Difference between revisions of "Timeline of FTX"

(→Inclusion criteria) |

(→Inclusion criteria) |

||

| Line 98: | Line 98: | ||

! Year !! Month and date (approximately) !! Entity !! Event type !! Details | ! Year !! Month and date (approximately) !! Entity !! Event type !! Details | ||

|- | |- | ||

| − | | 1992 || March 6 || {{w|Sam Bankman-Fried}} || Team || [[w:Sam Bankman-Fried|Samuel Benjamin Bankman-Fried]] is born in {{w|Stanford, California}}, to {{w|Barbara Fried}} and {{w|Joseph Bankman}}, both law professors from {{w|Stanford University}}. SBF would be raised in the midst of a strong philosophy of {{w|utilitarianism}}.<ref name="The early years of Bankman-Fried"/> | + | | 1992 || March 6 || {{w|Sam Bankman-Fried}} || Team || [[w:Sam Bankman-Fried|Samuel Benjamin Bankman-Fried]] (SBF) is born in {{w|Stanford, California}}, to {{w|Barbara Fried}} and {{w|Joseph Bankman}}, both law professors from {{w|Stanford University}}. SBF would be raised in the midst of a strong philosophy of {{w|utilitarianism}}.<ref name="The early years of Bankman-Fried"/> |

|- | |- | ||

| 2010 || || {{w|Sam Bankman-Fried}} || Team || SBF pursues physics at the {{w|Massachusetts Institute of Technology}}, sharing a room with [[w:Gary Wang (American businessman)|Gary Wang]]. Nine years later, Wang would become the co-founder of FTX.<ref name="DL News">{{cite web |title=SBF found guilty: A timeline of FTX, one of the worst failures in crypto history |url=https://www.dlnews.com/articles/regulation/timeline-over-the-rise-and-fall-of-sam-bankman-fried-and-ftx/ |website=DL News |access-date=14 December 2023 |language=en}}</ref> | | 2010 || || {{w|Sam Bankman-Fried}} || Team || SBF pursues physics at the {{w|Massachusetts Institute of Technology}}, sharing a room with [[w:Gary Wang (American businessman)|Gary Wang]]. Nine years later, Wang would become the co-founder of FTX.<ref name="DL News">{{cite web |title=SBF found guilty: A timeline of FTX, one of the worst failures in crypto history |url=https://www.dlnews.com/articles/regulation/timeline-over-the-rise-and-fall-of-sam-bankman-fried-and-ftx/ |website=DL News |access-date=14 December 2023 |language=en}}</ref> | ||

Revision as of 00:39, 9 March 2024

This page is about a topic potentially related to FTX, Alameda Research, Sam Bankman-Fried, or the FTX Future Fund. Other content on this wiki has been compensated by the Future Fund Regranting Program that used funds from the FTX Future Fund. These funds likely came from the FTX Foundation that was funded partly or wholly by money made by FTX, Alameda Research, or Sam Bankman-Fried. As such, there is a theoretical possibility of conflict of interest.

View all pages with possible conflicts of interest due to funding from Future Fund Regranting Program | View pages work on which was to be funded by the Future Fund Regranting Program

This is a timeline of FTX, a bankrupt company that formerly operated a cryptocurrency exchange and crypto hedge fund.

Contents

Sample questions

The following are some interesting questions that can be answered by reading this timeline:

- What events and developments characterize the journey of the FTX team and its key individuals?

- Sort the full timeline by "Event type" and look for the group of rows with value "Team".

- You will see a list of events describing the journey of the FTX team and key individuals. Information includes team appointments, leadership changes, partnerships, financial contributions, and philanthropic initiatives.

- What companies have been launched in relation to FTX?

- Sort the full timeline by "Event type" and look for the group of rows with value "Company launch".

- You will see a summary offering a chronological overview of the launch events associated with FTX and its related entities.

- What are the key management-related events and relocations involving FTX and its subsidiaries?

- Sort the full timeline by "Event type" and look for the group of rows with value "Management".

- You will find a timeline of management-related events for FTX, including relocations and changes in headquarters.

- What notable events are associated with FTX's product offerings, tokens, and trading activities?

- Sort the full timeline by "Event type" and look for the group of rows with value "Product".

- You will see events related to FTX's product launches, tokens, and trading activities. This includes launch and performance of the FTT token, the introduction of various products such as tokenized equities and futures, and announcements related to specific tokens like UBXT, and FTX's involvement in the NFT space.

- What are the key acquisitions made by FTX?

- Sort the full timeline by "Event type" and look for the group of rows with value "Acquisition".

- You will see details such as the entities involved and developments associated with each acquisition.

- How did FTX secure funding throughout its development, and what were the key details of each funding round?

- Sort the full timeline by "Event type" and look for the group of rows with value "Funding".

- You will see a chronological list of funding events related to FTX, including details such as the date of each funding round, the amount raised, the valuation reached, and notable investors involved.

- What partnership initiatives did FTX engage throughout its history?

- Sort the full timeline by "Event type" and look for the group of rows with value "Partnership".

- You will see FTX's strategic partnerships and collaborations with various entities, including those in the crypto trading and other industries.

- How did FTX perform in terms of trading volume, financial success, and user base?

- Sort the full timeline by "Event type" and look for the group of rows with value "Growth".

- You will see a list of events detailing FTX's performance in those metrics.

- What are some notable legal events and procedures associated with FTX?

- Sort the full timeline by "Event type" and look for the group of rows with value "Legal".

- You will see a list of events highlighting legal challenges and regulatory actions involving FTX, including dismissed lawsuits, cease-and-desist orders, state investigations, and charges against key individuals associated with the company.

- Other events are described under the following types: "Background", "Bussiness shutdown", "Charity", "Controversy", "Criticism", "External acquisition", "Financial", "Financial assistance", "Investment", "Marketing", and "Notable comment".

Big picture

| Time period | Development summary | More details |

|---|---|---|

| 2019 – 2021 | Launch and rapid ascent | In its initial phase, FTX, founded by Sam Bankman-Fried and Gary Wang, experiences a rapid ascent, securing significant funding and notable partnerships, such as a sponsorship deal with the Mercedes Formula 1 team. This culminates in a dominant position within the cryptocurrency exchange landscape.[1] |

| 2022 | Expansion and erosion of trust | This period witnesses FTX's expansion and increasing controversies. Notable events include multiple funding rounds, high-profile partnerships like the naming rights for the Miami Heat's arena, and emerging concerns regarding Alameda Research's dependency on FTX's native token.[1] |

| Late 2022 onwards | Collapse and aftermath | A leaked balance sheet on November 2 triggers a crisis of confidence, leading to FTX's suspension of operations, bankruptcy filing, and investigations into potential financial misconduct. Legal proceedings ensue. Reports of customer funds disappearance, regulatory probes, and a severe liquidity crisis unfold.[1] By January 2023, $5 billion in assets are recovered in cash and liquid assets, with total assets missing being estimated at $8 billion.[2] |

| 2023 | FTX trial | Sam Bankman-Fried faces a trial in October and is convicted in November on criminal charges after being extradited from The Bahamas to the U.S. Previously, one charge is dropped in July. Another trial is scheduled for March 2024, involving charges filed post-extradition.[3] |

Key statistics

The table below shows rounded out figures illustrating the evolution of FTX throughout the years.[4]

| Year | Annual revenue (USD) | Net income (USD) | Users | Peak trading volume (USD) | Annual crypto exchange volume (USD) |

|---|---|---|---|---|---|

| 2019 | 7,200,000 | 100,000 | 27,000,000,000 | ||

| 2020 | 85,000,000 | 17,000,000 | 1,000,000 | 7,000,000,000 | 385,000,000,000 |

| 2021 | 1,021,000,000 | 388,000,000 | 1,200,000 | 21,000,000,000 | 719,000,000,000 |

Investors

The table below shows FTX's investors, according to private market data provider PitchBook.[5]

| Year | Investors |

|---|---|

| 2019 | Tiger Global Management, Insight Partners, SoftBank Investment Advisors, Temasek, Telstra Ventures, Teachers Venture Growth, Steadview Capital Management, Redline DAO, Paradigm, New Enterprise Associates, Lightspeed Ventures, 500 Global, Binance Labs, Consensus Lab, FBG Capital, Galois Capital, Greylock Capital Management, Lemniscap, Race Capital, IVP, HOF Capital. |

| 2020 | Bitscale Capital, BR Capital, Evangelion Capital, Exnetwork Capital, Genblock Capital, Insignius Capital, Pantera Capital. |

| 2021 | BlackRock, Tom Brady, Gisele Bundchen, Samsung NEXT Ventures, Sequoia Capital, Coinbase Ventures, Base10 Partners, Astronaut Capital, AGE Crypto, Vetamer Capital, Senator Investment Group, Sea Capital, Paradigm, Meritech Capital Partners, ICONIQ Growth, Third Point Ventures, Thoma Bravo, Kevin O'Leary, Willoughby Capital, Digital Currency Group, Third Point, Tribe Capital, Bond Capital, Standard Investments, Circle , Ribbit Capital, Multicoin Capital, Mayfield, 6ixth Event, Abstract Ventures, Alan Howard, Altimeter Capital Management, Bond, Schoeneck & King, DHVC, Israel Englander, Mark VC. |

| 2022 | Temasek, SoftBank Vision Fund 2, Ontario Teachers Pension Plan, K5 Global, MiH Ventures, Mint Ventures, NKB Ventures, Signum Capital, Alchemy Ventures, Lux Capital, Fenrir, Claritas Capital, Hard Yaka, Early Capital Group, Chapter One Ventures, One Block Capital, Chainfund Capital, A'Z Angels, Allied Investors Group, ArkStream Capital. |

Full timeline

Inclusion criteria

We include:

- Events spanning from preludial times, towards complications leading to the FTX crisis in late 2022.

- Events describing FTX related entities mostly Alameda Research.

We do not include:

- Details on FTX collapse. Visit Timeline of FTX collapse

- Details on Sam Bankman-Fried's trial. Visit Timeline of FTX trial

| Year | Month and date (approximately) | Entity | Event type | Details |

|---|---|---|---|---|

| 1992 | March 6 | Sam Bankman-Fried | Team | Samuel Benjamin Bankman-Fried (SBF) is born in Stanford, California, to Barbara Fried and Joseph Bankman, both law professors from Stanford University. SBF would be raised in the midst of a strong philosophy of utilitarianism.[6] |

| 2010 | Sam Bankman-Fried | Team | SBF pursues physics at the Massachusetts Institute of Technology, sharing a room with Gary Wang. Nine years later, Wang would become the co-founder of FTX.[7] | |

| 2014 | Sam Bankman-Fried | Team | SBF graduates at the Massachusetts Institute of Technology with a bachelor's degree in physics and a minor in mathematics.[6] | |

| 2014 | June | Sam Bankman-Fried | Team | SBF initiates a three-year tenure as a trader at the quantitative trading firm Jane Street. During this period, he encounters individuals who later would ascend to senior roles at FTX and play pivotal roles in its eventual downfall. Notably, among them is Caroline Ellison, Bankman-Fried's on-and-off girlfriend at the time, who later becomes the CEO of Alameda Research.[7][8] |

| 2015 | Gary Wang | Team | Gary Wang graduates with a Bachelor's degree in math and computer science.[9] | |

| 2016 | Caroline Ellison | Team | Caroline Ellison graduates from Stanford University with a bachelor's degree in mathematics.[10][11][12] | |

| 2017 | June | Nishad Singh | Team | Nishad Singh graduates from University of California, Berkeley.[13] |

| 2017 | September | Sam Bankman-Fried | Team | SBF quits Jane Street Capital and moves to Berkeley, California.[14] |

| 2017 | November | Alameda Research | Team | SBF, along with co-founder Tara Mac Auley, establishes the cryptocurrency trading company Alameda Research in Berkeley, California.[15] |

| 2018 | January | Alameda Research | Team | SBF organizes an arbitrage operation, moving up to $25 million a day, to take advantage of the higher price of bitcoin in Japan compared to the price in the United States. This arbitrage opportunity allows Alameda Research to win $20 million in a single day.[6] |

| 2019 | April | Dotcom Silo | Company launch | Dotcom Silo is founded in Hong Kong by SBF, Gary Wang, and Nishad Singh. |

| 2019 | April | Alameda Research | Team | Tara Mac Auley and the entire management team steps down from Alameda Research, attributing their decision to "100 small things" perceived as missteps by SBF, as mentioned in Michael Lewis' book "Going Infinite — The Rise and Fall of a New Tycoon." Following their departure, Mac Auley and other team members establish Lantern Ventures, a trading firm managing approximately $400 million in assets.[7] |

| 2019 | May 8 | FTX | Company launch | SBF and Gary Wang set up FTX Trading Ltd.[16] The company is incorporated in Antigua and Barbuda.[4] It is founded by SBF as a centralized crypto exchange that specializes in derivatives and leveraged products. FTX is an abbreviation of "Futures Exchange". This exchange that initially worked within the structure of Alameda Research.[6] |

| 2019 | May 8 | FTX | Product | FTT, the native token of FTX, is launched. Initially trading at around $1.20, its value would quadruple by the end of 2020.[17] At launch, FTT has a total supply of 350 million tokens, with 175 million reserved for FTX's treasury, gradually unlocking over three years. Similar to BNB, FTT would operate on a deflationary model, reducing its supply over time, potentially driving demand for the remaining tokens. FTX would employ a token burning mechanism where it purchases FTT from the market and burns a portion weekly. The burning would include tokens equivalent to one-third of all fees generated on FTX’s markets, 10% of gains from its backstop liquidity fund, and 5% of fees from other areas on the FTX platform.[17] |

| 2019 | August 6 | FTX | Funding | FTX raises $8m in its seed funding round, attracting major investors including Proof-of-Capital, Consensus Lab, FBG and Galois Capital.[18] By this time, FTX’s trading volume reaches $1 billion per day.[7] |

| 2019 | October | FTX | Product | FTX launches an index of eight popular China-related cryptocurrencies, as well as futures contracts based on the index. The Dragon Perpetual Futures Index (DRGN-PERP) tracks a basket of coins including BTM, IOST, NEO, NULS, ONT, QTUM, TRX, and VET, based on a weighted average of their respective prices. FTX offers traders exposure to the coins through perpetual futures contracts, which can be leveraged up to 101 times. By this time FTX, which is based in Antigua and Barbuda, has a history of offering unconventional indices, including the Shitcoin Perpetual Futures Index in August. The launch of DRGN-PERP follows Chinese President Xi Jinping's recent call for the adoption of blockchain technology across a range of sectors, which caused a surge in interest in Chinese blockchain and tech stocks.[19] |

| 2019 | November | FTX | Funding | Series A. funding round. As part of a strategic partnership, Binance invests an undisclosed amount of money in FTX.[20] SBF states that “the investment will help accelerate the growth of FTX with support and strategic advisory from Binance while FTX maintains its independent operations.”[21] |

| 2019 | December 17 | FTX | External acquisition | Binance CEO and founder Changpeng Zhao acquires a 20% stake in FTX by employing a mix of equity and long positions involving the exchange's FTT token.[7][22] |

| 2019 | December | FTX | Legal | A United States district court in California dismisses a lawsuit brought against FTX for market manipulation and the sale of unlicensed securities. The lawsuit, filed by entity Bitcoin Manipulation Abatement LLC, sought $150 million in damages from FTX. The complaint also alleged that FTX ran an unlicensed money transmitting business with its OTC desk and accused the exchange of attempting to attack Binance. The court finds that the plaintiff failed to meet the requirements of the Federal Rules of Civil Procedure and dismisses the case with prejudice.[23] |

| 2020 | January | FTX US | Company launch | West Realm Shires Inc. (also known as FTX US) is founded by SBF, Gary Wang, and Nishad Singh, as a crypto asset trading platform designed primarily for customers in the United States.[24][25] |

| 2020 | January | FTX | Product | FTX introduces derivative tokens enabling users to speculate on the outcome of the US election. Assets like TRUMP and XRPBEAR contracts contribute to FTX's rise in rankings, positioning it just below BitMEX.[26] |

| 2020 | February | FTX | Product | FTX launches a futures contract, called TRUMP-2020 (TRUMP), which allows users to monetize their predictions of the outcome of the 2020 United States presidential election. The TRUMP futures contract would expire at $1 if Donald Trump is re-elected, and at $0 if he is not. The contract would be settled based on projections from major media outlets if a candidate is deemed the winner before all states have released their official vote counts. At this time, trading on FTX is not available in the United States and the TRUMP futures contract cannot be traded by residents of the US, EU, UK, Hong Kong, Singapore, and other prohibited jurisdictions.[27] |

| 2020 | February | FTX | Growth | FTX becomes the fifth largest exchange by volume, according to data from Alameda Research. The exchange is just below BitMEX, with $1.1 billion in reported and adjusted trading volume. Huobi Global ranks first, with $6.9 billion in adjusted volume, while OKEx, Binance, and BitMEX have $6.5, $4.2, and $3.7 billion in volume, respectively. FTX attributes its success to its screening methodology, which it claims filters out fake volume from other exchanges to provide a more accurate depiction of true trading volume.[28] |

| 2020 | March 2 | FTX | Controversy | An attempt to manipulate the price of FTT on Binance through a pump-and-dump scheme is found. Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency through coordinated buying, then selling off the coins at a higher price once the price has been driven up. These types of schemes are not uncommon in the cryptocurrency world and can be difficult to detect and prevent.[29] |

| 2020 | March 30 | FTX | Product | Binance announces that it will delist all 25 of the FTX leveraged tokens due to a lack of understanding of how they work among many of its users. FTX leveraged tokens are ERC-20 tokens that allow traders to gain exposure to FTX's perpetual futures with up to 3x leverage. For every future on FTX, there are three leveraged tokens available: BULL for long positions, BEAR for short positions, and HEDGE for hedging against market direction. Binance will delist BULL, BEAR, ETHBULL, ETHBEAR, EOSBULL, EOSBEAR, BNBBULL, BNBBEAR, XRPBULL and XRPBEAR assets, and their trading pairs against USDT and BUSD. Binance invested "tens of millions" of dollars in FTX in December 2019.[30][31] |

| 2020 | April 22 | FTX | Product | FTX launches oil futures contracts following the historic drop in the price of oil in the United States. The contracts would expire at the spot West Texas Intermediate (WTI) prices, plus $100 to protect against any negative settlement rate. However, FTX notes that "if the spot price of oil goes below minus $100, FTX OIL contracts can theoretically expire negative." To trade the crude oil futures on FTX, traders must clear level 1 Know Your Customer (KYC) checks, and are restricted if they are based in certain countries including the US, Canada, and the European Union.[32] |

| 2020 | May 26 | FTX | Partnership | Coinbase Custody announces that it will provide primary custodian services for FTT. Coinbase Custody is chosen after its storage solution passed FTX's review and scrutiny, and it has affirmed its commitment to serving a range of institutional clients including exchanges, brokerages, and hedge funds. At this time, FTX is one of the largest exchange clients of Coinbase Custody. The announcement comes as FTX launched its new trading platform for US users, offering liquidity, leverage, and competitive fees on six coins: BTC, ETH, BCH, LTC, PAXG, and USDT.[33] |

| 2020 | July 28 | FTX | Service | FTX introduces zero-confirmation transfers via Fireblocks. The latter, a digital asset security and transfer platform, launched its Deposit Acceleration Program, which aims to provide the fastest on-chain settlement times for the crypto buy-side. The program aims to bring new institutional trading volume to exchanges and accelerate on-chain trading operations for digital asset businesses. The first exchange to join the program is FTX. The program enables Fireblocks customers to deploy assets onto the FTX exchange in real-time with zero confirmations.[34][35] |

| 2020 | August 25 | FTX | Acquisition | FTX acquires cryptocurrency portfolio tracking app Blockfolio, for $150 million.[36] FTX plans to collaborate with Blockfolio on a retail trading application. Blockfolio's portfolio tracker provides users with a broad overview of the direction of the cryptocurrency market by taking price feeds of major cryptocurrencies from hundreds of exchanges.[37] Notably, FTX finances 94% of the acquisition using its native FTT token, as reported by Bloomberg News.[38] It is through this app that FTX would acquire most of its mobile users.[4] |

| 2020 | September 6 | Sam Bankman-Fried | Team | Chef Nomi, the creator of SushiSwap, a decentralized finance (DeFi) protocol, transfers control of the project to SBF. Nomi had faced criticism from the SushiSwap community after withdrawing $13 million from the project's liquidity pool on Uniswap. SBF tweeted his disapproval and called for Nomi to step down.[39] |

| 2020 | September 9 | FTX | Product | FTX announces it will host the initial exchange offering (IEO) for the Upbots utility token, UBXT. Upbots is a Swiss trading platform that aims to provide a one-stop dashboard for both professional and amateur traders. It connects to centralized exchanges through APIs and decentralized exchanges through a partnership with DEX.AG, and also offers charting and risk management tools. The main business model for Upbots is a marketplace for trading signals, bots, and social copy trading, with users paying a subscription fee or commission based on their earnings. UBXT tokens can be used to subscribe to online learning courses and for parts of the platform, and can also be staked for discounts on subscription fees.[40] |

| 2020 | October 28 | FTX | Partnership | FTX partners with crypto trading platform Hxro to launch TixWix, a trading product that allows users to play live odds on the crypto market. TixWix simplifies the process of trading crypto options by allowing traders to take positions based on live market odds. For example, if the market prices in a 33% chance that Bitcoin will finish the year above a certain price, a trader can take a position that will pay out 3x if correct. TixWix combines Hxro's front-end user experience with FTX's liquidity and backend technology, and is planned to be available in Asia-Pacific, EMEA, Oceania, and LatAm regions.[41] |

| 2020 | October 28 | FTX | Team | The Wall Street Journal discloses that SBF is identified as the second-largest contributor to President Joe Biden's re-election campaign, having made contributions totaling $5.2 million.[42] |

| 2020 | October 29 | FTX | Product | FTX launches tokenized equity trading on its platform through partnerships with German financial firm CM Equity AG and Swiss-based Digital Assets AG. This allows FTX users to trade and redeem equities that trade on the US stock market, including Facebook, Netflix, Tesla, Amazon, and the SPDR S&P 500 exchange-traded fund. The tokenized equity trading is open 24/7, unlike traditional equities markets, and allows users to trade fractions of the tokenized equities they purchase, similar to the trading app Robinhood. However, FTX's tokenized equity trading is not available in the United States and other restricted regions. The launch is significant for the blockchain and digital currency industry as it represents a step towards the digitization of traditional assets and securities on the blockchain.[43][44][45] |

| 2020 | November 3 | Alameda Research | Investment | Alameda Research invests $3 million in 3Commas, a trading platform for retail investors. 3Commas was launched in 2017 in Estonia. By this time, the platform has 100,000 active traders and offers a range of pre-determined trading strategies through its bots, which allow users to leave their assets on autopilot and receive notifications when trades are completed.[46] |

| 2020 | November 5 | Sam Bankman-Fried | Team | SBF donates $5.2 million to Joe Biden's presidential campaign. This contribution is part of a larger group of donations totaling $79.5 million from the top 100 CEO donors to Biden's campaign. Michael Bloomberg, co-founder of the financial and media company bearing his name, is the largest CEO contributor to the campaign, with a donation of $56 million.[47] |

| 2020 | November 16 | FTX | Product | UpBots, a platform for traders, launches a staking program for its native token, UBXT. The program is exclusively provided by FTX and allows users to stake their UBXT tokens for a minimum of 10,000 tokens and a maximum of 1 million tokens. While their tokens are staked, users would receive an annual percentage return of 25% and have access to three trading algorithm bots, as well as other features included in UpBots' MVP. Token-based rewards are distributed on an hourly basis, with half of the annual percentage return being unlocked and the other half added to the locked amount. UpBots aims to become an all-in-one trading ecosystem, providing automated trading bots, customizable algorithms, a cross-platform cryptocurrency wallet, and support for CEX and DEX exchanges. It also allows users to develop their own algorithms and trading bots, which can be rented out to other traders.[48] |

| 2020 | December 14 | FTX | Background | The Digital Assets and Registered Exchanges Act (‘DARE’ or the ‘Act’) comes into effect in The Bahamas. The legislation creates a legal definition for digital assets and a regulatory framework for digital asset businesses and digital asset activities permitted in the country.[49] |

| 2020 | Year round | FTX | Growth | According to financial statements, FTX manages to generate an operating profit of $14.4 million on revenue of $89.9 million in the year, its first full year in business.[50] |

| 2021 | January 20 | Alameda Research | Investment | Cape Town-based cryptocurrency exchange Ovex receives investment from Alameda Research. Founded in 2019, Ovex specializes in over-the-counter trading and arbitrage, offering South Africa's largest selection of digital asset markets. The company aims to improve the efficiency of the cryptocurrency market in South Africa and increase financial inclusivity. It has a monthly trading volume of $270m and a valuation of over ZAR1bn ($68m).[51] |

| 2021 | January 28 | FTX | Partnership | FTX partners with blockchain company Circle, with the purpose to allow its users to make near-instant Automated Clearing House (ACH) payments in the United States using USDC stablecoins, which are pegged to the US dollar and issued by Circle. The payments would be available on the Ethereum and Solana blockchains. Circle and FTX also collaborate with financial data transfer network Plaid to enable quick customer bank account verification. This partnership allows cryptocurrency users to access traditional banking more easily and enables FTX customers to make a bank transfer and convert it into USDC for trading or other purposes without waiting for standard ACH transactions.[52] |

| 2021 | January 29 | FTX | Product | FTX creates a new index called the Wall Street Bets Index, which follows the prices of several assets including GameStop (GME), AMC Entertainment (AMC), and Dogecoin (DOGE). The index trades as a futures contract with expiration on March 26, 2021 and is "cash settled vs the index of tokenized share markets on FTX." The index is made up of seven assets, each with a weight of 16.5% except for FTT, which has a weight of 1%. Its creation follows the recent rise in the price of these assets, which has been attributed to the Reddit group r/Wallstreetbets and their efforts to pump the prices of certain stocks.[53] |

| 2021 | February 1 | FTX | Product | In response to the Reddit-led interest in silver following the GameStop short squeeze, FTX swiftly lists tokenized silver stocks and futures on its platform. The new trend, known as the "silversqueeze," is driven by retail investors congregating on the subreddit r/wallstreetsilver. FTX's quick move follows its recent listing of GameStop stocks, showcasing the platform's agility in responding to market dynamics influenced by online communities. The surge in demand for precious metals has led to shortages at major silver dealers.[54][55][56] |

| 2021 | February 24 | Alameda Research | Investment | Alameda Research leads a $40 million investment round in Oxygen, a decentralized finance (DeFi) platform built on the Solana blockchain. Oxygen aims to make DeFi more accessible and user-friendly, similar to how Robinhood has made stocks more accessible to the general public.[57] |

| 2021 | March 4 | Sam Bankman-Fried | Team | The Hurun Research Institute in China publishes a list of the top three "blockchain billionaires," with Brian Armstrong, CEO of Coinbase, in the top spot. SBF is newly added to the list and is in second place with a reported wealth of around $10 billion. Changpeng Zhao, CEO of Binance, is in third place on the list.[58] |

| 2021 | March 26 | FTX | Marketing/acquisition | FTX secures the naming rights for the American Airlines Arena in Miami for $135 million. Known as the Kaseya Center at the time, the 19,000-capacity venue would be renamed FTX Arena on June 4, marking the first instance of a crypto business obtaining naming rights for a major U.S. professional sports venue. FTX and Miami-Dade County reach an agreement in principle for a 19-year partnership, subject to final approval by the Miami-Dade County Board of County Commissioners. This development highlights the increasing mainstream integration of the cryptocurrency industry, following similar moves by companies like Crypto.com partnering with sports teams.[59][60][61][62] |

| 2021 | May | FTX US | Team | Brett Harrison, a former technology executive at Citadel Securities, assumes the role of president at FTX US.[63] |

| 2021 | June 4 | FTX | Partnership | Esports organization TSM and FTX enter a $210 million, multi-year partnership deal. The agreement grants exclusive naming rights for TSM, later known as 'TSM FTX'.[64] |

| 2021 | June 29 | FTX | Team | NFL star Tom Brady and supermodel Gisele Bündchen reveal their collaboration with FTX. Brady assumes the role of brand ambassador, while Bündchen becomes FTX’s Environmental & Social Initiatives Advisor. According to author Michael Lewis, Brady would receive $55 million for 20 hours of work over three years, while Bündchen would be compensated with $20 million.[65] |

| 2021 | July | FTX | Funding | FTX raises 900 million dollars, reaching a valuation of more than $18 billion. More than 60 investors enter, including Softbank, Sequoia Capital and other companies.[66] |

| 2021 | July | FTX Digital Markets | Company launch | FTX Digital Markets is formed in Bahamas, and is duly registered as a digital asset business under The Bahamas' Digital Assets and Registered Exchanges Act, 2020 (the "DARE Act").[67] |

| 2021 | July | FTX | Funding | FTX completes a funding round amounting to $900 million, marking the largest in the history of the cryptocurrency industry. As a result, FTX's valuation surges to $18 billion.[7] |

| 2021 | July | FTX | Growth | FTX hits over one million users and becomes the third-largest exchange by volume. American subsidiary FTX US reaches up to $1 billion in daily volume.[7] |

| 2021 | July | FTX | Team | SBF buys back Binance’s stake in FTX for $2.3 billion, ending their investment relationship, and seeking to provide more flexibility for FTX. This move comes amid regulatory challenges faced by Binance globally. SBF emphasizes FTX's cooperative approach with regulators, highlighting potential differences in how the two exchanges operate. Binance confirms the exit, stating they have "exited completely."[68][69] |

| 2021 | August | FTX | Acquisition | FTX acquires LedgerX, positioning itself to offer derivative products in the United States.[69] |

| 2021 | August | FTX | Marketing | SBF engages in extensive marketing, spending $210 million on the FTX logo in esports, $135 million to rename the Miami Heat's arena, and $17.5 million for naming rights to UC Berkeley's football field.[69] |

| 2021 | August | Alameda Research | Team | At this time, SBF owns 90% of Alameda Research.[70] |

| 2021 | September 7 | FTX | Partnership | Golden State Warriors and three-time NBA champion Stephen Curry joins FTX as a global ambassador, receiving an equity stake in FTX Trading Limited. Curry also enters into an agreement where he is reportedly paid $35 million for a commitment of 20 hours per year for three years. Additionally, FTX US and its NFT marketplace become the official cryptocurrency platform for the Golden State Warriors.[71][72][73] |

| 2021 | September 9 | FTX | Growth | FTT token reaches an all-time high of $85. Subsequently, it would experience a decline and start 2022 trading at approximately $40.[17] |

| 2021 | September | FTX | Management | FTX relocates from Hong Kong to the Bahamas following regulatory approval for its Bahamian subsidiary, FTX Digital Markets.[74] [75] |

| 2021 | September 23 | FTX | Partnership | FTX enters a long-term sponsorship deal with the Mercedes’ Formula 1 racing team Mercedes-AMG Petronas. Although the duration of the deal is undisclosed, it is expected to span multiple race seasons, prominently featuring the FTX logo on both cars and drivers. The partnership includes branding on Mercedes-Benz trucks, in the garage, and in hospitality and communications facilities. FTX aims to leverage this collaboration to reach F1's global fan base, including access to team members such as drivers Lewis Hamilton and Valtteri Bottas. The deal involves potential collaborations on FTX Pay integration, an NFT collection, and corporate social responsibility initiatives.[76][77] |

| 2021 | September 25 | FTX | Management | FTX decides to relocate its headquarters and key operations from Hong Kong to the Bahamas. The move is a response to China's People's Bank declaring all cryptocurrency-related transactions illegal and reflects the Bahamas' proactive and supportive regulatory environment for digital currencies. FTX, the second-largest crypto derivatives exchange by 24-hour open interest, would be led by Ryan Salame as CEO of FTX Digital Markets in the new location. The People's Bank of China expresses concern about the growth of cryptocurrencies, deeming it a significant challenge for the global financial sector and traditional finance.[78] SBF announces FTX Digital Markets Ltd registration with the Securities Commission of the Bahamas.[79] |

| 2021 | October 12 | Alameda Research | Team | Caroline Ellison and crypto quant trader Sam Trabucco are appointed co-CEOs of Alameda.[80] |

| 2021 | October | FTX | Funding | FTX receives $420 million in Series B-1 funding, reaching a valuation of $25 billion. Investors include the OTPPB, Tiger Global, and BlackRock. |

| 2021 | October 21 | FTX | Funding | FTX's valuation reaches $25 billion with investments from notable entities such as Singaporean wealth fund Temasek and Tiger Global Management.[81] |

| 2021 | December 14 | FTX | Partnership | A sponsorship deal of approximately $10 million is reported between FTX and the Golden State Warriors basketball team. This makes FTX the official cryptocurrency platform and NFT marketplace for the NBA team. The agreement covers international rights and includes Golden State NFT drops on the FTX platform starting in 2022. The Warriors had earlier released their own NFTs, becoming the first major US sports franchise to do so. As part of the partnership, FTX would promote its brand during Santa Cruz Warriors' G League matches and feature in virtual on-court inventory during the Warriors Gaming Squad’s NBA 2K League games.[82][83] |

| 2022 | January 14 | FTX Ventures | Company launch | FTX reveals the establishment of FTX Ventures, a $2 billion investment division aimed at diversifying into industries like gaming, fintech, and healthcare.[84][85] |

| 2022 | January 26 | FTX US | Funding | FTX US receives $400 million in Series A funding round, reaching a valuation of $8 billion.[86] Investors include Multicoin, Paradigm, Sequoia, SoftBank and Temasek.[87] |

| 2022 | January 31 | FTX | Funding | FTX achieves a valuation of $32 billion after raising $400 million in a Series C funding round. This places FTX on par with Germany's Deutsche Boerse and surpasses the valuations of Nasdaq and Twitter. The funds aim to support FTX's global expansion and help secure additional licenses in various markets. SBF expresses the exchange's commitment to collaborating with regulators to ensure safe and compliant access to digital assets. The Series C funding round, backed by investors such as Paradigm, Temasek, Multicoin Capital, and SoftBank, coincide with a similar investment in FTX US, the American affiliate.[88][89] |

| 2022 | February 14 | FTX | Marketing | A Super Bowl commercial featuring comedian Larry David promotes FTX.[90] |

| 2022 | February | FTX | Service | It is reported that FTX is creating a gaming division that would help developers add cryptocurrency, NFTs, and other blockchain-related assets into video games.[91] |

| 2022 | March 10 | FTX | Charity | FTX announces the launch of the FTX Foundation, a charitable organization that would partner with organizations such as Effective Altruism, GiveWell, The Humane League, and OpenAI. FTX pledges to allocate 1% of its revenue from fees to the foundation. The foundation would allow the FTX community to vote on which issues, such as the pandemic, climate change, or global poverty, it should address. Sam Bankman-Fried states that the foundation is created in order to have a more official way to make a positive impact on the world through charitable donations.[92] |

| 2022 | March 22 | FTX | Acquisition | FTX acquires Good Luck Games, the developer of the card battle game "Storybook Brawl," as part of its gaming push. The acquisition aligns with FTX's strategy to encourage game publishers to adopt cryptocurrencies through its new FTX Gaming division. Storybook Brawl features fairytale and mythical characters in a card-based auto-battler game. FTX aims to explore the intersection of non-fungible tokens (NFTs), crypto, blockchain, and gaming.[93] |

| 2022 | April | FTX | Product | The Golden State Warriors drops its second NFT collection on the FTX NFT marketplace, commemorating its 2022 NBA playoffs performance.[71] |

| 2022 | May 10 | FTX US | Management | FTX US officially opens its Chicago headquarters at 167 Green Street, a new 17-story Fulton Market office building. The ribbon-cutting ceremony is attended by Mayor Lori Lightfoot and other Chicago officials.[94][95] |

| 2022 | May 26 | Sam Bankman-Fried | Charity/marketing | Brazilian fashion model Gisele Bündchen, Lauren Remington Platt and SBF engage in a discussion on effective altruism, emphasizing the importance of making a positive impact. They delve into their chosen causes, explore the role of crypto in creating a better future, and reveal FTX's latest fashion campaign during the conversation.[96] |

| 2022 | May | Sam Bankman-Fried | Team | The U.S. House of Representatives Committee on Agriculture conducts a hearing titled "Changing Market Roles: The FTX Proposal and Trends in New Clearinghouse Models." Witnesses, including SBF representing FTX US Derivatives, Terrence A. Duffy from CME Group, Walt Lukken from Futures Industry Association, Christopher Edmonds from Intercontinental Exchange, and Christopher Perkins from CoinFund Management LLC, provide insights into the FTX proposal and discuss evolving clearinghouse models in the market.[97][98] SBF defends the company's proposal, emphasizing that the Commodity Futures Trading Commission has the tools to be a model regulator for digital assets.Terrence Duffy argues against the FTX proposal, citing significant risks to market stability and participants. The hearing covers topics like risk, international standards, different clearinghouse models, regulation, agriculture's impact, and consumer protection. There is a contentious exchange between Rep. Ro Khanna and CME CEO Duffy regarding capital requirements. SBF expresses respect for the CFTC process and asserts that FTX's model ensures transparency and risk management.[99] |

| 2022 | May | FTX | Product | As of date, FTX has burned 17 million out of the 263 million FTT tokens in circulation.[17] |

| 2022 | June 1 | Sam Bankman-Fried | Team | SBF, with a fortune valued at $21 billion, signs the Giving Pledge, committing to give away the majority of his wealth for philanthropy. SBF's wealth primarily stems from his equity stake in FTX, valued at $32 billion after a $400 million fundraising round. Advocating for effective altruism, by this time SBF has a history of significant donations, including $12 million to Carrick Flynn's political campaign. To date, the FTX Foundation, FTX's philanthropic arm, has allocated $21.8 million to charity. The Giving Pledge, initiated by Bill and Melinda Gates and Warren Buffet in 2010, boasts 230 signatories worldwide, including Elon Musk and Mark Zuckerberg.[100][6] |

| 2022 | June 6 | FTX | Management | SBF tweets: Zig Zag and hiring:Later that month, FTX lays off around 20 people, mostly in the Bahamas, according to people familiar with the matter, as "FTX required some to sign nondisclosure agreements."[50] |

| 2022 | June 20 | Alameda Research | Financial assistance | Cryptocurrency broker Voyager Digital secures substantial loans from Alameda Research to navigate the market downturn. The line of credit includes a $200 million facility in a mix of cash and USD Coin, and a revolving credit facility for 15,000 bitcoin, totaling around $309 million. Both facilities expire on December 31, 2024, with a 5% annual interest rate. Voyager emphasizes using the loans to protect customer assets amid market volatility. The move follows industry challenges, with Bitcoin and Ether declining, and Voyager's stock down 91% in the year. SBF stresses the importance of larger companies supporting struggling cryptocurrency firms, while Voyager denies insolvency rumors.[102] |

| 2022 | June 21 | FTX US | Acquisition | FTX US acquires Embed Financial Technologies, including its subsidiary Embed Clearing, a clearing firm with memberships in FINRA, DTC, NSCC, Nasdaq, and IEX. The acquisition aims to enhance FTX US's equities and ETF trading platform, FTX Stocks, allowing it to provide whitelabel brokerage services. The deal facilitates routing, executing, clearing, and custody for customer equities and options accounts through Embed's infrastructure. The acquisition aligns with FTX's goal to expand financial services for US customers.[103] |

| 2022 | July 1 | FTX | Acquisition (failed) | FTX enters a deal with an option to acquire crypto lender BlockFi for up to $240 million. Additionally, FTX agrees to provide BlockFi with a $400 million revolving credit facility. The move comes amid challenges for BlockFi, including increased withdrawals following news of Celsius Network's freeze and concerns about a potential U.S. recession due to aggressive rate hikes.[104][105] The arrangement would collapse after FTX's later downfall.[106] |

| 2022 | July 6 | Alameda Research | Financial | Voyager Digital declares bankruptcy, announcing it and its U.S. affiliates having commenced voluntary Chapter 11 proceedings in the U.S. Bankruptcy Court for the Southern District of New York.[107] In its bankruptcy presentation, Voyager shows Alameda Research owes them $377 million.[108] |

| 2022 | July 14 | Sam Bankman-Fried | Criticism | Effective Altruism Forum user Sara Azubuike posts a discussion, expressing concerns over SBF substantial contributions to Effective Altruism, noting the speculative nature of the crypto market. The discussion emphasizes the potential adverse effects of a crypto crash, particularly on vulnerable populations heavily invested in it. Criticisms include the EA community's lax financial management due to significant crypto flows. According to Azubuike, post-crash repercussions might entail detrimental optics for EA or the discontinuation of various projects. Recommendations propose funding projects adaptable to financial fluctuations, suggesting reduced diversity in project funding. At this time, EA funding, especially in longtermism, increasingly relies on contributions from FTX.[109] |

| 2022 | July 29 | FTX US | Product | FTX US launches commission-free stock trading services for all U.S. clients, extending beyond existing cryptocurrency traders. The move aims to attract a broader user base and increase funds under custody. The platform now offers trading with US-listed equities, ETFs, and depository receipts, featuring 50 stocks of popular American companies like Tesla, Apple, Microsoft, Amazon, Meta, and Paypal. FTX US announces plans to further expand its services to include options trading in the future, with the goal of attracting both existing and new users to equity trading.[110] |

| 2022 | August 19 | FTX | Legal | The Federal Deposit Insurance Corporation (FDIC) issues a cease-and-desist order to FTX for making "false and misleading representations" about deposits being covered by FDIC insurance following FTX president Brett Harrison's tweet implying otherwise.[111] Following the regulatory action, Harrison would delete[112] the tweet and SBF would clarify in a tweet that FTX deposits are not insured by the FDIC.[113][114] |

| 2022 | August 24 | Alameda Research | Team (resignation) | Alameda Research co-CEO Sam Trabucco announces his resignation on Twitter, leaving co-CEO Caroline Ellison as the sole CEO, and announces he will remain in the capacity of adviser.[115] Trabucco tweets: I guess that's about it. My time at Alameda has been the most formative of my life. I've learned how to think, I've found out how far I can push myself, and I've been gifted the incredible experience of being in the trenches with lifelong friends -- and *winning*.[116] |

| 2022 | September 21 | FTX | Funding | FTX negotiates with potential investors to raise up to US$1 billion in new funding that would keep the company’s valuation at roughly $32 billion. Investors include Singapore’s Temasek Holdings, SoftBank Vision Fund 2 and Tiger Global Management.[117] |

| 2022 | September 26 | FTX | Acquisition | FTX successfully secures the bid to acquire the assets of Voyager Digital, a crypto lender that filed for bankruptcy in July. The winning bid by FTX US is valued at approximately $1.4 billion. The announcement leads to a 3.76% increase in the value of Voyager Token (VGX). Voyager Digital faces increased scrutiny for its business practices, especially regarding the protection of investors' deposits, and its bankruptcy filing revealed challenges, including a significant portion of its loan book tied to the bankruptcy of Three Arrows. FTX outbids Wave Financial in the acquisition, as reported on September 16 by CoinDesk. |

| 2022 | September 27 | FTX US | Management | FTX US relocates its headquarters from Chicago to Miami, emphasizing the importance of securing licenses for its various businesses. The move aligns with FTX's global strategy to establish offices worldwide. The shift to Miami is in line with the city's growing prominence as a hub for crypto companies, driven by favorable regulations and lower tax burdens. FTX's president, Brett Harrison, resigns citing a "protracted disagreement" with SBF and his inner circle. Harrison's concerns include the lack of proper delegation of authority, a formal management structure, and key hires, revealing internal issues contributing to the exchange's downfall.[118][119][120][121] |

| 2022 | October | FTX | Legal | The Texas State Securities Board investigates FTX US for allegedly offering unregistered securities products in the U.S. through its yield-bearing service. The Director of Enforcement, Joseph Rotunda, files the allegation as part of a court filing related to the potential sale of Voyager Digital's assets to FTX. Rotunda claimes that FTX US might be violating state law by offering a yield-bearing product to U.S. customers without proper registration. FTX responds, stating that they have been in talks with the Texas State Securities Board and have an active license application pending. They claim they are operating within regulatory bounds.[122][123] |

| 2022 | October 22 | FTX, Alameda Research | Criticism | A Youtuber alleges that FTX manipulates and sabotages competitors, especially those in the blockchain space challenging Solana. He claims FTX pumps token prices before their launch and then dumps on retail investors, citing instances involving Axie Infinity's Ronin token and ICP. The video argues that FTX aims to eliminate competition, mentioning its association with Solana and efforts to control the crypto market. He also discusses Alameda Research and accuses it of exploiting trading strategies. The narrator suggests a battle between manipulators and crypto enthusiasts, urging viewers to choose a side.[124] |

| 2022 | November | Alameda Research | Bankruptcy | A CoinDesk article on November 2 reveals that Alameda Research holds a significant amount of FTX's exchange token, FTT[125]. This disclosure leads to a withdrawal spike, leaving customers unable to retrieve their deposits. On November 11, FTX, Alameda Research, and over 100 affiliated entities file for bankruptcy, prompting SBF's resignation.[126] The FTX collapse has widespread implications on cryptocurrency markets, drawing parallels to major financial scandals and being labeled "one of the biggest financial frauds in American history" by federal prosecutors. The incident causes a ripple effect, notably contributing to Bitcoin's price hitting a two-year low. For more details, see Timeline of FTX collapse. |

| 2022 | December | FTX and all affiliated entities | Legal | On December 12, authorities arrest SBF in the Bahamas, charging him with multiple offenses, including fraud. The following day, the US Attorney’s Office of the Southern District of New York announces an eight-count indictment against Bankman-Fried. Simultaneously on December 13, the SEC files a civil complaint, accusing him of fraud and misappropriation of customer funds. By December 19, SBF agrees to be extradited to the US. On December 22, he is released on a record-setting $250 million bond. The same day, the attorney’s office unseals guilty pleas from Caroline Ellison and Gary Wang, who admit to seven and four charges, respectively, agreeing to cooperate with prosecutors.[7] See Timeline of FTX collapse and Timeline of FTX trial. |

| 2023 | January–August | Sam Bankman-Fried | Legal | In January, SBF pleads not guilty to criminal charges. In February, he faces additional criminal counts. By March, SBF pleads not guilty to the new charges. On July 20, prosecutors report attempted witness tampering by SBF, leading to a gag order on July 26, with a dropped campaign finance charge. On August 11, his bail is revoked, and on August 14, SBF is transferred from house arrest to prison. The criminal trial for his pre-extradition charges begins on October 2. [3] |

| 2023 | October–November | Sam Bankman-Fried | Legal | The trial of SBF is conducted. On November 2 he is convicted on seven federal counts, including two counts of wire fraud conspiracy, two counts of wire fraud, one count of conspiracy to commit money laundering, one count of conspiracy to commit commodities fraud, and one count of conspiracy to commit securities fraud. His sentencing is set for March 2024.[2] See Timeline of FTX trial. |

| 2024 | January 31 | FTX | Bussiness shutdown | FTX announces it will not resume operations for its cryptocurrency exchange. Instead, the company plans to liquidate all its assets and refund the money to its customers.[2] |

Visual data

Google trends

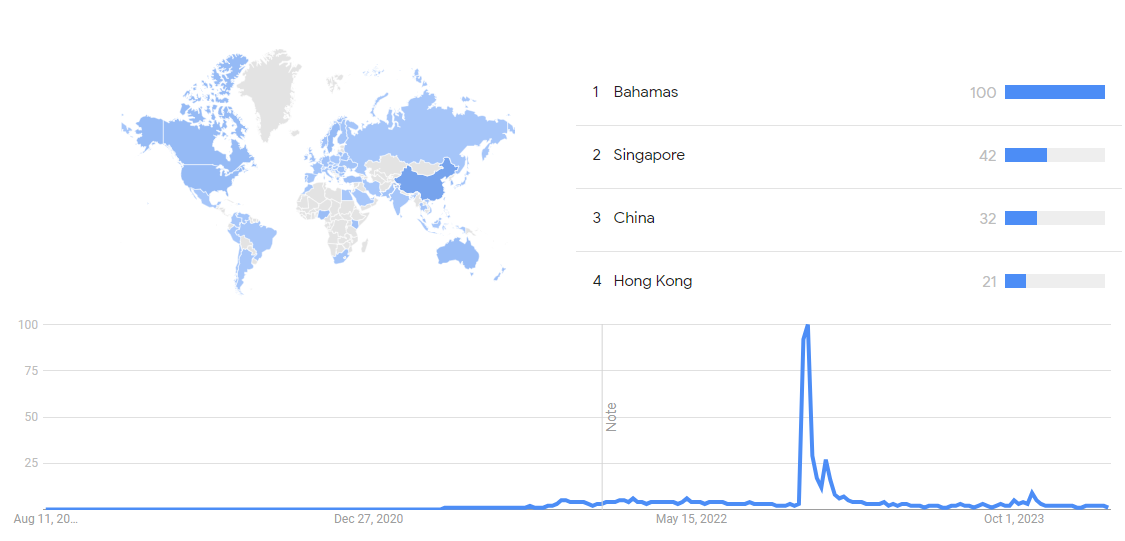

The chart below shows Google Trends data for FTX (company) from its inception on May 8, 2019, to February 2024, when the screenshot was taken. Interest is also ranked by country and displayed on world map.[127] See spike of interest towards the collapse of FTX in late 2022.

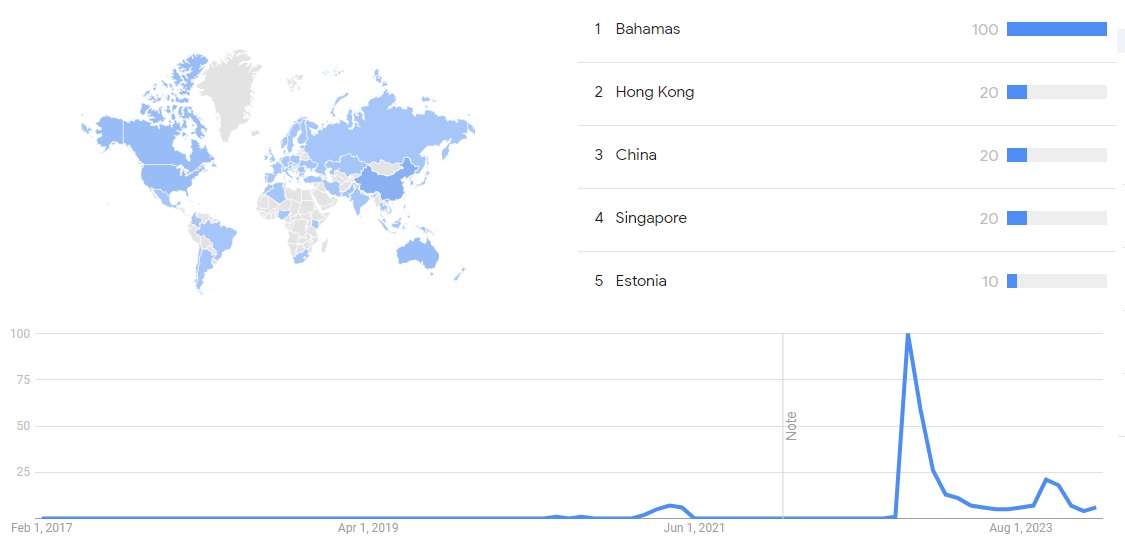

The chart below shows Google Trends data for Alameda Research (topic) from its launch on November, 2017, to February 2024, when the screenshot was taken. Interest is also ranked by country and displayed on world map.[128] See spike of interest towards the collapse of FTX in late 2022 and around late 2023 when the trial to Sam Bankman-Fried was conducted.

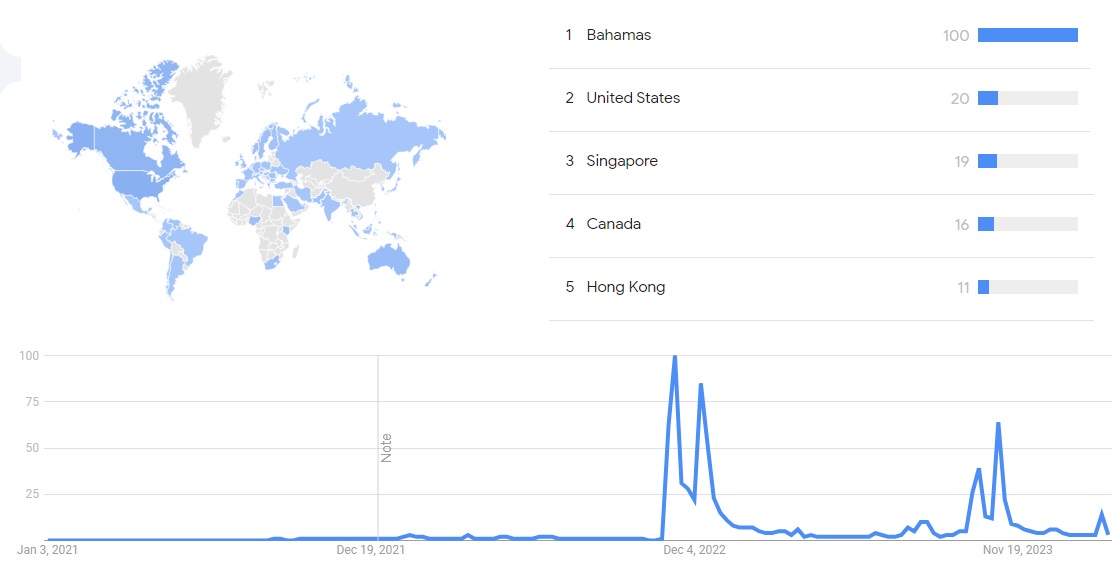

The chart below shows Google Trends data for Sam Bankman-Fried from January 2021, to February 2024, when the screenshot was taken. Interest is also ranked by country and displayed on world map.[129]

Wikipedia Views

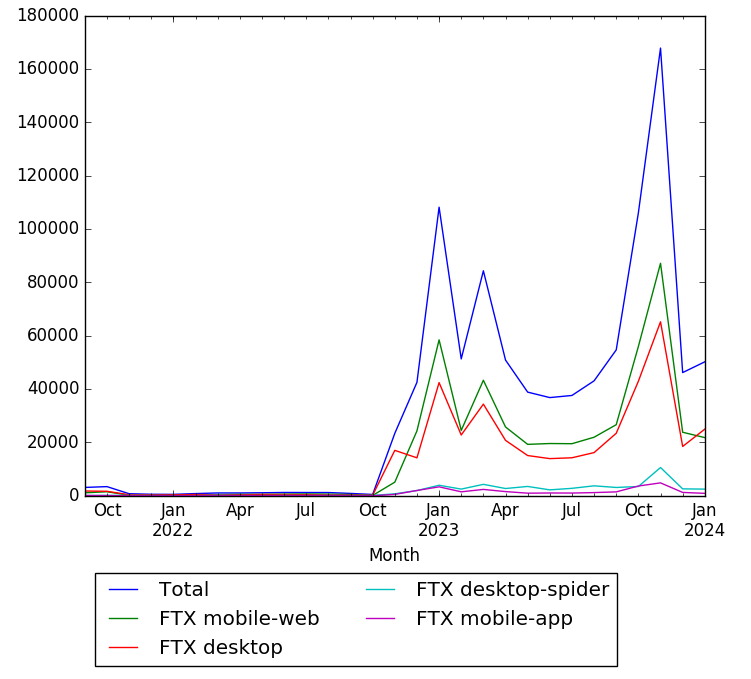

The chart below shows Wikipedia Views data for the article FTX from its creation in September 2021, to February 2024, when the screenshot was taken.[130]

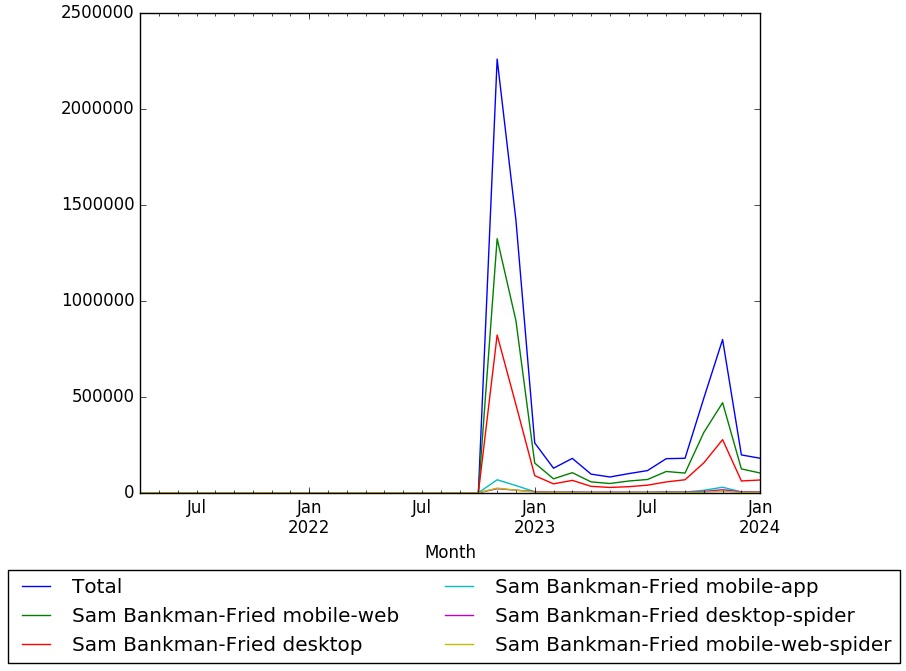

The chart below shows Wikipedia Views data for the article Sam Bankman-Fried from its creation in April 2021, to February 2024, when the screenshot was taken.[131]

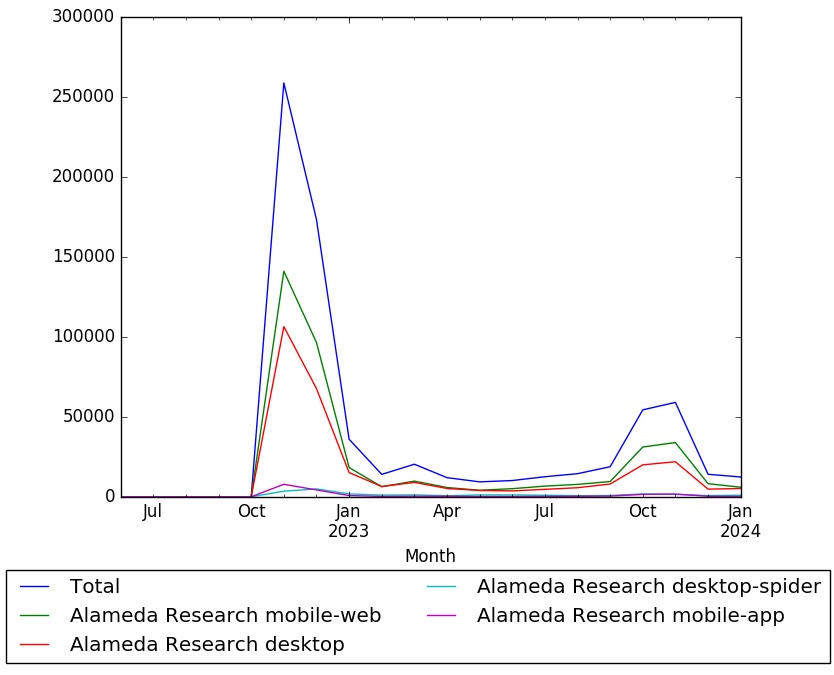

The chart below shows Wikipedia Views data for the article Alameda Research from its creation in June 2022, to February 2024, when the screenshot was taken.[132]

Meta information on the timeline

How the timeline was built

The initial version of the timeline was written by Sebastian Sanchez.

Funding information for this timeline is available.

Feedback and comments

Feedback for the timeline can be provided at the following places:

- FIXME

What the timeline is still missing

- https://es.cointelegraph.com/news/ftx-settles-dispute-sells-european-arm-33m

- https://www.techtarget.com/whatis/feature/FTX-scam-explained-Everything-you-need-to-know

- https://www.youtube.com/watch?v=2D5PcagsgDQ

- https://www.youtube.com/watch?v=LWq77i9mIRE

- Now-deleted Sequoia profile of FTX covers a lot of details about how it was founded

- https://conversationswithtyler.com/episodes/sam-bankman-fried/

Timeline update strategy

See also

External links

References

- ↑ 1.0 1.1 1.2 "Timeline: The rise and spectacular fall of FTX". Al Jazeera. Retrieved 14 February 2024.

- ↑ 2.0 2.1 2.2 "FTX scam explained: Everything you need to know". WhatIs. Retrieved 11 February 2024.

- ↑ 3.0 3.1 "The Collapse of FTX: What Went Wrong With the Crypto Exchange?". Investopedia. Retrieved 29 February 2024.

- ↑ 4.0 4.1 4.2 "FTX Revenue and Usage Statistics (2022)". Business of Apps. 13 October 2021. Retrieved 30 November 2022.

- ↑ "Rise and fall of crypto exchange FTX". Reuters. 17 November 2022. Retrieved 6 December 2022.

- ↑ 6.0 6.1 6.2 6.3 6.4 Academy, Bit2Me (22 November 2022). "Who is Sam Bankman-Fried?". academy.bit2me.com. Retrieved 6 December 2022.

- ↑ 7.0 7.1 7.2 7.3 7.4 7.5 7.6 7.7 "SBF found guilty: A timeline of FTX, one of the worst failures in crypto history". DL News. Retrieved 14 December 2023.

- ↑ "Sam Bankman-Fried". linkedin.com. Retrieved 14 December 2023.

- ↑ "Gary Wang". Golden. Retrieved 28 February 2024.

- ↑ "What do we know about Caroline Ellison and Gary Wang, the senior associates behind FTX's downfall?". Yahoo News. 22 December 2022. Retrieved 29 February 2024.

- ↑ "CEO of Alameda Research is a 28-year-old Harry Potter fan". eFinancialCareers (in us). 10 November 2022. Retrieved 29 February 2024.

- ↑ Baer, Hannah Miao and Justin. "How Caroline Ellison Found Herself at the Center of the FTX Crypto Collapse". WSJ. Retrieved 29 February 2024.

- ↑ "How FTX's Nishad Singh, Once an Honors Student, Turned to Crypto Crime". wsj.com. Retrieved 15 December 2023.

- ↑ "Is Sam Bankman-Fried Gay? Does He Have Husband Or Wife ?". geniuscelebs.com. 13 November 2022. Retrieved 8 December 2022.

- ↑ "'Manipulative' SBF led Alameda's co-founder to quit in 2018 — who is Tara Mac Aulay?". DL News. Retrieved 14 December 2023.

- ↑ International, F. T. X. "FTX Celebrates Two-Year Anniversary". www.prnewswire.com. Retrieved 14 December 2023.

- ↑ 17.0 17.1 17.2 17.3 "FTX Token". coindesk.com. Retrieved 26 February 2024.

- ↑ "Crypto Derivatives Platform FTX Raises $8 Million in Seed Round". Financial and Business News | Finance Magnates. Retrieved 26 December 2022.

- ↑ Palmer, Daniel (29 October 2019). "FTX Launches Futures on Index of 8 China Cryptos Amid Xi Blockchain Pump". www.coindesk.com. Retrieved 26 December 2022.

- ↑ Foxley, William (20 December 2019). "Binance Invests Undisclosed Sum in Crypto Derivatives Platform FTX". www.coindesk.com. Retrieved 8 December 2022.

- ↑ "Binance Announces Strategic Investment in Cryptocurrency Derivatives Exchange FTX". Binance Blog. Retrieved 8 December 2022.

- ↑ "Binance Invests Undisclosed Sum in Crypto Derivatives Platform FTX". coindesk.com. Retrieved 14 December 2023.

- ↑ "US Court Dismisses $150 Million Lawsuit Against Crypto Exchange FTX". Financial and Business News | Finance Magnates. Retrieved 26 December 2022.

- ↑ "UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK" (PDF). sec.gov. Retrieved 28 February 2024.

- ↑ "IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE" (PDF). d1e00ek4ebabms.cloudfront.net. Retrieved 8 December 2022.

- ↑ "FTX Joins Top 5 Crypto Exchanges by Volume". cryptobriefing.com. Retrieved 14 December 2023.

- ↑ "FTX users can now trade reelection futures contract for President Trump". finance.yahoo.com. Retrieved 26 December 2022.

- ↑ Garg, Priyeshu (21 February 2020). "FTX Joins Top 5 Crypto Exchanges by Volume". Crypto Briefing. Retrieved 26 December 2022.

- ↑ Lucian, Anton (2 March 2020). "Someone Tried to Pump and Dump FTX Token (FTT) on Binance". BeInCrypto. Retrieved 26 December 2022.

- ↑ "Binance to delist FTX leveraged tokens". finance.yahoo.com. Retrieved 26 December 2022.

- ↑ Lucian, Anton (29 March 2020). "Binance to Delist All FTX Leveraged Tokens to 'Protect Users'". BeInCrypto. Retrieved 26 December 2022.

- ↑ "FTX Launches Oil Futures with $100 Buffer | Finance Magnates". Financial and Business News | Finance Magnates. Retrieved 26 December 2022.

- ↑ Abel, Daniel (26 May 2020). "Coinbase Custody Selected to Store FTX Exchange Token". Altcoin Buzz. Retrieved 26 December 2022.

- ↑ "Crypto derivatives exchange FTX introduces zero-confirmation transfers via Fireblocks". CryptoNinjas. 28 July 2020. Retrieved 27 December 2022.

- ↑ "Zero-Confirmation Asset Transfers Launch on FTX". www.prnewswire.com. Retrieved 27 December 2022.

- ↑ Dillet, Romain (26 August 2020). "Cryptocurrency exchange FTX acquires portfolio tracker Blockfolio". TechCrunch. Retrieved 28 November 2022.

- ↑ Stevens, Decrypt / Robert (25 August 2020). "Crypto exchange FTX buys Blockfolio for $150 million". Decrypt. Retrieved 27 December 2022.

- ↑ "FTX Paid for Blockfolio Deal Mostly in FTT Token It Invented". Bloomberg.com. 22 December 2022. Retrieved 14 December 2023.

- ↑ Stevens, Decrypt / Robert (6 September 2020). "$SUSHI Price Doubles After Creator Shifts Control To FTX CEO". Decrypt. Retrieved 28 December 2022.

- ↑ Watson, Andy (9 September 2020). "FTX Will Host IEO for Trading Platform Upbots". Coinspeaker. Retrieved 27 December 2022.

- ↑ "Hxro and FTX partner to launch TixWix for crypto trading". www.wealthadviser.co. 28 October 2020. Retrieved 27 December 2022.

- ↑ Francis, Theo (28 October 2020). "It's a Close Race for CEO Support, Too". Wall Street Journal. Retrieved 14 December 2023.

- ↑ Thompson, Patrick (29 October 2020). "FTX launches tokenized equity trading". CoinGeek. Retrieved 27 December 2022.

- ↑ Avan-Nomayo, Osato (29 October 2020). "FTX Crypto Exchange Debuts Tokenized Stock Trading". BeInCrypto. Retrieved 27 December 2022.

- ↑ "Tesla meets crypto as FTX launches fractionalized stock trading". Cointelegraph. Retrieved 27 December 2022.

- ↑ Wang, Doreen (3 November 2020). "Alameda Research Invests $3M in 3Commas Crypto Trading Platform". www.coindesk.com. Retrieved 28 December 2022.

- ↑ "CEO of crypto derivatives exchange FTX donated $5M to Biden campaign". Cointelegraph. Retrieved 28 December 2022.

- ↑ "FTX Launches UpBots (UBXT) Staking program | Bitcoinist.com". bitcoinist.com. 16 November 2020. Retrieved 28 December 2022.

- ↑ "Bahamas: 15 FAQs on the digital assets and registered exchanges ('dare". www.iflr1000.com. Retrieved 8 December 2022.

- ↑ 50.0 50.1 Grossman, Alexander Osipovich, Caitlin Ostroff, Patricia Kowsmann, Angel Au-Yeung and Matt. "They Lived Together, Worked Together and Lost Billions Together: Inside Sam Bankman-Fried's Doomed FTX Empire". WSJ. Retrieved 25 November 2022.

- ↑ "Crypto Exchange Ovex Closes Strategic Investment From FTX And Is Now SA's Largest OTC - TechFinancials". techfinancials.co.za. 20 January 2021. Retrieved 28 December 2022.

- ↑ Chawla, Vishal (28 January 2021). "FTX Exchange Introduces ACH Support With Circle's USDC". Crypto Briefing. Retrieved 28 December 2022.

- ↑ "FTX created a r/Wallstreetbets index including GME, DOGE and others". Cointelegraph. Retrieved 28 December 2022.

- ↑ Williams, Chris (1 February 2021). "FTX Adds Silver Stocks Amid Reddit-Led Market Surge". Crypto Briefing. Retrieved 28 February 2024.

- ↑ "FTX lists tokenized silver stocks after WSB's short squeeze". invezz.com. Retrieved 28 February 2024.

- ↑ Williams, Chris (1 February 2021). "FTX Adds Silver Stocks Amid Reddit-Led Market Surge". Crypto Briefing. Retrieved 28 December 2022.

- ↑ Allison, Ian (24 February 2021). "Alameda Leads $40M Round in 'DeFi Prime Brokerage,' Plans Maps.me Integration". www.coindesk.com. Retrieved 28 December 2022.

- ↑ Frost, Decrypt / Liam (4 March 2021). "FTX CEO Sam Bankman-Fried Ranked as Second-Biggest Blockchain Billionaire". Decrypt. Retrieved 28 December 2022.

- ↑ Crawley, Jamie (24 March 2021). "Crypto Exchange FTX Secures Naming Rights for Miami Heat Arena for $135M". www.coindesk.com. Retrieved 28 February 2024.

- ↑ Pound, Jesse. "Crypto industry to get first major U.S. stadium with Miami-Dade County approving FTX for Heat home". CNBC. Retrieved 28 December 2022.

- ↑ "Welcome To FTX Arena". www.nba.com. Retrieved 14 December 2023.

- ↑ "FTX Inks $135M Sponsorship Deal for Miami Heat Arena". Blockworks. 23 March 2021. Retrieved 8 December 2022.

- ↑ "Brett Harrison - Architect.xyz | LinkedIn". www.linkedin.com. Retrieved 14 December 2023.

- ↑ "TSM and FTX Sign $210 Million Naming Rights Partnership, Largest in Esports History". www.prnewswire.com. Retrieved 14 December 2023.

- ↑ "Bankman-Fried agreed to pay Tom Brady $55M for 20 minutes of his time—and Gisele $20M". Fortune Crypto. Retrieved 14 December 2023.

- ↑ Seward, Zack (20 July 2021). "FTX Crypto Exchange Valued at $18B in $900M Funding Round". www.coindesk.com. Retrieved 6 December 2022.

- ↑ "Securities Commission Statement On Transfer Motion In FTX Digital Markets Chapter 15 Proceedings - Fin Tech - Bahamas". www.mondaq.com. Retrieved 29 November 2022.

- ↑ Hamacher, Decrypt / Adriana (22 July 2021). "Sam Bankman-Fried: Why I Bought Back Binance's Shares in FTX". Decrypt. Retrieved 28 February 2024.

- ↑ 69.0 69.1 69.2 Ehrlich, Steven. "Meet The World's Richest 29-Year-Old: How Sam Bankman-Fried Made A Record Fortune In The Crypto Frenzy". Forbes. Retrieved 15 December 2023.

- ↑ "Portrait of a 29-year-old billionaire: Can Sam Bankman-Fried make his risky crypto business work?". finance.yahoo.com. Retrieved 29 November 2022.

- ↑ 71.0 71.1 "Golden State Warriors and Miami Heat Axe FTX Deals". Blockworks. 15 November 2022. Retrieved 26 November 2022.

- ↑ "NBA Superstar Stephen Curry Becomes Global Ambassador and Shareholder of Leading Cryptocurrency Exchange FTX Through Long-Term Partnership". www.prnewswire.com. Retrieved 15 December 2023.

- ↑ "Your Jaw Will Drop When You See How Much Steph Curry Was Paid To Promote FTX | Bitcoinist.com". bitcoinist.com. 7 October 2023. Retrieved 15 December 2023.

- ↑ Wang, Nelson (24 September 2021). "FTX Moves Headquarters From Hong Kong to Bahamas". www.coindesk.com. Retrieved 15 December 2023.

- ↑ "Bankman-Fried's Crypto Exchange FTX Leaves Hong Kong for Bahamas". Bloomberg.com. 24 September 2021. Retrieved 28 November 2022.

- ↑ "F1 team Mercedes suspends sponsorship deal with FTX". AP NEWS. 11 November 2022. Retrieved 8 December 2022.

- ↑ "FTX signs sponsorship deal with top F1 team Mercedes-AMG Petronas". The Block. Retrieved 29 February 2024.

- ↑ "SAM BANKMAN-FRIED'S FTX MOVES HQ TO BAHAMAS AMIDST CRYPTO CRACKDOWN IN CHINA". cryptopolitan.com. Retrieved 29 February 2024.

- ↑ "EXHIBIT A" (PDF). pacer-documents.s3.amazonaws.com. Retrieved 28 February 2024.

- ↑ Research, Alameda. "Alameda Research Appoints Caroline Ellison And Sam Trabucco As Co-Chief Executive Officers". www.prnewswire.com. Retrieved 15 December 2023.

- ↑ "Crypto Exchange FTX Reaches $25 Billion Valuation". wsj.com. Retrieved 15 December 2023.

- ↑ Young, Jabari (14 December 2021). "Cryptocurrency platform FTX will pay Golden State Warriors $10 million for global rights". CNBC. Retrieved 15 December 2023.

- ↑ Jones, Rory (15 December 2021). "Golden State Warriors sign 'US$10m' FTX partnership". SportsPro. Retrieved 28 February 2024.

- ↑ Chernova, Yuliya (14 January 2022). "WSJ News Exclusive | Crypto Exchange FTX Sets Up $2 Billion Venture Fund". Wall Street Journal. Retrieved 28 November 2022.

- ↑ Ponciano, Jonathan. "Billionaire Bankman-Fried's FTX Launches $2 Billion Crypto Fund Amid Venture's Massive Deal Boom". Forbes. Retrieved 15 December 2023.

- ↑ "FTX US Closes $400M Series A Funding At $8 Billion Valuation". FinSMEs. 26 January 2022. Retrieved 8 December 2022.

- ↑ "Crypto exchange FTX US valued at $8 bln as first fundraise draws SoftBank, Temasek". reuters.com. Retrieved 15 December 2023.

- ↑ Crawley, Jamie (31 January 2022). "FTX Reaches $32B Valuation With $400M Fundraise". www.coindesk.com. Retrieved 29 February 2024.

- ↑ Wilson, Tom (31 January 2022). "Crypto exchange FTX valued at $32 bln as SoftBank invests". Reuters. Retrieved 6 December 2022.

- ↑ "FTX Super Bowl Don't miss out with Larry David". youtube.com. Retrieved 28 February 2024.

- ↑ Gariffo, Michael. "FTX's new gaming division faces an uphill battle in convincing gamers to buy NFTs". ZDNet. Retrieved 2022-11-28.

- ↑ Leetham, Alice (9 February 2021). "FTX To Donate 1% Of All Net Fees To Charities | CoinJournal.net". CoinJournal. Retrieved 28 December 2022.

- ↑ Betz, Brandy (22 March 2022). "FTX Acquires Good Luck Games Amid Gaming Push". www.coindesk.com. Retrieved 28 February 2024.

- ↑ "FTX collapse shakes up Chicago crypto market, where its US trading platform was going to be the next big thing". Chicago Tribune. 12 December 2022. Retrieved 29 February 2024.

- ↑ US, FTX. "FTX US Opens New Headquarters in Chicago and Launches Major Community Investment Initiative FTX US partners with Equity and Transformation to pilot largest private guaranteed income and banking inclusion program in country in Fall 2022". www.prnewswire.com. Retrieved 8 December 2022.

- ↑ "Effective Altruism: Education, Empowerment & Environment with Gisele & SBF | Crypto Bahamas". youtube.com. Retrieved 28 February 2024.

- ↑ "House Agriculture Hearing on the FTX Proposal and Trends in New Clearinghouse Models". youtube.com. Retrieved 28 February 2024.

- ↑ "Binance Backs Out of FTX Acquisition (Updated)". Gizmodo. 9 November 2022. Retrieved 27 November 2022.

- ↑ "House Ag FTX Hearing". SIFMA. Retrieved 28 February 2024.

- ↑ "FTX Founder Sam Bankman-Fried Signs Billionaires' Giving Pledge". Yahoo Finance. 1 June 2022. Retrieved 15 December 2023.

- ↑ "why FTX is going to keep growing as others cut jobs". Twitter. Archived from the original on November 19, 2022. Retrieved 25 November 2022.

- ↑ Nagarajan, Shalini (20 June 2022). "Voyager To Borrow $500M From Alameda Amid Industry Downturn". Blockworks. Retrieved 26 February 2024.

- ↑ US, FTX. "FTX US Acquires Clearing Firm Embed to Enhance FTX Stocks". www.prnewswire.com. Retrieved 28 February 2024.

- ↑ Hirsch, Lauren; Yaffe-Bellany, David; Livni, Ephrat (28 November 2022). "Crypto Lender BlockFi Files for Bankruptcy as FTX Fallout Spreads". The New York Times.

- ↑ "FTX signs deal with option to buy BlockFi for up to $240 mln". reuters.com. Retrieved 28 February 2024.

- ↑ Sigalos, Rohan Goswami,MacKenzie (25 January 2023). "BlockFi secret financials show a $1.2 billion relationship with Sam Bankman-Fried's crypto empire". CNBC. Retrieved 15 December 2023.

- ↑ "Voyager Digital Files Chapter 11 Bankruptcy | Department of Financial Regulation". dfr.vermont.gov. Retrieved 30 November 2022.

- ↑ "Voyager Digital reportedly had deep ties with SBF-owned Alameda Research". Cointelegraph. Retrieved 30 November 2022.

- ↑ "Crypto markets, EA funding and optics". forum.effectivealtruism.org. Retrieved 28 February 2024.

- ↑ "FTX US Introduces Stock Trading Service Nationwide". www.top1markets.com. Retrieved 29 February 2024.

- ↑ Scaggs, Alexandra (19 August 2022). "About that deposit insurance...". Financial Times.

- ↑ Brett Harrison. "We really didn't mean to mislead anyone". Twitter. Archived from the original on August 23, 2022. Retrieved 29 November 2022.

- ↑ Roth, Emma (20 August 2022). "FTX's money isn't insured, FDIC says". The Verge.

- ↑ Capoot, Ashley (19 August 2022). "Crypto firm FTX gets warning from FDIC to stop 'misleading' consumers about deposit protection". CNBC. Retrieved 15 December 2023.

- ↑ "Alameda Co-CEO Trabucco Steps Down From Crypto Trading Firm". Bloomberg.com. 24 August 2022. Retrieved 15 December 2023.

- ↑ Sam Trabucco. "I guess that's about it". Twitter. Archived from the original on November 16, 2022. Retrieved 15 November 2022.

- ↑ Rooney, Kate. "FTX in talks to raise up to $1 billion at valuation of about $32 billion, in-line with prior round". CNBC. Retrieved 12 November 2022.

- ↑ Ligon, Cheyenne (27 September 2022). "Crypto Exchange FTX Is Moving Its US Headquarters From Chicago to Miami". www.coindesk.com. Retrieved 8 December 2022.

- ↑ Ligon, Cheyenne (9 April 2023). "Former FTX US President Reportedly Quit After 'Protracted Disagreement' With Bankman-Fried". www.coindesk.com. Retrieved 28 February 2024.

- ↑ Ligon, Nelson Wang and Cheyenne (27 September 2022). "Crypto Exchange FTX.US President Brett Harrison Stepping Down". www.coindesk.com. Retrieved 28 February 2024.

- ↑ "Brett Harrison". twitter.com. Retrieved 15 December 2023.

- ↑ De, Nikhilesh (17 October 2022). "Crypto Exchange FTX US Under Investigation by Texas Regulator Over Securities Allegations". www.coindesk.com. Retrieved 29 February 2024.

- ↑ De, Nikhilesh (17 October 2022). "Crypto Exchange FTX US Under Investigation by Texas Regulator Over Securities Allegations". www.coindesk.com. Retrieved 8 December 2022.

- ↑ "The DARK TRUTH About FTX! (Sam Bankman Fried EXPOSED)". youtube.com. Retrieved 28 February 2024.

- ↑ Allison, Ian (2 November 2022). "Divisions in Sam Bankman-Fried's Crypto Empire Blur on His Trading Titan Alameda's Balance Sheet". www.coindesk.com. Retrieved 8 December 2022.

- ↑ "Order to Cease and Desist Issued | Department of Banking and Finance". dbf.georgia.gov. Retrieved 15 February 2024.

- ↑ "Google Trends". Google Trends. Retrieved 29 February 2024.

- ↑ "Google Trends". Google Trends. Retrieved 1 March 2024.

- ↑ "Google Trends". Google Trends. Retrieved 1 March 2024.

- ↑ "Wikipedia Views: results". wikipediaviews.org. Retrieved 1 March 2024.

- ↑ "Wikipedia Views: results". wikipediaviews.org. Retrieved 1 March 2024.

- ↑ "Wikipedia Views: results". wikipediaviews.org. Retrieved 1 March 2024.