Timeline of FTX trial

From Timelines

This page is about a topic potentially related to FTX, Alameda Research, Sam Bankman-Fried, or the FTX Future Fund. Other content on this wiki has been compensated by the Future Fund Regranting Program that used funds from the FTX Future Fund. These funds likely came from the FTX Foundation that was funded partly or wholly by money made by FTX, Alameda Research, or Sam Bankman-Fried. As such, there is a theoretical possibility of conflict of interest.

View all pages with possible conflicts of interest due to funding from Future Fund Regranting Program | View pages work on which was to be funded by the Future Fund Regranting Program

This is a timeline of FTX trial.

Contents

Sample questions

The following are some interesting questions that can be answered by reading this timeline:

- What are some significant events preceding the trial of Sam Bankman-Fried?

- Sort the full timeline by "Event type" and look for the group of rows with value "Early proceeding".

- You will see early proceedings marking the initial stages of the legal battle involving allegations of financial fraud and misconduct against Sam Bankman-Fried.

- What are the significant developments in the trial of Sam Bankman Fried?

- Sort the full timeline by "Event type" and look for the group of rows with value "Trial proceeding".

- You will see a detailed summary of the trial proceedings involving Sam Bankman Fried, including key events and developments from each trial day.

- What are some post-trial proceedings after the conclusion of the trial?

- Sort the full timeline by "Event type" and look for the group of rows with value "Post-trial proceeding".

- Other events are described under the following types: "Criticism", "Prelude", and "SBF statement".

Big picture

| Time period | Development summary | More details |

|---|---|---|

| May 2019 – October 2022 | Pre-bankruptcy era | FTX is founded by Sam Bankman-Fried and Gary Wang. The exchange grows rapidly, reaching its peak in July 2021, with over one million users and becoming the third-largest cryptocurrency exchange by volume. |

| November 2022 | Bankruptcy of FTX | FTX collapses in less than a month, starting on November 2 after a CoinDesk article leaks FTX balance sheet. In response to the mismanagement and unclear handling of funds, Binance announces its decision to sell all FTT tokens, prompting its value to collapse and leading FTX customers to withdraw money from their accounts. |

| October–November 2023 | FTX trial | The trial of Sam Bankman-Fried begins on October 3, 2023, facing seven fraud and conspiracy charges. The case depicts a battle between his alleged criminal mastermind and defense portraying him as an earnest entrepreneur overwhelmed by circumstances. |

| March 2024 | Sentence | Sam Bankman-Fried is sentenced to 25 years for fraud and money laundering in one of the largest white-collar crimes. |

Full timeline

Inclusion critera

We include:

- Trial procedures by day.

- Announcements by prosecutors, and other procedures not part of the trial but related.

We do not include:

- Thorough details of the collapse of FTX (see Timeline of FTX collapse)

- Thorough details of the history of FTX (see Timeline of FTX)

Timeline

| Year | Month and date | Event type | Details |

|---|---|---|---|

| 2019 | May | Prelude | SBF establishes the FTX Crypto Exchange Firm, which achieves a valuation exceeding $32 billion at its highest point.[1] |

| 2022 | November | Prelude | FTX faces a crisis after revelations on November 2 that Alameda Research holds a significant amount of FTX Token (FTT), raising questions about their connection. On November 6, Binance CEO Changpeng Zhao declares the liquidation of Binance's $2.1 billion FTT holdings, rejecting Ellison's offer to buy them.[2] Concerns sparked a rush on FTX. SBF reassures on Twitter, defending the exchange's assets and blaming a competitor for rumors. By November 8, FTT's price plummets from $22 to $15.40 amidst the turmoil.[3] |

| 2022 | December | Early proceeding | FTX is initially arrested in the Bahamas on December 12, following charges filed against him by the U.S. government.[4] He is arrested in the United States upon his return from the Bahamas. Additionally, FTX co-founder Gary Wang and Alameda Research CEO Caroline Ellison, agree to plead guilty in connection with the case. |

| 2023 | January 3 | Early proceeding | Court proceedings commence, with SBF pleading not guilty. The judge sets the next hearing for October 2023. In a blog post, SBF attributes FTX's challenges to the crypto market downturn and refutes allegations of fraud, maintaining his innocence amidst the legal proceedings.[5] |

| 2023 | February | Early proceeding | All three former colleagues from Sam Bankman-Fried's inner circle plead guilty to fraud charges and agree to cooperate with investigations, placing additional pressure on the co-founder.[5] |

| 2023 | February 23 | Early proceeding | SBF is criminally charged with additional counts.[6] |

| 2023 | March 30 | Early proceeding | SBF pleads not guilty to five new federal charges, including conspiring to bribe Chinese officials. The charges are part of what prosecutors call one of the largest financial frauds in US history. The latest indictment accuses Bankman-Fried of bribing Chinese officials with $40 million in cryptocurrency to unfreeze accounts belonging to his hedge fund, Alameda Research. Prosecutors claim he used FTX customer deposits to fund risky bets and contribute to US politicians. SBF, on $250 million bond, awaits trial in October, facing a potential 155+ years in prison if convicted.[7][6] |

| 2023 | July 20 | Early proceeding | Prosecutors alert federal judge of attempted witness tampering by SBF.[6] |

| 2023 | July 26 | Early proceeding | Judge places gag order on SBF. Prosecutors drop campaign finance charge.[6] |

| 2023 | August 11 | Early proceeding | SBF's bail is revoked.[6] |

| 2023 | August 12 | Early proceeding | SBF remains in custody after a US federal judge revokes his bail, suspecting attempts to tamper with witnesses. The judge, Lewis A. Kaplan, claims that SBF likely intended to influence two witnesses, former Alameda Research CEO Caroline Ellison and the former FTX general counsel. Despite his lawyers filing an appeal, the decision means SBF would remain in jail while awaiting trial. Prosecutors accuse him of leaking documents to discredit Ellison, a key government witness.[8][5] |

| 2023 | August 14 | Early proceeding | SBF is transferred from house arrest to Brooklyn's Metropolitan Detention Center (MDC). Ordered by US District Judge Lewis Kaplan for alleged witness tampering, SBF's confinement highlights the MDC's dismal reputation, marred by severe staffing shortages and unsanitary conditions.[9] |

| 2023 | October 3 | Trial proceeding | Trial day 1.[10] Trial against SBF begins in New York, where he faces seven charges of wire fraud and money laundering. While he denies the charges, he is tried on accusations of extravagant spending and fraudulent use of customer funds.[11][12][13] Senior District Judge Lewis A. Kaplan oversees the trial, with Assistant U.S. Attorney Nicolas Roos heading the prosecution, and Mark Cohen leading the defense. The trial begins with jury selection, presided over by Kaplan, who indicates that the case might conclude sooner than expected, potentially within a couple of weeks.[14] The defense portrays SBF as a young entrepreneur who made unsuccessful business decisions. They deny secret transactions between Alameda and FTX, emphasizing that all transactions were legitimate. Witnesses highlight FTX's marketing campaigns to establish itself as a trustworthy crypto investment platform.[10] |

| 2023 | October 4 | Trial proceeding | Trial day 2. During the initial hours of the trial, the United States Department of Justice (DOJ) accuses SBF of deliberately deceiving investors to enrich himself and expand his crypto empire. The DOJ alleges SBF used Alameda to "steal customers' funds" and influence politicians, focusing on claims that he misled customers, investors, and lenders about the safety of their funds. The defense portrays SBF as a young entrepreneur who made unsuccessful business decisions. They deny secret transactions between Alameda and FTX, emphasizing that all transactions were legitimate. Witnesses highlight FTX's marketing campaigns to establish itself as a trustworthy crypto investment platform.[10] SBF parents Joe Bankman and Barbara Fried, arrive at court in New York.[15][16] Former FTX developer Adam Yedidia testifies.[17] |

| 2023 | October 5 | Trial proceeding | Trial day 3. The prosecution cross-examines Former FTX engineer Adam Yedidia, who reveals that SBF encouraged using Signal with auto-delete settings for messages and disclosed discussions about raising funds from Saudi Arabia and the UAE. Yedidia expresses concerns about FTX defrauding customers and mentioned Bankman-Fried's risky behavior. Paradigm co-founder Matt Huang testifies about FTX's lack of corporate controls and potential favoritism toward Alameda. Later, Gary Wang, former FTX CTO, admits to wire fraud, unveiling special privileges for Alameda, including a hidden $65 billion credit line on FTX. Wang discloses Alameda's ability to withdraw unlimited funds and Bankman-Fried's significant ownership stakes in both Alameda and FTX. Yedidia's cross-examination centers on an $8 billion liability from Alameda to FTX, illustrating fund commingling concerns. The defense portrays FTX's rapid growth and challenges in opening a bank account. Huang testifies about Paradigm's investment, unaware of fund commingling and Alameda's privileges. Wang acknowledges committing fraud and reveals Alameda's special advantages, and his testimony will continue on October 6.[18][19][20][21][22] |

| 2023 | October 6 | Trial proceeding | Trial day 4. It is revealed that Alameda Research had an $11 billion debt to FTX. SBF sought to have Alameda return the borrowed money but faced challenges due to their deeply intertwined financial situation. Alameda, granted special privileges, operated as an FTX market maker. Bankman-Fried attempted to shut down Alameda before their close connection with FTX was exposed, exploring alternatives like Modulo, a firm he partially owned. FTX faced financial instability, leading to its bankruptcy declaration. Witnesses like Gary Wang testifie about these financial intricacies, with cross-examinations causing courtroom tension.[23] |

| 2023 | October 10 | Trial proceeding | Trial day 5. Conclusion of Gary Wang's testimony, where he faces cross-examination by one of SBF’s lawyers, Christian Everdell. Wang discusses SBF’s consideration of shutting down Alameda, indicating a 30% chance according to SBF. He remains uncertain about the factors behind the FTX bank run, including the tweet by Binance CEO Changpeng Zhao or leaked financials.[24] Subsequently, Caroline Ellison, former CEO of Alameda and an ex-girlfriend of Bankman-Fried, takes the stand.[25] She admits guilt in misusing FTX user funds, attributing the actions to Bankman-Fried's setup of systems allowing Alameda to take $14 billion from the exchange.[26] Ellison reveals personal details about their relationship, SBF's presidential aspirations, and attempts to influence former President Donald Trump's reelection bid.[27] She also discloses Alameda's funding sources and her involvement in transactions to mitigate risks.[10] |

| 2023 | October 11 | Trial proceeding | Trial day 6. As the sole witness[28], former CEO of Alameda Research, Caroline Ellison, provides crucial testimony during the trial, indicating that SBF directed employees to engage in fraudulent activities against FTX customers, which involved transferring billions of dollars to Alameda Research, a hedge fund affiliated with FTX. Ellison discloses that SBF specifically instructed her to create deceptive "alternative" balance sheets, which were presented to the cryptocurrency lender Genesis. These manipulated documents concealed a substantial sum of $10 billion, which had been borrowed from FTX customers. Ellison notes that her involvement in the scheme was under the explicit instruction of SBF, stating, "Sam told me to." Additionally, SBF purportedly contemplated raising funds from the Saudi Crown Prince, Mohammed bin Salman. Ellison also reveals SBF's directive to "keep selling BTC if it's over $20,000," prompting concerns about potential market manipulation allegations.[29] Ellison provides detailed information regarding the period leading up to the collapse of FTX in November 2022. Following a market downturn in May, lenders, notably Genesis Capital, demanded the repayment of loans, resulting in significant financial strain. Ellison, the former co-chief executive of Alameda Research, testifies that SBF directed her to devise "alternative ways" to present Alameda's financial data to lenders, concealing their substantial liability towards FTX. SBF's strategies for survival included seeking capital from Crown Prince Mohammed bin Salman of Saudi Arabia and advocating for regulatory measures against Binance, a competing cryptocurrency exchange.[10] |

| 2023 | October 12 | Trial proceeding | Trial day 7. The cross-examination of Caroline Ellison continues in the Southern District Court of New York. The defense delves into the capital lent to Alameda by crypto lenders Genesis and Voyager, with Ellison stating that borrowed funds could be legally utilized for various purposes, including trading activities. Communication challenges with SBF, particularly after their breakup in April 2022, are highlighted, emphasizing how their strained relationship influenced Ellison's decisions at Alameda. She admits to cooperating extensively with prosecutors and discusses financial forecasts made during the bear market. Details about Alameda's bank accounts and fund redirection from FTX are also presented during the examination.[10] |

| 2023 | October 13 | Trial proceeding | Trial day 8. During the trial, digital asset lender BlockFi CEO Zac Prince testifies that BlockFi's bankruptcy was caused by its association with FTX and Alameda Research. Prince reveals BlockFi had US$1.1 billion on FTX and blames FTX and Alameda's false balance sheets for BlockFi's collapse. He emphasizes BlockFi wouldn't have lent to Alameda if aware of FTX customer funds' involvement. BlockFi began lending to Alameda in 2020-2021, with loans exceeding $1 billion by May 2022. Prince highlights BlockFi's due diligence but admits losses due to Terra Luna's collapse. Prosecutors question customer awareness, contrasting BlockFi's transparency with FTX's practices. BlockFi's over-exposure to FTX Token (FTT) in 2021 also contributed to its financial distress.[30][31][32][33] |

| 2023 | October 16 | Trial proceeding | Trial day 9. Former FTX engineering head Nishad Singh testifies that $1.3 billion of customer funds were used to build SBF's social capital and public image. Singh's testimony highlights the alleged misuse of customer funds and excessive spending on sponsorships, including celebrity endorsements. Singh reveals that FTX spent $1.3 billion on promotions, with millions sent to celebrities like Steph Curry, Kevin O'Leary, Tom Brady, and Larry David. Singh also describes SBF's involvement in political donations, including a complex system of loans and transfers, and his attempts to deceive regulators. Defense attorney Mark Cohen pushes to adjourn the trial to wait for additional Adderall medication for SBF, but the judge rules to continue the daily hearing schedule.[34][35][36][37] |

| 2023 | October 17 | Trial proceeding | Trial day 10. Former Senior Engineer Nishad Singh testifies about SBF's lavish spending and large-scale investments from FTX's funds. Singh reveals that he received bonuses and borrowed significant amounts, intending to make donations to charity, but those transactions never occurred. The defense cross-examines Singh, emphasizing discrepancies in financial records and pointing out missing funds in the balance sheet. Additionally, pictures of SBF socializing with celebrities and political leaders are presented to the jury. The trial continues with detailed scrutiny of financial transactions and Bankman-Fried's expenditures.[38] |

| 2023 | October 18 | Trial proceeding | Trial day 11. Prosecutors reveal SBF's profane messages criticizing regulators, undermining his cryptocurrency oversight image. The messages, sent to journalists including Vox and The Block, displayed his frustration with regulators, challenging his advocacy facade. Despite objections, the messages are admitted as evidence, portraying his true mindset during the alleged fraud. Separately, an expert witness discloses a $9.3 billion money trail, exposing FTX's misuse of customer funds. Transactions involved investments, political donations, and real estate purchases. Prosecution's evidence strengthens claims of fraud, conspiracy, and money laundering.[39][40][41] |

| 2023 | October 19 | Trial proceeding | Trial day 12. Former FTX General Counsel Can Sun testifies about a US$7 billion deficit in customer funds, expressing shock and revealing that SBF asked him for legal justifications. Sun also mentions Nishad Singh's emotional state before FTX's collapse. The defense focuses on FTX's terms of service, particularly margin trading, seeking to understand customer risk. Sun reveals SBF's attempt to find theoretical justifications for the missing funds, which Sun finds unsupported by facts. The session ends with Robert Boroujerdi stating Third Point wouldn't have invested if aware of Alameda's privileges.[42][43][44][45] |

| 2023 | October 26 | Trial proceeding | Trial day 13. The courtroom witnesses extensive legal maneuvering and interruptions by District Court Judge Kaplan due to repeated questions, sidebars, and objections from both sides' attorneys. Prosecutors conclude their case with FBI Agent Mark Troiano's testimony, who examined over 300 Signal groups associated with SBF, most utilizing the auto-delete feature. Following the prosecution's conclusion, the defense calls witnesses, including Bahamas attorney Krystal Rolle, who discloses that FTX transferred all digital assets to the Bahamas regulator on the same day a court order was issued in November 2022. The defense also presents financial consultant Joseph Pimbley, who analyzed FTX's assets, revealing over $5.8 billion in accounts with trading enabled, excluding FTX entities or Alameda Research. However, prosecutors point out discrepancies in FTX's database accuracy during cross-examination. In a pre-trial hearing, SBF testifies in his defense, adopting a strategy of ignorance on specific matters, deflecting blame onto his legal advisors, and relying on internal lawyers and consultants. SBF's testimony features numerous "I don't recall" statements. Despite the defense's motion to dismiss the case, citing lack of evidence for fraud and money laundering, Judge Kaplan denies the motion.[46][47][48] |

| 2023 | October 27 | Trial proceeding | Trial day 14. SBF testifies, blaming his former girlfriend and Alameda CEO, Caroline Ellison, for poor management in Alameda and accepting some mistakes while denying other claims made by colleagues. SBF denies defrauding anyone and discloses borrowing from various sources for Alameda. He clarifies the internal name for Alameda as 'Wireless Mouse,' refuting the term 'Sam's Crypto Trading Firm.' He explains FTX and Alameda's moves to Hong Kong and the Bahamas were due to a more flexible regulatory environment. SBF acknowledges aggressive FTX marketing funded by Alameda loans. He emphasizes Alameda's market maker role on FTX, blaming Ellison for lack of risk management focus. He claimed ignorance about the "Allow Negative" code and admitted to political donations funded by Alameda loans. Bankman-Fried cited Alameda's liquidity drop and internal solvency concerns, blaming Ellison again for not hedging bets and considering shutting down Alameda in 2022 due to the absence of proper management. The trial continues with cross-examination and a rebuttal case expected before the verdict.[49][50][51] |

| 2023 | October 30 | Trial proceeding | Trial day 15. SBF displays a deep disdain for regulators, using profanities and expressing his negative views about a "subset of people" on Crypto Twitter. Despite his public support for crypto regulation, he admits to privately saying, "fuck regulators." SBF's defense attorneys try to shift blame onto Caroline Ellison, the former CEO of Alameda Research, claiming she admitted to inadequate hedging and offered to resign. SBF states he attempted to help Alameda by suggesting larger hedges and discussing a potential rescue package with private equity firm Apollo. Prosecutors question his credibility, presenting evidence of his involvement in trading decisions at Alameda and inconsistencies in his public statements. The trial is expected to conclude on October 31.[52][53][10] |

| 2023 | October 31 | Trial proceeding | Trial day 16. Prosecutors challenge SBF's credibility, focusing on his lack of awareness regarding the $8 billion spending of FTX customer funds by Alameda. SBF admits to not segregating FTX customer funds from Alameda's and not investigating the money's use. Prosecutor Danielle Sassoon questions his alleged close ties with Bahamian government officials and presents emails discussing segregated funds for Bahamian customers. Both sides rest their cases, leading to closing arguments and subsequent jury deliberations. The prosecution highlights inconsistencies in SBF's statements, while the defense points to decisions made by other executives. SBF is questioned about FTX's insolvency and his unawareness of Alameda's $8 billion liability. His defense that negative comments about regulators are due to skepticism is presented. The judge denies the defense's request for acquittal, setting the stage for closing arguments on November 1, with a verdict expected by November 3. No additional witnesses will be called by either side by this time.[54][55][56] |

| 2023 | November 1 | Trial proceeding | Trial day 17. In the closing arguments of the trial over the collapse of FTX, government prosecutors accuse SBF of orchestrating a "pyramid of lies" to deceive and defraud customers of $10 billion. Assistant U.S. Attorney Nicholas Roos presents the case, alleging that SBF engaged in illegal operations while maintaining a legitimate facade. The prosecution emphasizes SBF's alleged knowledge of wrongdoing and argues that his claims of ignorance and advice-of-counsel are insufficient. Defense attorney Mark Cohen portrays SBF as both a victim and a responsible actor, highlighting his repayment of lenders and suggesting the failure of other executives. The trial is set to conclude with rebuttal arguments and jury deliberation.[57][58][10] |

| 2023 | November 2 | Trial proceeding | Trial day 18. SBF is found guilty on all seven criminal fraud counts, facing a potential prison term of up to 115 years. The charges include defrauding lenders and consumers, with a provisional sentencing date set for March 28, 2024. US Attorney Damian Williams characterizes the case as one of the largest financial scams in American history. SBF's defense lawyer, Mark Cohen, hints at an appeal, emphasizing his client's innocence. The trial involves deliberations on the use of FTX customer funds for various purposes, and the prosecution argues that SBF schemed and lied to obtain and misuse the money. The situation draws comparisons to Elizabeth Holmes, founder of Theranos. The jury's swift decision follows an 18-day trial. Sentencing is scheduled for March 28, 2024, and the verdict could have SBF facing decades in prison.[59][60][61][62] |

| 2023 | December 29 | Post-trial proceeding | U.S. prosecutors announce that they will not pursue a second trial against SBF. The decision is based on the "strong public interest" in promptly resolving the case against him. The prosecutors emphasize the significance of this interest, especially considering SBF's upcoming sentencing on March 28, 2024, which is expected to involve orders for forfeiture and restitution to his victims.[63] |

| 2024 | March 15 | Post-trial proceeding | Federal prosecutors urge a New York judge to sentence SBF to 40 to 50 years in prison. They accuse him of defrauding over 1 million victims of more than $8 billion and seek $11 billion in restitution. SBF's attorneys argue for a five- to six-year prison term, citing his charitable work and autism. Prosecutors refute his claims of good intentions, portraying him as unrepentant and driven by greed, with a history of misappropriating customer funds for personal gain.[64] |

| 2024 | March 21 | Criticism | FTX's CEO John Ray III sharply criticizes SBF's attempt to reduce his potential 50-year sentencing, asserting that victims continue to suffer. Ray disputes SBF's claims of FTX's financial stability and asserts that victims won't fully recover from the massive fraud. Ray reveals SBF's misrepresentation of the situation and lack of remorse, highlighting unrecovered assets and deceptive portrayals. As Ray's testimony unfolds, the sentencing outcome for SBF, whether a 50-year term or otherwise, is eagerly anticipated.[65] |

| 2024 | March 28 | Post-trial proceeding | SBF receives a 25-year prison sentence, along with three years of supervised release, and is ordered to forfeit $11 billion for orchestrating various fraudulent schemes. He is found guilty on multiple charges including wire fraud, securities fraud, and money laundering, he secretly diverted customer deposits for personal gain, investments, political contributions, and loan repayments. The FBI led the investigation, resulting in swift justice against financial crimes. While expressing remorse, SBF faces criticism from victims, with one investor noting the severe impact, including suicides. U.S. Attorney Damian Williams emphasizes the severity of the crime, stating the sentence would deter others. With no possibility of parole in federal cases, SBF may serve a reduced term with good behavior, potentially as little as 12.5 years.[66][67][68][69] |

| 2024 | April 1 | SBF statement | SBF expresses remorse after receiving a 25-year prison sentence for fraud charges. In an interview with ABC News from prison, he acknowledges his responsibility for FTX's insolvency and the impact on customers. Despite claiming he never intended harm, he admits to falling short of his own standards and causing distress to thousands of customers. He emphasizes his daily anguish over the losses incurred, stating he wishes to repair the damage. He also mentions his defense's intention to appeal, citing misrepresentation of trial evidence. The interview reveals SBF's acknowledgment of wrongdoing and his desire for restitution despite limitations from incarceration.[70][71][72] |

Visual data

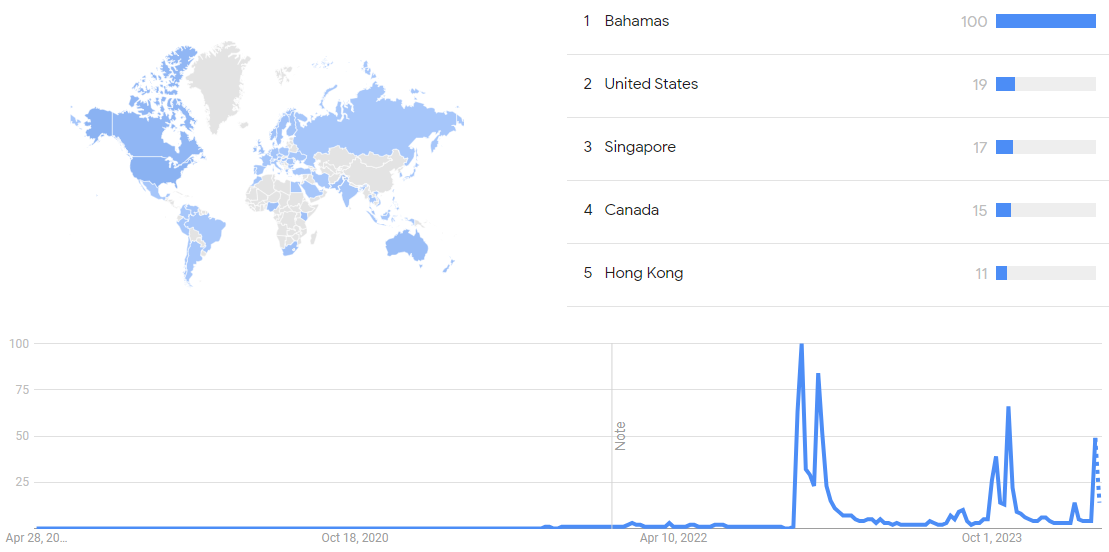

Google Trends

The chart below shows Google Trends data for Sam Bankman-Fried from January 2021, to March 2024, when the screenshot was taken. Interest is also ranked by country and displayed on world map.[73]

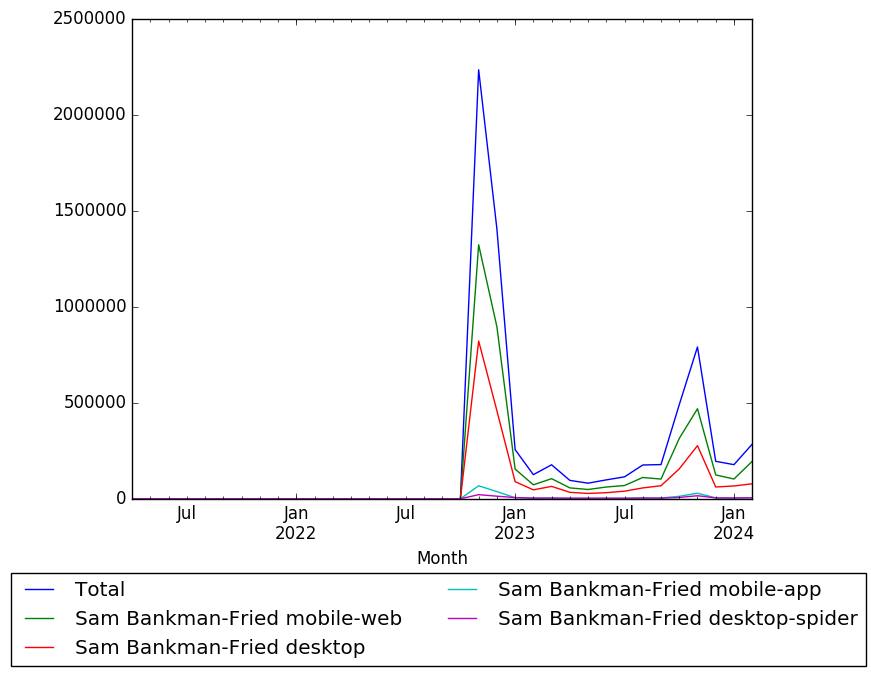

Wikipedia views

The chart below shows Wikipedia views data for the article Sam Bankman Fried, from April 2021 (when the article was created) to February 2024.[74]

Meta information on the timeline

How the timeline was built

The initial version of the timeline was written by Sebastian.

Funding information for this timeline is available.

Feedback and comments

Feedback for the timeline can be provided at the following places:

- FIXME

What the timeline is still missing

- https://www.law.com/newyorklawjournal/2024/03/12/cruel-but-not-unusual-the-sentence-recommended-for-sam-bankman-fried/?slreturn=20240213011331

- https://www.ft.com/content/785a1278-2180-426f-9625-e25b3f8b80d5

- https://edition.cnn.com/2024/02/28/business/sam-bankman-fried-sentence-ftx/index.html

- Divide trial day 3 in parts like in here: https://blockworks.co/news/sam-bankman-fried-trial-day-3

Timeline update strategy

See also

External links

References

- ↑ Bureau, ABP News (23 December 2022). "What Caused The FTX Fiasco? A Timeline Of Events So Far". news.abplive.com. Retrieved 14 December 2023.

- ↑ "Binance to liquidate its entire FTX Token holdings after 'recent revelations'". Cointelegraph. 7 November 2022. Retrieved 9 November 2023.

- ↑ "FTX Token price risks 30% plunge as a 23M FTT 'part' moves to Binance". Cointelegraph. 7 November 2022. Retrieved 9 November 2023.

- ↑ "Disgraced crypto founder Sam Bankman-Fried to be extradited to US following spectacular collapse of FTX". ABC News. 13 December 2022. Retrieved 14 December 2023.

- ↑ 5.0 5.1 5.2 Fernandes, Jocelyn (3 November 2023). "FTX's Sam Bankman-Fried found guilty. A timeline of the events". mint. Retrieved 14 December 2023.

- ↑ 6.0 6.1 6.2 6.3 6.4 "The Collapse of FTX: What Went Wrong With the Crypto Exchange?". Investopedia. Retrieved 29 February 2024.

- ↑ Scannell, Kara (30 March 2023). "Sam Bankman-Fried pleads not guilty to new federal charges | CNN Business". CNN. Retrieved 1 March 2024.

- ↑ "FTX's Sam Bankman-Fried jailed after bail revoked for tampering with witnesses". mint. 12 August 2023. Retrieved 14 December 2023.

- ↑ Archive, View Author; Author, Email the; Twitter, Follow on; feed, Get author RSS (14 August 2023). "Sam Bankman-Fried locked up in 'reprehensible' Brooklyn jail". Retrieved 2 April 2024.

- ↑ 10.0 10.1 10.2 10.3 10.4 10.5 10.6 10.7 "Sam Bankman-Fried trial [Day 17] — latest update: Live coverage". Cointelegraph. 2 November 2023. Retrieved 9 November 2023.

- ↑ "Fallen crypto king Sam Bankman-Fried faces 110 years in prison for alleged FTX fraud". The Independent. 2 October 2023. Retrieved 20 October 2023.

- ↑ "Who is Sam Bankman-Fried, the former 'King of Crypto' on trial for fraud?". Sky News. Retrieved 20 October 2023.

- ↑ "Sam Bankman-Fried: Trial of 'Crypto King' begins". BBC News. 3 October 2023. Retrieved 20 October 2023.

- ↑ "FTX founder Sam Bankman-Fried's trial day 1: Recap". crypto.news. 3 October 2023. Retrieved 8 November 2023.

- ↑ Morrow, Allison (4 October 2023). "Sam Bankman-Fried's crypto empire was 'built on lies,' US prosecutor says | CNN Business". CNN. Retrieved 20 October 2023.

- ↑ Dumas, Breck (4 October 2023). "Sam Bankman-Fried trial Day 2: What to expect and who could testify". FOXBusiness. Retrieved 8 November 2023.

- ↑ Neumeister, Larry. "FTX co-founder testifies against Bankman-Fried, says they committed crimes". www.timesofisrael.com. Retrieved 20 October 2023.

- ↑ Wagner, Katherine Ross,James Cirrone,Casey (5 October 2023). "Sam Bankman-Fried trial live updates: Day 3". Blockworks. Retrieved 10 November 2023.

- ↑ "SBF Trial, Day 3: Why a True Believer in FTX Flipped Once He Learned One Fact". Unchained Crypto. Retrieved 10 November 2023.

- ↑ "SBF trial day 3: ex-FTX CEO committed fraud, co-founder Gary Wang testifies". crypto.news. 6 October 2023. Retrieved 10 November 2023.

- ↑ "SBF Trial Day 3: Former Business Partner Confirms SBF Allowed Alameda Research to Withdraw FTX Customers' Funds". tokeninsight.com. 6 October 2023. Retrieved 10 November 2023.

- ↑ "Sam Bankman-Fried's Trial Day 3". Binance. Retrieved 22 October 2023.

- ↑ Wagner, Katherine Ross,James Cirrone,Casey (6 October 2023). "Sam Bankman-Fried trial updates: FTX backstop fund was 'fake,' Wang testifies". Blockworks. Retrieved 22 October 2023.

- ↑ "FTX co-founder Wang discusses plea deal, knowledge of financial concepts at SBF trial". Cointelegraph. 10 October 2023. Retrieved 9 November 2023.

- ↑ "Sam Bankman-Fried trial: former Alameda CEO Caroline Ellison to testify". Cointelegraph. 10 October 2023. Retrieved 9 November 2023.

- ↑ "Caroline Ellison blames Sam Bankman-Fried for misuse of FTX user funds at trial". Cointelegraph. 10 October 2023. Retrieved 9 November 2023.

- ↑ "Sam Bankman-Fried aspired to become US president, says Caroline Ellison". Cointelegraph. 10 October 2023. Retrieved 9 November 2023.

- ↑ "Trial Day 6: Caroline Ellison Testimony Continues". WSJ. Retrieved 8 November 2023.

- ↑ "Caroline Ellison Testifies in FTX Trial That SBF Told Her to "Keep Selling BTC If It's Over $20K"". Binance. Retrieved 22 October 2023.

- ↑ "SBF Trial: Crypto Lender BlockFi Believed Alameda Was Solvent Given Balance Sheet It Was Shown, CEO Testifies". Yahoo Finance. 13 October 2023. Retrieved 9 November 2023.

- ↑ De, Helene Braun and Nikhilesh (13 October 2023). "SBF Trial: Crypto Lender BlockFi Believed Alameda Was Solvent Given Balance Sheet It Was Shown, CEO Testifies". www.coindesk.com. Retrieved 9 November 2023.

- ↑ "BlockFi's Lending Relationship With FTX and Alameda Research Hastened Its Downfall". inc.com. Retrieved 9 November 2023.

- ↑ "BlockFi CEO points finger at Alameda, FTX for collapse of crypto lender during testimony at SBF trial". The Block. Retrieved 9 November 2023.

- ↑ "SBF trial day 9: FTX's founder spent $1.3b on celebrity endorsements". crypto.news. 16 October 2023. Retrieved 9 November 2023.

- ↑ "SBF Trial Day 9: FTX's Founder Spent $1.3b on Celebrity Endorsements". Binance. Retrieved 9 November 2023.

- ↑ Cirrone, Katherine Ross,Casey Wagner,James (16 October 2023). "Nishad Singh's respect for 'formidable' SBF 'eroded' over time: SBF trial live updates". Blockworks. Retrieved 9 November 2023.

- ↑ "SBF Trial, Day 9: Nishad Singh Describes Former FTX CEO as a Bully and Big Spender". Unchained Crypto. Retrieved 9 November 2023.

- ↑ "FTX founder Sam Bankman-Fried's trial day 10: Recap". crypto.news. 17 October 2023. Retrieved 8 November 2023.

- ↑ "FTX Founder Sam Bankman-Fried's Trial Day 11: Recap". Binance. Retrieved 9 November 2023.

- ↑ "SBF trial day 11: financial forensic report exposes FTX $9.3b money trail". crypto.news. 18 October 2023. Retrieved 9 November 2023.

- ↑ Cohen, Luc; Cohen, Luc (18 October 2023). "Sam Bankman-Fried trial jury sees his profane messages about regulators". Reuters. Retrieved 9 November 2023.

- ↑ "Sam Bankman-Fried Trial Day 12: a $7 Billion Hole in FTX's Balance". Binance. Retrieved 9 November 2023.

- ↑ "SBF Trial, Day 12: Former FTX General Counsel Speaks Out Against SBF". Unchained Crypto. Retrieved 9 November 2023.

- ↑ Cirrone, Katherine Ross,Casey Wagner,James (19 October 2023). "Former FTX lawyer 'shocked' by missing $7B: SBF trial live updates". Blockworks. Retrieved 9 November 2023.

- ↑ Cohen, Luc; Cohen, Luc (19 October 2023). "Sam Bankman-Fried sought 'justifications' for missing funds, lawyer testifies". Reuters. Retrieved 9 November 2023.

- ↑ "SBF trial day 13: FTX founder claims ignorance in mock testimony". crypto.news. 26 October 2023. Retrieved 9 November 2023.

- ↑ "SBF Trial Day 13: FTX Founder Claims Ignorance in Mock Testimony". Binance (in العربية). Retrieved 9 November 2023.

- ↑ "SBF Trial, Day 13: Before Judge, Former FTX CEO Sam Bankman-Fried Gives Few Straight Answers". Unchained Crypto. Retrieved 9 November 2023.

- ↑ "SBF trial day 14: FTX's Bankman-Fried blames Alameda's Ellison for absent hedging". crypto.news. 27 October 2023. Retrieved 9 November 2023.

- ↑ De, Sam Kessler, Danny Nelson, Helene Braun and Nikhilesh (27 October 2023). "Sam Bankman-Fried Throws Caroline Ellison Under Bus in Testimony". www.coindesk.com. Retrieved 9 November 2023.

- ↑ "FTX founder Sam Bankman-Fried takes the stand: Recap of trial day 14". crypto.news. 28 October 2023. Retrieved 9 November 2023.

- ↑ Morrow, From CNN's Allison (30 October 2023). "FTX daily withdrawal surged to $4 billion after tweet from crypto rival, Binance". CNN. Retrieved 9 November 2023.

- ↑ "SBF trial day 15: "I was trying to help" FTX founder claims on third day of testimony". crypto.news. 30 October 2023. Retrieved 9 November 2023.

- ↑ "SBF Trial, Day 16: In Final Cross Examination, SBF Gets Caught Again by His Own Words". Unchained Crypto. Retrieved 10 November 2023.

- ↑ "SBF trial day 16: Judge Kaplan denies acquittal motion, closing arguments set for Nov. 1". crypto.news. 31 October 2023. Retrieved 10 November 2023.

- ↑ De, Helene Braun, Sam Kessler and Nikhilesh (31 October 2023). "Sam Bankman-Fried Again Blames Underlings for Woes as FTX Founder Wraps Up Testimony". www.coindesk.com. Retrieved 10 November 2023.

- ↑ "SBF trial day 17: FTX founder pitched as a criminal and a victim in closing arguments". crypto.news. 1 November 2023. Retrieved 10 November 2023.

- ↑ Sigalos, MacKenzie (1 November 2023). "Sam Bankman-Fried lawyer says government portrayed FTX founder as a 'monster'". CNBC. Retrieved 10 November 2023.

- ↑ "Sam Bankman-Fried FTX Trial: SBF Prosecution Day 18". ccn.com. Retrieved 10 November 2023.

- ↑ "SBF trial day 18: Jury begins deliberation over Bankman-Fried verdict". crypto.news. 2 November 2023. Retrieved 10 November 2023.

- ↑ "SBF Trial, Day 18: Sam Bankman-Fried Found Guilty on All 7 Counts in Swift Verdict". Unchained Crypto. Retrieved 10 November 2023.

- ↑ Lopatto, Elizabeth (2 October 2023). "FTX founder Sam Bankman-Fried is guilty of fraud". The Verge. Retrieved 10 November 2023.

- ↑ "Sam Bankman-Fried will not face a second trial". reuters.com. Retrieved 11 February 2024.

- ↑ Weil, Julie Zauzmer (15 March 2024). "Prosecutors: Sam Bankman-Fried should get 40 to 50 years in prison". Washington Post. Retrieved 21 March 2024.

- ↑ Jr, Chuks Nnabuenyi (21 March 2024). "FTX's Chief criticizes Sam Bankman-Fried ahead of potential 50-year sentencing". CryptoTvplus - The Leading Blockchain Media Firm. Retrieved 21 March 2024.

- ↑ "Office of Public Affairs | Samuel Bankman-Fried Sentenced to 25 Years for His Orchestration of Multiple Fraudulent Schemes | United States Department of Justice". www.justice.gov. 28 March 2024. Retrieved 31 March 2024.

- ↑ Kessler, Nikhilesh De and Sam (2 November 2023). "Sam Bankman-Fried Guilty on All 7 Counts in FTX Fraud Trial". www.coindesk.com. Retrieved 11 February 2024.

- ↑ "Former FTX CEO Sam Bankman-Fried sentenced to 25 years in prison for fraud - UPI.com". UPI. Retrieved 31 March 2024.

- ↑ N, Edward (28 March 2024). "Sam Bankman-Fried sentenced to 25 years in prison in crypto fraud case". The Toronto Post. Retrieved 31 March 2024.

- ↑ News, A. B. C. "FTX founder Sam Bankman-Fried speaks out after sentencing: 'I'm haunted, every day, by what was lost'". ABC News. Retrieved 4 April 2024.

- ↑ "Sam Bankman-Fried speaks from prison for the first time: 'I'm haunted, every day, by what was lost.'". Quartz. 1 April 2024. Retrieved 4 April 2024.

- ↑ News, A. B. C. "FTX founder Sam Bankman-Fried speaks out after sentencing: 'I'm haunted, every day, by what was lost'". ABC News. Retrieved 4 April 2024.

- ↑ "Google Trends". Google Trends. Retrieved 2 April 2024.

- ↑ "Wikipedia Views: results". wikipediaviews.org. Retrieved 31 March 2024.