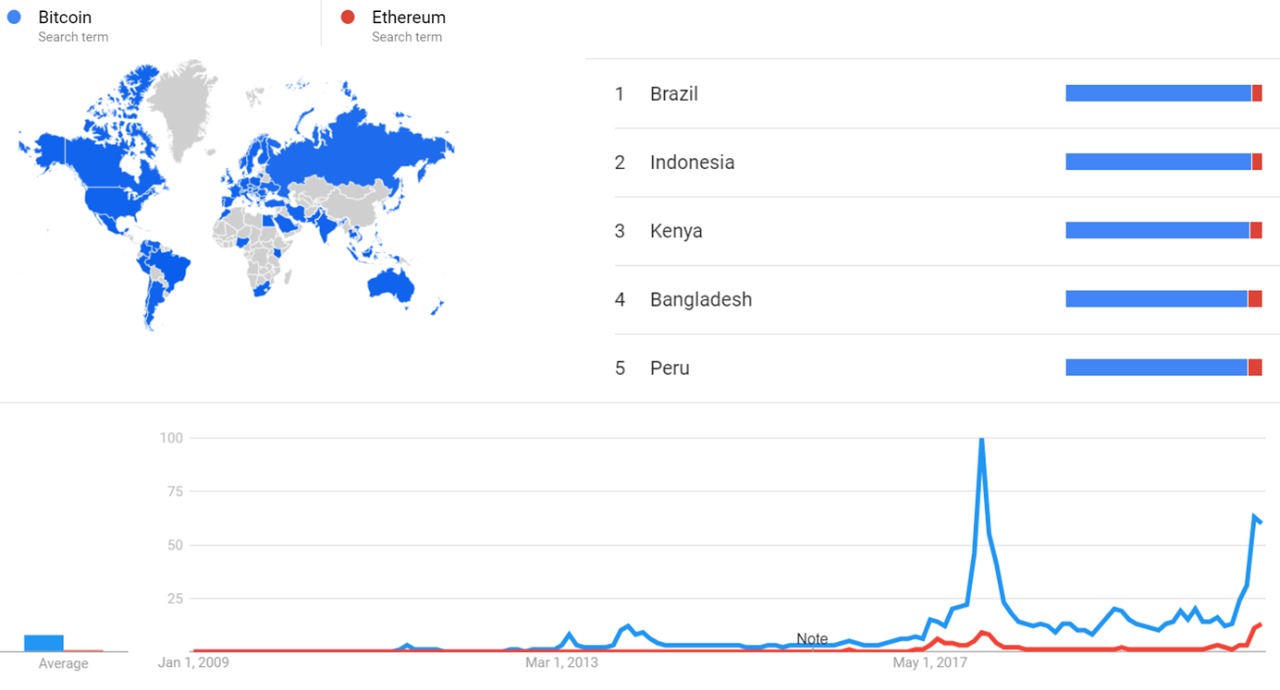

| + | === Google Trends === | ||

| + | |||

| + | The comparative chart below shows {{w|Google Trends}} data for Bitcoin (Search term) and Ethereum (Search term) from January 2009 to February 2021, when the screenshot was taken. Interest is also ranked by country and displayed on world map.<ref>{{cite web |title=Bitcoin and Ethereum |url=https://trends.google.com/trends/explore?date=2009-01-01%202021-02-16&q=Bitcoin,Ethereum |website=Google Trends |access-date=18 February 2021}}</ref> | ||

| + | |||

| + | [[File:Bitcoin eth gt.jpeg|thumb|center|800px]] | ||

| + | |||

| + | === Other === | ||

| + | |||

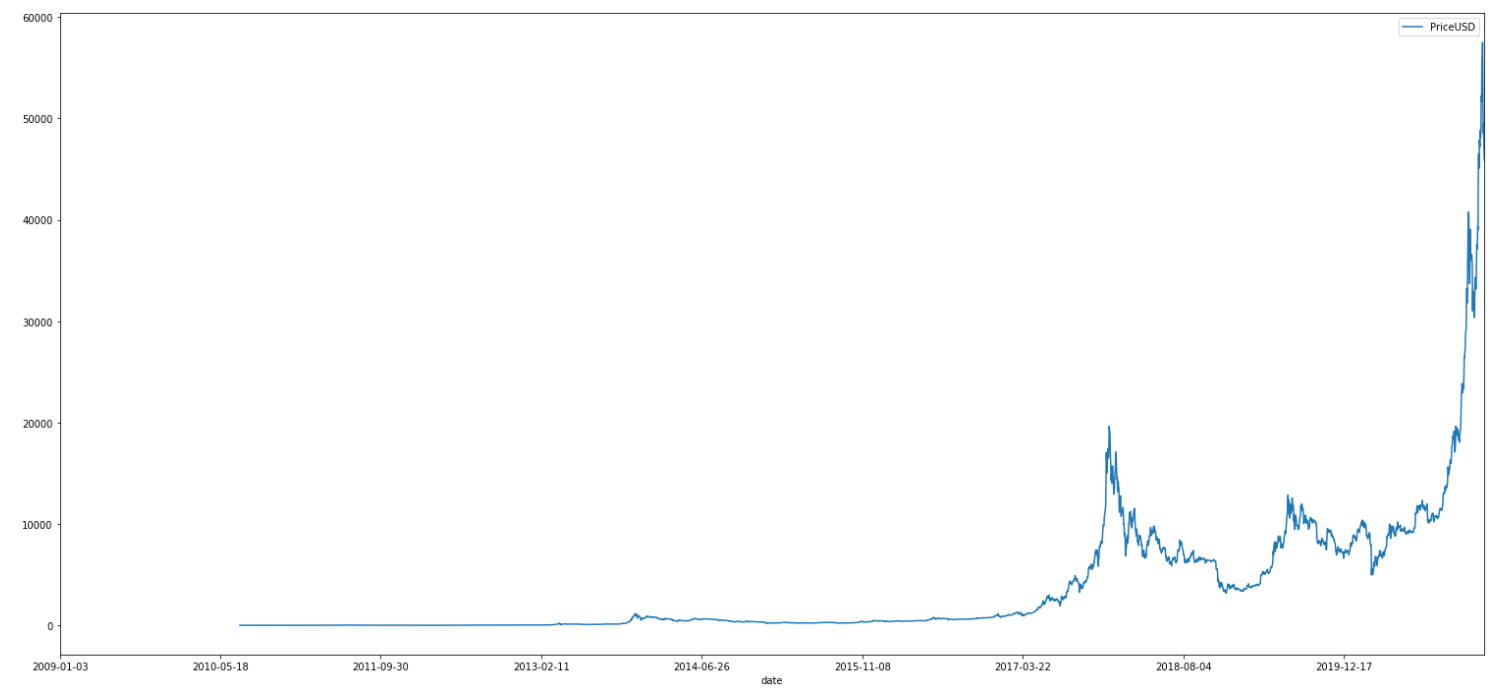

| + | The chart below illustrates the evolution of Bitcoin daily price in United States Dollars, from its earliest value to February 27th 2021.<ref name="Coin Metrics"/> | ||

| + | [[File:BTC price February 28 2021.png|thumb|center|1000px]] | ||

| + | |||

| + | |||

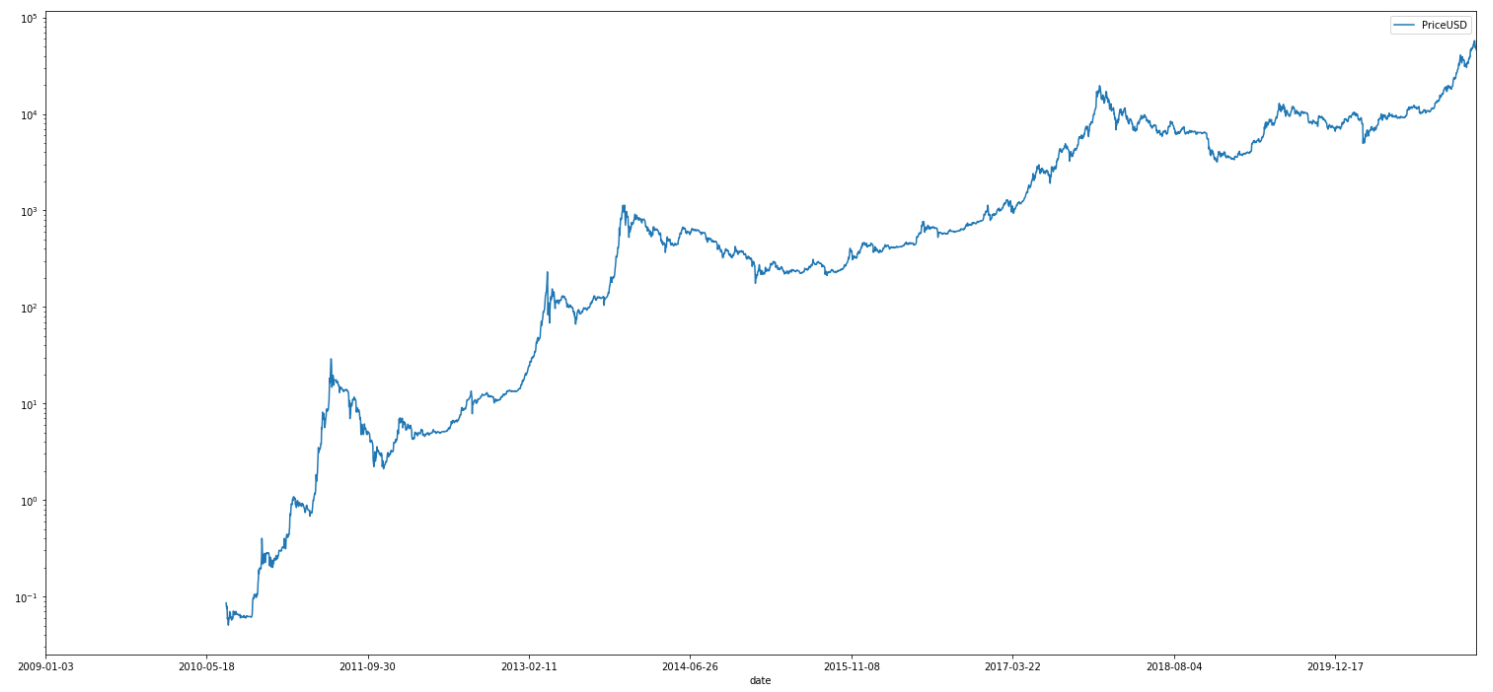

| + | The chart below illustrates the evolution of Bitcoin daily price in US Dollars, up to February 27th 2021, in logarithmic scale.<ref name="Coin Metrics">{{cite web |last1=Metrics |first1=Coin |title=Data File Downloads |url=https://coinmetrics.io/community-network-data/ |website=Coin Metrics |access-date=1 March 2021}}</ref> | ||

| + | [[File:BTC price February 28 2021 log.png|thumb|center|1000px]] | ||

| + | |||

| + | |||

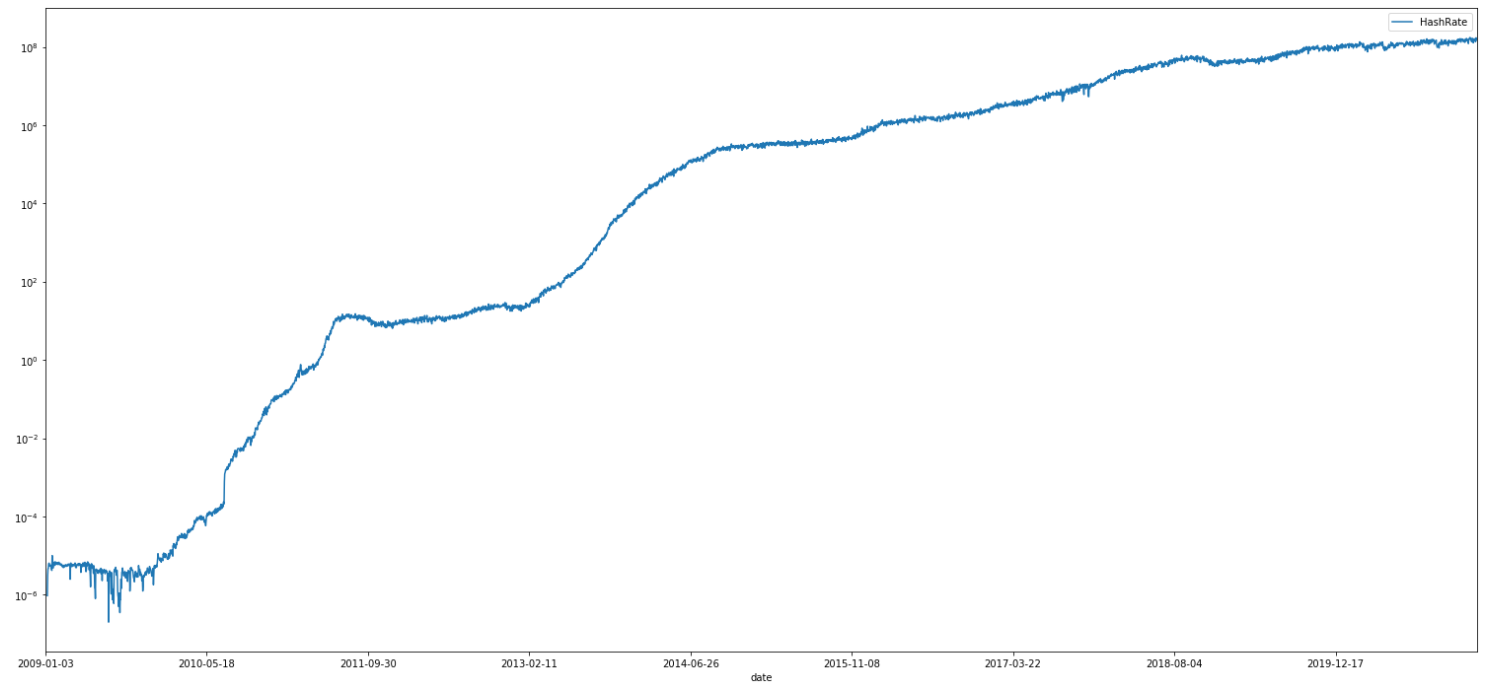

| + | The chart below illustrates the Bitcoin hash rate, which is the measuring unit of the processing power of the Bitcoin network; from January 3rd 2009 to February 27th 2021.<ref name="Coin Metrics">{{cite web |last1=Metrics |first1=Coin |title=Data File Downloads |url=https://coinmetrics.io/community-network-data/ |website=Coin Metrics |access-date=1 March 2021}}</ref> | ||

| + | [[File:Btc hash rate.png|thumb|center|1000px]] | ||

| + | |||

| + | |||

| + | The chart below shows the Bitcoin hash rate evolution in logarithmic scale.<ref name="Coin Metrics"/> | ||

| + | [[File:Btc hash rate February 28 2021 log.png|thumb|center|1000px]] | ||

==Meta information on the timeline== | ==Meta information on the timeline== | ||

| Line 1,002: | Line 1,074: | ||

===What the timeline is still missing=== | ===What the timeline is still missing=== | ||

| − | * Make sure we have rows for the launch of major publications exclusively or primarily covering Bitcoin and cryptocurrency (Coindesk, Cointelegraph). | + | * Make sure we have rows for the launch of major publications exclusively or primarily covering Bitcoin and cryptocurrency (Coindesk, Cointelegraph).✔ |

| − | * Go through current list of 10-20 top holders of Bitcoin and make sure we have events covering their major acquisitions of Bitcoin. | + | * Go through current list of 10-20 top holders of Bitcoin and make sure we have events covering their major acquisitions of Bitcoin.✔ |

| − | * Maybe stuff from https://www.coindesk.com/bitcoin-prices-in-2020-heres-what-happened | + | * Maybe stuff from https://www.coindesk.com/bitcoin-prices-in-2020-heres-what-happened ✔ |

| − | * [https://www.cnbc.com/2020/12/17/largest-us-cryptocurrency-exchange-coinbase-files-for-ipo-as-bitcoin-soars-past-23000.html?fbclid=IwAR2anAzS7G3vLNGpV3gs_Y-8bJw7v9WGRDtBAhS9yCONc1wQDLuYzspVVoo] | + | * [https://www.cnbc.com/2020/12/17/largest-us-cryptocurrency-exchange-coinbase-files-for-ipo-as-bitcoin-soars-past-23000.html?fbclid=IwAR2anAzS7G3vLNGpV3gs_Y-8bJw7v9WGRDtBAhS9yCONc1wQDLuYzspVVoo] |

* TODO Add more events about exchange rate changes | * TODO Add more events about exchange rate changes | ||

* TODO Add CVEs and other incidents related to security and bad transactions | * TODO Add CVEs and other incidents related to security and bad transactions | ||

| Line 1,013: | Line 1,085: | ||

* TODO https://en.wikipedia.org/wiki/LocalBitcoins | * TODO https://en.wikipedia.org/wiki/LocalBitcoins | ||

* TODO triple-entry accounting, e.g. http://iang.org/papers/triple_entry.html | * TODO triple-entry accounting, e.g. http://iang.org/papers/triple_entry.html | ||

| + | * [https://www.newscientist.com/article/2273672-bitcoin-mining-emissions-in-china-will-hit-130-million-tonnes-by-2024/?utm_medium=social&utm_campaign=echobox&utm_source=Facebook&fbclid=IwAR1RshEYJFZ9wlilShCeqQ-oIJT0nrUZZ-nag1jDLo358kxEYlNZLxXqP-A#Echobox=1617721621] | ||

===Timeline update strategy=== | ===Timeline update strategy=== | ||

| + | |||

| + | === Pingbacks === | ||

| + | |||

| + | * [https://books.google.com.ar/books?id=TJBDEAAAQBAJ&pg=PT79&lpg=PT79&dq=timelines.issarice&source=bl&ots=hFhjnzC3FI&sig=ACfU3U3F8GKWug6FDK0FDmRFgfbxhgNnLg&hl=en&sa=X&ved=2ahUKEwigls6v1--CAxVpppUCHd1nBCA4HhDoAXoECAIQAw#v=onepage&q=timelines.issarice&f=false ''The Sweet Life with Bitcoin: How I Stopped Worrying about Cryptocurrency and You Should Too!'', by Anthony Scaramucci] Endnote 31 | ||

==See also== | ==See also== | ||

| − | * [[Timeline of | + | * [[Timeline of Ethereum]] |

| + | * [[Timeline of Coinbase]] | ||

| + | * [[Timeline of cryptocurrency and philanthropy]] | ||

* [[Timeline of money transfer]] | * [[Timeline of money transfer]] | ||

Latest revision as of 20:00, 1 December 2023

This is a timeline of Bitcoin, attempting to describe the evolution of the cryptocurrency and its influence around the world. All Bitcoin Core version updates are included.

Contents

Sample questions

The following are some interesting questions that can be answered by reading this timeline:

- What are some significant events prior to the development of Bitcoin?

- Sort the full timeline by "Event type" and look for the group of rows with value "Prelude".

- You will see significant events like early key publications and technologies.

- What are some significant early events related to the development of Bitcoin?