Timeline of FTX collapse

This page is about a topic potentially related to FTX, Alameda Research, Sam Bankman-Fried, or the FTX Future Fund. Other content on this wiki has been compensated by the Future Fund Regranting Program that used funds from the FTX Future Fund. These funds likely came from the FTX Foundation that was funded partly or wholly by money made by FTX, Alameda Research, or Sam Bankman-Fried. As such, there is a theoretical possibility of conflict of interest.

View all pages with possible conflicts of interest due to funding from Future Fund Regranting Program | View pages work on which was to be funded by the Future Fund Regranting Program

This is a timeline of FTX collapse, considered one of the biggest collapses in the crypto ecosystem. The bankruptcy of FTX left an estimated 1 million customers and other investors facing total losses in the billions of dollars.[1]

Contents

Sample questions

The following are some interesting questions that can be answered by reading this timeline:

- What are some notable details directly related to Sam Bankman-Fried?

- For SBF apology statements, sort the full timeline by "Event type" and look for the group of rows with value "SBF apology".

- For comments by SBF, sort the full timeline by "Event type" and look for the group of rows with value "SBF comment".

- For SBF interviews, sort the full timeline by "Event type" and look for the group of rows with value "SBF interview".

- See also "SBF net worth", "SBF reputation", "SBF arrest", and "SBF release".

- What are some notable details on the financial status by FTX and Alameda Research?

- Sort the full timeline by "Event type" and look for the group of rows with value "Financial".

- You will see a number of events describing the financial situation of the companies and the mechanisms that led to their collapse.

- What are some details related to the bankruptcy filing by FTX and its affiliates?

- Sort the full timeline by "Event type" and look for the group of rows with value "Bankruptcy".

- What are some reactions by notable peers in the cryptocurrency industry to the FTX collapse?

- Sort the full timeline by "Event type" and look for the group of rows with value "Industry peer reaction".

- You will see statements by important people in the crypto industry, such as Changpeng Zhao and Vitalik Buterin.

- What are some comments by notable people in relation to the FTX crisis?

- Sort the full timeline by "Event type" and look for the group of rows with value "Notable comment".

- You will read statements by important people not in the crypto industry, such as Elon Musk and Edward Snowden.

- What are some details describing financial rescue attempts by third parties to FTX?

- Sort the full timeline by "Event type" and look for the group of rows with value "Rescue attempt".

- You will see from early warnings prior to the collapse to rescue attempts in the midst of the debacle.

- What are some details describing the impact on users?

- Sort the full timeline by "Event type" and look for the group of rows with value "Impact on users".

- You will read the names of important customers affected by the collapse of the exchange, as well as events related to stuck funds withdrawal attempts.

- What are some events describing the impact of the FTX collapse on the effective altruist community?

- Sort the full timeline by "Event type" and look for the group of rows with value "Impact on effective altruism".

- What are events pointing to the overall collapse of FTX?

- Sort the full timeline by "Event type" and look for the group of rows with value "FTX collapse".

- Other events are described under the following types: "Background", "Contract termination", "Impact on the public", "Legal", "Official intervention", "Partnership proposal", "Partnership termination", "Prelude", "Psychopharmacology", "Security", "Unauthorized transaction", and "Tweet removal".

Big picture

Summary of background events by year

| Year | Development summary |

|---|---|

| 1992 | Sam Bankman-Fried is born. |

| 2017 | Alameda Research is founded in November. |

| 2019 | FTX is founded in May. In December, Binance invests $100 million into FTX for 20% of the firm.[2] |

| 2020 | FTX explodes in popularity.[3] |

| 2021 | FTX becomes a serious competitor to Binance, which sells its equity share (in FTX) in exchange for $2.1 billion of FTT and USD. |

| 2022 | FTX Future Fund launches in February. In November, FTX plunges into crisis. |

Summary of key days

| Date in 2022 | Development summary |

|---|---|

| November 2 (Wednesday) | CoinDesk publishes an article sharing details revealing high exposure to FTT token in the FTX balance sheet. |

| November 4 (Friday) | Building on the CoinDesk report, a post on the Dirty Bubble Media Substack questions the solvency of FTX. |

| November 5 (Saturday) | Nearly $600 million in FTT, the native token of FTX, is transferred from a wallet to Binance. |

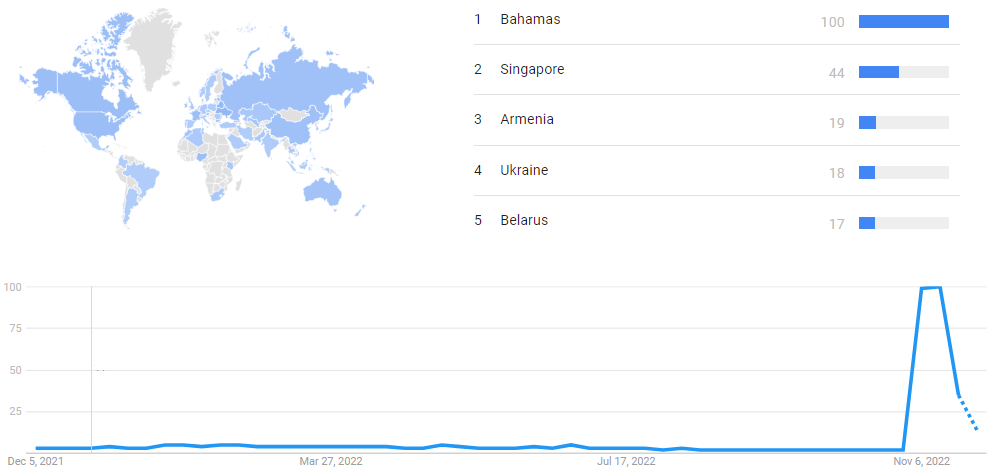

| November 6 (Sunday) | Binance CEO Changpeng Zhao announces on Twitter that his exchange is liquidating all FTX tokens. |

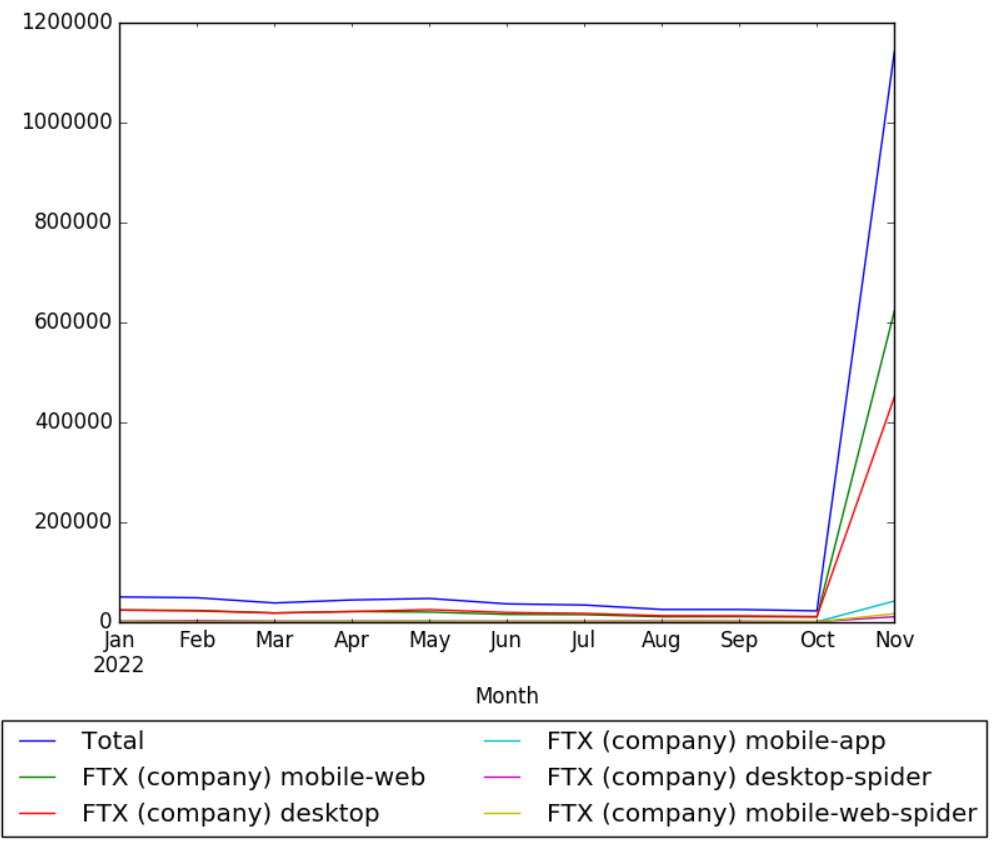

| November 7 (Monday) | FTX records the largest number of withdrawal transactions in its history. |

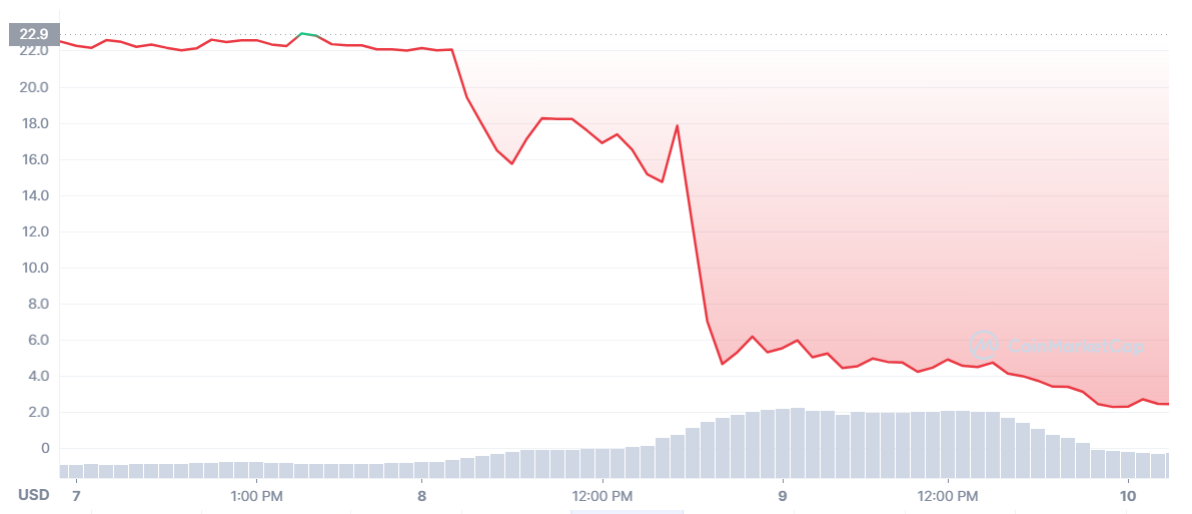

| November 8 (Tuesday) | FTX reaches a deal to sell itself to Binance. FTT price falls 80% (most of the drop happening after the announcement of the Binance deal) and would fail to recover. |

| November 9 (Wednesday) | The SEC and CFTC begin investigating FTX. Binance walks back plans to acquire FTX. Instability spreads to the rest of the crypto industry. |

| November 10 (Thursday) | FTX pauses trading on its platform. The exchange seeks $9,4 billion in rescue funds from OKX, Sequoia Capital, etc.[4] FTX assets are frozen by Bahamian regulator. Alameda stops trading.[5] |

| November 11 (Friday) | SBF resigns. FTX files for bankruptcy. FTX US ceases processing crypto withdrawals.[6] |

| November 12 (Saturday) | FTX is hacked for most of its remaining crypto. Unauthorized transactions are reported. Blockchain analytics firms estimate outflows between $473 million and $659 million in "suspicious circumstances". Reuters reports at least $1 billion of customer funds having vanished from the exchange. |

| November 13 (Sunday) | Bahamian police investigate FTX whether there was any criminal misconduct in the collapse of the crypto exchange.[7] |

| November 14 (Monday) | Golden State Warriors terminates all FTX-related promotional deals. Digital asset lender BlockFi discloses "significant exposure" to FTX.[8] 101 FTX affiliated debtors (collectively, the "Debtors") each file for bankruptcy.[9] |

| November 15 (Tuesday) | BlockFi announces it is likely to file for bankruptcy.[10] |

| November 16 (Wednesday) | The first class action lawsuit against SBF is filed. Crypto lender Genesis halts customer redemptions and new loan originations, blaming on FTX's collapse. |

| November 17 (Thursday) | FTX's liquidator John J. Ray III comments: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here." |

| November 18 (Friday) | Bahamas regulators confirm custody of FTX assets. |

| November 19 (Saturday) | FTX discloses in a court filing that it owes almost $3.1 billion to its top 50 creditors. It also says it could have more than one million creditors.[11] |

| November 20 (Sunday) | FTX hacker moves 50,000 ETH to a unique address 0x866E. |

| November 22 (Tuesday) | FTX's bankruptcy hearing begins, before judge John T. Dorsey in court. |

| December 12 (Monday) | SBF is arrested in the Bahamas. |

| December 23 (Friday) | SBF is released on $250 million bail. |

Key actors

NOTE: Geographical locations are inferred based on place of residence and incorporation, and may not accurately reflect where the actors were at all times covered in the timeline.

| Name | Other names | Known for | Twitter handle | Geographical location (timezone offset) | Notes |

|---|---|---|---|---|---|

| FTX | Cryptocurrency exchange, creator of FTT token | @FTX_Official | Bahamas (UTC-5) | ||

| Alameda Research | Cryptocurrency trading firm | @AlamedaResearch | Hong Kong (UTC+8) | The public discovery of the loans from FTX to this company (collateralized by FTT) prompted the collapse of the token and both companies. | |

| Sam Bankman-Fried | SBF | FTX founder and CEO. Alameda Research co-founder and top shareholder | @SBF_FTX | Bahamas (UTC-5) | |

| Caroline Ellison | Alameda Research CEO | @carolinecapital | Hong Kong (UTC+8) | She was aware of the backdoor for sending funds from FTX to Alameda Research. | |

| Gary Wang | FTX CTO | Bahamas (UTC-5) | He was the central figure managing the FTX codebase. It is believed that he implemented the backdoor for sending funds from FTX to Alameda Research at SBF's request. | ||

| Nishad Singh | FTX Director of Engineering | @Nishad__Singh | Bahamas (UTC-5) | According to Caroline Ellison, he was one of the four people who knew about the backdoor for sending funds from FTX to Alameda Research. | |

| John J. Ray III | FTX post-bankruptcy CEO | ||||

| Binance | Large cryptocurrency exchange, FTX competitor, significant holder of FTT | @binance | Binance's decision to sell its whole position of FTT played a big role in the collapse of the token. It attempted to rescue FTX from collapse and subsequently withdrew. | ||

| Changpeng Zhao | CZ | Binance CEO | @cz_binance | Singapore (UTC+8), Dubai (UTC+4) (for part of the time period) | He played a key role in communicating Binance's decisions related to FTX through Twitter. |

| Elon Musk | Twitter CEO | @elonmusk | San Francisco (UTC-8) | ||

| Sam Trabucco | Former Alameda Research co-CEO | @AlamedaTrabucco | |||

| Matt Levine | Bloomberg columnist | @matt_levine | He covered the FTX crisis. | ||

| Lucas Nuzzi | Head of Research and development at CoinMetrics | @LucasNuzzi | New York metropolitan area | He analized FTX-Alameda transfers, providing early conclusions on his Twitter account. | |

| Tiffany Fong | @TiffanyFong_ | She's followed on Twitter by SBF with whom she had phone calls. | |||

| Autism Capital | They present themselves as "The most based citizen journalism in Crypto." | @AutismCapital | They follow the FTX saga on a daily basis. |

Full timeline

Inclusion criteria

This timeline is focused on the FTX collapse that occurred in November 2022, and events that were directly leading up to it. The broader history of FTX will eventually be covered in the timeline of FTX.

The following are some criteria that were used to determine what rows to include in the timeline:

For events prior to November 2022:

- We include resignations of people starting August 2022, limited to those that would later be discussed in connection with the FTX collapse.

- We include suspicious transactions and activities starting August 2022, that would later be linked by observers to the FTX collapse.

- We only include critical commentary prior to November 2022 if it specifically talks about the risks of FTX or Alameda being overleveraged on FTT or the possibility of loans from FTX to Alameda.

For events since November 2022:

- We include key announcements (often in the form of articles, Substack posts, other blog posts, and tweets) that shaped the trajectory of the FTX collapse.

- We include commentary by notable people or commentary that attracted a lot of attention. This includes commentary by journalists, finance people, and people on the Effective Altruism Forum.

- For posts on the Effective Altruism Forum tagged FTX collapse, we determine whether a post is worth including on this forum based on criteria such as upvotes, comments, and whether the post is chronologically the first of its kind.

Timeline

| Date in 2022 | Time (UTC) | Actor | Communication method | Event type | Details |

|---|---|---|---|---|---|

| May 4–11 | Prelude | TerraUSD and Luna collapse, wiping out almost $45 billion market capitalization in one week and causing hundreds of billions in losses in the larger crypto market.[12][13][14] Overall, the collapse of Terra Luna wipes $500 billion from the crypto market.[15] A precursor of the FTX collapse, the TerraUSD and Luna crash would influence and prove the severity of the FTX and Alameda Research situation as they would find themselves short after their loans start being recalled.[16] | |||

| July 7 | Rich Handler | Rescue attempt | Jefferies Financial Group CEO Rich Handler writes an email to an unidentified colleague, suggesting setting up a dinner date with SBF to provide business advice. Handler writes: Do you know Sam Bankman-Fried? He seems in over his head and could quickly be in a precarious position (...) What he is going through is not going to pass as quickly as he might wish and you can quickly become the rescuee versus the rescuer if you are not careful. Handler would reckon he could have helped FTX.com avoid its collapse if only SBF had taken his meeting earlier in the year.[17] He would post pictures of the email on his personal Twitter account on November 9, 2022.[18] | ||

| August 24 | 9:16 p.m. | Sam Trabucco | Tweet | Team (resignation) | Alameda Research co-CEO Sam Trabucco announces his resignation on Twitter, leaving co-CEO Caroline Ellison as the sole CEO, and announces he will remain in the capacity of adviser. Trabucco tweets: I guess that's about it. My time at Alameda has been the most formative of my life. I've learned how to think, I've found out how far I can push myself, and I've been gifted the incredible experience of being in the trenches with lifelong friends -- and *winning*.[19] |

| September 16 | Rich Handler | Rescue attempt | Rich Handler makes a second attempt to connect with SBF. He emails to a colleague: I’m at the Rosewood Hotel in the Bahamas today. Do we have a smart way to see if the FTX guy wants to grab lunch? I believe he is here.[17]Handler would be rebuffed once again. He would later tweet: “No response and no meeting/discussion.”[18] In a November 8 email to his colleague, Handler writes: Sure looks like Sam Bankman-Fried should have taken the meeting. :)[18] | ||

| September 27 | 3:27 p.m. | Brett Harrison | Tweet | Resignation | FTX.US President Brett Harrison announces his resignation, with his role be replaced by Zach Dexter, the CEO of FTX's U.S. derivatives unit.[20] Harrison tweets: I’m stepping down as President ofAfter the FTX collapse, it would be found that his resignation happened one day before a massive transfer of FTT tokens occured from FTX to Alameda Research. |

| September 28 | Financial (notable transaction) | A massive transfer of 173 million FTT tokens worth over 4 billion USD occurs on this day. After the collapse of FTX in November, researcher Lucas Nuzzi would identify this transfer as a massive bailout from FTX for Alameda Research.[22] | |||

| September 30 | 1:44 p.m. | Adam Cochran | Tweet | Notable transaction | Adam Cochran publishes a 22-tweet thread starting with the following tweet: So ETH OI has been overall down recently, but on FTX it's at all time highs (1.2M ETH) and in this low liquidity environment ETH has seemingly split with the macros and tried to defend aggressively around that 1200-1300 range.Cochran concludes that someone institutional is very leveraged in a large position on FTX, likely some sort of staked ETH hedge.[23] |

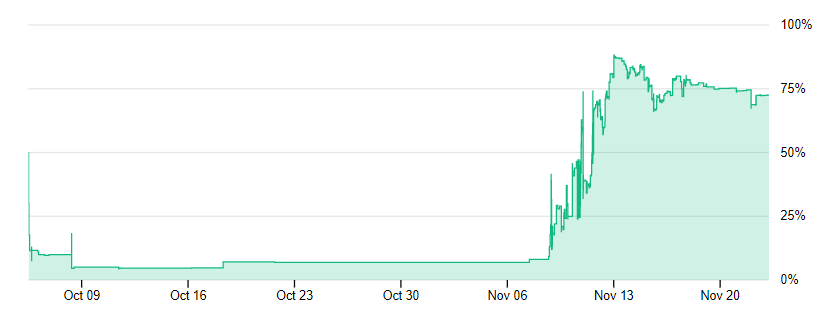

| October 5 | 12:06 p.m. | SBF reputation | A Manifold Markets prediction is published, asking users to bet whether SBF would be convicted of a felony before 2026. Affirmative bets would skyrocket on November 8.[24] | ||

| November 2 | 2:44 p.m. | Ian Allison, coindesk.com |

Article | Financial | An article at coindesk.com by Ian Allison shares some critical financial details from Alameda Research, revealing that its balance sheet is full of the FTT token, which is issued by the exchange that grants holders a discount on trading fees on its marketplace. It is revealed that Alameda rests on a foundation largely made up of a coin that sister company FTX invented, instead of an independent asset like a fiat currency or another crypto. Total assets totalling $14.6 billion are reported to be comprised of $5.8 billion FTT token, $1.2 billion Solana token (SOL), $3.37 billion in unidentified “crypto held,” $2 billion in “investments in equity securities”, leaving roughly $2.2 billion in assets. According to this balance sheet, Alameda only had $134 million in cash on hand in June 2022.[25][26] Regarding FTT, Alameda is found to hold far more of the tokens than traded on the market, suggesting its stake would be hard to liquidate at current prices.[27] In a post-FTX-collapse interview, Binance CEO Changpeng Zhao would recall this as the cause of Binance's decision to liquidate its stake of 23 million FTX Token (FTT) for risk management reasons, with their subsequent announcement causing a sell-off in FTT in the market.[28][29]

|

| November 4 | Dirty Bubble Media | Article | Financial | Following the CoinDesk report, a pseudonymous crypto researcher post on the Dirty Bubble Media Substack asking if the company is insolvent. Referring to the holding of a chunk of assets in FTT, it adds: “It’s almost as if SBF found a way to hack the financial system, printing billions of dollars out of thin air against which he was able to borrow massive sums from unknown counterparties.” This post would lead to rumors spreading over the weekend[25][30][31] | |

| November 5 | 2:09 p.m. | Whale Alert | Tweet | Notable transaction | Whale Alert Twitter user posts: 22,999,999 #FTT (584,818,174 USD) transferred from unknown wallet to #Binance.[32] |

| November 6 | 2:32 p.m. | Caroline Ellison | Tweet | Financial | In response to the CoinDesk article, Caroline Ellison tweets: A few notes on the balance sheet info that has been circulating recently: |

| November 6 | 3:47 p.m. | Changpeng Zhao | Tweet | Industry peer reaction | Changpeng Zhao tweets: As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books.[34]CZ compares FTT to the imploded luna token, which Binance also previously backed.[27] In the tweet thread, he says they will try to liquidate in a way that minimizes market impact, expecting a complete liquidation in a few months.[34] However, FTT’s price would start to wobble after this announcement.[27] |

| November 6 | 4:03 p.m. | Caroline Ellison | Tweet | Financial | Caroline Ellison tweets @cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22![35]According to a Wall Street Journal article published later, "Binance contacted her about the offer but never heard back, a person familiar with the matter said."[36] |

| November 6 | 9:49 p.m. | Changpeng Zhao | Tweet | Industry peer reaction | Changpeng Zhao tweets: Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.[37] |

| November 6 | 11:28 p.m. | Sam Bankman-Fried | Tweet | Financial | SBF tweets declaring that FTX is solvent. Among other comments in the thread, he declares: FTX keeps audited financials etc. And, though it slows us down sometimes on product, we're highly regulated.[38] |

| November 7 | 12:38 p.m. | Sam Bankman-Fried | Tweet | Financial | SBF posts a thread of four different tweets claiming that FTX has “enough to cover all client holdings.” He also states that the firm didn’t invest client assets and has been processing all withdrawals and “will continue to be.” Another tweet reads: We have a long history of safeguarding client assets, and that remains true today.[39] This thread would be removed the following day.[40] |

| November 7 | Evening/circa 4 p.m. | Sam Bankman-Fried, Changpeng Zhao | Instant messaging, call | Rescue attempt | CZ is approached by SBF, who seeks to have Binance rescue FTX through acquisition. Sources would give divergent versions. In an interview, CZ would reveal having received a call from SBF about 24 hours after CZ communicated Binance's liquidation of its remaining FTT, with SBF confessing FTX is in big trouble, wants to protect its users, and proposes a rescue deal.[28] According to a Wall Street Journal report, CZ received a message over Signal, an encrypted messaging app, from SBF, who congratulates his rival and describes Binance as the perfect buyer for FTX.[36] |

| November 8 | circa 2:00 a.m. | FTT valuation | Still affected after Binance said it would liquidate its holding in the token, FTT price falls sharply 19%, from roughly $22 to below $18 in a short time.[41] The prices of Solana and Serum, both cryptocurrencies associated with SBF, also plummet, dropping far more than the rest of the market.[42] | ||

| November 8 | 11:37 a.m. | Impact on customers | According to on-chain data, FTX appears to have stopped processing withdrawal requests, with last transaction from the exchange taking place on the Ethereum blockchain.[43][44] | ||

| November 8 | Morning in Bahamas | Sam Bankman-Fried | SBF apology | SBF sends a message to his team, apologizing for the chaos and thanking them for their efforts. Days later, according to FTX senior marketing specialist, "it was clear the game was over”.[36] | |

| November 8 | 4:03 p.m. | Sam Bankman-Fried | Tweet | Rescue attempt | SBF tweets a thread announcing plan to sell FTX.com (its non-U.S. business) to Binance. He writes: Things have come full circle, andAlong the tweet thread, he announces that FTX customers are protected and that the teams are working to clear out liquidity crunches.[45] |

| November 8 | 4:05 p.m. | Impact on customers | Tech news sites cover slow withdrawals at FTX.[44] | ||

| November 8 | 4:09 p.m. | Changpeng Zhao | Tweet | Rescue attempt | Binance CEO Changpeng Zhao announces that Binance has signed a non-binding agreement to buy FTX's non-US assets in order to save the competitor from a liquidity crisis that FTX actually found itself in partly through Binance's own actions, as the latter accused FTX of committing fraud with FTT tokens.[46][47] CZ tweets: This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days.The terms of the deal are not set in stone.[48] However, FTT token subsequently jumps 38% to almost $20 at 4:12 p.m.[49] |

| November 8 | circa 5 p.m. – 8 p.m. | FTT valuation | After Binance announcement of plans to acquire FTX, but before pulling out from the deal, a massive sell-off of FTT makes it price plunge about 80%, from around $22 to below $5, wiping out more than $2 billion in a day.[50][51] | ||

| November 8 | 5:23 p.m. | Charles He | Forum post | FTX collapse | The first Effective Altruism Forum post about the FTX crisis is published. The Author suggests a probable relation to liquidity and solvency issues.[52] |

| November 8 | 6:57 p.m. | Changpeng Zhao | Tweet | Industry peer reaction | After agreeing to buy FTX, Changpeng Zhao pledges to implement a Proof-of-Reserve audit system to allow verification of Binance digital asset holdings and provide “full transparency” through the use of Merkle Trees — a data structure used to encode blockchain data more efficiently and securely.[53] Changpeng Zhao tweets: All crypto exchanges should do merkle-tree proof-of-reserves. |

| November 8 | 7:14 p.m. | Coinbase, Kraken | Impact in industry | Amid market turbulence, Coinbase and Kraken platforms experience issues related to connectivity to the platforms and unconfirmed rumors of halted withdrawals. Complaints are posted on Twitter.[55] | |

| November 8 | 7:16 p.m. | Effective Altruism Forum members | Tweet | FTX collapse | A number of Effective Altruism Forum members post a summary of key events of the FTX crisis as document with the purpose to add clarity. The authors estimate a ~90% of SBF failing in his attempt to raise funds to cover deposits.[56] |

| November 8 | 7:26 p.m. | Lyn Alden | Tweet | Notable comment | Lyn Alden, founder of Lyn Alden Investment Strategy, starts a two-tweet thread illustrating the printing of FTT token. Alden writes: Imagine McDonald's makes its own money, let's call them clown-bucks, keeps most of it, and sells some to the market. McDonald's then uses their remaining clown-bucks as collateral for actual loans. And then people remember clown-bucks aren't real. And then Starbucks comes and market sells the clown-bucks they were holding, while reminding the market that clown-bucks aren't really a thing. McDonald's balance sheet is trashed, with their clown-bucks wiped out. Anyway, that's what happened in crypto-land this week.[57] |

| November 8 | 8:14 p.m. | Dylan LeClair | Tweet | Impact on users | UTXO Management senior analyst Dylan LeClair tweets: Don't mean to be the bearer of bad news here, but if it isn't clear already, if you still have funds on FTX, they're gone. You're an unsecured creditor. The probable outcome is Chapter 11 & a class action lawsuit that draws out for years, where you get $0.10-$0.30 on the dollar.[58]He also posts on the thread: Similarly, expecting CZ to come in with billions of cash purely to make users whole does not make sense from a business perspective.[58] |

| November 8 | 8:16 p.m. | Kraken Exchange | Tweet | Industry peer reaction | Kraken Exchange in its official account on Twitter posts: Check if the exchange you’re using undergoes Proof of Reserves audits. |

| November 8 | 9:07 p.m. | Brian Armstrong | Tweet | Industry peer reaction | Brian Armstrong publishes a 13-tweet thread addressing the FTX crisis. Among the announcements, he states that Coinbase doesn't have any material exposure to FTX or FTT (and no exposure to Alameda). Another of his tweets reads: I think it's important to reinforce what differentiates Coinbase in a moment like this. This event appears to be the result of risky business practices, including conflicts of interest between deeply intertwined entities, and mis-use of customer funds (lending user assets).[60] |

| November 8 | 9:25 p.m. | Sam Bankman-Fried | Rescue attempt | A Substack newsletter Newcomer writer publishes an email SBF sent to his investors with subject line as “FTX Update”[61], SBF apologizes over a lack of communication about the deal with Binance.[62] He writes: I'm sorry I've been hard to contact the last few days (...) I wish I had more details for you guys right now; I don’t yet.[63][64] | |

| November 8 | 10:30 pm | Sam Bankman-Fried | Tweet | Tweet removal | SBF removes his “assets are fine” thread a few hours after announcing a strategic transaction with Binance.[40] |

| November 8 | 10:42 p.m. | Jeremy Allaire | Tweet | Industry peer reaction | Jeremy Allaire, co-founder and CEO of stablecoin issuer Circle, publishes a 15-tweet thread expressing his thoughts on the FTX and Binance situation. Allaire denies exposure to FTX. He also tweets: The good news is that the foundations that have been built with crypto infrastructure and public chains give us the building blocks to now re-make financial services with radically more transparency than we've ever known.[65] |

| November 8 | 11:22 p.m. | Lucas Nuzzi | Tweet | Financial (FTX-Alameda connection) | Crypto Security Researcher Lucas Nuzzi publishes a 15-tweet thread describing having found evidence that FTX might have provided a massive bailout for Alameda in September 28, when 173 million FTT tokens worth over 4 billion USD became active on-chain. This would be discovered and seen as oportunity from competitor Binance, a large holder of FTT, which could start deliberately tanking FTT's market to force a liquidity crunch. [22] He also notes FTX may have minted a lot of Serum (SRM) out of thin air to prop up its balance sheet.[66] |

| November 8 | 9:52 p.m. | Tom Maloney | Article | SBF net worth | Tom Maloney at Bloomberg reports on SBF net worth dropping an estimated 94%, the largest one day drop in the Bloomberg Billionaires Index history, from $15.6 billion to about $1 billion.[67] |

| November 9 | 12:32 p.m. | CoinDesk | Article | Rescue attempt | CoinDesk becomes the first to report Binance is strongly leaning against buying FTX after just a few hours of checking its books and loans.[68][69] |

| November 9 | 1:06 p.m. | Edward Snowden | Tweet | Notable comment | Famous whistleblower Edward Snowden tweets: Custodial exchanges were a mistake.[70] |

| November 9 | 2:30 p.m. | Changpeng Zhao | Tweet | FTX collapse | Changpeng Zhao shares on Twitter a note to Binance employees, telling staff that the near FTX collapse wasn't planned and would likely trigger increased regulatory scrutiny. The note reads: We did not master plan this or anything related to it (...) FTX going down is not good for anyone in the industry. Do not view it as a "win for us".[71] |

| November 9 | 4:11 p.m. | U.S. Securities and Exchange Commission, Commodity Futures Trading Commission | Article | Official intervention | An article published at Bloomberg reports that the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission started investigating the FTX's relationships with Alameda Research and FTX US, as well as allegations that the company mishandled customer funds.[72][27] |

| November 9 | 8:10 p.m. | Matt Levine | Article | FTX collapse | Financial writer Matt Levine at Bloomberg News publishes an article explaining the FTX crisis as a death spiral financing case.[73][74] On November 10, Levine would further expand the case in a new article.[75] |

| November 9 | 9:00 pm | Binance | Tweet | Rescue attempt | Binance tweets: As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.[76]In another statement of the thread, Binance says: Our hope was to be able to support FTX's customers to provide liquidity, but the issues are beyond our control or ability to help.[77]The decision is the result of Binance executives poring over FTX’s books, in which they were confronted with a confusing mess, according with a person familiar with the matter, who also said that FTX first put the hole that needed to be plugged at $2 billion, then $5 billion, then finally more than $8 billion. People familiar with the matter would also report on many of FTX’s lawyers quitting while the talks were under way.[36] |

| November 9 | circa 9:20 p.m. | Impact on other assets | Bitcoin falls as low as $16,027. At 9:20 p.m. UTC, BTC trades at $16,120.[78] | ||

| November 9 | 9:56 p.m. | Changpeng Zhao | Tweet | Rescue attempt | Changpeng Zhao comments on the incapacity of Binance to push ahead with the deal to acquire FTX. CZ tweets: Sad day. Tried, but 😭[79] |

| November 9 | circa 10:00 p.m. | FTX website instability | The first outage at the FTX website occurs, and the website appears to struggle to stay online. The instability impacts FTX’s international site, while its affiliate FTX.US appears unaffected. An error message at FTX.com reads: We're sorry, something went wrong while processing your request. Please try again later.[80] | ||

| November 10 | 3:00 a.m. | Justin Sun | Tweet | Rescue attempt | Without details, Tron cryptocurrency network founder Justin Sun drops hints at saving FTX.[68][81] Sun tweets: Further to my announcement to stand behind all Tron token (#TRX, #BTT, #JST, #SUN, #HT) holders on #FTX, we are putting together a solution together with #FTX to initiate a pathway forward.[82] |

| November 10 | 9:19 a.m. | Jesse Powell | Tweet | Industry peer reaction | Kraken former CEO Jesse Powell publishes 14-tweet thread reflecting on the FTX crisis.[83] The first tweet reads: This industry is made up of so many smart, passionate, open-minded, welcoming people, with genuine humanitarian interest at heart. I know we're going to get past this. True believers will not be deterred. But, this is a massive setback. I'm really trying to control my rage.Another of his tweets reads: Red flags: |

| November 10 | 11:51 a.m. | Effective Altruism Forum post | Impact on effective altruism | A post by Julia Wise on the Effective Altruism Forum adresses people affected by the collapse of FTX, offering support from the community health team. Affected individuals include customers as well as grantees by FTX Future Fund, a project of the FTX Foundation, a philanthropic foundation funded primarily by Sam Bankman-Fried.[84] FTX is connected to the effective altruist community, which received millions of dollars of funding from SBF and FTX via Future Fund.[85] | |

| November 10 | 1:24 p.m. | Bloomberg | Article | Impact on users | Bloomberg reports on crypto asset manager CoinShares having around $30.3 million in Bitcoin, Ether and USDC stuck in FTX.[86] |

| November 10 | 2:13 p.m. | Sam Bankman-Fried | Tweet | Bankruptcy | SBF publishes a 22-tweet thread apologizing for the situation and offering and offering his version of events. In the first tweet, SBF says: I'm sorry. That's the biggest thing. I fucked up, and should have done better.[87] |

| November 10 | 2:45 p.m. | Tom Emmer | Tweet | Politician reaction | American Republican politician Tom Emmer tweets: Interesting. Gary Gensler runs to the media while reports to my office allege he was helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly. We're looking into this.[88] |

| November 10 | 7:08 p.m. | FTX | Tweet | Impact on users | FTX communicates thorugh Twitter: Per our Bahamian HQ's regulation and regulators, we have begun to facilitate withdrawals of Bahamian funds. As such, you may have seen some withdrawals processed by FTX recently as we complied with the regulators.[89] |

| November 10 | 7:48 p.m. | Tron | Tweet | Rescue attempt | FTX tweets: We are pleased to announce that we have reached an agreement with Tron to establish a special facility to allow holders of TRX, BTT, JST, SUN, and HT to swap assets from FTX 1:1 to external wallets.In the tweet thread, it is reported that the functionality would be enabled at 18:30 UTC, November 10, and that funding capacity would be provided by Tron. As part of this agreement, Tron deposits would be disabled for all users during this period, allowing only pre-announced deposits conducted weekly.[90] As a result of this, Tron-based tokens would surge as much as 1000% on FTX as users scramble to find ways of extracting locked-up liquidity from the exchange.[91] |

| November 10 | Financial Services Agency | Official intervention | The Financial Services Agency of Japan requests FTX Japan suspend business orders, citing the policies of FTX Trading Limited. FTX Japan is ordered to suspend over-the-counter derivative transactions and related margins as well as new deposits from November 10 to December 9 unless the FSA steps in.[92][93] | ||

| November 10 | Securities Commission of The Bahamas | Official intervention | FTX assets are frozen by the Securities Commission of The Bahamas, which appoints a liquidator for one of his entities, as SBF raced to raise as much as US$8 billion to save FTX.[94] | ||

| November 10 | 10:00 p.m. | CoinDesk | Article | Team | An article published at CoinDesk reports that FTX was run by a group of 10 housemates. Among the 10 housemates, FTX CTO Gary Wang, FTX DOE Nishad Singh, and Alameda CEO Caroline Ellison, with Wang, Singh, and SBF controling the code, the exchange's matching engine and funds. According to several current and former FTX and Alameda employees interviewed on the condition of anonymity, members of the team are in on again, off again relationships, and FTX is "a place full of conflicts of interest, nepotism and lack of oversight". According to a person familiar with the matter: "The whole operation was run by a gang of kids in the Bahamas".[95][96] |

| November 10 | 10:23 p.m. | Holden Karnofsky | Blog post | Impact on effective altruism | Holden Karnofsky publishes the first public announcement by Open Philanthropy (the other major funder of the EA ecosystem) regarding the FTX crisis. Karnofsky clarifies that funds directed by Open Philanthropy are not invested in or otherwise exposed to FTX or related entities. He also states that if the FTX Foundation stops funding longtermist and effective altruist projects, then Open Philanthropy would have to consider a substantially larger set of funding opportunities, raising their bar for longtermist grantmaking. On November 13, Karnofsky would edit the post, adding that it’s very likely that FTX engaged in outrageous, unacceptable fraud, and expressing fury at the behavior of FTX leadership.[97] |

| November 10 | 11:31 p.m. | Evan Hubinger | Effective Altruism Forum post | Impact on effective altruism | A post by Evan Hubinger on the Effective Altruism Forum discusses engaging in fraudulent activities for the sake of effective altruism. The post concludes that, if FTX did engage in fraud, the lasting consequences to effective altruism —and the damage caused by FTX to all of their customers and employees—will likely outweigh the altruistic funding already provided by FTX to effective causes.[98] |

| November 10 | 10:39 p.m. | Genesis | Tweet | Industry peer reaction | Cryptocurrency brokerage Genesis tweets: As part of our goal in providing transparency around this week’s market events, the Genesis derivatives business currently has ~$175M in locked funds in our FTX trading account. This does not impact our market-making activities.[99] |

| November 10 | ? | Lucinda Shen | Article | Rescue attempt | Lucinda Shen at American news website Axios reports that FTX approached Kraken for a potential rescue deal. The small size of Kraken shows just how thin FTX's options are getting at this time.[100] |

| November 11 | 1:04 a.m. | FTX Future Fund | Effective Altruism Forum post | Team (resignation) | A post by FTX Future Fund members on the Effective Altruism Forum announces resignation of the entire FTX Future Fund team.[101] The group expresses their devastation as there are many pledged grants that the Future Fund would not be able to honor in its letter.[102] |

| November 11 | 8:03 a.m. | Venus Feng, Tom Maloney | Article | SBF net worth | Venus Feng and Tom Maloney at Bloomberg News publish an article on SBF assets, estimating his net worth at $16 billion prior to the collapse, which is reported as having been wiped out.[103] |

| November 11 | 9:30 a.m. | Sam Bankman-Fried | Bancruptcy | SBF resigns and authorizes John J. Ray III to commence Chapter 11, Title 11, United States Code cases.[104] | |

| November 11 | ? | Partnership termination | Miami-Dade County and professional basketball team Miami Heat cut ties with now bankrupt FTX, and announce renaming the FTX Arena, as naming rights deal come to an end.[105] | ||

| November 11 | ? | Changpeng Zhao | Interview | FTX collapse | Changpeng Zhao gives his first interview after the collapse of FTX at Indonesia Fintech Summit 2022.[28] |

| November 11 | 2:14 p.m. | FTX | Tweet | Bankruptcy | Official FTX bankruptcy filing is published on Twitter.[106] At 3:23 p.m. SBF in his account tweets having filed FTX, FTX US, and Alameda Research for voluntary Chapter 11 proceedings in the United States.[107] (See Alameda filing showing the corporate structure and pictorial representations of the dependencies). It is announced that SBF will step down as CEO and be replaced by John J. Ray III.[95] Just before the bankruptcy, the Financial Times reported that the exchange’s primary balance sheet showed only $900 million in liquid, easy-to-sell assets against $9 billion in liabilities.[108][109] In addition, over 100 FTX-affiliated business entities declare bankruptcy. |

| November 11 | 3:59 p.m. | Changpeng Zhao | Tweet | Industry peer reaction | Changpeng Zhao tweets:

FTX aside, avoid businesses/exchanges/projects that: |

| November 11 | 4:05 p.m. | Robert Wiblin | Tweet, blog post | Grantmaking | 80,000 Hours Director of Research Robert Wiblin publishes a 17-tweet thread expressing his indignation over the FTX Future Fund team resignation. He comments in one of his tweets: I've been waiting for the Future Fund people to have their say, and they have all resigned.[101]Another tweet reads: No plausible ethics permits one to lose money trading then take other people's money to make yet more risky bets in the hope that doing so will help you make it back.[111] Wiblin expresses his concern and sympathy for Future Fund grantees, some of whom quit jobs or made life plans hoping to work to reduce suffering and catastrophic risks using funds that would be evaporated.[111] He reiterates his statements in an Effective Altruism Forum blog post.[112] |

| November 11 | 4:52 p.m. | Sawyer Bernath | Effective Altruism Forum post | Grantmaking | Berkeley Existential Risk Initiative Executive Director Sawyer Bernath publishes the first Effective Altruism Forum post discussing the possibility of clawbacks, in which case FTX grantees could be legally obligated to return funds.[113] |

| November 11 | 5:47 p.m. | SaraAzubuike | Effective Altruism Forum post | Impact on effective altruism | An Effective Altruism Forum post is published with explicit suggestions to the EA community for changing funding given the already infamous FTX Foundation case. Suggestions include considering anonymous posts, and partially anonymized finances. The author writes: If an EA org receives some money above a certain threshold from an individual contribution, we should be transparent in saying that we will reject said money if it is not donated anonymously.[114] |

| November 11 | 8:12 p.m. | Doug Colkitt | Tweet | FTX collapse | DEX protocol CrocSwap founder Doug Colkitt publishes a 23-tweet thread, explaining his version of what happened to FTX. Among the tweets, Colkitt comments that Alameda was a prop firm with mediocre traders, a "big fish in a little pond", that at one point or another lost more than it could internally fund, and had to dip into FTX reserves. He also comments that FTX was a ponzi targeting trading firms.[115] |

| November 11 | 8.35 p.m. | Celsius | Tweet | Impact on users | Bankrupt crypto lender Celsius Network tweets: In the interest of transparency, Celsius has approximately 3.5mm SRM tokens on FTX, most of which are locked, as well as loans to Alameda totaling approximately $13MM (based on current values) which are currently under-collateralized (primarily by FTT tokens).[116] |

| November 11 | 9:41 p.m | Vitalik Buterin | Tweet | Industry peer reaction | Vitalik Buterin tweets: MtGox "looked" sketchy and never tried too hard to whitewash itself. Luna too. FTX was the opposite and did full-on compliance virtue signaling (not the same thing as compliance) |

| November 11 | 11:43 p.m. | Eliezer Yudkowsky | Tweet | Grantmaking | Eliezer Yudkowsky publishes a Twitter thread discussing FTX's charity recipients. The first tweet reads: Your incredibly obvious reminder that MANY people besides FTX's charity recipients had HIGH personal stakes in guessing whether FTX was stealing customer deposits; and the supermajority of those people, who were much deeper into cryptostuff, did not publicly guess this right.[118] |

| November 11 | 11:55 p.m. | William MacAskill | Tweet | Bankruptcy | Scottish philosopher and ethicist William MacAskill posts a tweet thread discussing FTX’s bankruptcy, and expressing the enormous harm that was caused as a result, involving the likely loss of many thousands of innocent people's savings.[119] |

| November 11 | Late | Unauthorized transaction | Some $473 million in funds are removed from FTX through what Ryne Miller, FTX US's general counsel, characterizes as "unauthorized transactions".[120] | ||

| November 12 | 0:15 a.m. | Brian Armstrong | Article | Industry peer reaction | Coinbase's CEO, Brian Armstrong publishes an op-ed calling for renewed attention to implementing reasonable regulations and checks and balances to prevent future FTX sized disasters.[121][95] |

| November 12 | 0:22 a.m. | Elon Musk | Tweet | Partnership proposal | South African business magnate and Twitter CEO Elon Musk tweets: Accurate. He set off my bs detector, which is why I did not think he had $3B.[122]The comment refers to an instance in March in which SBF offered "at least $3 billion" to help Musk buy Twitter, and proposing a deal to integrate Twitter with blockchain technology.[123][95] Upon meeting Bankman-Fried, Musk reports having immediately sensed “something wrong.” He does not have capital, and he will not come through. That was my prediction. And that was definitely what happened.[124]The role of William MacAskill in the negotiation would be discussed after the FTX collapse, as MacAskill was a liaison between SBF and Musk.[125] |

| November 12 | 3:51 a.m. | Eliezer Yudkowsky | Effective Altruism Forum post | Grantmaking | Eliezer Yudkowsky publishes an Effective Altruism Forum post proclaiming against clawbacks from FTX Foundation grantees, as some of them feel obligated to return their grants. Yudkowsky provides some moral arguments and analogies to sustain his position.[126] |

| November 12 | 5:14 a.m. | Elon Musk | Tweet | Notable comment | Elon Musk tweets: FTX meltdown/ransack being tracked in real-time on Twitter.[127] |

| November 12 | 6:31 a.m. | Tether Limited | Tweet | Security | Blockchain investigator ZachXBT tweets: Breaking: $3.9m USDT on AVAX and $27.5m USDT on SOL of the FTX attacker’s has been blacklisted by Tether.[128]By blacklisting the alleged stolen USDT token, hackers are disabled to transfer the assets to another account or exchanging them for other cryptocurrencies.[129][130] |

| November 12 | 7:07 a.m. | Trung Phan | Article | FTX collapse | Trung Phan on his Substack publication SatPost posts a highly cited and respected summary of the FTX's collapse, organized along a list of key memes and tweets assembled to provide a full-ish picture.[2] |

| November 12 | 7:07 a.m. | Ryne Miller | Tweet | Bankruptcy | FTX US General Counsel Ryne Miller tweets: Following the Chapter 11 bankruptcy filings - FTX US and FTX [dot] com initiated precautionary steps to move all digital assets to cold storage. Process was expedited this evening - to mitigate damage upon observing unauthorized transactions.[131] |

| November 12 | 7:33 a.m. | Autism Capital | Tweet | Psychopharmacology | Autism Capital tweets the alpha on stimulants within the organization shared by a source inside FTX: Stimulants were highly advised to be used by new hires for a long time. Sam would literally give an orientation on stimulants and would describe which would do that. He told them to give them all a try and see what works best and what they felt most productive on. Sam used a patch for designer stimulants that mainlined them into his blood to give him a constant buzz all the time.[132] |

| November 12 | 12:45 p.m. | Nathan Young | Effective Altruism Forum | Impact on effective altruism | Nathan Young publishes an open-ended question post asking how the effective altruist community can avoid a FTX-like situation, assuming that given the information available indicated an avoidable failure. The author asks for suggestions the EA community could have actually done with the information they had.[133] |

| November 12 | 2:22 p.m. | Tyrone-Jay Barugh | Effective Altruism Forum | Impact on effective altruism | Tyrone-Jay Barugh publishes a post on the Effective Altruism Forum suggesting an independent investigation on key EA orgs (like the Center for Effective Altruism/Effective Ventures, Open Philanthropy, and Rethink Priorities) to try to identify whether key figures in those organizations knew about the likely fraud at FTX.[134] |

| November 12 | 4:36 p.m. | Mark Cuban | Tweet | FTX collapse | American entrepreneur Mark Cuban tweets: These blowups have not been crypto blowups, they have been banking blow-ups. Lending to the wrong entity, misvaluations of collateral, arrogant arbs, followed by depositor runs. See Long Term Capital, Savings & Loan and Sub-Prime blowups. All different versions of the same story.[135] |

| November 12 | circa 5 p.m. | Article | Financial | An article at ft.com reports that FTX held less than $1 billion in liquid assets against $9 billion in liabilities the day before it collapsed into bankruptcy, according to investment materials seen by the Financial Times.[136]

| |

| November 12 | 5:05 p.m. | Mike McGuiness | Tweet | Hacking | gm.xyz founder Mike McGuiness tweets: PSA: if you have a bank account linked to FTX US, change your bank account password and stop sharing data immediately.In the tweet, McGuiness shows a screenshot of his bank account, claiming hackers tried accessing through the FTX US website.[137] |

| November 12 | 5:26 p.m. | Antoine Gara, Kadhim Shubber, Joshua Oliver | Article | Financial | The Financial Times reports that FTX's balance sheet shortly before the bankruptcy showed $9 billion in liabilities against $900 million in liquid assets, $5 billion in "less liquid" assets, and $3.2 billion in illiquid private equity investments. An obscure $7 million holding called “TRUMPLOSE” is also reported. There are no bitcoin assets listed, despite bitcoin liabilities of $1.4 billion.[138] |

| November 12 | 6:17 p.m. | Ryne Miller | Tweet | Unauthorized transaction | FTX's US general counsel Ryne Miller writes in a tweet: Among other things, we are in the process of removing trading and withdrawal functionality and moving as many digital assets as can be identified to a new cold wallet custodian. As widely reported, unauthorized access to certain assets has occurred.[139] |

| November 12 | 10:31 p.m. | Alyssa Vance | Tweet | Financial | AI startup Apprente team member Alyssa Vance tweets: This FTX "balance sheet" is absolutely the most ludicrous fucking thing I've ever seen. This is for a company that, in a boom year, had $1B in revenue and $300MM in profit.[140]Dustin Moskowitz would comment on the tweet: As it got worse, the deceptions apparently increased. It is very hard to swallow that SBF was doing rational enterprise value calculations at that point; seems more like the classic case of the rogue trader doubling down rather than admitting mistakes.[141] |

| November 12 | 10:54 p.m. | Marcelo Claure | Tweet | Notable comment | Former SoftBank COO Marcelo Claure tweets: I have been reflecting personally on the whole FTX fiasco and it taught me one more time that we should NEVER invest because of FOMO and we should always 100% understand what we are investing in. I totally failed here on both.[142]SoftBank revealed days ago that it sunk just under $100 million into the company.[143][144] |

| November 12 | 11:44 p.m. | Securities Commission of The Bahamas | Tweet | Impact on users | The Securities Commission of The Bahamas publishes on Twitter a FTX Statement which contradicts FTX claim that it was required to process local withdrawals. According to the statement, SCB did not require the exchange to allow withdrawals for users in the country.[145][146] |

| November 13 | 0:42 a.m. | Dustin Moskovitz | Tweet | Impact on effective altruism | Dustin Moskovitz posts a 15-tweet thread on the FTX crisis. The first tweet reads: Two seemingly contradictory things I believe about the SBF situation:Moskovitz also states that, either effective altruism encouraged SBF's unethical behavior, or provided a convenient rationalization for such actions, and either is bad. He outlines the situation as infuriating, devastating, and incredibly humbling all at once.[141] |

| November 13 | 5:00 a.m. | Hamish Doodles | Effective Altruism Forum | FTX collapse | Hamish Doodles at the Effective Altruism Forum publishes a FAQ post on the FTX situation. Among the answered FAQs, it is estimated that FTX Future Fund contributed US$262 million, equivalent to the 35% of the total EA funds (741 million) in 2022.[85] |

| November 13 | 4:01 p.m. | Molly Kovite | Effective Altruism Forum | Grantmaking | An Open Philanthropy legal counsel publishes a highly upvoted and referenced post aiming to provide legal context on clawbacks from FTX Future Fund grantees to the FTX bankruptcy court. The post doesn't address ethical or other practical perspectives on the topic. The author warns that FTX grants made in the 90 days before bankruptcy are likely to be clawed back.[147] On November 23rd, Molly Kovite wouldpublish another post at the EA Forum, expressing her thoughts on legal concerns surrounding the FTX situation.[148] |

| November 13 | 4:06 a.m. | Vitalik Buterin | Tweet | Industry peer reaction | Russian-born Canadian Ethereum co-founder Vitalik Buterin tweets: SBF the public figure deserves what it's getting and it's even healthy to have a good dunking session to reaffirm important community values. |

| November 13 | 6:24 p.m. | Coindesk | Article | Impact on the industry | Coindesk reports on Hong Kong-based crypto exchange AAX suspending withdrawal for as long as 10 days due to the failure of an unidentified third party.[150] The company says it has no financial exposure to FTX or its affiliates.[151] |

| November 13 | 10:00 p.m. | Angus Berwick | Article | Impact on users | Angus Berwick at Reuters publishes an article reporting at least $1 billion of customer funds have vanished from FTX.[152] |

| November 13 | circa 10:40 p.m. | Sam Bankman-Fried | Bankruptcy | SBF penthouse in Nassau is put for sale with a price tag of US$39.5 million.[153] | |

| November 13 | 6:02 p.m. | Nonlinear | Effective Altruism Forum | Grantmaking | Members of non-profit Nonlinear announce funding for Future Fund grantees affected by the FTX collapse, offering a small budget to help grantees cope with financial crisis.[154] |

| November 13 | 10:45 p.m. | Scott Alexander | Article | Impact on effective altruism | Scott Alexander at his Substack publication Astral Codex Ten publishes an open thread, discussing the collapse of FTX and its impact in effective altruism. The thread elaborates on the risk taken by utilitarians, like the St. Petersburg paradox, which involves the game of flipping a coin where the expected payoff of the theoretical lottery game approaches infinity but nevertheless seems to be worth only a very small amount to the participants. Alexander writes: ..if you St. Petersburg yourself a bunch of times and lose everything, it’s going to be really hard to pat yourself on the back for a job counterfactually well done and walk away. More likely you’re going to panic and start grasping for unethical schemes that let you escape doom. So real-world St. Petersburg isn’t “50% chance of doubling your money, 50% chance of zero”, it’s “50% chance of doubling your money, 50% chance of getting put in a psychologically toxic situation where you’ll face almost irresistible pressure to do crazy things that will have vast negative impact.”[155] |

| November 14 | 0:39 a.m. | Effective Altruism Forum | Impact on effective altruism | A post on the Effective Altruism Forum addresses some lessons from the FTX situation that the author suspects are questionable in view of all that has happened. The author examines ambition, as well as the slogan "earning to give", also dicussing ethics and utilitarianism.[156] | |

| November 14 | 3:01 a.m. | Sam Bankman-Fried | Tweet | Notable comment | SBF account starts posting mysterious tweets, in what some suspect a compromised account, which posts the word “What,” which would be followed by another tweet with the letter “H”. Within the day, someone would make a WHAT meme coin based on SBF’s tweet.[157][158] |

| November 14 | 6:39 a.m. | Changpeng Zhao | Tweet | Industry peer reaction | Changpeng Zhao tweets: To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis. More details to come soon. In the meantime, please contact Binance Labs if you think you qualify.[159] |

| November 14 | 12:43 p.m. | James Fodor | Effective Altruism Forum | Impact on effective altruism | In light of the FTX crisis, James Fodor at the Effective Altruism Forum publishes a post arguing that aspects of good governance and robust institution building have not been very highly valued in the broader effective altruist community. The author questions weak norms of governance and calls for the need for better norms.[160] |

| November 14 | ? | Partnership termination | San Francisco-based NBA team Golden State Warriors terminates all FTX-related promotional deals, including global ambassador for FTX Stephen Curry, and FTX US and its NFT marketplace as the Warriors’ official cryptocurrency platform.[161][162] | ||

| November 14 | 1:41 p.m. | Byrne Hobart | Article | FTX collapse | An article at Substack newsletter The Diff! is published by Byrne Hobart, analizing the FTX crisis in relation to the concepts of money, credit, and trust.[163] |

| November 14 | 4:49 p.m. | Travis Kling | Tweet | Impact on users | Travis Kling from crypto management firm Ikigai announces on Twitter having been caught up in the FTX collapse. With a large majority of the hedge fund’s total assets on FTX, Kling announces having been able to withdraw very little out. In the thread Kling writes: It was entirely my fault and not anyone else’s. I lost my investors’ money after they put faith in me to manage risk and I am truly sorry for that. I have publicly endorsed FTX many times and I am truly sorry for that. I was wrong.[164] |

| November 14 | 6:09 p.m. | Matt Levine | Article | Financial | Financial columnist Matt Levine at bloomberg.com publishes an article explaining the disastrous FTX balance sheet.[165][166]

|

| November 14 | 6:46 p.m. | Eric Neyman | Effective Altruism Forum | Impact on effective altruism | Eric Neyman at the Effective Altruism Forum publishes a highly upvoted post suggesting higher standards for how to draw lessons from the FTX collapse. The author expresses that proposed answers to the question of what should members of the EA community have done differently, given the information they had at the time, would be considerably more useful if they address a number of criteria.[167] |

| November 14 | 9:07 p.m. | Kari McMahon | Article | Team | An article at The Block is published, focusing on FTX’s billionaire co-founder Gary Wang, who was also one of the top executives at the exchange. The article highlights his quiet personality, with coding being his only interest, according to sources.[168] |

| November 14 | circa 11 p.m. | Sam Bankman-Fried | Interview | FTX collapse | SBF is interviewed by the New York Times. He confesses: Had I been a bit more concentrated on what I was doing, I would have been able to be more thorough (..) That would have allowed me to catch what was going on on the risk side.[169]The New York Times article focuses on the impact the FTX collapse has had on effective altruism.[170] |

| November 15 | 6:46 a.m. | whalechart.org | FTX collapse | Mr. Whale 🐳 whalechart.org on Twitter publishes a document shared by an insider, where Caroline Ellison explains how FTX and Alameda collapsed.[171] | |

| November 15 | 9:58 a.m. | PeckShield | Tweet | Security | Security firm PeckShield tweets: #PeckShieldAlert FTX Accounts Drainer has swapped 48.27M $DAI (~$48.36M) to 37.57k $ETH (~$47.69M) on Ethereum |

| November 15 | ? | Sam Harris | Podcast | Impact on effective altruism | American philosopher Sam Harris publishes a podcast discussing SBF, the collapse of FTX, and its impact on Effective Altruism.[173][174] |

| November 15 | 1:24 p.m | Jack Lewars | Effective Altruism Forum | Impact on effective altruism | Jack Lewars at the Effective Altruism Forum publishes the first post adressing the impact the FTX collapse had on the EA funding ecosystem.[175] |

| November 15 | 5:49 | Linda Kinstler | Article | Impact on effective altruism | Linda Kinstler at The Economist publishes an article addressing the impact of the collapse of FTX has had on effective altruism. The author concludes that SBF's advocated longtermism is a stance in which prediction and speculation are often indistinguishable and obligations to a probabilistic future outweigh those to the material present. Kinstler describes effective altruism as ultimately a gamble, in which SBF placed his bet, and for now, he has lost.[176] |

| November 15 | 5:51 p.m. | Tiffany Fong | Tweet | Impact on users | Tiffany Fong tweets: [[wikipedia:Salt Lending has admitted exposure to FTX & has paused deposits & withdrawals effective immediately.[177]|Salt Lending has admitted exposure to FTX & has paused deposits & withdrawals effective immediately.[177]]] Hours later, CoinDesk would report SALT halting all deposits and withdrawals on its platform due to FTX exposure.[178] |

| November 15 | Liquid Global | Tweet | Impact on the industry | Japanese crypto exchange Liquid, owned by FTX, announces on Twitter the suspension both fiat and crypto withdrawals on its Liquid Global platform, which writes: Due to the Chapter 11 filing by FTX Trading International the ultimate beneficial owner of Quoine Pte. Ltd, Liquid Exchage (Quoine Pte.) is halting all withdrawals - both fiat and crypto currency.[179] | |

| November 15 | 7:42 p.m. | Shakeel Hashim | Effective Altruism Forum | Impact on effective altruism | Shakeel Hashim from the Centre for Effective Altruism publishes a post addressing communication from EA organizations and their leaders, and the frustrating situation for all involved, as EA community members may not want to say things they’ll regret in the years to come. The author expects that in the short term there will be a lot less communication for a number of reasons, including legal risk. This is the first post talking about the EA org side of the situation.[180] |

| November 16 | 2:44 a.m. | Sam Bankman-Fried | Tweet | SBF comment | SBF tweets as part of a days-long thread: A few weeks ago, FTX was handling ~$10b/day of volume and billions of transfers. |

| November 16 | 4:47 a.m. | Eliezer Yudkowsky | Effective Altruism Forum | Impact on effective altruism | Eliezer Yudkowsky at the Effective Altruism Forum publishes a post asking who's responsible for the FTX fiasco. The post is highly commented by important figures in the effective altruist community.[181] |

| November 16 | ? | 80,000 Hours | Impact on effective altruism | London-based nonprofit organization 80,000 Hours publishes their official statement regarding the collapse of FTX. Among the announcements, the org confirms it will start by removing instances on their website where SBF was highlighted as a positive example of someone pursuing a high-impact career.[182] | |

| November 16 | 8:20 p.m. | Kelsey Piper | Interview | SBF interview | Kelsey Piper, a writer at a Vox’s effective-altruism-inspired section, publishes an interview with SBF, who claims his firms FTX and Alameda Research have gambled with customer money without realizing that’s what they were doing. He also comments about regulators, about regretting his decision to declare bankruptcy, and about what he would have done differently with FTX and Alameda, which includes more careful accounting and offboarding Alameda from FTX once FTX "could live on its own".[183] FTX would publish an official response on Twitter regarding SBF comments, in a 3-tweet thread with John Ray stating that SBF has no ongoing role at FTX, FTX US, or Alameda Research, and does not speak on their behalf.[184] SBF revelations would also be commented in a Hacker News discussion,[185] and covered at Business Insider.[186] |

| November 16 | 5:10 a.m. | Open Philanthropy | Effective Altruism Forum | Impact on effective altruism | Bastian Stern from Open Philanthropy publishes a post announcing Open Phil is seeking applications from FTX Future Fund grantees impacted by the FTX collapse.[187] |

| November 16 | 9:18 a.m. | Scott Alexander | Blog post | Psychopharmacology | A blog post at Astral Codex Ten discuses the use of drug stimulants in the FTX team and their possible contribution to the collapse of the Exchange. The author considers the probability of medication causing overspending and compulsive gambling as a side effect in SBF.[188] |

| November 16 | 11:18 a.m. | Olúfẹ́mi O. Táíwò, Joshua Stein | Article | Impact on effective altruism | Georgetown University fellows Olúfẹ́mi O. Táíwò and Joshua Stein publish an article on The Guardian criticizing the effective altruist movement, and points the FTX fraud scandal calling into question the “effective” part of effective altruism. A quote from the article reads: If the movement doesn’t change course, then one of the most ambitious charitable fundraising drives in recent history will be used to pour money back into the pockets of wealthy donors who fancy themselves swashbuckling visionaries.The authors suggest that proposed structural reforms and democratic control of philanthropic organizations by those who are impacted by the organizations’ endeavors seem to have been largely ignored in favor of a tech and capital-friendly research agenda, and a system controlled by a wealthy minority.[189] They also shortly criticize longtermism as a guise for tech billionnaires to develop pet projects.[190] |

| November 16 | ? | Impact on users | The first class action lawsuit against SBF is filed, claiming that FTX violated Florida law and demanding $11 billion in damages on behalf of its customers.[191] | ||

| November 16 | ? | Impact on the industry | Affected by the fallout of FTX's collapse, the lending division of cryptoasset manager Genesis suspends customer redemptions and new loan originations.[192] | ||

| November 17 | 7:15 a.m. | Changpeng Zhao | Speech | Industry peer reaction | Speaking at an event in the United Arab Emirates with economic think tank the Milken Institute, Changpeng Zhao calls SBF a “psychopath” for alluding in a tweet that Zhao was his “sparring partner” amid the FTX collapse.[193][194] |

| November 17 | 11:00 a.m. | Matthew Yglesias | Blog post | Impact on effective altruism | American blogger and journalist Matthew Yglesias at Substack newsletter Slow Boring publishes his thoughts on the FTX collapse, including implications for effective altruism, and for the linear utility theory.[195] |

| November 17 | circa 1:00 p.m. | John J. Ray III | Court document | Bankruptcy | Lawyers for FTX file in Delaware, asking a federal judge to transfer to the state a competing bankruptcy case filed in New York by Bahamian liquidators.[196][197][198] In a court document John J. Ray III says: Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here (...) From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.[199]Aditionally, noting that he worked on Enron's bankruptcy, he states having still never seen such a "complete failure" and "absence of trustworthy financial information".[200] Also: From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated, and potentially compromised individuals, this situation is unprecedented.[201] |

| November 17 | 1:26 p.m. | Zvi | Effective Altruism Forum | FTX collapse | A post on Effective Altruism Forum provides a very extensive and comprehensive coverage of the situation as of time.[66] |

| November 17 | 3:15 p.m. | Elon Musk | Tweet | Impact on effective altruism | Elon Musk tweets: SBF is ineffective altruism, but they thought he was saying he was in effective altruism. Easy misunderstanding.[202] |

| November 17 | 6:57 p.m. | FTX | Tweet | Bankruptcy | FTX Group announces having established Kroll as its claims agent, witl all official documents filed with the United States bankruptcy court available online.[203] |

| November 17 | 10:37 p.m. | John Hyatt | Article | Impact on effective altruism | John Hyatt at Forbes publishes an article addressing the groups associated with effective altruism, who are tied to millions of dollars that could be clawed back in bankruptcy proceedings, according to restructuring lawyers. Brooklyn Law School bankruptcy law professor Edward Janger is quoted saying: To the extent that any FTX entities transferred funds to the foundation while insolvent, the creditors of those entities in the bankruptcy may be able to assert fraudulent conveyance claims to recover those funds.and Yes, the charities should be worried.The article continues describing the upheaval the FTX scandal caused on the EA movement.[204] |

| November 18 | ? | Background | Theranos CEO Elizabeth Holmes is sentenced to 11 years in prison.[205] | ||

| November 19 | 4:00 p.m. | Alexander Osipovich, Caitlin Ostroff , Patricia Kowsmann , Angel Au-Yeung and Matt Grossman | Article | Team | An article is published at The Wall Street Journal, describing the lives of the people who ran FTX. The article describes the firm as an unruly agglomeration of corporate entities, customer assets and SBF himself, with neither accounting nor functioning human-resources departments.[36] |

| November 21 | 1:47 a.m. | Tyler Whitmer | Effective Altruism Forum | Impact on effective altruism | Tyler Whitmer publishes a highly upvoted and commented post on the Effective Altruism Forum discussing the pros and cons of talking publicly about SBF/FTX for effective altruism. Whitmer suggests ther would be very few declarations about the FTX/SBF fiasco from any EA public figures or institutions, and suggests it would be best for effective altruists not to comment on the FTX/SBF situation, and not just for their own sake.[206] |

| November 22 | 3:41 p.m. | Lucas Nuzzi | Tweet | Financial (FTX-Alameda connection) | Lucas Nuzzi starts a new Twitter thread providing some answers on how Alameda Research lost billions of dollars of FTX user funds. Among the answers, Nuzzi mentions directionally wrong trades; likely leveraged DeFi lending markets, esp. stablecoin-denominated; and cross-chain bridges, either hacked or their native tokens becoming worthless; all mechanisms through which Alameda might have lost considerable amounts of user funds.[207] |

| November 22 | 4:00 p.m. | Bankruptcy | A hearing on the First Day Motions (“First Day Hearing”) is held at 11:00 a.m before judge John T. Dorsey in the United States Bankruptcy Court for the District of Delaware.[9] The first-day motion requests focus on the company's assets, debts, and the location of the bankruptcy case. FTX has 36 banks and more than 200 bank accounts, and the group of companies employed over 500 people, primarily in the United States. According to FTX counsel James Bromley, a "substantial amount" of the company's assets have either been stolen or are missing. FTX brings on investment banking advisory firm Perella Weinberg to help maximize the value of its remaining viable assets. The company owes money to a range of parties, including banks, trading firms, and other cryptocurrency exchanges.[208] | ||

| November 22 | 6:51 p.m. | Koh Gui Qing | Article | An article at Reuters reports on FTX and SBF, along with other senior executives and SBF's parents, having purchased at least 19 properties worth nearly $121 million in the Bahamas over the past two years. Attorneys for FTX also claim that one of the company's units spent $300 million in the Bahamas buying homes and vacation properties for its senior staff, and that FTX was run as a "personal fiefdom" by SBF.[209] | |

| November 22 | 10:33 p.m. | Sam Bankman-Fried | Letter | SBF apology | Finance journalist Liz Hoffman tweets screenshots of a new letter that SBF shared with FTX employees on the same day, apologizing again and sharing a list of collateral and liabilities. His opening line states that he feels “deeply sorry about what happened.” He also says “maybe there still is a chance to save the company.”[210] |

| November 23 | 10:54 p.m. | Rethink Priorities | Effective Altruism Forum | Impact on effective altruism | Lead members of effective altruist organization Rethink Priorities publish a post expressing their statement on the FTX crisis, and its impact on the non-profit and the EA space.[211] |

| November 23 | ? | Cathie Wood | Interview | Notable comment | Bloomberg publishes interview with Ark Invest CEO Cathie Wood, who reiterates her optimism on crypto assets in the wake of FTX's collapse. Wood says: I think the thing that is shocking is how many people were very close to [Sam Bankman-Fried]... the fact that so many people were completely fooled is quite shocking. You know, I think he had this aura around him or something that caused people to ask fewer questions than might otherwise been the case. It's very hard to understand.[212][213] |

| November 24 | 10:30 a.m. | Rachel Louise Ensign, Ben Cohen | Article | Impact on effective altruism | Rachel Louise Ensign and Ben Cohen at The Wall Street Journal publish an article on SBF pledge to donate billions to philanthropy.[214] |

| November 25 | 3:02 p.m. | Robert Wiblin | Effective Altruism Forum post | Impact on effective altruism | Robert Wiblin at the Effective Altruism Forum publishes a post discussing SBF and his views on expected value and risk aversion in giving. Wiblin also clarifies his own position on diminishing returns and risk aversion in giving, after an April interview to SBF resurfaces with the FTX crisis. Wiblin discusses the concept of expected value and risk aversion in philanthropy, specifically in relation to large-scale giving. He agrees with the idea that returns to additional money become sublinear at larger scales, which suggests a need for risk aversion, especially in more niche cause areas and when considering giving on a scale of billions rather than millions of dollars. However, the writer also notes that there are practical considerations, such as the potential harm to organizations and individuals who depend on a known minimum level of funding, that may also weigh in favor of risk aversion. Wiblin also clarifies that their original description of this concept may have been oversimplified and potentially erroneous.[215] |

| November 26 | 6:39 a.m. | Tiffany Fong | Blog post | SBF interview | Tiffany Fong publishes her first post on Substack describing her phone calls with SBF.[216] The call would be published on Youtube on November 29. SBF confesses I'm much more worried about the damage that I did to that than whatever happens to me personally.[217]The interview would be covered on the Effective Altruism Forum.[218] |

| November 28 | Impact on the industry | Digital asset lender BlockFi files for bankruptcy, citing exposure to FTX, which is listed as BlockFi’s second creditor in importance.[219] | |||

| November 28 | Ryan Pinder | National statement | Bankruptcy | The Bahamian government severely criticizes John J. Ray III for his statements made in US bankruptcy proceedings. In a national statement, Bahamas Attorney General Ryan Pinder says that such statements made by Ray were “regrettable”, that “it is possible that the prospect of multimillion dollar legal and consultant fees is driving both their legal strategy and the intemperate statements,” and “In any case, we urge prudence and accuracy in all future filings,” he adds.[220][221] | |

| November 29 | 4:26 p.m. | Tiffany Fong | Tweet/Youtube | SBF interview | Tiffany Fong publishes an audio from her first interview with SBF, who talks about bankruptcy, the alleged “backdoor,” donations to the Democratic Party, Ukraine money laundering rumors, the hack, Alameda’s margin position on FTX, and using FTT as collateral, among other topics.[222] |

| November 29 | ? | Spencer Greenberg | Podcast | Notable comment | Spencer Greenberg in his podcast Clearer Thinking publishes a podcast discussing several aspects of the FTX collpase in interviews with a number of experts: newsletter writer Byrne Hobart; Maomao Hu, a ablockchain, fintech, and AI entrepreneur; Marcus Abramovich, a managing partner at a cryptocurrency hedge fund and involved in effective altruism causes; programmer and researcher Ozzie Gooen; and Vipul Naik, a PhD providing mathematical concepts in order to analize the magnitude of monetary damage caused by FTX.[223] |

| November 30 | Sam Bankman-Fried | Interview | SBF interview | SBF gives an interview to ABC News in which he denies knowing about any "improper use of customer funds" and accepts responsibility for the collapse of both companies. SBF acknowledges that he failed to have proper oversight and management in place, which led to the crash of FTX. He also denies reports of illegal drug use by FTX employees and says that he and Caroline Ellison were not in a polyamorous relationship. SBF says his focus is now on working through regulatory and legal processes and trying to make up for the harm caused.[224][225] | |

| November 30 | 8:12 p.m. | Impact on effective altruism | An article at CNBC reports on a UK charity backed by SBF raising concerns about its future with the Charity Commission for England and Wales, following the collapse of FTX. SBF had donated millions of dollars to the charity and had pledged to donate billions more. The charity, the Effective Ventures Foundation (formerly the Centre for Effective Altruism), filed a "serious incident report" with the commission, which is required to be filed in certain circumstances, including the "loss of your charity’s money or assets" or "harm to your charity’s work or reputation".[226] The report is discussed on the Effective Altruism Forum, in a highly commented post.[227] | ||

| December 1 | circa 1 a.m. | Sam Bankman-Fried | Interview | SBF interview | An interview with SBF at The New York Times’s DealBook Summit is published on nytimes.com.[228] Among his announcements, he says he “didn’t knowingly commingle” FTX customer funds, he denies he had knowingly committed fraud, he says that he did not realize what a dangerous position the firms were in, and he admits that big mistakes were made.[229]

|